January 2021 / MULTI-ASSET SOLUTIONS

Uncovering Opportunities Amid Recovery

A winding path back

Key Insights

- The year ahead will likely be defined by how quickly vaccines can combat COVID‑19’s spread and unlock the global economy.

- The global recovery should create a broadening of investment opportunities and rotation toward more cyclically oriented regions and sectors.

- Post‑pandemic winners and losers will emerge as consumers, businesses, and economies adapt to the new environment.

Markets are entering the new year optimistic about the successful development of vaccines to combat the spread of COVID‑19, seeing the news as a light at the end of the dark tunnel that was 2020. The extreme enthusiasm, however, has driven many markets to record highs, extending valuations and creating a rotation toward cheaper stocks in more cyclically exposed parts of the economy. In contrast with last year, 2021 is likely to be a year of reversion rather than momentum, reinforcing the benefits of broader diversification.

Reopening to Unleash Pent‑Up Global Demand

While there is reason to be optimistic about the effectiveness of the vaccines as a catalyst for recovery in 2021, global economies still face unprecedented logistical challenges in deploying the vaccines. At the same time, fears about another wave of the coronavirus are again forcing many countries to enforce lockdowns. The path to successful global immunization by the spring could be winding and uneven as different parts of the world deal with the current crisis while potentially exhausting their stimulus measures, leaving extended markets vulnerable to near‑term volatility. Although the path may be choppy, we expect the recovery to take hold once broad immunization occurs, allowing economies to safely reopen and unleashing pent‑up global demand.

The improving economic backdrop, supported by monetary policies set to remain ultra‑accommodative, will create opportunities and risks as markets rotate toward the “COVID‑off recovery.” The environment should be supportive for risk assets, including stocks and corporate bonds, as growth and earnings outlooks improve, potentially leading to a broadening of performance across asset classes and sectors. More cyclically exposed economies and sectors may outperform, although investors will be cautious in avoiding segments of the markets that may be impaired by post‑pandemic trends, warranting the need to be selective.

Improving growth trends, however, may put upward pressure on longer‑term interest rates, leaving nominal U.S. Treasuries and other high‑quality global sovereign bonds as unattractive diversifiers. Investors will likely trend toward higher‑yielding sectors, inflation‑linked securities, and other investments with less interest rate sensitivity. Although the new year is beginning with little perceived upside to extended valuations, attractive relative valuation opportunities persist across markets—notably those that have been on the losing side of decades‑long trends.

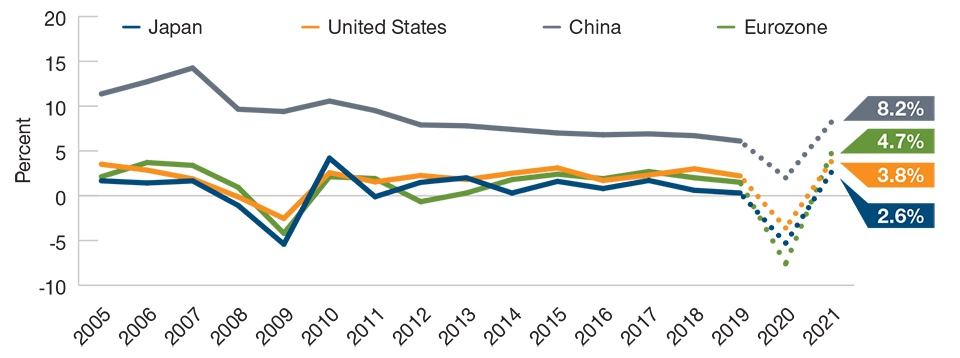

Pent‑Up Demand Could Boost Recovery

(Fig. 1) Real year-over-year gross domestic product growth*

As of November 30, 2020.

*Dotted lines represent Bloomberg consensus estimates for 2020 and 2021.

Source: Bloomberg Finance L.P.

To read the full document, download the PDF.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.