December 2020 / GLOBAL MARKET OUTLOOK

For Investors in Japan, the Outlook Appears Suga Sweet

Four reasons to be bullish about the Japan investment outlook

Key Insights

- Japan has adeptly managed the coronavirus crisis, and the cyclical nature of the market means it is well placed to potentially lead a post‑coronavirus recovery.

- Japan’s new Prime Minister Yoshihide Suga has vowed to continue to drive structural reform in Japan, as well as improve productivity.

- Competitive valuations, and companies’ increased focus on higher shareholder returns, further underpin our view that now is a good time to be invested in Japan.

Japanese equities are well placed to excel in 2021, in our view, with various factors underpinning our positive outlook, heading into the new year. Not least of these is the cyclical nature of the Japanese market, which is highly leveraged to a post‑pandemic global recovery. Importantly, new Prime Minister Yoshihide Suga has also vowed to continue to drive Japan’s structural improvement, including market and governance reform, as well as focus on boosting productivity. Competitive valuations, and a greater company emphasis on higher shareholder returns, are further potential performance drivers. In short, we believe that now is a good time to be invested in Japan, and we outline four key reasons for this view in more detail in this paper.

Japan Is a Cyclical Market and Is Currently Trading at a Discount to Peers

Japan should be well positioned to benefit from a post‑pandemic cyclical recovery as global economies bounce back. Domestically, Japan has managed the coronavirus crisis well; the death toll, and infection rate, have been relatively low compared with many other countries.

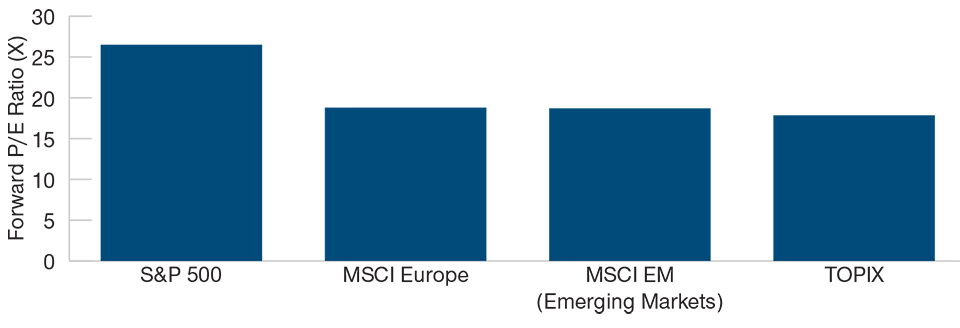

Yet, Japan has underperformed other major equity markets, year‑to‑date, and continues to trade at a discount to these markets. Japan’s TOPIX, for example, is trading at 17.9x price/earnings (P/E) as of November 13, 2020. This compares with 26.5x P/E in the U.S. (S&P 500), 18.8x in Europe (MSCI Europe), and 18.7x in emerging markets (MSCI EM).

Japan Market Valuation1 Versus Major Market Peers

Japanese equities continue to trade at a discount relative to global peers

As of November 13, 2020.

Actual future outcomes may differ significantly from forward estimates.

12021 forward price/earnings ratio.

Source: T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

Japan is a highly cyclical market, and this has weighed on market performance in 2020 as the coronavirus has undermined global trade. As a result, foreign investors are significantly underweight Japan, despite the growing prospects of a global cyclical recovery. Valuations are appealing, relative to other markets, and this presents an opportunity as global growth recovers. In short, Japan is relatively cheap, under‑owned, and highly leveraged to a potential global economic recovery. With this in mind, we have been adding exposure to cyclical companies during the summer, including names in the food service, electronics and automation, and auto industries.

Japan Is Home to Leading Companies That Exemplify Manufacturing Excellence

From advanced robotics and automation to semiconductors and 5G technology, Japan is home to world‑leading industrial and technology companies, many of which have been supported by long‑term, secular tailwinds. The coronavirus, for example, has highlighted the risks of an unavailable or depleted labor force and the need for increased factory automation post‑pandemic. Similarly, other industrial businesses have been benefiting from the rollout of the 5G technology cycle and the ongoing, secular demand for semiconductors. These companies are global leaders, exporting their intellectual property and technological advantage to the world. We believe the outlook for these businesses is only set to improve meaningfully from here.

Japan’s Digital Transformation and Improving Productivity Are Being Prioritized

While Japan is known for its manufacturing excellence in a number of key industries, the adherence to various societal and workplace customs and practices continues to create inefficiency and undermine overall productivity. For example, fax machines are still widely used by Japanese companies, in both the public and private sectors, and this is technology that has long been superseded. Meanwhile, areas like e‑commerce and contactless payments remain underpenetrated in Japan compared with developed market peers, while investment in workplace technology and cloud computing infrastructure has also lagged.

Given Japan’s well-documented aging demographics, reform of these outdated customs and practices is an essential step toward increasing overall productivity. For investors, it also presents potentially exciting opportunities, especially among under‑researched smaller companies in Japan.

Importantly, Japan’s new Prime Minister Yoshihide Suga has picked up where his predecessor, Shinzo Abe, left off, prioritizing Japan’s structural reform agenda and singling out Japan’s digital transformation as the top national priority. The creation of a new Digital Affairs Ministry, and the recently announced “Digital Agency,” tasked with administering, overseeing, and promoting this transformation, underscores the government’s commitment to delivering this key priority.

This is an exciting time for those industries and businesses at the forefront of this change, and we believe that we are well exposed to many of these potential growth areas, from telemedicine to cloud computing to online payment processing. A number of the companies that we own in these areas are smaller names, identified through our deep coverage and knowledge of the Japanese market, and so not widely owned by many of our peer group strategies.

Corporate Governance Reform Is Very Real, but Still in the Early Stages

Some investors are quick to suggest that Japanese equities are cheap for good reason—poor governance standards and lower shareholder returns. But, where this once may have been true, it no longer fairly reflects the Japanese landscape. If there has been one area of visible policy success in Japan over the past decade, it is in relation to corporate governance reform. The improvement seen during this time has been both rapid and significant, and it continues today.

Similarly, the improvement in shareholder returns in recent years is undeniable. The level of share buybacks by Japanese companies reached an all‑time high in 2019. While the overall level in 2020 has understandably been lower, it is noteworthy that, in March, Softbank carried out the largest share buyback in its history. Corporate Japan will have certainly noted this, and we anticipate a potentially sharp rise in shareholder returns for Japanese equities in 2021.

While shareholder returns have pulled back as a result of the coronavirus pandemic, a more positive impact has been the forced acceleration of corporate restructuring in Japan. This will be a record year, with tender offers up sharply, year on year, in 2020 so far.

With the sudden resignation of former Prime Minister Abe in September 2020, there were some fears that the “Abenomics” economic and structural reform program might also come to an end. However, the election of Mr. Suga as Japan’s new prime minister is widely seen as a vote for continuity, as he served as chief cabinet secretary and right‑hand man throughout Mr. Abe’s tenure. Mr. Suga has made it clear that his administration will continue to progress the Abenomics reform agenda, with tax incentives for companies to encourage reform, as well as initiatives to promote “business transformations.”

In Conclusion

As described, we are confident about the outlook for Japanese equities in 2021 and beyond. The appointment of Mr. Suga as prime minister is positive, in our view, as it ensures that the Abenomics reform program remains on track. At the same time, the prioritization of Japan’s digital advancement improving productivity could drive increased profits for Japanese companies and potentially greater returns for investors. We also believe that this is a good time to be invested in Japan given the market’s sensitivity to a global recovery—history shows that Japan has frequently outperformed coming off the bottom of the economic cycle. As such, we believe that company profits in Japan could exceed current consensus expectations. We also anticipate further improvement and restructuring across industries, as we expect more companies focus on long‑term sustainability and strive to deliver improved returns for shareholders.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

December 2020 / GLOBAL MARKET OUTLOOK