April 2024 / INVESTMENT INSIGHTS

Hedging inflation risk

Recession fears are fading, but inflation concerns are on the rise.

Key Insights

- Recession fears are fading, but inflation concerns have resurfaced as consumer price index expectations have steadily risen since the beginning of the year.

- To hedge against inflation risk, T. Rowe Price’s Asset Allocation Committee is overweight stocks, with an overweight allocation to real assets equities.

This is a modal window.

Playback Denied: Unavailable

Risks have shifted. Recession fears are fading, and economists now expect a healthy 2.1% growth in U.S. gross domestic product in 2024. However, inflation concerns have resurfaced. Expectations for the U.S. consumer price index (CPI) have steadily risen from 2.2%—a level that would have been in line with the Federal Reserve’s target—to 2.8% as of March 22, 2024.

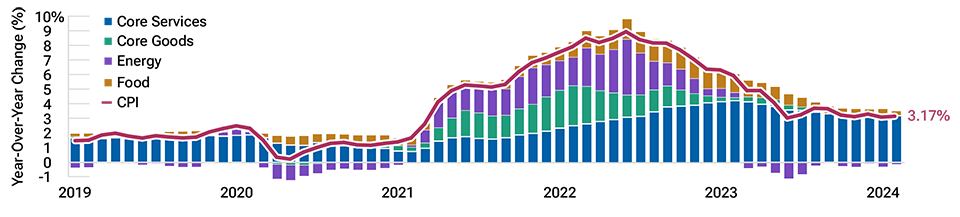

CPI, a widely used measure of inflation, surged to a peak in June 2022 due to elevated goods prices, specifically in the food, energy, and core goods categories of the CPI basket. As supply chains normalized, inflation fell as prices in these categories declined. Meanwhile, services inflation has barely budged and now accounts for the vast majority of inflation (Figure 1).

Inflation has fallen since the 2022 peak but looks sticky

(Fig. 1) Components of the consumer price index

January 2019 to February 2024.

Sources: Federal Reserve Board, Federal Reserve Bank of Philadelphia, University of Michigan/Haver Analytics.

This is concerning to investors. In order to meet the Federal Reserve’s 2% target, not only will the stubborn services inflation have to moderate, but goods inflation will also have to remain dormant. This is a very optimistic assumption.

Given the shift from recession risk to inflation risk, we believe that investors should reconsider their asset allocation. A review of asset returns during various inflationary environments provides some useful insights (Figure 2).

Energy stocks have performed well in high-inflation environments

(Fig. 2) Average one-year asset class returns by monthly CPI ranges

December 1989 to February 2024.

Past performance is not a reliable indicator of future performance.

Sources: T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. S&P and Bloomberg indexes. See Additional Disclosures.

As illustrated, bonds historically have been an excellent hedge in recessionary periods, but they have not been an effective hedge against elevated inflation. Meanwhile, stocks have outperformed bonds when inflation was at low, moderate, and even slightly elevated levels. But their returns dipped sharply during recessions and also weakened when inflation moved to very high levels.

Notably, stocks in the energy sector historically have performed quite well in periods where inflation is at very high levels. These results imply that a tilt toward stocks, with an emphasis on the energy sector, could be a way to hedge inflation risk.

The Asset Allocation Committee recently moved to an overweight position in stocks. We also hold an overweight position in real assets equities, which have a large allocation to energy and other commodity-oriented equities.

Additional Disclosures

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

The S&P indexes are a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and have been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); T. Rowe Price’s Products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P indexes.

Bloomberg® and Bloomberg US Aggregate Bond Index are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend T. Rowe Price. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to T. Rowe Price.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

8 May 2018 / Price Point - In Brief

April 2024 / ENVIRONMENTAL, SOCIAL, AND GOVERNANCE