February 2024 / INVESTMENT INSIGHTS

After the Fed pivot, what’s next?

With cooling expectations, investors wonder when and how far U.S. rates will fall in 2024.

Key Insights

- Reduced expectations that the Federal Reserve will begin cutting interest rates in March have left investors wondering when—and how far—U.S. rates will fall in 2024.

- Based on past Fed hiking and cutting cycles, we expect modest rate cuts, although the Fed’s actions will be influenced by inflation and labor market conditions.

Following the Fed’s unexpected pivot away from monetary tightening in December 2023, futures markets aggressively began to price in seven rate cuts in 2024, far exceeding the three cuts of 25 basis points (bps)1 each projected in the Fed’s Summary of Economic Projections. Since then, however, market optimism has cooled, reviving questions about when and how far rates will fall this year.

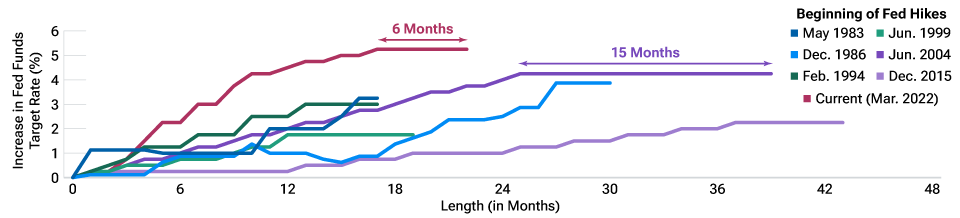

In the past six Fed hiking cycles since 1980, the first rate cut occurred 6.7 months, on average, after the final rate hike (Figure 1). At the end of 2023, futures markets were pricing in a more than 80% chance of a March rate cut. By January 23, 2024, futures markets were projecting a full cut in May. Since the Fed has been on pause since July 2023, a rate cut in March would be nine months after the last hike. Only during the hiking cycle that began in June 2004 was there a longer pause, one which lasted 15 months.

When will the Fed start cutting rates?

(Fig. 1) Fed hiking cycles

1980 to January 23, 2024.

Past results are not a reliable indicator of future results. Actual outcomes may differ materially from forward estimates.

Source: Bloomberg Finance L.P.

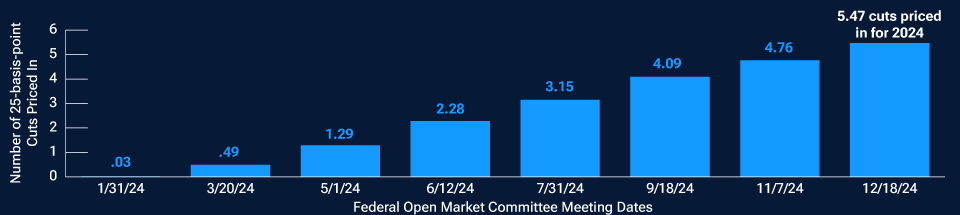

How many Fed cuts in 2024?

(Fig. 2) Cumulative number of rate cuts priced in by Fed funds futures market

As of January 23, 2024.

Actual outcomes may differ materially from forward estimates.

Source: Bloomberg Finance L.P.

A basis point is 1/100th of one percentage point.

A review of the past seven Fed cutting cycles since 1980 shows that the average rate reduction in the first nine months of each cutting cycle was 2.5%, an equivalent of 10 25-bp cuts. However, these reductions varied widely—from 75 bps to 800 bps—reflecting the varying economic environments.

During five of the past seven cutting cycles, the U.S. economy went into recession. The remaining two cycles—those starting in September 1984 and June 1995—were “soft landings,” which provide a better guide in the current economic environment, in our view. In the two soft-landing cycles, rates declined by an average of 23.5% from the peak level. Applied now, the same percentage reduction would lower the federal funds rate target from 5.5% to 4.2%—equaling 5.2 cuts of 25 bps each. Notably, as of January 23, the funds futures market was pricing in a similar outcome, 5.47 cuts in 2024 (Figure 2).

If the U.S. economy remains on track for a soft landing, we expect modest rate cuts in 2024. However, the Fed’s actions will depend heavily on inflation and labor market conditions. If inflation heats up, the pace of rate cuts is likely to slow considerably. But if the labor market shows signs of extreme distress, the Fed could speed up cuts to try to avoid a recession.

T. Rowe Price cautions that economic estimates and forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differ materially from those anticipated in estimates and forward‑looking statements, and future results could differ materially from historical performance. The information presented herein is shown for illustrative, informational purposes only. Any historical data used as a basis for analysis are based on information gathered by T. Rowe Price and from third-party sources and have not been verified. Forecasts are based on subjective estimates about market environments that may never occur. Any forward-looking statements speak only as of the date they are made. T. Rowe Price assumes no duty to, and does not undertake to, update forward-looking statements.

Additional Disclosure

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

February 2024 / INVESTMENT INSIGHTS