July 2023 / INVESTMENT INSIGHTS

Post-Pandemic Trends Support Credit Quality in Health Care

Collaboration across health care industries reveals credit trends

Key Insights

- While the pandemic introduced unprecedented volatility into the health care space, we are cautiously optimistic that pressures driven by COVID have peaked.

- We expect the fundamental credit quality of health care providers and medical technology companies to gradually improve.

- Health insurers increased rates after the onset of the pandemic prior to renegotiating reimbursement rates, so we think their credit profiles will be stable.

While COVID introduced unprecedented volatility into the health care space, we are cautiously optimistic that pressures driven by COVID have peaked, and we expect the fundamental credit quality of most health care providers and medical technology companies to gradually improve. Conversely, health insurers benefited from the ability to increase rates after the onset of the pandemic prior to renegotiating reimbursement rates with providers, so we anticipate that the credit profiles of health insurers will remain stable.

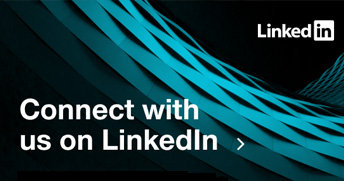

Health Care Vacancies Surged in Pandemic

(Fig. 1) Job openings as a percentage of total employment

As of May 31, 2023.

Source: Department of Labor.

Pandemic Headwinds for Hospitals

COVID presented many headwinds for hospitals; some of those, such as the temporary suspension of elective procedures, were short-lived. Others, such as elevated labor costs, continue to linger to varying degrees. Various federal and state COVID relief funding initiatives offset much of the lost revenue from the suspension of elective procedures, but most of those funds have now been exhausted.

Nurse burnout, early retirements, and higher-paying agencies that specialize in providing health care labor support turbocharged a nursing shortage that existed prior to the pandemic, pushing hospital labor costs even higher. Figure 1 illustrates how U.S. health care and social assistance job vacancies increased even more than vacancies in the broad job market during the pandemic.1

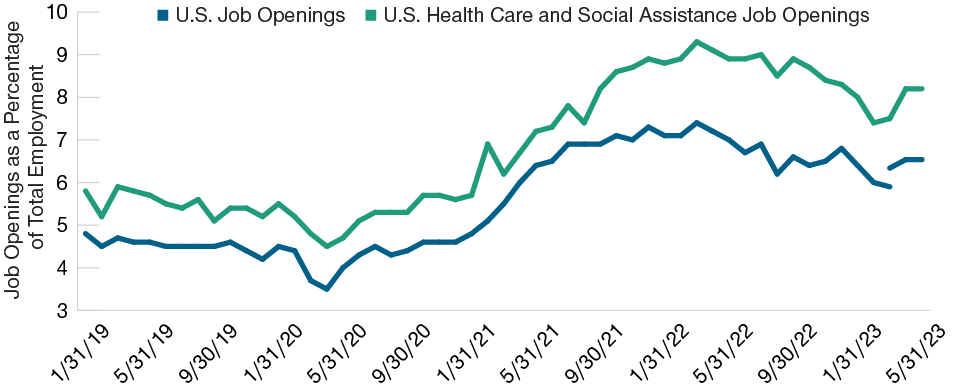

Health care systems responded by boosting pay to attract and retain talent, increasing overtime pay to fill staffing gaps, and relying on expensive agency labor. Figure 2 shows the material escalation of hourly agency rates relative to pre-pandemic levels. Although rates vary by regional market, broadly speaking, the hourly agency rate was roughly USD 75 before the pandemic, peaked at approximately USD 150 during the omicron surge, and moderated to around USD 110 in the first quarter of 2023.2

Suspension of Elective Procedures Weighed on Medical Technology Firms

In addition to challenging health care providers, the suspension of elective procedures and the intensified nursing shortage negatively impacted medical technology companies. Staffing shortages prevented providers from operating at full capacity, let alone recapturing the procedures that had been deferred during the acute phase of the pandemic. Procedure volumes—and therefore demand for medical products—remained stubbornly below pre-pandemic levels through 2021 and most of 2022, creating a headwind for medical technology companies.

Multiyear Contracts Helped Insulate Insurers From Cost Pressures

While health care providers experienced margin compression from material wage inflation, health insurers were structurally insulated from this pressure. Reimbursement rates paid by insurers to providers are locked in under multiyear contracts with low fixed annual escalators or negotiated increases in payments to providers, but health insurers reprice their insurance books annually. This gives insurers the ability to raise premiums before provider contracts are renegotiated (i.e., the ability to price ahead of unit cost inflation). This dynamic allowed health insurers to grow earnings at or above their long-term growth averages in 2022 even as health care providers struggled to maintain their profitability.

Hourly Agency Labor Rates Still High

(Fig. 2) But agency costs are well below post-pandemic peak

Sources: AMN Healthcare Services, Inc., T. Rowe Price estimates.

But Contracts Dragged Down Provider Profitability

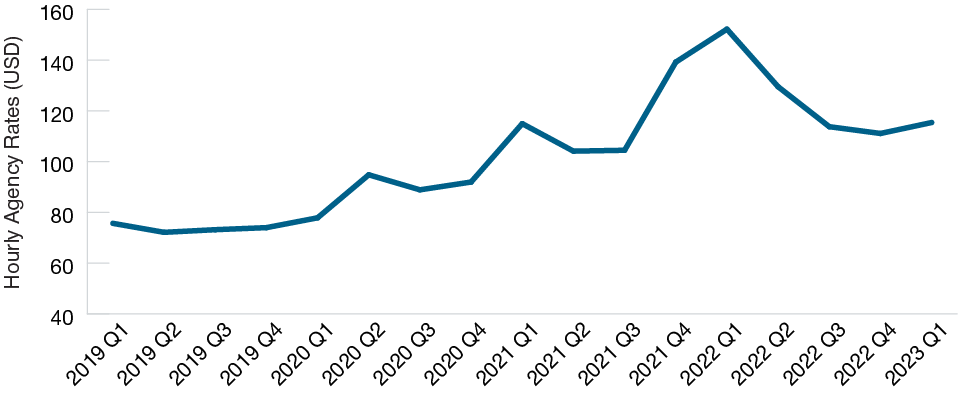

The multi-year contracts that helped provide stability to insurers resulted in many hospital systems experiencing a meaningful decline in profitability over the last 18 months or so, leading to a deterioration in credit metrics such as debt service coverage3 and debt-to-EBITDA.4 As shown in Figure 3, health care systems have recently started to show signs of margin improvement due in part to lower contract rates and agency utilization.

Nevertheless, higher full-time employee (FTE) costs and above-average use of contract labor compared with pre‑pandemic levels continue to weigh on provider operations. Over time, health care systems should be able to pass these costs through to insurers as contracts come up for renewal and are renegotiated. It is important to note that health insurers have already started to pass these costs through to their customers by raising premiums. As a result, we expect the fundamental credit quality of insurers to remain stable.

New Staffing Strategies Help Labor Retention

Agency labor costs moderated as management teams across health care providers implemented a variety of strategies to shift contract labor into full‑time staff. Through our conversations with dozens of health care leadership teams, it appears that new staffing strategies such as pay increases, sign-on bonuses, and enhanced fringe benefits have improved retention rates and lowered agency demand. It is still not clear what the net savings will ultimately be from lower agency use, as higher permanent costs in the form of higher FTE wages may offset lower agency spend.

Operating Margins Have Improved

(Fig. 3) Easing labor costs support first-quarter margins

As of March 31, 2023.

Past performance is not a reliable indicator of future performance.

Source: Kaufman Hall National Hospital Flash Reports.

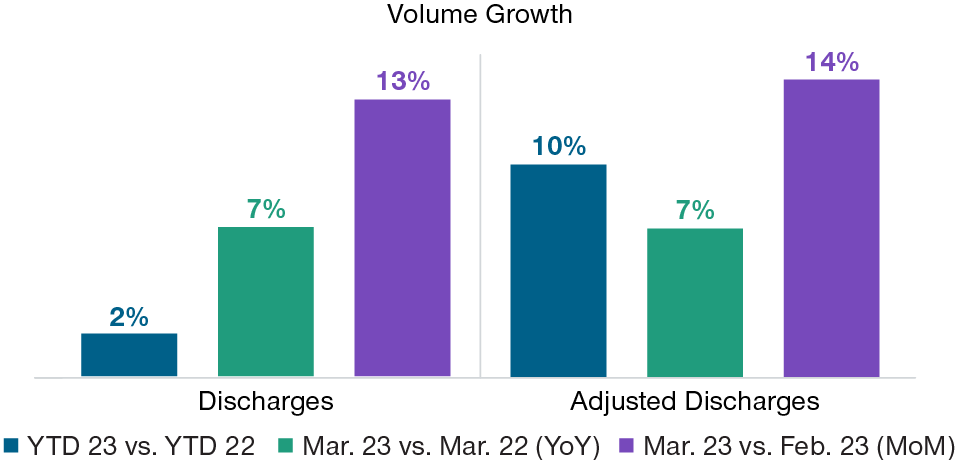

Medical Procedure Volumes Have Increased

(Fig. 4) Procedures have continued to rebound post-COVID

As of March 31, 2023.

Source: Kaufman Hall National Hospital Flash Reports.

Adjusted discharges standardize all patient revenue in terms of discharges.

However, margins seem to be moving in the right direction. Figure 3 lays out the first-quarter operating margins for the U.S. health care sector for years 2021–2023, which shows a gradual improvement as expenses, particularly labor, have eased; first-quarter 2021 operating margins were 2%, first-quarter 2022 were -2.1%, and first-quarter 2023 were about flat based on preliminary data.5

Procedure volumes have increased, boosting the topline for hospitals even as moderating staffing costs support the bottom line. The data shown in Figure 4 illustrate recent discharge and adjusted discharge6 volume growth that includes increases of 2% and 10%, respectively, for 2023 through March versus the same period in 2022 as well as favorable growth of 13% and 14%, respectively, in March from February.6 The backlog of patient procedures that built up over the last few years should continue to support this trend. We also expect this backlog to drive strong demand for medical products in the near to intermediate term, a credit positive for medical technology companies.

Health Care Industries Adapt to Pandemic Unwinding in Varying Ways

With many of the abrupt changes to the sector that resulted from the coronavirus pandemic unwinding, different health care industries stand to benefit in varying ways. Labor cost pressure and procedure capacity constraints are abating, which is already supporting health care provider margins and helping medical technology companies increase their revenues. Cost pressures during the height of the pandemic did not have the same degree of negative effects on health insurance companies because of their long-term contracts with providers, and insurers have already started passing costs along through higher premiums in an effort to maintain their financial stability.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

July 2023 / INVESTMENT INSIGHTS