September 2023 / MARKETS & ECONOMY

Global Markets Monthly Update

Key Insights

- Stocks in many developed markets pulled back sharply on fears of a prolonged period of higher interest rates.

- Japanese markets continued to outperform, as exporters benefited from a further decline in the yen.

- Longer-term bond yields in the U.S. hit their highest levels in 16 years, while German yields moved to their highest in a decade, resulting in a headwind to fixed income markets.

U.S.

Stock prices were lower across the board in September, with all the major indexes suffering significant declines. Value stocks held up better than growth shares in the large- and small-cap universes, while large-caps overall fell modestly less than small-caps. Energy was the sole sector within the S&P 500 Index to record a gain, while information technology shares fell 6.87% on a total return (including dividends) basis— only the small real estate sector fared worse, declining 7.25%. The month’s losses pushed the S&P 500 back into correction territory, down 11.01% from its early-2022 intraday high.

Long-Term U.S. Treasury Yields Hit Highest Level Since 2007

Fixed income markets also came under pressure as the yield on the benchmark 10-year U.S. Treasury note increased to nearly 4.65%, its highest level in 16 years, before falling back a bit to end the month. (Bond prices and yields move in opposite directions.) The Federal Reserve kept official short-term rates unchanged at its September 19–20 meeting, as was widely expected, but policymakers raised their rate expectations for 2024 and 2025, along with their growth forecasts. Fed officials also anticipated raising rates one more time in 2023.

Indeed, evidence of surprising resilience in the economy and its implications for higher rates seemed to drive a dynamic of “good news is bad news” for equity investors early in the month. At the start of the month, the Institute for Supply Management announced that its gauge of activity in the services sector jumped unexpectedly in August to its highest level in six months. Weekly unemployment claims also fell to their lowest level over roughly the same period. Retail sales jumped 0.6%, more than expected, although part of the increase was due to a substantial rise in gasoline prices. Domestic oil prices hit their highest level in over a year, driven in part by declining inventories.

The rise in energy prices was also reflected in August’s consumer price index (CPI), which rose 0.6% over the month, the fastest pace in a year, and headline producer prices also rose more than expected. Core (excluding food and energy) prices increased 0.3%, a tick above expectations, but investors received better news on the Fed’s preferred inflation gauge, the core personal consumption expenditures (PCE) price index, which rose only 0.1%. Over the three months ended in August, core PCE ran at an annualized rate of around 2.0%, right in line with the Fed’s long-term target.

Growing Wage Demands May Pose Threat to Margins

Persistent worries that inflation might pick up appeared to weigh on sentiment, however, driven by both the increase in oil prices and growing demands for higher wages. In what appeared to be part of a broader pattern, the United Auto Workers (UAW) announced a limited strike against the three major U.S. automakers, which had the potential to become the largest work stoppage in the U.S. in a quarter century. On September 27, a prolonged strike by the Writers Guild of America ended with significant concessions from Hollywood studios, and a Gallup poll showed the highest level of popular support for unions since the 1960s.

The UAW strike, combined with a resumption of student loan payments following the end of a COVID-era moratorium, seemed to drive worries at the end of the month that they might be enough to finally tilt the U.S. economy into recession. The prospect of a government shutdown following Congress’ failure to pass a budget for the coming year threatened to be a further headwind to the economy, although it was staved off, at least temporarily, by a last-minute agreement to fund the government through mid-November.

Europe

The pan-European STOXX Europe 600 Index fell for a second month running on concerns that interest rates would stay higher for longer even as economic activity slows. Signs of a weakening Chinese economy also weighed on sentiment. Germany’s Xetra DAX, Italy’s FTSE MIB, and France’s CAC 40 Index also declined. The UK’s FTSE 100 Index, however, gained ground in U.S. dollar terms.

European government bond yields broadly climbed as investors focused on the higher-for-longer rates narrative in financial markets. Germany’s benchmark 10-year government bond yield rose to nearly 3%—a level unseen in more than a decade. Italian bond yields advanced almost to 5% amid concerns that the government would need to increase debt issuance next year to finance a bigger deficit. In the UK, the yield on the benchmark 10-year bond ended just below 4.5%.

ECB Policymakers Indicate Rates Could Stay High for Some Time

The European Central Bank (ECB) raised interest rates for the 10th consecutive time and hinted that it could be nearing the end of its monetary tightening campaign. ECB President Christine Lagarde said a “solid majority” of policymakers had backed the quarter-point hike that took the key deposit rate to 4.0%, a record high. The ECB said that the move meant “interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.” A handful of policymakers—including Lagarde and Chief Economist Philip Lane—subsequently reaffirmed their commitment to maintaining a restrictive monetary policy for an extended period to bring inflation back to the 2% target.

Eurozone Inflation Drops to Lowest Level in Two Years; PMI Falls for Fourth Month

Consumer prices increased 4.3% annually in September—weaker than forecast and the slowest pace in about two years—from the 5.2% registered in August. The initial estimate of inflation data also showed that the core rate (a measure of underlying inflation pressures that excludes food, energy, alcohol, and tobacco) declined to 4.5% from 5.3%. Economic activity weakened in August, with purchasing managers’ surveys compiled by S&P Global showing private sector output remained in contractionary territory for a fourth consecutive month.

BoE, SNB Keep Rates Steady; Sweden’s Riksbank Tightens Policy

The Bank of England’s (BoE) Monetary Policy Committee voted 5-4 to keep the key interest rate unchanged at 5.25% as economic growth slows—the first pause since December 2021. The Swiss National Bank (SNB) defied expectations and kept its key interest rate at 1.75%— the first time it has not hiked since March 2022. Both central banks said more increases are still possible. As expected, Sweden’s Riksbank raised its policy rate by a quarter of a percentage point to 4.00% and kept the door open for another increase in November.

Japan

Equities in Japan outperformed most developed market peers in September, with the MSCI Japan Index gaining 0.5% in local currency terms to continue its strong run year-to-date. Yen weakness, benefiting Japan’s exporters, remained a tailwind. However, sentiment was dampened by the U.S. Federal Reserve signaling that it planned to keep interest rates higher for longer to combat persistent inflation. In contrast, the Bank of Japan (BoJ) matched expectations of no change to its monetary policy, dashing hopes that the central bank would hint at an exit from negative interest rates.

Against the backdrop of this monetary policy divergence, the yen weakened to its lowest level in over 11 months, to around JPY 149.8 against the U.S. dollar (USD), from about 145.5 at the end of August. This added to speculation that Japanese authorities could intervene in the foreign exchange (FX) market to prop up the yen, having repeatedly stated that they would respond appropriately to rapid currency moves. However, Finance Minister Shunichi Suzuki denied that the authorities have in mind a specific level for the USD-JPY that would trigger intervention.

BoJ Retains Dovish Stance, Signals No Rush to Tighten Policy

At its September meeting, as widely anticipated, the BoJ kept its short-term interest rate at -0.1% and that of 10-year Japanese government bond (JGB) yields at around 0%. It also left unchanged its 50-basis-point allowance band set on either side of the 0% yield target, as well as sticking to the 1% cap it effectively adopted in July when it tweaked its policy of yield curve control (YCC) to allow yields to rise more freely. The yield on the 10-year JGB rose to 0.76% over the month, from 0.65% at the end of August, reaching its highest level in over a decade.

The BoJ maintained its pledge to add stimulus without hesitation, if needed. It is continuing with monetary easing under the current framework because sustainable and stable inflation, accompanied by wage growth, is not yet in sight. When the central bank is in a position to achieve this goal, it will consider scrapping its YCC policy and modifying the negative interest rate,according to BoJ Governor Kazuo Ueda.

Japan’s core CPI rose 3.1% year on year in August, slightly ahead of consensus expectations. Core inflation has continued to slow, however, mainly because of the government’s economic measures pushing down energy prices.

Downward Revision to Second‑Quarter Economic Growth Weighs on Sentiment

Some sluggish economic data releases suggested that Japan’s economy was not doing as well as previously thought, with a downward revision to second-quarter economic growth weighing on sentiment. Japan’s second-quarter gross domestic product (GDP) expanded 4.8% quarter on quarter on an annualized basis, weaker than preliminary estimates of 6.0% growth. Capital spending, private consumption, and public investment were all softer than anticipated.

China

Chinese stocks declined on concerns about the country’s persistent property slump even as some indicators showed that the economy may have bottomed. The MSCI China Index fell 2.74% while the China A Onshore Index gave up 1.82%, both in U.S. dollar terms.

Inflation data revealed that consumer prices returned to growth after slipping into contraction in July. The consumer price index rose 0.1% in August from a year earlier, up from July’s 0.3% decline. Meanwhile, the producer price index fell 3% from a year ago but eased from the 4.4% drop the previous month.

Economy Shows Signs of Stabilization

Other readings showed that the economy was stabilizing in China, where activity began to flag after a brief post-lockdown rebound in the first quarter. Industrial production and retail sales grew more than forecast in August from a year earlier, while unemployment unexpectedly fell from July. However, fixed asset investment growth in August missed forecasts due to a steeper decline in real estate investment. New bank loans rose an above-consensus RMB 1.36 trillion in August, up from July’s RMB 345.9 billion.

In monetary policy news, the People’s Bank of China cut its reserve ratio requirement by 25 basis points for the second time this year to inject more liquidity into the financial system. The central bank also rolled out RMB 591 billion into the banking system compared with RMB 400 billion in maturing loans. Many analysts predict further policy easing in the year’s second half as Beijing tries to revive the economy, which has been weighed by a widening property sector slump that began in 2021.

In a sign of investors’ concern about the outlook for the economy, China recorded capital outflows of USD 49 billion in August, the largest since December 2015, which pushed the onshore yuan to a 16-year low against the U.S. dollar in September.

Other Key Markets

Türkiye (Turkey) as Central Bank Returns to More Orthodox Policy

Stocks in Türkiye, as measured by MSCI, returned 3.44% versus -2.57% for the MSCI Emerging Markets Index.

Equities were buoyed by the central bank’s continuing efforts to return to more orthodox policymaking practices. In the first half of the month, the central bank introduced additional monetary measures intended to limit the attractiveness of bank deposits protected from FX fluctuations. Specifically, the central bank raised the reserve requirement ratio (RRR) for FX-protected deposits with maturities up to six months to 25% from 15%, and it reduced the RRR with maturities over six months to 5%. For perspective, more than 80% of Türkiye’s FX-protected deposits have maturities of less than six months.

Also, toward the end of the month, the central bank raised its key policy rate, the one-week repo auction rate, from 25.00% to 30.00%. While this is well above the 8.50% level, where it was as recently as May, year-over-year inflation is currently around 60%, so real (inflation-adjusted) interest rates are still deeply negative.

T. Rowe Price sovereign analyst Peter Botoucharov is encouraged by Türkiye’s return—albeit at a measured pace—to a more orthodox monetary policy stance. However, Botoucharov acknowledges that there are still extensive macro-prudential regulations in place that are not allowing more normal functioning of the local interest rate markets and the FX market. In addition, there is still the risk that President Recep Tayyip Erdogan’s unorthodox policy views—for example, he has openly opined in the past that high interest rates cause high inflation—could resurface.

Polish Stocks Dive as Policymakers Note Slowing Growth

Polish stocks, as measured by MSCI, returned -11.06% and significantly underperformed the MSCI Emerging Markets Index.

On September 6, Poland’s central bank shocked investors by cutting its key policy rate, the reference rate, from 6.75% to 6.00%. This rate cut was much larger than expected—especially considering that the inflation rate, while declining, remains well above the reference rate—and it prompted a sharp drop in the zloty versus the euro.

According to the post-meeting statement, policymakers acknowledged a “slowdown in activity growth,” noting that a preliminary estimate of annual GDP growth in the second quarter was -0.6%. However, they also noted that the labor market situation “remains good and unemployment is low.” Nevertheless, they justified their action by noting that “recently incoming data point to a weaker demand pressure than previously expected, which will contribute to a faster return of inflation” to the central bank’s inflation target.

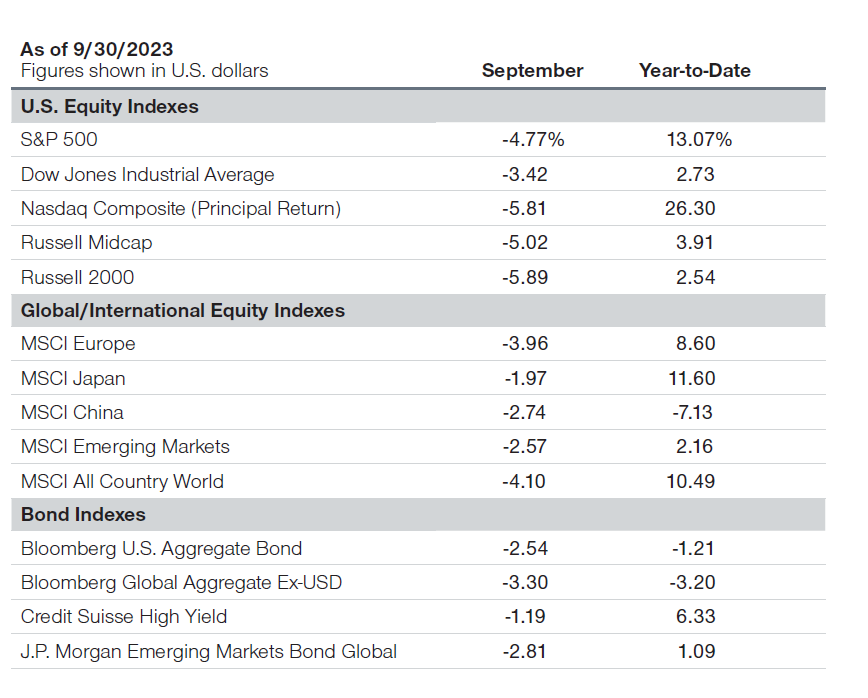

Major Index Returns

Total returns unless noted

Past performance is not a reliable indicator of future performance.

Note: Returns are for the periods ended September 30, 2023. The returns include dividends and interest income based on data supplied by third-party provider RIMES and compiled by T. Rowe Price, except for the Nasdaq Composite Index, whose return is principal only.

Sources: Standard & Poor’s, LSE Group, Bloomberg Index Services Limited, MSCI, Credit Suisse, Dow Jones, and J.P. Morgan (see Additional Disclosures).

Interestingly, policymakers asserted that “the decrease in inflation would be faster if supported by an appreciation of the zloty exchange rate, which would be consistent with the fundamentals of the Polish economy.” However, not long after the rate cut decision, central bank president Adam Glapinski expressed his belief that the current zloty exchange rate was acceptable and indicated that the central bank was not planning on intervening in the currency market.

Past performance is not a reliable indicator of future performance.

Additional Disclosures

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. “Russell®” is a trade mark(s) of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The LSE Group is not responsible for the formatting or configuration of this material or for any inaccuracy in T. Rowe Price Associates’ presentation thereof.

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

“Bloomberg®” and Bloomberg U.S. Aggregate Bond, Bloomberg Global Aggregate Ex-USD are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend its products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to its products.

© 2023 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2023, J.P. Morgan Chase & Co. All rights reserved.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

September 2023 / U.S. FIXED INCOME