July 2023 / MARKETS & ECONOMY

Global Markets Monthly Update

Key Insights

- Signs of moderating inflation in key economies helped most global equity markets to advance in July.

- Investor sentiment in the U.S. and Europe appeared to receive a lift from hopes that interest rates might be closer to peak levels.

- Stocks in China rallied as government officials vowed to implement measures to support the country’s economy.

U.S.

The major U.S. stock indexes advanced as signs of moderating inflation spurred hopes that interest rates could be near their peak and that the economy might avoid a significant contraction. The large-cap S&P 500 Index notched a fifth consecutive monthly gain. Participation in the rally broadened, with all 11 sectors finishing higher. Energy stocks returned the most, as the price of West Texas Intermediate crude oil rallied to a three‑month high. The health care and real estate sectors lagged. Small‑cap stocks, as represented by the Russell 2000 Index, outperformed their large‑cap counterparts.

Yields on 10-year U.S. Treasuries ended the month higher but retreated from peak levels above 4%. (Bond prices and yields move in opposite directions.) Within the Bloomberg U.S. Aggregate Bond Index, asset-backed securities (ABS) and corporate bonds posted the strongest returns as signs of easing inflation appeared to improve investors’ appetite for risk.

Inflation Moderates in June

Both headline and core (excluding volatile food and energy prices) inflation rose 0.2% in June, a tick below expectations. Later in the month, data showed that the Federal Reserve’s preferred inflation gauge, the core personal consumption expenditures (PCE) price index, increased 0.2% in June, a deceleration from the 0.3% month-over-month uptick registered in May. On a year-over-year basis, the PCE index was up 4.1%—the slowest pace of inflation since September 2021.

Wholesale inflation, as measured by producer price index (PPI) data, was arguably even more encouraging. Headline producer prices rose only 0.1% over the year ended in June, nearing deflation territory. Core producer prices rose 2.4% over the period, the slowest pace since January 2021.

Fed Raises Rates, Says Incoming Data Will Guide Future Changes

The Fed announced a 25-basis-point increase in the federal funds target rate on July 26, as expected. (A basis point is 0.01 percentage point.) T. Rowe Price traders noted that the tone of the Fed’s official statement was received as relatively benign, however, and expectations grew that the Fed might be finished raising rates, at least for the year.

In his post-meeting press conference, Fed Chair Jerome Powell acknowledged that “restrictive” monetary policy was now “putting downward pressure on economic growth and inflation,” but he stressed that further changes to interest rates would be guided by incoming data.

U.S. Economy Expands by More Than Expected in Second Quarter

The Commerce Department reported that the economy expanded at a year‑over‑year pace of 2.4% in the quarter, well above both the previous quarter’s growth rate of 2.0% and consensus expectations of around 1.8%. Both businesses and consumers appeared to remain in good shape and spending freely. Durable goods orders jumped 4.7% in June, while personal spending rose 0.5%.

Europe

In local currency terms, the pan-European STOXX Europe 600 Index rose, as did major stock indexes in Germany, Italy, France, and the UK. Concerns that interest rates would stay higher for longer sapped stocks at the start of the month, but investor sentiment strengthened after the European Central Bank (ECB) hinted that policy tightening might end soon.

ECB Raises Rates but Hints at Pause in Monetary Tightening

Toward the end of the month, the ECB raised its key deposit rate to a record‑equaling high of 3.75%, in a move that was widely expected. The central bank cited the prospect of inflation staying too high for too long as a key reason for the quarter-percentage-point hike. ECB President Christine Lagarde suggested that the bank was keeping an open mind about future rate decisions and hinted at a pause in policy tightening. While stressing that decisions would depend on incoming economic data, Lagarde said, “Do we have more ground to cover? At this point in time, I wouldn’t say so.” She added, “There is the possibility of a hike (next time). There is the possibility of a pause. It’s a decisive maybe.”

Eurozone Inflation Moderates in July; Second-Quarter Economic Growth Surprises to the Upside

Annual inflation in the eurozone slowed to 5.3% in July from 5.5% in June but remained well above the ECB’s 2.0% target.

Meanwhile, the eurozone economy strengthened more than expected in the second quarter, expanding 0.3% from the previous three months. Stronger exports and tourism helped growth in France and Spain, while Germany’s gross domestic product (GDP) was unchanged as industrial output contracted. Italy’s economy shrank.

Even so, a prominent purchasing managers’ survey suggested that business activity contracted in July. This gauge, which includes services and manufacturing, dropped to its lowest level since November. Future output expectations and new order inflows also deteriorated, signaling the potential for further weakness in the coming months.

UK Inflation Slows More Than Forecast, but Wages Grow at Record Rate

Annual consumer price growth in the UK slowed more than forecast in June to 7.9% from 8.7% in May, as gasoline and diesel prices plunged. The core inflation rate—which excludes volatile food, energy, alcohol, and tobacco prices—eased from a 31-year high of 7.1% to 6.9%.

However, the Bank of England (BoE) is concerned that strong wage growth may keep consumer price inflation higher for longer. The BoE’s forecast calls for inflation to decline steadily and to fall below its 2.0% target by 2025. On a year-over-year basis, wages rose a record 7.3% in the three months through May. However, signs of an easing labor market could mitigate these pressures. The unemployment rate unexpectedly increased to 4.0% in the three months through April, and the number of people out of work increased by the most since 2020.

Japan

Japanese equities gained in July, with the MSCI Japan Index up about 1.3% in local currency terms. The Bank of Japan (BoJ) surprised investors by tweaking its monetary policy, announcing that it would increase flexibility around its yield curve control (YCC) target. As widely expected, the BoJ also raised its forecast for the consumer price index (CPI) in fiscal 2023. Inflation remained well above the BoJ’s 2% target: CPI rose 3.3% year on year in June, in line with expectations and up slightly from the prior month’s 3.2%.

The yield on the 10-year Japanese government bond (JGB) rose to 0.61%, from 0.39% at the end of June, to its highest level in around nine years on the BoJ’s monetary policy tweak and in anticipation of further policy normalization. The yen strengthened to about JPY 142 against the U.S. dollar, from around 144 the prior month. There was some speculation that the BoJ would intervene in the foreign exchange market to prop up the Japanese currency, but no such move was forthcoming.

BoJ Tweaks Monetary Policy, Revises up Inflation Forecast

Following its July 28–29 monetary policy meeting, the BoJ decided to keep its key short-term interest rate unchanged at -0.1% and that of 10-year JGB yields around zero percent.

However, the central bank surprised investors with the announcement that it would conduct YCC with greater flexibility to enhance the sustainability of monetary easing under the current framework. While it will continue to allow 10-year JGB yields to fluctuate in a range of around plus or minus 0.5 percentage point from the zero percent target level, greater flexibility means that it will regard the upper and lower bounds of the range as references, not as rigid limits, in its market operations. The BoJ will also offer to buy 10-year JGBs at 1.0% (changed from 0.5%) every business day through fixed rate purchase operations.

After the announcement, BoJ Governor Kazuo Ueda said that the surprise policy change did not represent an unwinding of YCC and negative-rate policy but was rather a risk-management decision made for technical reasons.

In its Outlook for Economic Activity and Prices, the BoJ left its projected real economic growth rates relatively unchanged, forecasting that GDP would expand 1.3% year on year in the fiscal year ending March 31, 2024. The central bank revised its forecast for the year‑over‑year increase in CPI in fiscal year 2023 to 2.5% from 1.8%. The significant upward revision is mainly because cost increases, led by the past rise in import prices, have been passed on to consumer prices to a greater extent than expected. There was not much change to the central bank’s CPI forecasts for fiscal year 2024 (+1.9%) and fiscal year 2025 (+1.6%).

China

Chinese equities rose after Beijing vowed to support the country’s sputtering economic recovery. The MSCI China Index soared 10.86%, while the China A Onshore Index gained 5.73%, both in U.S. dollar terms.

The Politburo, China’s top decision‑making body led by President Xi Jinping, pledged to provide stimulus to boost domestic consumption. Officials also vowed to enhance support for the ailing real estate sector following the Politburo’s latest meeting, during which leaders set economic policy for the rest of 2023.

Economy Grows at a Slower‑Than‑Expected Pace in the Second Quarter

For the second quarter, China’s GDP expanded 6.3% on a year-over-year basis, trailing expectations but growing faster than the 4.5% growth rate recorded in the first quarter. On a quarter-on-quarter basis, the economy grew 0.8%, slower than the first quarter’s 2.2% expansion. Quarterly readings provide a better reflection of underlying growth in China than year-ago comparisons because Shanghai and other major cities were then under lockdown to curb the spread of the coronavirus.

Other economic readings showed that China’s post-pandemic recovery lost momentum in the year’s first half. Profits at industrial firms declined 8.3% in June from a year earlier, a slower pace than the 12.6% drop recorded in May, according to China’s statistics bureau. Industrial profits fell 16.8% from January to June from a year earlier, better than the 18.8% drop recorded in the first five months of 2023. The unemployment rate remained steady at 5.2% in June, but youth unemployment jumped to a record 21.3%.

CPI Data Spur Concerns About Potential Deflation

The CPI remained unchanged in June from a year earlier and marked the weakest reading since February 2021. Core inflation, which excludes volatile food and energy prices, slid to 0.4% from the previous month’s 0.6%. The PPI slipped to a lower‑than‑expected rate of 5.4%, notching its ninth consecutive monthly decline.

Other Key Markets

Stocks Surge in Turkey as Central Bank Fights Inflation

The MSCI Turkey Index returned 19.26% in U.S. dollar terms, compared with the 6.29% gain posted by the MSCI Emerging Markets Index.

On July 20, the Turkish central bank— now led by Governor Hafize Gaye Erkan—decided to raise its key policy rate, the one-week repo auction rate, to 17.5% from 15.0%. This action followed on the heels of a 650-basis-point rate increase in the latter part of June.

According to the central bank’s postmeeting s atement, policymakers “decided to continue the monetary tightening process in order to establish the disinflation course as soon as possible, to anchor inflation expectations, and to control the deterioration in pricing behavior.” They also noted that “recent indicators point to continuation of the increase in the underlying trend of inflation,” which has been driven by “domestic demand, cost pressures stemming from wages and exchange rates, and the stickiness of services inflation.”

With a goal of bringing down inflation to the central bank’s 5% target in the medium term, central bank officials affirmed their intention to continue tightening monetary policy “as much as needed in a timely and gradual manner until a significant improvement in the inflation outlook is achieved.” Annual consumer price inflation surged to 47.8% in July from 38.2% in the preceding month.

Chile’s Central Bank Kicks off Easing Cycle

Stocks in Chile, as measured by MSCI, returned 5.86% in U.S. dollar terms. Near the end of the month, the Chilean central bank officially kicked off an easing cycle by cutting its monetary policy rate by 100 basis points from 11.25% to 10.25%. The rate cut was larger than generally expected, and the decision was unanimous—a sharp contrast to the central bank’s narrow decision to keep rates unchanged at the previous meeting.

According to T. Rowe Price emerging market Sovereign Analyst Aaron Gifford, the post-meeting statement acknowledged that weak economic growth was in line with expectations and that inflation had somewhat surprised to the downside. As a result, the board found it appropriate to start the easing cycle at a faster pace than what it projected in its most recent quarterly monetary policy report.

Gifford notes, however, that the board didn’t seem to abandon its central macroeconomic scenario, suggesting that faster rate cuts in the near term may not necessarily set the stage for a cycle where the central bank eases monetary policy significantly. Overall, policymakers said that the magnitude and timing of rate cuts will depend on incoming economic data points and their implications for the trajectory of inflation. They also asserted that they will be flexible in case any domestic or external risks materialize.

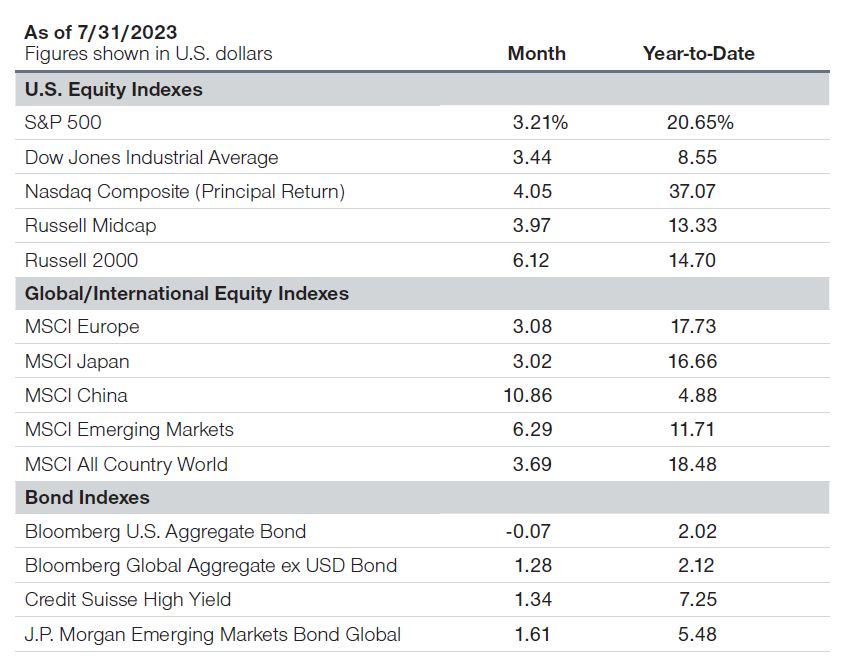

Major Index Returns

Total returns unless noted

Past performance is not a reliable indicator of future performance.

Note: Returns are for the periods ended July 31, 2023. The returns include dividends and interest income based on data supplied by third‑party providerRIMES and compiled by T. Rowe Price, except for the Nasdaq Composite Index, whose return is principal only.

Sources: Standard & Poor’s, LSE Group, Bloomberg Index Services Limited, MSCI, Credit Suisse, Dow Jones, and J.P. Morgan (see Additional Disclosure).

The specific securities identified and described are for informational purposes only and do not represent recommendations.

Additional Disclosure

The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. “Russell®” is a trademark(s) of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The LSE Group is not responsible for the formatting or configuration of this material or for any inaccuracy in T. Rowe Price Associates’ presentation thereof.

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

“Bloomberg®” and Bloomberg U.S. Aggregate Bond, Bloomberg Global Aggregate Ex‑USD are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by T. Rowe Price. Bloomberg is not affiliated with T. Rowe Price, and Bloomberg does not approve, endorse, review, or recommend its products. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to its products.

© 2023 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2023, J.P. Morgan Chase & Co. All rights reserved.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

July 2023 / INVESTMENT INSIGHTS