December 2022 / INVESTMENT INSIGHTS

Securitised Credit Continues to Evolve

Post-GFC rules have toned down risk, but careful analysis is key

Key Insights

- The securitized credit asset class has a deserved reputation for both risk and complexity, but it has evolved positively since the global financial crisis.

- Securitized credit can offer diversification benefits and attractive credit spreads relative to similarly rated bonds in other sectors like corporate bonds.

- Liquidity in certain areas of securitized credit can sometimes be limited, resulting from the fact that it is a smaller and more fragmented market.

The securitized credit asset class has a long track record of innovation and creativity in securitising the cash flows from a wide variety of collateral. Bonds backed by music royalties, pioneered by artists such as David Bowie, have become increasingly common tools for musicians to monetize their future cash flows. On a more down-to-earth level, residential and commercial mortgages are among the more common types of securitisations. And deals backed by auto loans, mobile phone plan payments, or quick-service restaurant chain franchise fees and royalties can offer investors exposure to essential consumer services that could prove relatively recession resistant.

The diverse and sometimes esoteric asset class has a deserved reputation for both risk and complexity, but it has evolved in positive ways since the global financial crisis (GFC). Securitized credit investors can take advantage of the potential diversification benefits and attractive credit spreads that are often available relative to similarly rated bonds in other sectors like corporate bonds, where institutional investors often concentrate their exposures.

The complexity and sometimes limited liquidity of the asset class typically drives most of this spread premium. Investors with the needed research, technology, and trading resources can capitalize on the structural risk premiums and inefficiencies in the securitized credit market, helping to add alpha through security selection and strategic sector allocation.

Post-GFC Regulations Fortified Securitized Assets

Despite being at the epicenter of the GFC, regulations imposed since that traumatic time have forced changes on the asset class that have effectively curtailed risky lending practices, improved investor protections, and strengthened securitized credit structures. Credit rating agencies also came under major scrutiny following the problems of the GFC for making rosy assumptions about default risks and suffering from conflicts of interest when rating bonds. The rating agencies have since been compelled to more stringently examine bonds in the asset class, giving the broad investor community a better picture of risk and credit quality.

With that said, we thoroughly analyze the underlying collateral and deal structure of each security that we consider for purchase and assign our own rating for credit quality. Because many segments of securitized credit are complex and effective analysis often requires a deep bench of experienced credit analysts with sector expertise and access to specialized data, there is often a complexity premium built into bond prices in the sector. We believe that T. Rowe Price has the necessary scale and expertise along with the ability to collaborate with a global team of corporate credit and equity analysts to provide additional insights and take advantage of the complexity premium.

Four Segments of Securitized Credit

There are four main segments of securitized credit. Although they are distinct sectors with different structures and risk profiles, they share some common characteristics, such as generating cash flows from a pool of collateral, or underlying assets. These cash flows are structured into different tranches of varying credit quality, with the higher-rated tranches having first priority on receiving cash flows, while the lower-rated tranches are the first to incur any losses due to underlying loan delinquencies or defaults.

In many respects, such as being backed by a pool of loan collateral, securitized credit is similar to agency mortgage-backed securities (MBS), by far the largest securitized market; however, agency MBS holders take little to no credit risk because the issuing government-sponsored enterprises (GSEs) provide government backing, either implicit or explicit. Agency MBS can also play an important role in a diversified fixed income portfolio. Unlike smaller and less standardized securitized credit sectors, the MBS asset class is one of the most liquid areas of fixed income. While MBS generally offer a smaller risk premium than securitized credit because of their government support, MBS can offer attractive relative value versus Treasuries or high-grade corporate bonds when interest rate volatility creates pricing dislocations.

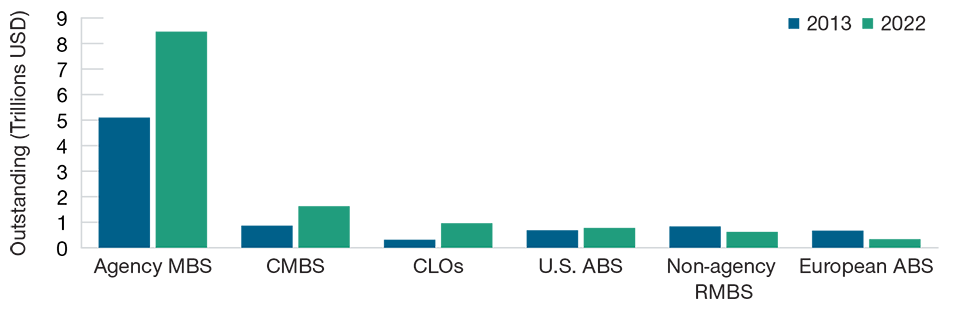

Size of Securitized Markets

(Fig. 1) Securitized credit is much smaller than agency MBS

As of November 22, 2022.

Source: J.P. Morgan

In contrast with agency MBS, securitized credit investors assume credit risk, along with the interest rate risk inherent in most fixed income assets, but they are also compensated to varying degrees for doing so.

1. Asset-backed securities (ABS)

ABS tend to be higher quality and shorter maturity than the other segments of securitized credit. This can make them an important source of portfolio diversification when credit risk falls out of favor. Some ABS segments also typically have floating coupons, which can be attractive when interest rates are rising. A wide range of mostly consumer-related collateral can back ABS deals, ranging from “plain vanilla” cash flows related to vehicle loans and leases, credit card receivables, student loans, and farm equipment loans to more esoteric collateral linked to franchise royalties, aircraft, and data centers.

Our credit analysts examine a range of key ABS deal characteristics that may vary widely depending on the type of collateral. When examining a new deal backed by auto loans, for example, we consider the issuer’s experience in the ABS capital markets as well as its underwriting and funding plans going forward. We can also collaborate with T. Rowe Price equity analysts and corporate credit analysts to get a fuller picture of the issuer’s overall creditworthiness. We analyze the performance of the deal’s collateral type (prime or subprime) through past economic cycles as well as the current default rates and severities, or the percentage of the original loan not recoverable in a default, on the issuer’s loans.

More specifically, we analyze the borrower credit scores for the loans underlying the deal and the seasoning of the collateral—the number of months that the loans have been outstanding. Auto loan borrowers are typically more likely to default on their obligations early in the life of the contract. The original term length of the loan is also important because defaults and severities on longer-term loans—contracts of more than five years—can be higher. Also, loans on new vehicles tend to perform better than loans made on used vehicles, with all else equal.

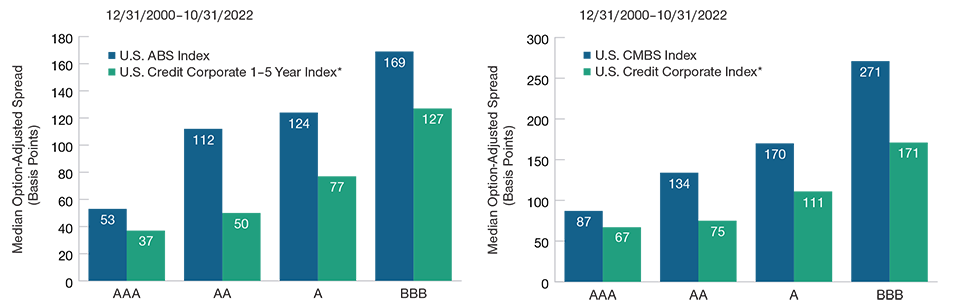

Historical Credit Spread Advantage

(Figs. 2 and 3) ABS and RMBS have offered more spread than corporates

As of October 31, 2022. Past performance is not a reliable indicator of future performance.

*Bloomberg indexes.

Source: Bloomberg Finance, L.P.

Credit ratings for securities are provided by Moody’s, Standard & Poor’s, and/or Fitch and are referenced here in Standard & Poor’s nomenclature. A rating of AAA represents the highest-rated securities, and a rating of BBB represents securities with the lowest investment-grade rating. Based on the Bloomberg indexrating methodology: When a rating is available from all three agencies, the median rating is used; if there are two ratings, the lower rating is used; if only one ratingis available, that rating is used. In addition to the ratings from the major rating agencies, T. Rowe Price maintains its own proprietary credit rating methodology forall securities held in portfolios.

We also consider the geographic diversity of the loans from an environmental, social, and governance (ESG) perspective. For example, deals with greater exposure to loans issued in states such as Florida may be more susceptible to climate risk in the form of flooding and wind damage to vehicles.

2. Non-agency residential mortgage-back securities (RMBS)

RMBS, which are backed by mortgages on residential properties, can have a wide variety of structures and credit quality. RMBS issued before the GFC have essentially disappeared from the market as the surviving deals have either matured or paid down in advance of maturity. Mortgage originators are now far more selective in extending mortgage credit, and new RMBS structures backed by mortgages subject to much more stringent underwriting standards have slowly replaced pre-crisis structures. Also, compared with the pre-GFC period, much more—and more accurate—data are now available on the underlying mortgages and borrowers.

As a direct result of post-crisis regulations, Fannie Mae and Freddie Mac, which are GSEs and among the primary issuers of agency MBS, began issuing an innovative type of RMBS called credit risk transfer (CRT) securities that, as the name suggests, do not have an implicit government credit guarantee. Other types of RMBS include bonds backed by prime-quality, nonconforming mortgages (those that do not qualify for purchase by the GSEs) or by single-family rental properties, illustrating the segment’s diversity of collateral and deal structures.

3. Commercial mortgage-backed securities (CMBS)

CMBS are backed by loans on commercial property (e.g., office buildings, retail establishments, hotels, and warehouses), which have different characteristics than residential home mortgages. Thorough analysis of the cash flow features and quality of the underlying property is essential in analyzing CMBS. Traditional “conduit” CMBS consist of pooled collateral like most other types of securitized credit and generally pay a fixed coupon. A rapidly growing segment of CMBS, known as single-asset, single-borrower (SASB), are backed by a single commercial property or multiple properties owned by the same borrower. SASB deals typically have floating interest rates and tend to be backed by high-quality “trophy” properties, reducing some of the risk of the lack of collateral diversification.

4. Collateralized loan obligations (CLOs)

Unlike other securitized assets that are backed by consumer or property loans, CLOs are backed by syndicated bank loans to corporations, which usually have below investment-grade credit ratings. A third-party collateral manager actively manages the loan portfolio backing the CLO deal, making the segment distinct from other types of securitized credit. This feature requires an additional level of analysis to assess the quality and experience of the manager. Another unique aspect of the CLO market is that established, experienced buyers can negotiate the terms of new deals with issuers.

Most of the debt tranches in a CLO have credit ratings that range from AAA to BB, depending on the amount of credit enhancement—support from the cash flow structure of the CLO. Taking advantage of T. Rowe Price’s broad fundamental research platform, we collaborate with our high yield and equities analysts to get a fuller picture of the quality of collateral underlying CLOs.

Monitoring Relative Value

In addition to monitoring credit fundamentals, we track credit spreads on various types of securitized credit relative to corporate bonds and other fixed income sectors with comparable credit quality and maturity profiles. Unlike corporate bonds, each securitized credit deal has different tranches that can have widely varying characteristics and appeal to different types of investors. When securitized credit offers more spread than competing assets—a relatively common situation that often results from the higher complexity and more limited liquidity of the asset class—our analysts recommend individual securities that our portfolio managers can add to take advantage of the relative value opportunity.

Securitized credit segments can have discrete drivers of credit quality that differ from other fixed income segments, potentially providing opportunities to diversify or to more directly benefit from those drivers. With the exception of CLOs, the overall credit quality of securitized credit tends to be driven more by consumer and real estate fundamentals, not by corporate fundamentals. Depending on the state of the economy, the consumer and corporate sectors can be in very different states of health. Also, the vast majority of securitized credit is bankruptcy remote—the deals are legally structured with the assets in a trust separate from the issuing corporation’s assets—which could be helpful in avoiding defaults in the later parts of the credit cycle.

Several segments of securitized credit appeared to offer attractive relative value in early December 2022. High-quality CLOs traded at particularly wide spreads relative to other credit sectors, possibly driven by ongoing deleveraging by UK pension funds. We remain confident that the sturdy credit enhancement provided by AAA rated CLOs would be able to withstand a meaningful increase in corporate defaults. ABS backed by both prime and subprime auto loans also offered attractively wide spreads to corporate credit, although thorough analysis of these deals is even more important given that consumer strength may be peaking ahead of a possible recession in 2023. We also saw some potential value in segments of CMBS, though we have been particularly cautious in that segment given its existing fundamental headwinds exacerbated by recession risk.

Liquidity Risk Awareness

Of course, the securitized credit asset class has meaningful risks that we actively monitor, one of the most significant of which is that liquidity in certain areas can sometimes be limited. This more constrained liquidity results from the fact that securitized credit is simply a smaller and more fragmented market than corporate or government bonds, for example, with a smaller investor base.

Our securitized credit traders maintain strong working relationships with Wall Street dealers, which should allow them to source liquidity where possible as well as gain access to primary and secondary market offerings. This is particularly important because many securitized credit deals have limited trading or are bought and held to maturity. We consider liquidity as a risk factor when weighing the relative value in securitized credit against other fixed income sectors that may typically offer better liquidity conditions.

We work with local regulators to ensure that all of our securitized credit holdings in European accounts and funds comply with European Union or UK risk retention requirements, which mandate that the deal originator, sponsor, or original lender retains at least 5% of the securitisation’s net economic interest. This regulation ensures that the originator has “skin in the game,” unlike many pre-GFC deals where the originator had no exposure to a securitization’s risk after selling it all to investors. Even outside the UK and EU, we see this as another broad layer of risk management in addition to each deal’s credit enhancement features and our own fundamental research.

What we’re watching next

In addition to allowing us to analyze complex securities within securitized credit, our systems and access to sophisticated data also give us the capability to deliver detailed data to our clients on the performance of our securitized credit holdings. This can include figures on projected cash flows and principal payments as borrowers on the underlying collateral pay down their loans.

General Fixed Income Risks

Capital risk—the value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between. the base currency of the portfolio and the currency in which you subscribed, if different.

ESG and Sustainability risk—may result in a material negative impact on the value of an investment and performance of the portfolio.

Counterparty risk—an entity with which the portfolio transacts may not meet its obligations to the portfolio.

Geographic concentration risk—to the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk—a portfolio’s attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk—investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management risk—the investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

Operational risk—operational failures could lead to disruptions of portfolio operations or financial losses.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.