December 2022 / ASSET ALLOCATION VIEWPOINT

The 2023 Inflation Outlook

Interest rate cut is unlikely if inflation settles above Fed’s target

Key Insights

- Inflationary pressures have been a headwind for financial markets, so recent reports showing a declining trend in prices have been encouraging to investors.

- Moderating inflation may slow—or even pause—Fed hikes in the near term, but we believe a rate cut is unlikely if inflation settles above the 2% Fed target.

Elevated inflation has weighed down global financial markets and remains a key variable for investors. Recently, equity markets rallied strongly after inflation data for October 2022 showed that prices fell for the fourth consecutive month and services inflation, which had been steadily increasing, appeared to be peaking.

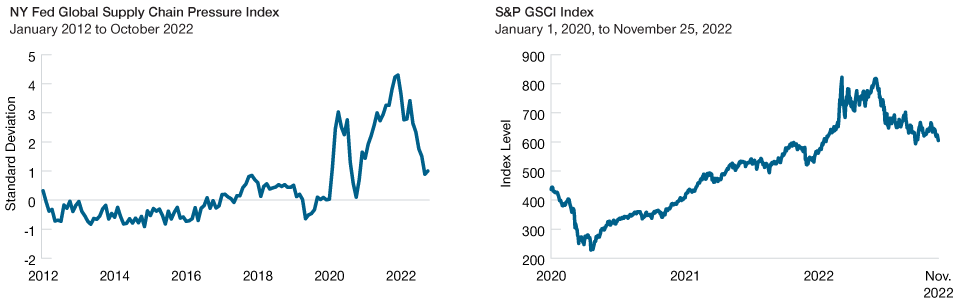

The cost of goods collectively—which includes food, energy, and other commodities—has declined consistently since the beginning of the year. The rapid improvement in supply chains since April has helped alleviate price pressures, and forward-looking indicators show that the downward trend is likely to continue (Figure 1).

Goods Inflation Should Continue to Ease

(Fig. 1) Supply chains have improved significantly, while commodity prices remain

below peak levels.

Past performance is not a reliable indicator of future performance.

Sources: New York Federal Reserve, Liberty Street Economics/Haver Analytics, and S&P Indices. See Additional

Disclosures.

Meanwhile, commodity prices remain well below the inflated levels reached early this year and are expected to remain somewhat anchored amid fading demand due to weakening economic activity. Robust natural gas storage levels in Europe, supported by a mild winter thus far, and rising U.S. oil production have also eased energy supply concerns.

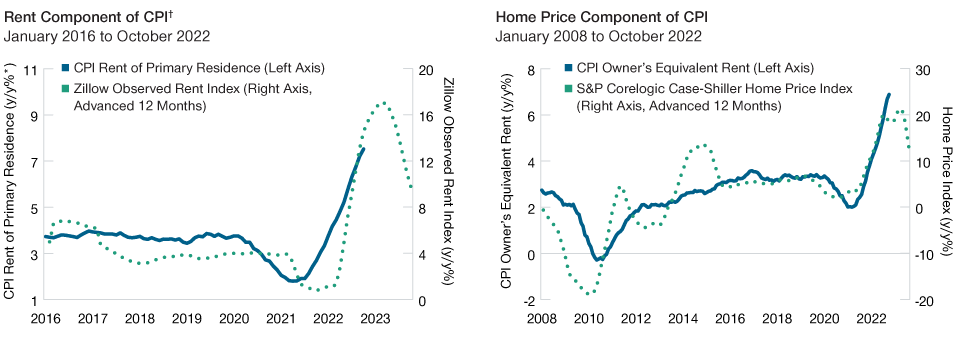

Rising costs within the services segment of inflation are a crucial area of focus for the Federal Reserve because services inflation is “stickier” and tends to persist for longer. On the positive side, shelter inflation—which is a large component of services inflation—is expected to fall significantly over the next 12 months (Figure 2). Unfortunately, the outlook for other services components is less promising as wage inflation remains elevated, driven up by sustained labor shortages.

Shelter Inflation is Expected to Recede

(Fig. 2) Forward-looking indicators suggest a sharp pullback in housing costs within

12 months.

Sources: U.S. Bureau of Labor Statistics, S&P Indices, and Zillow/Haver Analytics.

See Additional Disclosures.

*y/y = year over year

† Consumer Price Index (CPI) measures the monthly change in prices paid by consumers and is a widely used measure of inflation.

Actual future outcomes may differ materially from estimates.

Overall, the costs of both goods and services are likely to decline considerably by the middle of next year, and it is, therefore, reasonable to expect the Fed to slow its pace of—or even pause—rate hikes. However, we believe that an interest rate cut is unlikely in 2023 if labor costs remain elevated and inflation settles well above the Fed’s 2% target.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.