June 2022 / U.S. FIXED INCOME

Interest Rate Volatility Creates Value in RMBS

Strong housing supports mortgage-backed bonds with credit risk.

Key Insights

- Recent selling pressure has created areas of compelling value within mortgage-backed securities with credit risk, given the strong housing market fundamentals.

- We do not expect home prices to keep rising at the recent annual pace of close to 20%, but we also do not expect them to fall in the near to medium term.

- We are selectively finding value in credit risk transfer (CRT) and single-family rental property (SFR) securitizations.

Mortgage-backed securities with credit risk, known as RMBS, were certainly not immune to the early 2022 bond market sell-off as consensus expectations for Federal Reserve rate hikes leaped higher along with inflation. Indeed, because fluctuations in rates can substantially alter the cash flows investors ultimately receive, RMBS tend to be more susceptible to interest rate volatility than many other fixed-income segments, where cash flows are more predictable.

Despite concerns about the ramifications of tighter Fed policy and declining housing affordability, we think that the fundamentals backing the housing market remain strong, so the selling pressure has created areas of compelling value within RMBS. These segments include credit risk transfer (CRT) securities and bonds backed by mortgages on single-family rental properties (SFRs).

Elevated Interest Rate Volatility

From the beginning of 2022 through April, consensus expectations for 2022 Fed rate hikes abruptly moved from a total of about 75 basis points1 to 250 basis points as even the Fed acknowledged that it would need to expeditiously tighten policy to fight inflation. At the same time, the ICE BofA MOVE Index2 of implied Treasury market volatility reached its highest levels since the onset of the pandemic in March 2020.

The mortgage loans backing RMBS allow the mortgagor to refinance at lower rates—prepaying principal balances—when rates fall. This causes the effective duration3 of the bonds to shorten. On the other hand, fewer mortgagors have an incentive to prepay when rates rise, causing the duration of the bonds to lengthen. The rapid increase in mortgage rates in 2022 has lengthened the duration of many RMBS, exacerbating price declines.

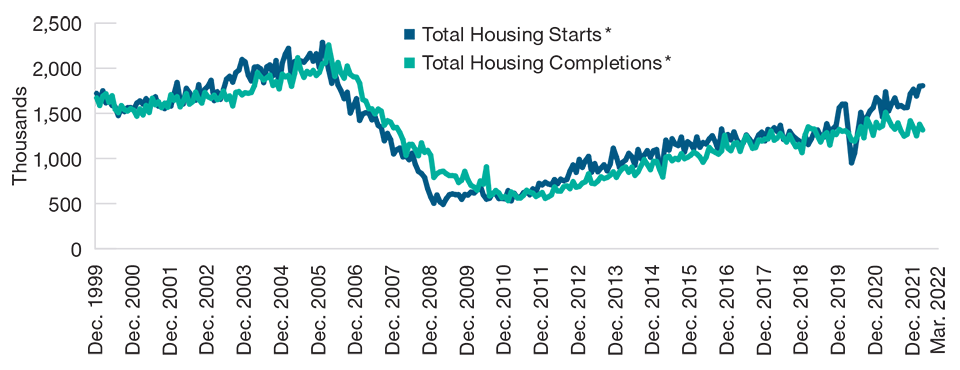

Housing Starts, Completions Lag

(Fig. 1) Housing supply has not kept pace with demand

As of March 31, 2022.

Source: U.S. Census Bureau via Bloomberg Finance L.P.

*Seasonally adjusted annualized rate: (monthly rate adjusted for standard seasonal variation and converted to annual rate).

Credit spreads4 on RMBS have widened meaningfully this year amid elevated interest rate volatility and the general risk-off sentiment following Russia’s invasion of Ukraine. Issuers also rushed to bring new RMBS deals to market as rates moved higher, so the technical pressure from the additional supply helped drive spreads even wider. At the same time, the combination of concerns about the sustainability of the economic expansion, interest rate volatility, and cheapening valuations for other assets with credit risk, such as corporate bonds, caused RMBS demand to dry up.

Strong Housing Market, Consumer Balance Sheets

In our view, some segments of RMBS at these spread levels represent solid value, given the strong fundamental condition of the housing market. After the very large housing price gains since early 2020, homeowners have plenty of equity in their houses as well as healthy balance sheets with incomes bolstered by the strong labor market and relatively low levels of debt. Together, these factors represent a substantial buffer against defaults even in the event of a major housing market downturn.

While we do not expect home prices to keep rising at the close to 20% annual pace experienced in recent months, we also do not expect them to fall in the near to medium term. We anticipate that home price growth will slow to a more sustainable pace of about 5% annually. Although mortgage rates have climbed substantially so far in 2022, the supply of homes remains quite limited, and many millennials are forming households and buying homes. Home prices could decline in 2023 if easing supply chains allow the pace of new home completions to pick up significantly at the same time that the economy falls into recession, but that is not our current base-case outlook.

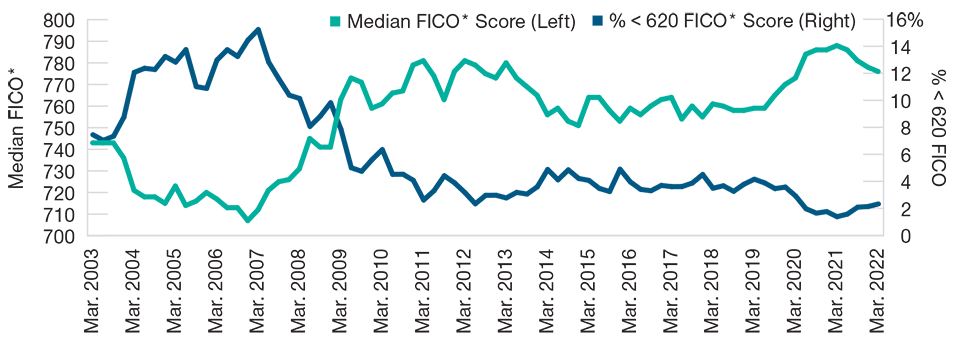

Mortgage Borrower Credit Scores Rise

(Fig. 2) Lower percentage of loans to subprime borrowers

As of March 31, 2022.

Source: Federal Reserve Bank of New York Consumer Credit Panel and Equifax, via Haver Analytics.

*FICO scores, created by the Fair Isaac Corp., measure a borrower’s creditworthiness on a scale of 300 to 850.

Value in CRTs

Looking within the broad and diverse RMBS sector, one segment of the market where we are finding value is in CRTs. Fannie Mae and Freddie Mac—known as government-sponsored enterprises (GSEs)—issue CRTs. But, unlike the conventional agency mortgage-backed securities that the GSEs also issue, CRT securities are exposed to credit risk and can incur losses if enough homeowners in a pool of mortgages default on their loans.

However, the GSEs retain a significant portion of the credit risk in the CRT structure, giving them some “skin in the game.” This likely motivates them to avoid insuring loans that are badly underwritten or have a high degree of default risk. CRTs also have floating interest rates, which is an appealing feature in an environment of rising rates.

We are confident in the mortgage underwriting standards of Fannie Mae and Freddie Mac, which have become much more disciplined and stringent following the housing-fueled credit crisis of 2008–2009. Median borrower credit scores have notably increased, and loans to subprime borrowers are a much lower percentage of the total mortgage market than before 2008.

Underwriting technology, in particular, has advanced markedly, with Internal Revenue Service documents now easily available to verify income for mortgage applicants. Home valuation technology with tools like Google Earth have allowed more accurate analysis of comparative home sales. However, CRTs do not have as much credit enhancement—support from more junior tranches in the transaction—as other types of RMBS, so they require more diligent surveillance of collateral quality.

Rent Inflation to Support SFRs

SFRs are another RMBS segment where we are seeing value. The collateral backing an SFR securitization is typically a single loan that is essentially collateralized by a pool of single-family rental properties. The rental income on these properties is ultimately used to pay bondholders of the SFR securitization. SFRs share some characteristics with RMBS backed by mortgages on single-family homes as well as with multifamily commercial mortgage-backed securities (CMBS). Credit spreads on SFRs reached very wide levels compared with their historical averages in April, generating opportunities to find compelling value.

SFRs have some fundamental credit quality advantages over other types of RMBS, including a large buffer against home price declines, as the SFR securities typically benefit from an excess collateral of properties backing the securitization. In addition, SFR securities can also benefit from both the price appreciation of the underlying rental homes and an increase in rental income on the underlying properties as rents trend higher nationwide. Because of the acute shortage of housing in the country and worsening affordability for homebuyers, many analysts expect rents to keep rising even if other forms of inflation slow. Finally, unlike many other forms of fixed rate MBS, SFRs have limited risk of duration extension due to strong structural incentives for an issuer redemption by their expected maturity dates.

Liquidity and Volatility Are Risks

The obvious macro risk to RMBS is a near-term recession that causes housing prices to fall, but we think that the economy is strong enough to avoid this scenario. Even in the case of a recession, we think that the fundamentals of most areas of RMBS would allow them to withstand the downturn without major distress. In our view, the most significant risk is that RMBS is still a fairly illiquid sector, which tends to make it more volatile in periods of elevated risk aversion. However, we think that the longer-term advantages of the strong housing market, healthy borrowers, and the strong credit quality of CRT and SFR securities more than offset any short-term volatility.

What we’re watching next

The average interest rate on a fixed rate 30-year home mortgage recently jumped above 5%, raising concerns about decreasing home affordability. While mortgage payments as a percentage of median family income have already increased meaningfully and mortgage rates could climb further, we think that the supportive effects of limited existing home supply and constrained new construction will more than offset the downside of decreasing affordability on housing prices.

General Fixed Income Risks

Capital risk—the value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

ESG and sustainability risk—may result in a material negative impact on the value of an investment and performance of the portfolio.

Counterparty risk—an entity with which the portfolio transacts may not meet its obligations to the portfolio.

Geographic concentration risk—to the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk—a portfolio’s attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk—investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management risk—the investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although, in such cases, all portfolios will be dealt with equitably).

Operational risk—operational failures could lead to disruptions of portfolio operations or financial losses.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is no guarantee or a reliable indicator of future results.. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2024 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.