November 2021 / DEFINED CONTRIBUTION

Three Tips for Evaluating Target Date Solutions

Helping plan sponsors identify solutions fit for purpose.

Key Insights

- Target date solutions are a central lever in defined contribution plans used to help participants seek successful retirement outcomes.

- Plan sponsors are examining target date solutions more thoroughly, with an emphasis on identifying solutions that are fit for their specific purpose.

- We believe the importance of making an appropriate choice should not be underestimated and offer three tips to help plan sponsors in the assessment process.

Plan sponsors increasingly recognize the critical role that the qualified default investment alternative (QDIA) plays in helping many of their participants seek successful retirement outcomes. As a result, more sponsors are playing closer attention to the evaluation and selection of target date solutions—by far the most commonly used QDIA in defined contribution (DC) plans.

This paper offers three key tips designed to help plan sponsors on their journey of evaluating target date solutions, with an emphasis on identifying solutions that are fit for purpose—i.e., those that are most suitable for their plan’s specific objectives and preferences.

We think it can be a valuable exercise for plan sponsors to take a step back and carefully evaluate the target date solutions in their plans to ensure they still are aligned with the plan’s objectives, the investment committee’s beliefs and preferences, the characteristics of the participant population, and the needs of the covered workforce.

As a solutions provider, T. Rowe Price begins every client engagement by asking about plan objectives, with an emphasis on understanding what the sponsor is seeking to achieve with their QDIA.

While we understand there is no one “right” answer to this question, there are a few baseline facts that we believe are important to review, as they underscore the deepening challenge of helping participants reach their retirement goals:

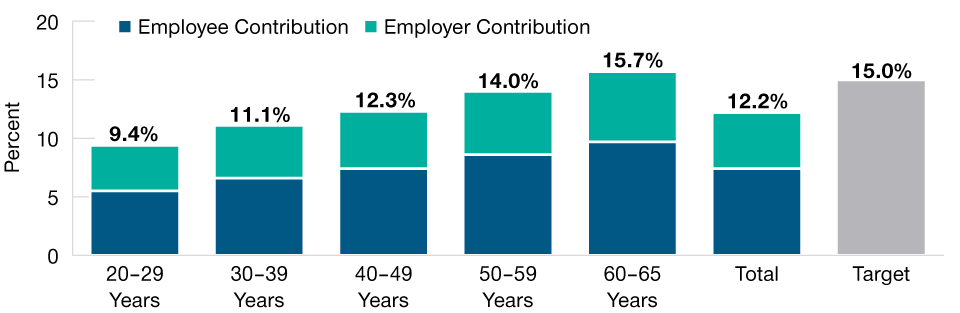

- The U.S. has a savings shortfall. A savings rate equal to 15% of salary is widely considered the minimum necessary to build an adequate retirement nest egg. However, T. Rowe Price’s recordkeeping data suggest that employee deferrals and employer contributions combined are falling well short of this mark, except in the age 60 to 65 cohort (Figure 1).

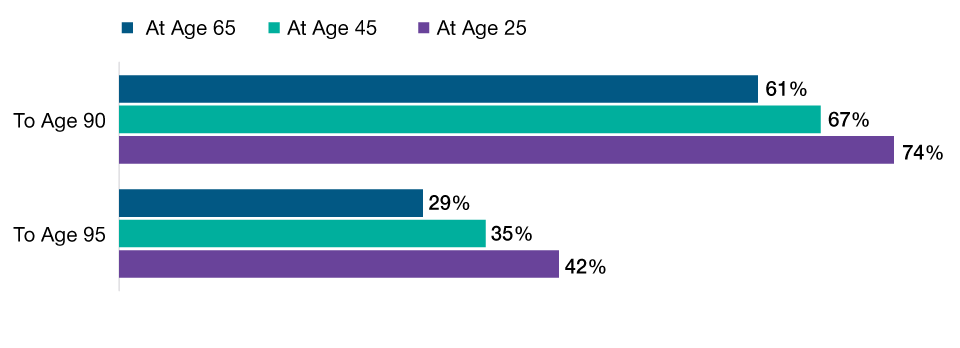

- People are living longer in retirement. Although the COVID-19 pandemic temporarily reversed the longer‑term trend, life expectancy for older Americans has been rising steadily for decades. A growing number can expect to live well into their 90s (Figure 2).

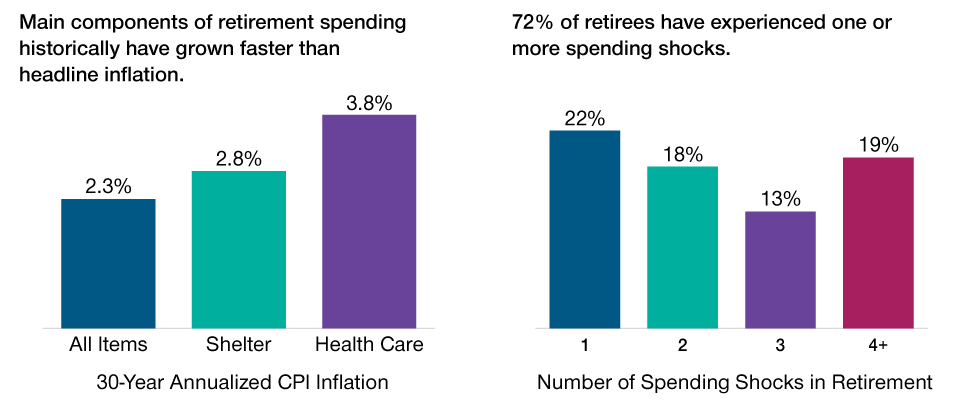

- Spending needs in retirement can be uncertain. Figure 3 shows that about three‑quarters of retirees have faced one or more spending shocks—such as unexpected health care costs or uninsured property losses—in retirement.

Savings Rates May Be Too Low

(Fig. 1) Average contribution rates as % of salary in T. Rowe Price-administered DC plans.

As of December 31, 2020.

Source: T. Rowe Price Retirement Plan Services, Inc.

Many Participants Can Expect Lengthy Retirements

(Fig. 2) Probability of at least one member of a couple living to age 90 or 95.

As of August 31, 2021.

Sources: Society of Actuaries and T. Rowe Price.

Spending Needs in Retirement May Be Uncertain

(Fig. 3) Inflation rates and spending shocks in retirement.

As of December 31, 2020

Sources: U.S. Bureau of Labor Statistics and Society of Actuaries.

These facts emphasize the importance of making plan decisions that solve for the financial challenges future retirees will face as well as a growing need for sponsors to consider how their benefit structures fit into their overall workforce management policies.

We believe that our ongoing client engagements have enabled us to identify potential opportunities to have a positive impact on the target date evaluation process. We focus here on three specific tips to help sponsors consider critical inputs that are fundamental to selecting a solution fit for purpose but that are easy to overlook or may not be well understood.

We think these insights could prove helpful for plan sponsors reevaluating their existing QDIA offering, for sponsors seeking to add a target date strategy to their existing lineup, or for those who simply recognize that their plan and their workforce needs both have evolved in ways that require a deeper examination of their plan structure.

Tip 1: Use Key Inputs to Inform Glide Path Selection

In our view, there are two important sets of inputs that should inform the overall target date glide path selection process:

- Plan objectives. A critical first step is to identify priorities—the specific goals the plan sponsor is solving for.

- Plan characteristics. Plan characteristics—such as salary levels, deferral rates, and employer contributions—offer a baseline for evaluating the current retirement preparedness of plan participants.

Plan Objectives

Despite the importance of starting with an analysis of plan objectives, we often see this step skipped for a straight‑line focus on the decision whether to employ active or passive building blocks for the management of target date portfolios. We believe this represents a missed opportunity that can lead to subpar decisions. Or as our head of target date strategies, Wyatt Lee, says, “It’s hard to know where you’re going if you don’t know your destination.”

We believe one of the key target date trade-offs that sponsors need to consider is whether their primary focus is on helping participants achieve their long‑term retirement income goals, or on seeking to minimize balance variability at any one point in time—such as at retirement or during short‑term episodes of market volatility.

In other words, what is the most important retirement outcome sponsors want participants to be able to achieve? Is the sponsor primarily concerned about seeking to limit the risk that participants might suffer unexpected losses near retirement? Or are they more concerned about participants being able to support their long‑term retirement income needs?

Most sponsors are likely to place high importance on both objectives. However, from an investment perspective the two goals are somewhat at odds—a target date glide path that seeks the portfolio growth needed to help fund adequate retirement income may increase the risk of short‑term balance variability, while a glide path that seeks to reduce balance variability could lead to slower growth and less income in retirement.

Looking Beyond Market Risk

The word “risk” historically has been anchored to market risk, either absolute volatility (standard deviation) or deviation relative to a benchmark (tracking error). But we fundamentally believe this is an oversimplification—one that could leave DC plans exposed to other risks that can materially impact retirement outcomes.

The reality is that risk comes in many forms, and the relative importance placed on these risks can vary across investment audiences.

Our studies of plan sponsor and consultant attitudes have shown that longevity risk—defined as the risk of participants outliving their resources—is a leading concern for both groups. In our recent surveys, 64% of plan sponsors and 67% of consultants ranked longevity risk as either their first or second highest concern.1

Prioritizing longevity risk should not suggest that other risks don’t matter. Rather, we believe that sponsors who understand the full range of risks that should be considered and the relevant trade-offs between them will be in a better position to apply a more informed approach to target date evaluation.

This inherent trade‑off is central to the target date evaluation process, in our view. A higher focus on maximizing spending power ultimately will suggest a more growth‑oriented glide path (i.e., one with a higher equity allocation). Alternatively, a relative focus on managing variability around retirement and/or over short time horizons will tend to suggest a less growth‑oriented glide path (i.e., lower equity).

We encourage our clients to aim for balancing the two objectives relative to the plan objectives in order to assess trade‑offs and choose an appropriate glide path.

Plan Characteristics

Key plan characteristics also should play a vital role in informing the target date evaluation process. These characteristics influence cash flows both into and out of the plan and help determine how well positioned participants are to achieve their retirement goals. They also directly impact the glide path design that is most compatible with the plan’s objectives:

Salaries: Other things being equal, higher pay levels may result in a higher equity glide path. Generally, those with higher salaries will have a higher income replacement rate to target, and thus may need more portfolio growth.

Participant deferrals: Relatively lower employee deferral rates also may result in higher equity glide paths due to the need for growth to help offset lower savings.

Employer contributions: Larger employer contributions may result in a lower equity glide path as the higher level of savings from employers may offset the need for growth.

Tip 2: Think Beyond the Averages

Designing a glide path to serve an entire plan population is inherently challenging, because it’s a solution for all when the participant population is likely to be heterogeneous—characteristics such as earnings, savings behavior, and behavioral preferences can and typically do vary. The goal, then, is to select a glide path that is robust enough to accommodate those differences.

Inputs Matter

Glide path assessment is an iterative process. In this paper, we focus on primary inputs. However, there are additional contributing factors that underpin those inputs. In our view, plan sponsors should ask themselves the following questions as part of the assessment process:

- Do you prefer that participants keep assets in the DC plan after retirement?

- Do you prefer greater consistency of returns and portfolio balances, or are you comfortable with some variability to achieve different outcomes?

- Are you primarily focused on long‑term market cycles, or are you more sensitive to short‑term market events? What is the target spending horizon for participants? Is the primary objective to set participants up for a lengthy retirement, or are DC benefits intended to be supplemental?

Of course, this is by no means an exhaustive list. Every sponsor will have their own inputs and insights.

Many target date providers respond to this challenge by designing solutions that use the characteristics of a hypothetical average participant as key design inputs. These averages are assumed to represent the center of the plan population—and, thus, provide the most appropriate representation for participants as a whole.

The drawback of this approach is that it assumes there is an actual “average” person, which is far from ideal for participants who are not well represented by the hypothetical averages, particularly those who are more financially vulnerable.

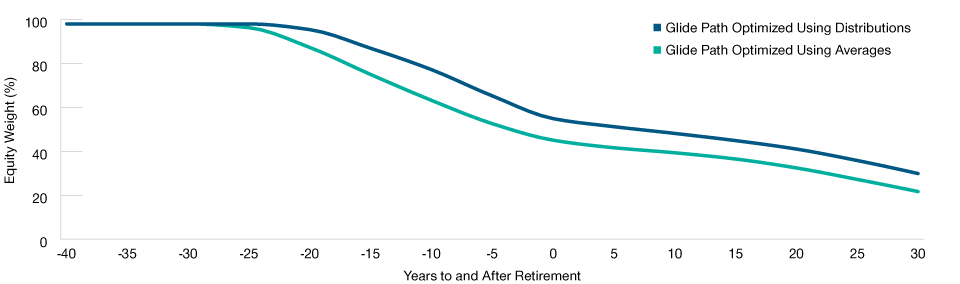

Rather than constructing glide paths for a mythical “average” participant, we believe it is more effective to use statistical distributions of key characteristics across the assumed plan population—representing the full curve of those values, not just a single point. Figure 4 offers a visual representation of this concept.

Looking Beyond the “Average” Plan Participant

(Fig. 4) Hypothetical glide paths based on simple averages and on plan distributions.

Source: T. Rowe Price.

2 Please see the Appendix for a description of the study methodology.

T. Rowe Price’s asset allocation research team used scenario analysis to compare the two approaches. Based on the assumed characteristics of a hypothetical plan population, they generated two different glide paths—one using simple averages as inputs and the other incorporating the statistical distributions of those values across the hypothetical population.2

As can be seen in Figure 5, the most striking difference was that the glide path based on simple averages featured a lower equity allocation. This was because a glide path optimization exercise reflecting average values may not account for individuals on the lower or higher ends of the earnings and/or savings spectrums. But these are the participants who are more likely to be vulnerable in terms of income replacement and, thus, most in need of the long‑term growth potential that a higher equity glide path can provide.

Averages‑Based Glide Paths Tend to Feature Lower Equity Levels

(Fig. 5) Glide paths based on average earnings and preferences and on distributions of those values within a hypothetical plan population.1

Source: T. Rowe Price.

1 The results shown above are hypothetical, do not reflect actual investment results, and are not a guarantee of future results. See Additional Disclosures.

See the Appendix for a description of the study methodology and the hypothetical participant demographic and behavioral values modeled in the simulations.

Indeed, when our research team looked at hypothetical outcomes in our scenario tests, they found that the distributions‑based glide path significantly outperformed in terms of both asset accumulation at retirement and consumption replacement during retirement. In fact, in 76% of the 10,000 scenarios we tested, portfolio values at retirement were higher for the distributions‑based glide path compared with the averages‑based one.

The point here is not to make the case one way or another for a higher or lower equity glide path. But we do believe that using inputs that represent the full characteristics of a plan population results in a more realistic analysis and is more likely to reflect the needs of participants who might otherwise be underserved.

Tip 3: Align Implementation to Plan Goals and Beliefs

Earlier we mentioned that we often see clients begin their target date selection process by weighing the relative merits of active versus passive implementation. We hope our first two tips made the case for taking a step back and first considering the key inputs—and how those inputs are represented in a glide path design. However, it also is true that the decision to use either active or passive building blocks can materially impact retirement outcomes.

But, before addressing this topic, it’s worth a reminder that, in reality, there is no such thing as a purely “passive” target date solution. The decisions applied across the board in target date designs—such as the shape of the glide path and the level of diversification within the asset mix—are active decisions.

Accordingly, our third tip focuses on the building blocks used for the underlying investment strategies within the target date portfolio and the corresponding trade-offs involved in active versus passive decisions.

In our experience, it is common for the active versus passive investment discussions to focus narrowly on cost. A target date solution implemented entirely with passive vehicles should be cheaper than an active or blend strategy, reflecting the lower management costs of simply seeking to track the performance of a market benchmark. But we believe the evaluation needs to go deeper and examine the potential trade‑offs involved in active versus passive decisions. More specifically, we believe the emphasis should be on the value‑for‑cost equation and how it fits with the sponsor’s objectives for a target date solution.

One driver of a narrow focus on cost has been an assumption that the Employee Retirement Income Act of 1974 (ERISA) somehow requires plan sponsors to prioritize the use of passive investments and to seek the lowest‑cost providers. In fact, ERISA dictates nothing of the sort. It describes a need for plan sponsors to seek costs that are “reasonable.”3

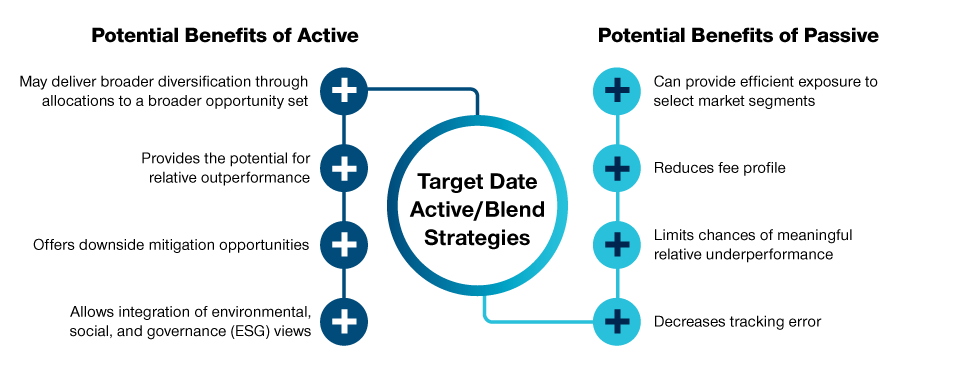

Figure 6 summarizes some of the potential benefits of both active (left) and passive (right) strategies. Whether sponsors choose a purely active or purely passive approach, or a combination of both (often referred to as a blend strategy), we believe it is imperative that sponsors carefully consider their own beliefs and objectives relative to these techniques.

Managing the Trade-Off Between Active and Passive

(Fig. 6) Possible advantages of active and passive target date strategies.

Source: T. Rowe Price.

The Bottom Line

At T. Rowe Price, we think of retirement planning as the long game. Accordingly, the goal of our work is to help plan sponsors and their advisors make sound long‑term decisions that are in the best interests of their plans and their participants.

In keeping with this philosophy, we offer the following action items for plan sponsors to consider:

- First think about your objectives, then consider the characteristics of the plan population. Finally, consider how the combination of these inputs collectively can inform the selection of a glide path fit for purpose.

- Think about the distributions of key characteristics across your plan’s population, rather than relying on simple averages.

- Be mindful of the trade-offs when evaluating active versus passive implementation approaches.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

USA—Issued in the USA by T. Rowe Price Associates, Inc., 100 East Pratt Street, Baltimore, MD, 21202, which is regulated by the U.S. Securities and Exchange Commission. For Institutional Investors only.

© 2025 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

November 2021 / FIXED INCOME