July 2021 / INVESTMENT INSIGHTS

A Moderating Outlook for Equities

Stock returns may be subdued, as key performance drivers peak

Key Insights

- Our Asset Allocation Committee modestly decreased the allocation to equities recently, given elevated stock valuations and a moderating economic outlook.

- In our view, key performance drivers may peak in the near term, which could temper potential equity returns going forward.

In March and April, our Asset Allocation Committee moderated the allocation to stocks relative to bonds, which was surprising given the very strong economic environment and improving earnings expectations.

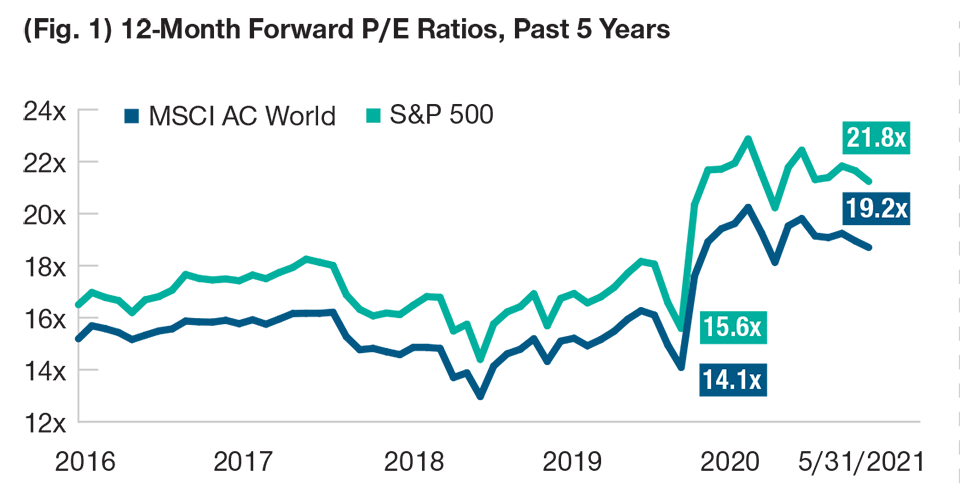

The decision to underweight stocks was driven, in part, by elevated stock valuations after a period of very strong appreciation. In the 12 months ended March 31, 2021, both the S&P 500 Index and the MSCI All Country World Index rallied by more than 50%. As a result, overly optimistic expectations pushed forward price-to-earnings (P/E) ratios higher (see Figure 1), and a lot of good news was already incorporated in stock prices. Further, despite an appealing macroeconomic environment, evidence was emerging that some of the tailwinds for stocks—such as accommodative monetary and fiscal policies and strong economic growth—might peak soon.

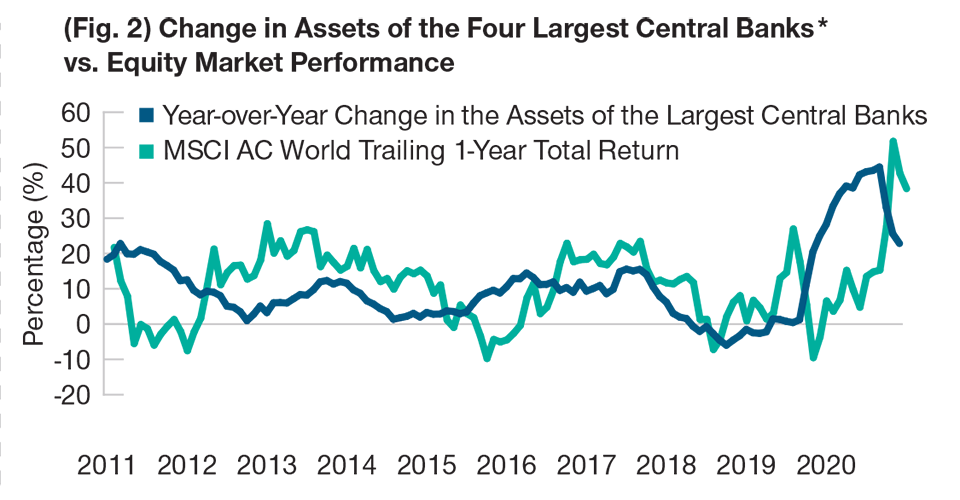

While stocks have continued to advance in recent months, the positive impact from these key drivers has started to diminish. In June, Fed policymakers appeared more concerned about the pace of inflation, highlighting the likelihood that global central banks have probably surpassed the point of peak dovishness. Notably, the rate of change in asset purchases by the world’s four largest central banks is already slowing (see Figure 2)— typically a headwind for stocks. Also, fiscal stimulus is likely to peak soon with lower government spending expected in 2022 as coronavirus relief measures fade, and an increase in U.S. corporate taxes to fund recovery costs is likely.

In our view, the changing economic environment could temper potential equity returns. As a result, we believe a more moderate allocation to equities may be appropriate going forward.

A Changing Macro Environment

Stock returns may be subdued going forward

As of May 31, 2021.

Past performance is not a reliable indicator of future performance.

Sources: Standard & Poor’s. MSCI. T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. See Additional Disclosures.

*The Four Largest Central Banks are U.S. Federal Reserve, European Central Bank, Bank of Japan, Central Bank of China

Source: Bloomberg Finance L.P. MSCI. T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. See Additional Disclosures.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

July 2021 / INTERNATIONAL EQUITIES