May 2021 / MARKET OUTLOOK

Investment Ideas for the Next 12 Months

Positioning your portfolio for the risks and opportunities ahead

Key Insights

- The post‑pandemic economic recovery will probably be unlike any other in history, making the current investment environment highly unpredictable.

- Our five themes for the next 12 months are: a sustainable recovery, earnings growth, rising yields, China’s return to business as usual and a changing world.

- For each theme, we have identified three key investment ideas.

Investors have rarely experienced such an extraordinary period. Just as the 2020 shutdown of much of the global economy by the coronavirus pandemic was unprecedented, the recovery this year is likely to be unlike any that preceded it. Economic activity is reviving far more quickly than anticipated and has already produced a V‑shaped recovery in some countries and regions. Growth looks set to accelerate further in the second half of 2021, particularly in the US.

However, the economic policies of governments and investment fundamentals have both been reshaped in ways with which financial markets are still coming to terms, while a high degree of unevenness and uncertainty persist. We think this process will create both opportunities and risks in the second half of 2021, highlighting the potential benefits of an active approach to investing that involves creativity and thinking outside the box.

Our Five Investment Ideas

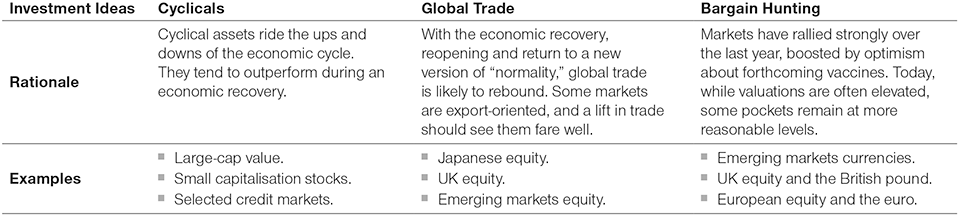

(Fig. 1) Preparing your portfolio for the 12 months ahead

We are living in uncharted territory, with many of the typical features of an economic recovery turned on their heads: Valuations are elevated, personal savings are robust and debt levels are soaring. Nonetheless, we have identified five key themes we believe will drive the performance of markets over the coming 12 months and beyond.

Crystallising a Sustainable Recovery

1. Crystallising a Sustainable Recovery

The global economy is recovering at a much faster pace than after previous recessions as many countries adapt to life with the virus and reopen with the help of unprecedented fiscal stimulus and monetary easing. Meanwhile, households have amassed massive amounts of savings because they had limited opportunity to spend during lockdowns and were supported by governments’ employment replacement programmes. Fiscal policies remain stimulatory, although not all fiscal support is equal. Debt levels are coming back into focus as the recovery builds, with tax rises on the horizon.

The critical role of the public health initiative—the vaccine campaign—adds another unprecedented dimension here. Vaccine rollouts are accelerating, although at highly uneven rates among countries. In many parts of the world, a race is on between vaccination programmes and potential coronavirus mutations. Central banks are signalling they will maintain their current relaxed stances until the recovery is well entrenched and unemployment falls to pre‑pandemic levels. In a well‑telegraphed shift, the U.S. Federal Reserve has indicated a willingness to allow inflation pressures to build before increasing interest rates.

Although fundamentals—growth, inflation, interest rates, credit spreads, valuations—still matter, investors need to interpret these factors with particular care in such an unusual environment. A return to “normal” depends on what form the post‑pandemic economy takes and how quickly we get there. As the hoped‑for sustainable economic revival takes shape, investors should balance the risks of an irregular recovery and selected investment opportunities that could shine as growth resumes.

2. Capitalising on Earnings Growth

Valuations are elevated for most asset classes relative to history, prompting concerns that investors may have become too optimistic. Signs of “irrational exuberance” have appeared in areas such as initial public offering (IPO), special‑purpose acquisition companies (SPACs) and cryptocurrencies. Parts of software and electric vehicles have also been bid up. Most regional equity markets and sectors appear historically expensive—even accounting for low interest rates and earnings yields that are still above long‑term bond yields.

Capitalising on Earnings Growth

Current conditions may persist for a while—elevated valuations can become even more elevated—but sustained gains will be harder to identify. However, while valuations for the big technology companies are high, there are key differences from the bubble of the late 1990s: Profit margins for the most expensive stocks in the S&P 500 Index, for example, are significantly higher now than they were back then, and high‑multiple names account for a dramatically larger share of S&P 500 earnings.

Whether current valuations persist will depend largely on whether they are supported by the expected acceleration in corporate earnings growth. Long‑term secular themes will endure, and a cyclical recovery may create opportunities in areas that are likely to generate strong earnings growth in such an environment, such as value stocks and Japanese and emerging markets equities. However, continued economic and business disruption suggests that diversification and careful security selection will remain critical to success.

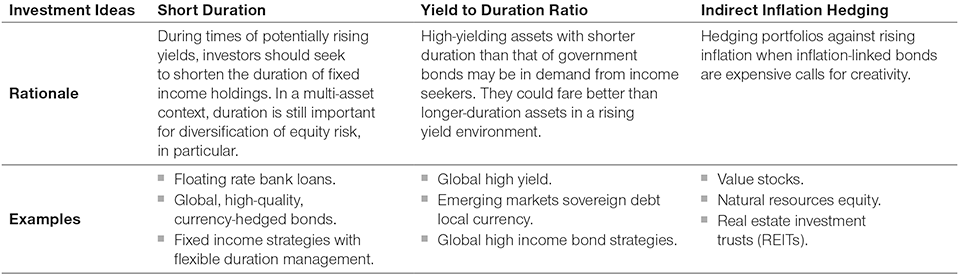

3. Creativity Amid Rising Yields

Short‑term interest rates remain near zero, and major central banks show no current inclination to raise them (futures markets have shifted their expectations for a first Fed rate hike to mid‑2022). Nevertheless, bond yields rose sharply in early 2021 as investors began to anticipate stronger growth and higher inflation. Orderly reflation is a positive development for both the macroeconomy and credit as it reflects expectations for improving economic growth. However, a meaningful and sharp move higher in yields could adversely impact financial markets, tightening financial conditions.

Creativity Amid Rising Yields

Rising yields, a steepening yield curve and doubts over the timing of future Fed policy moves could lead to further episodes of market volatility in the second half of 2021. High yield bonds, floating rate bank loans and emerging markets debt (including bonds in local currencies) still appear to offer opportunities. However, credit spreads have tightened considerably, leaving less margin for error in sector and/or security selection.

Investors will need to show creativity in managing the fixed income portion of their portfolios. Strategies such as diversifying equity risk with local government bonds, which has generated attractive positive total returns and income in the past, may not work anymore. Similarly, hedging portfolios against inflation risk through purchasing inflation‑linked bonds looks less attractive after their recent price rises.

4. China’s Return to Business as Usual

China’s extraordinary economic, social and financial transformation over the past two decades appears poised to accelerate as a result of the coronavirus. Better containment of the pandemic and a more moderate policy response mean that investors can access higher bond yields and superior earnings growth potential at reasonable valuations. There is a significant opportunity to uncover the alpha potential of China’s growing and diverse markets in consumer spending and healthcare amid demographic shifts, technological innovation (China now accounts for the lion’s share of global IPOs) and sustainability ambitions.

These opportunities come with complexity and risk. China’s growing global economic and financial weight—and its policy conflicts with the US—will be critical issues for investors to be mindful of in the second half of 2021 and beyond. Despite the arrival of a new US administration, trade tensions remain elevated. China’s drive to secure leading positions in critical technologies is another flashpoint. Furthermore, Chinese regulators are clamping down on the domestic e‑commerce giants widely favoured among foreign investors.

While US fiscal spending dominates the inflation debate, credit growth in China is tightening—which will be an important global growth dynamic to watch as the year unfolds. The Chinese dragon is likely to continue its ascent, but its flight is unlikely to follow a straight line.

China’s Return to Business as Usual

A Changing World

5. A Changing World

The emergence of the world from the pandemic and the global economic recovery are not likely to be smooth and linear. Stock and credit markets have enjoyed favourable conditions, riding the tidal waves of stimulus and increased optimism. As stimulus fades and sentiment approaches a peak, investors should reconcile themselves to volatility and choppy markets.

At the same time, in a rapidly changing world, many of the portfolio management paradigms of the past decade no longer hold true. The yields of government bonds are low and rising; valuations in many markets are elevated; and worldwide demographics, technological disruption and global geopolitical forces continue to evolve. Investors should carefully consider how to manage their portfolios during regime shifts because what has been is unlikely to continue. You cannot simply extrapolate the past to manage portfolios in the future.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

May 2021 / INVESTMENT INSIGHTS

1 June 2021 / U.S. FIXED INCOME