May 2021 / GOING BEYOND THE NUMBERS

Diversity, Equity, and Inclusion in the Spotlight

From tragedy comes unity and a commitment to improve

Key Insights

- The wave of global protests against racial injustice and social inequality in 2020 has compelled companies to examine their links to systemic racism.

- In our many years of ESG engagement, we have never seen companies exhibit the kind of unity and commitment as they have on diversity, equity, and inclusion (DEI).

- After speaking with hundreds of companies in 2020, it is clear that those that do not regard DEI as a core value will likely struggle to compete for talent and see their market share eroded.

Generating Insights on DEI and Corporate Culture

(Fig. 1) A lack of comprehensive and comparable data is an ongoing challenge

Source: T. Rowe Price.

Amid the tumultuous market environment of 2020, as virtually every country grappled with the unprecedented coronavirus pandemic, another important investment movement was emerging from a tragedy of a different kind.

The interest of investors and other stakeholders in diversity, equity, and inclusion (DEI) exploded following the tragic death of George Floyd at the hands of Minneapolis police in May 2020. An extended period of protests against racial injustice followed, both across the U.S. and in cities around the world. These incidents prompted many of us as individuals to examine how we could promote positive change in our own lives, but they also caused corporations to examine their links to systemic racism and explore ways to change these persistent, destructive patterns. Corporations were responding to a variety of stakeholders as they undertook this analysis: their employees, investors, communities, potential future employees, and boards of directors. Often, corporate leaders felt it was an important moment to speak out.

In this paper, we describe the ways that DEI intersects with investment decision‑making at T. Rowe Price. We also share what we learned in 2020 after speaking with hundreds of companies about their perspectives and actions to create truly inclusive and representative workplaces.

The Task of Collecting Data on DEI

T. Rowe Price generates insights about DEI and corporate culture in four principal ways, but the lack of comprehensive and comparable data in this area remains a serious challenge.

1. Primary Research

The first way we collect information about corporate culture, including DEI, is through our investment analysts’ primary research of the companies they follow. Assessing corporate culture is difficult for any outsider to gauge, but after many years of following a company and its peers, our analysts have developed a deep understanding of the businesses, with the necessary knowledge and resources to make these assessments. Insights into culture are frequently included in our proprietary internal research, which is shared across our Equity, Fixed Income, Quantitative, Responsible Investment, and Governance teams.

2. Proxy Voting Guidelines

Another principal way of obtaining information about diversity is through our Proxy Voting Guidelines, which specifically address board diversity. Since 2018, our voting policies have reflected our investment view that boards lacking in diversity represent a suboptimal composition and a potential risk to the company’s competitiveness over time. We recognize that diversity can be defined across a number of dimensions. However, in our view, if a board is to be considered meaningfully diverse, some representation across gender, racial, ethnic, or nationality lines must be present.

In key developed markets, our policy is that a lack of board diversity represents a failure on the part of its nominating and/or governance committee. Accordingly, we generally vote against the reelection of these directors. Each year, we have increased the number of global markets where this policy is applied.

3. Corporate Engagement

The third way we generate insights about companies’ approach to DEI is through our ESG engagement program. Each year, members of T. Rowe Price’s investment division host thousands of one‑on‑one meetings with senior management teams of the companies our clients are invested in.

In 2020, about 1,002 of these meetings were characterized as ESG engagements because of their intentional and specific focus on issues in the ESG realm. DEI has always been a frequent topic of discussion in these meetings, but in 2020, it rose to become one of our top engagement priorities. These ESG engagement notes are published on our internal research platform, alongside other fundamental company research. In this way, these discussions contribute to our firm’s collective knowledge of the corporate cultures generally—and DEI practices specifically—of our portfolio companies. Later in this report, we discuss some of the key insights drawn from the hundreds of DEI discussions we held with companies in 2020.

4. Responsible Investing Indicator Model (RIIM)

Finally, we also gather information about DEI via our Responsible Investing Indicator Model. Applying a quantitative lens to DEI remains very challenging given most companies do not yet provide comprehensive disclosure about their policies and programs to foster diversity, nor do they publish sufficiently detailed information about the present composition of their workforces.

Naturally, the definition of what constitutes an underrepresented minority population depends on the country or region where the company is located. Also, privacy and employment laws vary around the world, and there are regions where employers are prohibited from collecting information on the racial or ethnic identities of their employees.

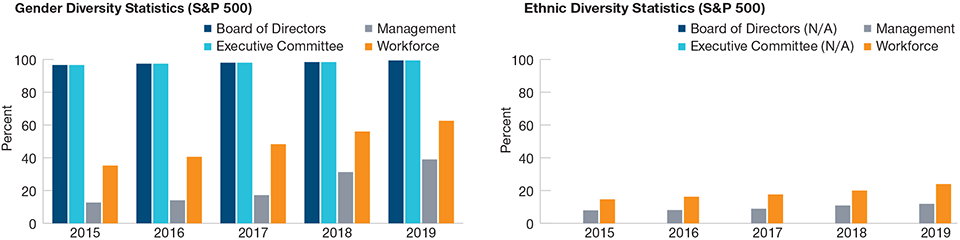

The charts below illustrate the gender and ethnic diversity statistics for the current constituents of the S&P 500 Index. Disclosure levels as of the end of 2019 were not impressive. Even for the large‑cap U.S. equity universe, the level of disclosure on gender diversity in management and the workforce is poor at 38% and 62%, respectively. However, it is even worse for ethnic diversity at just 12% and 24%, respectively.

Encouragingly, however, we think the trends are quite positive in this space, as dozens of larger U.S. companies have already agreed to accommodate investors’ requests for more detailed diversity information. For example, many have already begun publicly reporting their EEO‑1 data, which breaks down their U.S. employee populations by seniority, gender, race, and ethnicity. Consequently, we expect to see a marked improvement in disclosure rates when a full set of 2020 statistics becomes available.

Corporate Disclosure of Workforce Gender and Ethnic Diversity

(Fig. 2) Even in large‑cap, developed markets, disclosure levels are poor

As of December 31, 2020. Please note, Full Year 2020 data is not available at time of writing.

The dataset examines the historical disclosure of the current S&P 500 constituents.

Source: Bloomberg Finance L.P.

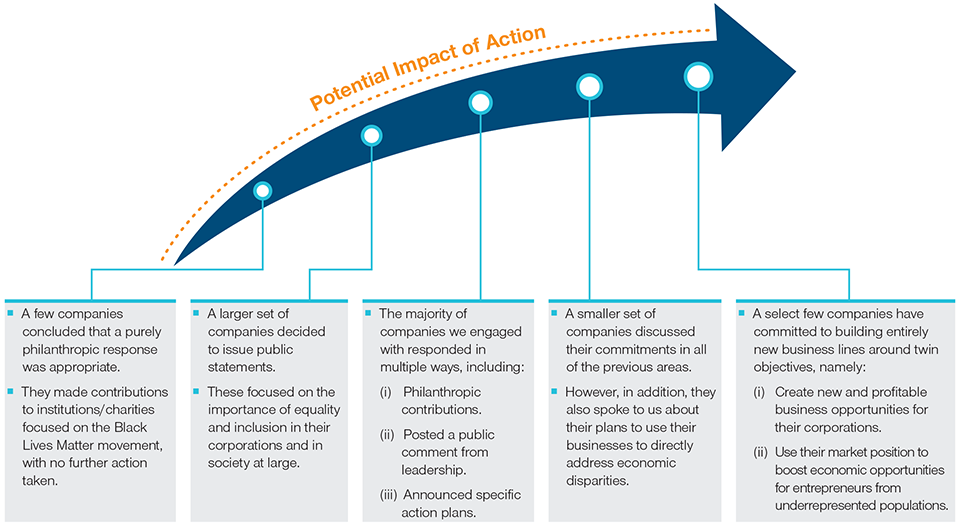

DEI Was Prioritized for Engagement in 2020

(Fig. 3) Corporate responses to DEI issues have fallen along a continuum

As of December 31, 2020.

Source: T. Rowe Price.

With time, we believe this information will become more easily accessible by investors, and we will be able to extract further insights from it by observing how the workforce composition changes over time. For example, are the populations becoming progressively more diverse every year? Are there bottlenecks at certain points in the seniority stack where women and/or ethnically diverse employees consistently lose ground? Which industries tend to have more representative employee populations relative to others? Is there a correlation between the diversity of a company’s board and that of its management team and general employee population?

Today, our RIIM tool collects data in several categories related to corporate culture and human capital. For example, one category seeks evidence that the company has a merit‑driven culture. Accordingly, where available, we collect data points in these areas:

- The presence of dedicated programs to improve DEI.

- The level of diversity on the board and senior management team.

- The racial and gender composition of the workforce.

- Any recognition of the company by third parties such as the Human Rights Campaign.

- Any controversies related to discriminatory practices.

- The presence of any gender pay equity analysis.

Over time, as this data set improves, we believe looking at the time series of these items at a company level will provide us with good insights as to the priority that a management team places on DEI issues within the company.

Racial Inequality: A Continuum of Corporate Responses

An intense focus by communities and corporations on systemic inequality was sharpened by the tragic incidents in the spring of 2020 but has continued at a steady pace since then. In our many years of engagement with companies on ESG issues, we have never seen companies exhibit the type of unity, candor, and commitment on any single issue as they have on DEI.

True equity and inclusion in the corporate sector are clearly a long‑term journey. However, the momentum we are seeing is encouraging, as evidenced by the increase in the number of companies disclosing workforce composition data and talking about DEI publicly over the past year. Of the 633 individual companies with which T. Rowe Price held ESG‑focused engagement discussions in the third and fourth quarters of 2020, DEI was a prominent agenda item in 58% of these meetings. What we learned from these discussions is that corporations’ actions, to date, have fallen along a continuum.

Observations on DEI From Our 2020 Engagements

After speaking with hundreds of companies about diversity, equity, and inclusion over the past year, we came away with these key observations.

- True DEI is a long‑term challenge for investors and companies. We expect this to remain a top subject of dialogue in our ESG engagements with companies. As the availability of data improves, we anticipate being able to generate more company‑specific insights as we monitor changes in company culture and representation over time.

- To a less intense degree than in 2020, we have been speaking with companies about diversity for several years. Our experience is that companies have become much more comfortable speaking about the real DEI challenges they face. For many companies, DEI has clearly been pushed to the top of the priority list. As a result, they have a more coherent message and they can present more concrete objectives to their investors. One example of this increased prioritization can be seen in the diversity of company boards. When we first implemented our proxy voting policy on board diversity, there were 90 U.S. companies held in the T. Rowe Price portfolios with no discernible level of board diversity. Today, that figure is less than 10.

- Over time, we expect most companies to report steady improvement in the level of representation of women and underrepresented minorities in corporations’ entry level, mid‑level, and senior level employees. In 2021, however, we anticipate that companies in industries experiencing a particularly negative impact from the pandemic will see their representation figures decrease. These companies—for example, in the leisure and entertainment industries, travel, bricks‑and‑mortar retailing—face multiyear recovery periods due to changes in consumer behavior that are likely to persist. They report a heightened level of poaching from recruiters in other, more stable industries that are opportunistically seeking diverse talent. By and large, these same companies are also experiencing mass layoffs or temporary furloughs of workers, making year‑on‑year comparisons of employee data quite difficult.

- The pandemic may have unanticipated effects on DEI over time. Many of the companies we have spoken with are excited about the possibility of improving the levels of representation in their workforces because the pivot to remote work has enabled them to be more flexible about the pools of talent they recruit from. For example, if reporting to corporate headquarters every day is no longer a requirement, companies realize they can recruit employees from far‑flung geographies or create a hiring pipeline at schools located in regions where they’ve never hired from before. These are indeed potentially exciting new avenues to broaden the talent pool of these companies.

Retention of employees over the long term is related to how valued and included they feel in the corporate culture. By its nature, inclusion is especially challenging to achieve in a remote‑work environment, and even more so for people who may be underrepresented by race, gender, religion, LGBTQ identity, or geography. Companies will need to carefully balance the potential long‑term challenges of inclusion against their newfound geographic flexibility in the way they manage their human capital.

A Final Word…

From our perspective, there is no single correct response for a company to take on the issue of racial justice. We believe this is a topic we will be discussing with companies for years to come, following up on the commitments they have made to assess the kinds of outcomes they produce. What is clear already is that DEI is a core value for many stakeholders of these companies: their current and future employees, their customers, their investors, their leaders, and their boards. Companies that do not meet these stakeholders’ expectations will likely see erosion in their ability to compete for talent and market share.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request. It is not intended for distribution to retail investors in any jurisdiction.

May 2021 / POLICY INSIGHTS