December 2021 / INTERNATIONAL EQUITIES

China Market Outlook 2022

Attractive opportunities amid China’s fast-changing environment.

Key Insights

- Better understanding of Beijing’s long‑term policy agenda helps investors navigate the regulatory environment in China.

- With signs of economic deceleration, the balance might be shifting back to support growth in 2022. We would expect a more stable regulatory situation next year.

- China remains a fertile hunting ground for investors seeking sustainable businesses and alpha opportunity through bottom‑up fundamental research.

Policy has been on top of investors’ minds in 2021 in China, which had a meaningful impact on several industries. While some policies caught investors by surprise, we think the government’s intention has been clear and consistent. Take the policies on property, health care, and education, for example. The overarching goal is to build a more sustainable and equitable society. On the other hand, the regulations on online platforms aim to create an open, more competitive ecosystem, instead of “walled gardens.” The introduction of the new policies may lead to short‑term volatility. However, China has experienced multiple regulatory cycles in the past, and history has informed us that they have led to an acceleration of innovations.

We would also like to point out that there are cyclicality elements to China’s regulatory environment. The idea is to “fix the roof on sunny days.” China’s regulators tend to carry out structural reforms when the economic situation is favorable rather than weak. We believe the recent countercyclical policy moves can help China’s economy to become more resilient against future external shocks.

There are signs that policy restrictions are easing as the economy faces more headwinds following power shortages, sporadic COVID‑19 outbreaks, and disruptions caused by indebted lower‑quality property developers. In our view, Beijing has enough policy instruments to engineer a soft landing for the Chinese economy in 2022, though fresh stimulus measures are likely to be selective and targeted.

Risks From the Property Sector Are Manageable

Since property and its related sectors account for almost one‑third of China’s gross domestic product, some slowdown in the overall economy appears inevitable. However, we believe that the government has the right policy tools to avoid serious systemic risk and a “hard landing.” We believe they will navigate their way around the problems of the property sector with considerable caution. Property has been a major driver for China’s economy over the past two decades. On the other hand, this has contributed to some less desirable side effects, such as a widening wealth gap, a rising cost of living, and the rapid growth in financial leverage. The government is determined to address these structural issues. This round of financial deleveraging started five to six years ago and continues today. Markets in 2021 underestimated the amount of short‑term volatility Beijing is willing to incur in order to improve the quality of future economic growth.

We are of the view that the overall volume of primary property sales might have peaked. We also expect continued margin pressure across the industry. On the other hand, we see select developers with unique models and strong financial positions poised to consolidate the market. At the same time, we see multiyear growth opportunities in the after‑sales market, such as property management, remodeling, and furniture upgrade.

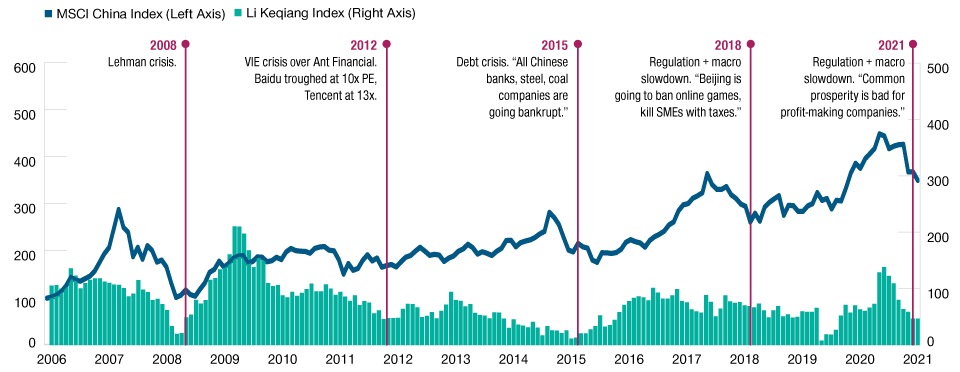

In China The Market Tends to Recover After Shocks

(Fig. 1) MSCI China Index and Li Keqiang Index1 of economic activity

As of September 30, 2021.

Past performance is not a reliable indicator of future performance.

Sources: T. Rowe Price, data provider FactSet. Copyright 2021 FactSet. All Rights Reserved. MSCI Index data is rebased to 100 on 7/31/06.

1 The Li Keqiang Index is a mix of real economic activity indicators first introduced by Premier Li Keqiang. The Li Keqiang Index is a proxy measure for China’s economic activity.

“Common Prosperity” Depends on Larger and Growing Pie

The policy of common prosperity seeks to “properly deal with the relationship between efficiency and fairness.” It does not imply a wholesale redistribution of existing wealth from the rich to the poor. Common prosperity is neither anti‑private enterprise nor anti‑market. Rather, the goal of common prosperity is to enhance social mobility and allow all citizens to participate in the economic development. The prerequisite of common prosperity is that the economic pie should continue to get bigger. In some areas, such as the low pay and benefits of gig economy workers, the government believes direct intervention is necessary to balance the power between platforms and workers. In China, workers are not effectively represented by trade unions in negotiations with their employers.

Investment Opportunities in 2022

The case for investing in China is the economy upgrade. The days of demographic dividends are gone, but the education dividend just started. Over the past two decades, China’s annual college graduates went from 1 million to 9–10 million. China’s competitive advantage is shifting from low cost to technology driven.

Innovation is already a major source of opportunities and wealth creation. Over the past three years, there has been a USD 1.8 trillion (as of September 2021) increase in public market capitalization from the Chinese internet, biotech, and electric vehicle sectors alone. In the traditional industrial space, Chinese companies are also quickly moving up the value chain. Increasingly, they are competing on performance, rather than pure cost.

In the consumer space, we have seen the rapid rise of Chinese domestic brands. They are usually the forerunners to embrace social media and e‑commerce, which offers them the opportunity to disrupt incumbents. We also see tremendous consolidation opportunities in service industries, such as hotel chains. We believe that the service industry will likely be home to many future earnings compounders.

We think energy transition, electric/smart vehicle, and high‑performing computing are three mega trends for the next five to 10 years. In our view, there are many Chinese companies that are well positioned to benefit from these trends. Some of the pure plays are well discovered and are trading at high multiples. However, we can find attractive opportunities among different parts of the supply chain, such as grid automation and auto parts, with the rising content in electric vehicles.

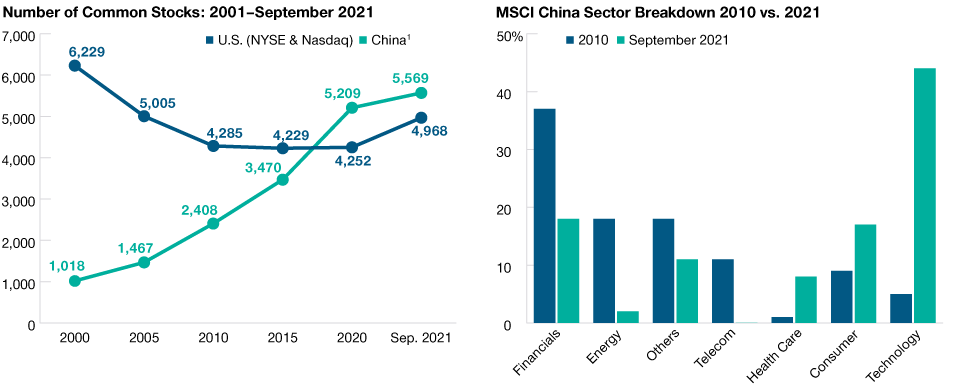

China’s Investment Universe and MSCI China Sector Composition

(Fig. 2) Rapidly expanding over time and rapidly changing in composition

As of September 30, 2021.

Sources: Bloomberg Finance L.P., FactSet. Financial data and analytics provider FactSet. Copyright 2021 FactSet. All Rights Reserved.

1 China total represents all listed stock. Dual‑listed ADR/GDR excluded to avoid double counting.

MSCI China Index sector weightings as of September 30, 2021, and December 31, 2010. T. Rowe Price uses the MSCI/S&P Global Industry Classification Standard (GICS) for sector and industry reporting. T. Rowe Price will adhere to all future updates to GICS for prospective reporting. Please see Additional Disclosures page for information about this MSCI and GICS information.

We also focus on leading players in various niche industries; many are mid‑cap companies in industrials and business services segments. After the 2020 rally, we think valuations for some well‑discovered blue chips have become rich. On the other hand, we believe niche industry leaders can offer strong fundamentals at a reasonable price.

Finally, we see mispricing opportunities created by the recent regulatory concerns. With investors shying away from anything related to the property and health care sectors, we believe there are companies with unique business models that can navigate the environment successfully. That includes select companies in property management services, furniture retail, and medical devices, for example.

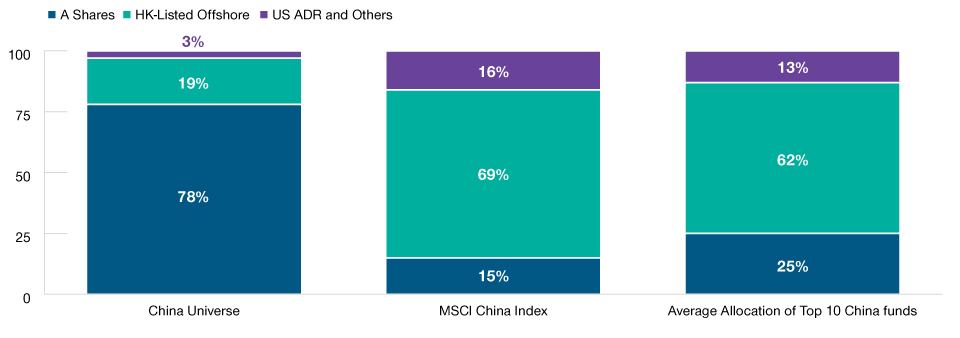

China A Shares Though Accessible are Underowned

(Fig. 3) China universe, Index, and fund composition by share type

As of September 30, 2021.

Past performance is not a reliable indicator of future performance.

Sources: MSCI, Goldman Sachs, Morningstar. Please see Additional Disclosures page for information about this MSCI and Morningstar information. The Top 10 China funds refer to the funds in the Morningstar China Equity universe, measured by assets under management.

IMPORTANT INFORMATION

Where securities are mentioned, the specific securities identified and described are for informational purposes only and do not represent recommendations.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.