A Differentiated Approach to Integrating ESG Analysis

At T. Rowe Price, our central mission is to help our clients reach their long-term financial goals. Consistent with that objective, we have an obligation to understand the long-term sustainability of the companies in which we invest. Environmental and social factors — such as food, water and energy security, access to natural resources, climate change, human rights and supply chain labor standards — present material issues for businesses and the corporate world. At the same time, poor corporate governance practices — such as corruption, weak succession planning or executive compensation plans that are not aligned with investor interests — can also materially impact shareholder value. To this end, responsible investing requires investment managers to take a wider view, acknowledging and understanding the full spectrum of long-term risks and opportunities.

Defining ESG at T. Rowe Price

It is important to set out what we mean by ‘ESG’ and how we approach it, as the umbrella term has given rise to a myriad of interpretations in the asset management industry.

As a signatory of the United Nations Principles for Responsible Investment (UNPRI), we subscribe to their definition of ESG integration as considering ESG factors to enhance investment decisions. We believe our investment decisions are better informed when we consider these factors alongside more traditional financial, industry-related, macroeconomic and other qualitative indicators. In addition to using ESG-integration as a tool to enhance investment decisions, we manage portfolios to help our clients meet a specific values goal. This type of portfolio is classified as a ‘socially responsible investment’ (SRI) and managed through separate accounts or funds with an explicit SRI approach.

Integrating ESG as a Central Component of Our Investment Process

We believe ESG integration is most effective when executed by experienced investors who know the company or issuer well, which is why the responsibility for integrating ESG into investment decisions lies with our analysts and portfolio managers. Our research analysts incorporate ESG factors into company valuations and ratings, while our portfolio managers balance the ESG factor exposures at a portfolio level.

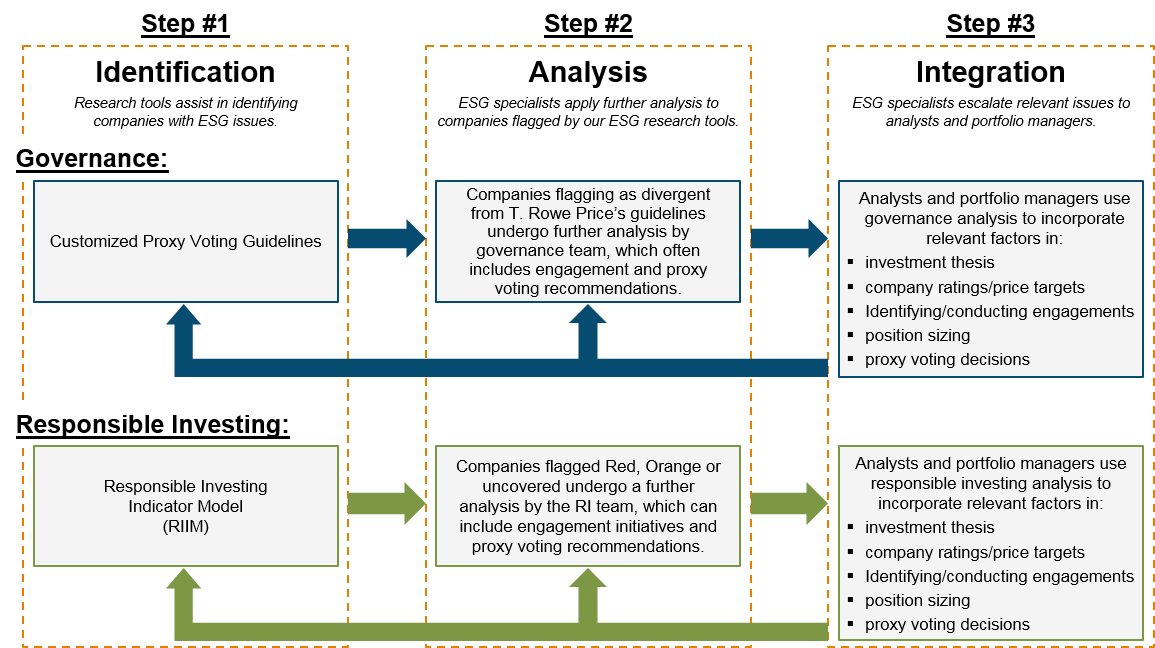

Our in-house ESG specialists support the investment team through all stages of the investment process: identification, analysis and integration. While ESG terminology tends to group environmental, social and governance factors into one bucket, we believe the ‘E’ and ‘S’ factors need to be treated differently to the ‘G’ factor. Corporate governance standards are well established and generally uniformly disclosed across the world, while disclosure of environmental and social factors is comparatively limited. Additionally, some factors we screen for in our ‘E’ and ‘S’ analysis fall outside the normal scope of company disclosures, such as strained relations or incidents with various stakeholder groups.

As a result, our dedicated in-house ESG resource comprises two teams: Responsible Investing (‘RI’), which covers environmental and social factors, and Governance. Collectively, these teams help our investors identify, analyse and integrate the ESG factors most likely to have a material impact on the long-term performance of an investment.

RESPONSIBLE INVESTING INDICATOR MODEL (RIIM)

There are four main reasons why we think RIIM is an improvement on third-party vendor analysis:

Improved materiality

- RIIM aligns ‘E’ and ‘S’ factor materiality with investment materiality.

- RIIM helps to screen out ‘green-washing’ efforts.

- Factor materiality is more accurate as it is assessed at the sub-industry level.

Improved coverage

- RIIM provides systematic and proactive analysis beyond that of third-party vendors.

Fewer 'false alarms'

- RIIM information is more up to date.

- Companies often receive poor ratings for lack of disclosure when there is no record of negative incidents.

Compatibility with T. Rowe Price's investment style

- Our proprietary model is designed for practical application by our analysts and portfolio managers. RIIM aligns ‘E’ and ‘S’ factor materiality with investment materiality.

Proprietary Factor Analysis Sets T. Rowe Price Apart

To help our analysts and portfolio managers consider the impact of environmental and social factors, the RI team conducts analysis on individual securities as well as the wider portfolio. It also assists with company engagement.

Since ‘E’ and ‘S’ data points are not always readily disclosed by companies and other issuers, we have built a proprietary model that systematically and proactively screens the RI profile of an investment. This model is called the Responsible Investing Indicator Model (RIIM).

The most fundamental utility of RIIM is that it flags any elevated RI risks with an investment. However, RIIM can also identify investments with positive RI characteristics and manage RI factor exposures at the portfolio level. RIIM uses ESG data from T. Rowe Price databases, company reports and select third-party vendors, to cover a universe of approximately 7,900 corporate entities, meaning this quantitative tool does not cover 100% of our prospective investments. For investments that are not covered, our RI team screens for environmental, social and ethical controversies using a third party provider and – where enough information is available – conducts a fundamental evaluation of the company’s ESG profile.

Dedicated Analysis of Governance Standards and Practices

Monitoring the management, performance, strategy, and governance of the companies in which we invest is a natural extension of our long-term, fundamental investment process.

Our in-house governance team works directly with analysts and portfolio managers to assess governance issues among existing and potential investments. They also help engage with companies and facilitate proxy voting.

Governance analysis starts with our proxy voting guidelines, which are set annually by our proxy voting committee that is predominantly comprised of investors. In addition to informing our proxy voting process, the guidelines reflect T. Rowe Price’s perspective toward the appropriate governance standards in each region. If a company is flagged as divergent, it will be subject to further analysis by our governance team.

Our approach to governance analysis is differentiated because it is:

1. Investment-driven:

Portfolio managers and analysts often raise and identify areas of concern.

2. Conducted in-house:

Voting and engagement decisions are not outsourced.

3. Flexible:

Governance standards are evaluated in light of regional, industry and company circumstances.

4. Compatible with our investment style:

Because governance is embedded into our investment process – and portfolio managers are involved – we ensure our governance and investment priorities are aligned and there is a coherent external message.

This stage often includes engagement and proxy voting recommendations. Once considered a niche practice, sustainable investing today is a major market segment and one that continues to grow rapidly. Indeed, for many investors, integrating ESG factors as part of the investment process is no longer seen as an optional extra, but as an essential component of better decision-making and, ultimately, better long-term investment outcomes.

This thinking lies at the heart of T. Rowe Price’s proprietary RIIM model, namely harnessing differentiated, data-rich ESG insights to enhance our investment process. Integrating these unique views, alongside financial, macro and other qualitative factors, enables us to approach decisions with a richer set of information, encompassing the full spectrum of long-term risks and opportunities. As such, we believe that we are better able to support investors in achieving their financial objectives.

201809-609034

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.