June 2022 / MARKET OUTLOOK

Transitioning to a New Paradigm

Adjusting to an uncertain future

Key Insights

- Russia's invasion of Ukraine, COVID-19 lockdowns in China, higher energy prices, and rising interest rates could make the second half difficult.

- A spike in bond yields punished equity valuations in the first half. The question now is whether an earnings slowdown will be the next shoe to drop.

- U.S. Treasuries and other core bonds didn’t offer much diversification in the first half as equity correlations jumped. New approaches may be needed.

- War in Ukraine and sanctions against Russia could continue pushing commodity prices higher but also could accelerate a shift to renewable energy.

Adjusting to an Uncertain Future

Heading into the second half of 2022, higher inflation and rising interest rates remain the most serious threats to global financial markets, T. Rowe Price senior investment leaders say.

Russia’s invasion of Ukraine has added fire to those risks by pushing food and energy prices sharply higher and further disrupting global supply chains.

This inflationary “shock on shock” has put more pressure on the U.S. Federal Reserve and other major central banks to tighten monetary policy, while making it more difficult for them to tame inflation without choking off economic growth, according to Sébastien Page, Head of Global Multi‑Asset and Chief Investment Officer (CIO).

“The three biggest challenges for investors over the next few months will be inflation, inflation, and inflation,” Page says. “It’s the transmission mechanism for all the other risks we are facing.”

The key question now is whether those risks will cause a sharp deceleration in growth or push major economies into full‑blown recessions, dragging corporate earnings down as well, Page warns.

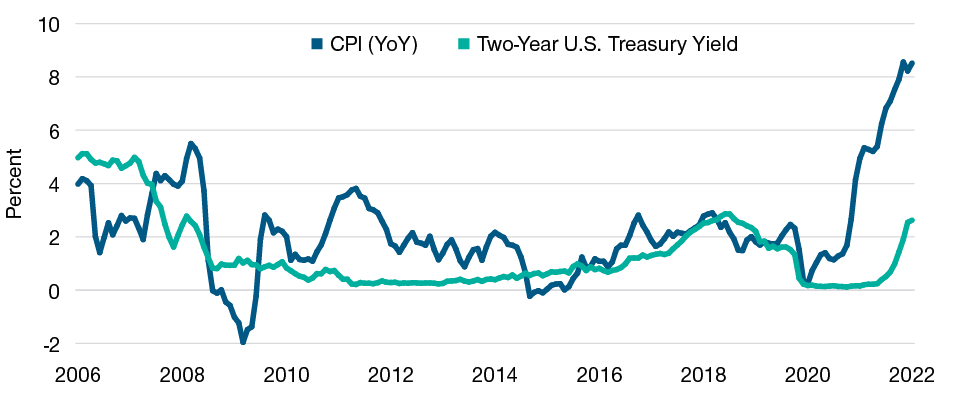

Beyond the cyclical risks, investors need to consider that global markets may have reached a structural inflection point—an end to the era of ample liquidity, low inflation, and low interest rates that followed the 2008–2009 global financial crisis (Figure 1).

“I think that regime is over,” says Arif Husain, Head of International Fixed Income and CIO. “You can throw away that playbook.”

Central bank liquidity was critical for stabilizing economies and markets during both the financial crisis and the coronavirus pandemic, notes Justin Thomson, Head of International Equity and CIO. But it helped push valuations for many risk assets toward historical extremes. “I think we’ve learned from history that those extremes are never permanent,” he says.

However, the new paradigm also could offer potential opportunities for investors with the skills and research capabilities needed to seek them out, Thomson adds. “In volatile markets, active management can be your friend.”

The Era of Tame Inflation and Ample Liquidity Appears To Be Over

(Fig. 1) U.S. inflation* and the yield on the U.S. two‑year Treasury note

May 31, 2006, through May 31, 2022.

*Inflation = year‑over‑year change in U.S. Consumer Price Index for All Urban Consumers.

Sources: U.S. Bureau of Labor Statistics and the Federal Reserve Bank of St. Louis.

Explore our four themes:

Navigating Challenging Currents

How can investors respond to the risks of recession in Europe and the US and a further growth slowdown in China?

Fundamentals Matter

With earnings growth likely to decelerate and interest rates rising, what opportunities do equity markets offer?

Flexible Fixed Income

Bonds struggled to diversify against equity risk in the first half of the year, so how should investors approach fixed income?

Managing Through Geopolitical Risks

Geopolitics will continue to be a key focus for investors in the second half, reinforcing the importance of diversification.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.