December 2021 / INVESTMENT INSIGHTS

China Evolution Equity: Unique Exposure to the China Opportunity Set

The Chinese economy is rich, deep and wide-ranging

The Chinese economy is rich, deep and wide-ranging. As we noted in China: Too big to ignore?, it is an economy that has been undergoing unprecedented change, a dynamic that has helped foster an abundant investment landscape.

Yet, while China is a large and liquid market, it remains largely under-researched and under-owned, offering exciting opportunities for skilled, active investors. Indeed, the majority of portfolios accessing China stock markets typically limit their exposure to the well-understood and well-owned mega caps. Think the likes of Tencent, Alibaba, Baidu, and China Mobile, for example. While many of the mega caps have been extremely successful and can argue a strong investment case for future growth, we believe investors can diversify their portfolio and optimise their investment return by looking beyond this small group of names.

A strategy that looks beyond the index

The T. Rowe Price China Evolution Equity Strategy has been designed to do just that – seeking to exploit inefficiencies across the full spectrum of Chinese markets (both onshore and offshore) to find the best risk-reward opportunities.

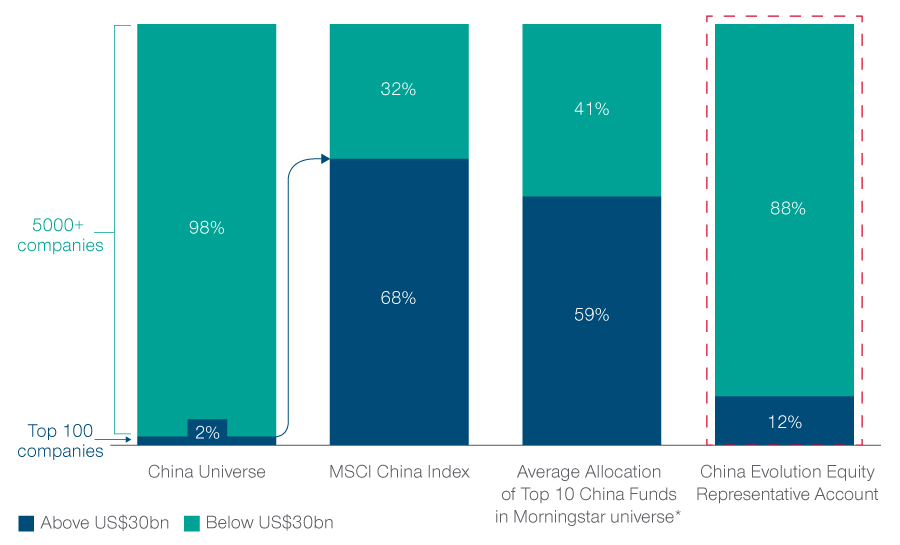

We focus on areas of the market that may be overlooked by some investors, going beyond the 100 largest companies by market cap – that dominate the index and are commonly seen in other China portfolios – to identify future winners and mispriced opportunities from across the expanding universe of some 5,000 names or more.

Fig. 1 China’s opportunity set is much more that the mega caps

Market cap breakdown by stock count (%), as at 30 September 2021

Sources: MSCI, HKex, FactSet, Wind, Morningstar. Financial data and analytics provider FactSet. Copyright 2021 FactSet. All Rights Reserved.

* The Top 10 China funds refer to the funds in the Morningstar China Equity universe, measured by AUM.

The representative portfolio is an account in the composite we believe most closely reflects current portfolio management style for the strategy. Performance is not a consideration in the selection of the representative portfolio. The characteristics of the representative portfolio shown may differ from those of other accounts in the strategy. Please see the GIPS® Composite Report for additional information on the composite.

Please see Additional Disclosures page for information about this MSCI and Morningstar information.

Local expertise in unexplored markets

Finding such successful companies across China’s diverse and expanding universe is critically dependent on robust local research and understanding. T. Rowe Price has a long history of investing in China, and we were early investors in A-shares through the QFII and Stock Connect programs. We currently manage assets totalling over US$32 billion in Chinese equities for our clients (as at 30 September 2021).

With a local investment team in Asia since 1987, and having more recently established an office in Shanghai, we have been able to accumulate extensive local knowledge and build long-term relationships with companies, suppliers, competitors and industry experts. All essential to our fundamental, bottom‑up research designed to seek out the best risk-reward opportunities.

Today, we have one of the industry’s strongest in‑house research teams dedicated to the Asian region and specifically to China. Portfolio manager, Wenli Zheng, has been investing in China since 2010. He works closely with a team of over 20 local, on-the-ground analysts in Asia focused solely on opportunities in China. He is further supported by our emerging market debt analysts, ESG specialist teams and over 100 sector and regional specialists who provide a broader perspective on what is happening globally and help evaluate the potential impact for companies in China.

The stability of our research team, strong collaboration and continuous exchange of information between the portfolio manager, our native Chinese analysts and the broader global platform are the key to finding and understanding the companies we believe are best positioned to prosper in an evolving economy like China.

Unique exposure to China’s future growth

The team focuses on identifying outlier companies, beyond the widely owned mega‑cap stocks – that small percentage of exceptional companies which drive the majority of market returns (see China: Why it pays to look for the overlooked). Currently, this typically means investing in companies with a market capitalisation below US$30 billion at purchase (although we are not compelled to sell should a stock go above this threshold provided the investment thesis remains intact). But these are not necessarily small or mid-sized companies, most are still sizeable, multi-billion dollar companies – established, robust businesses with good liquidity in their shares.

The businesses we seek to find tend to fall into one of three buckets:

Compounders

These are long-term core holdings, typically innovative, scalable businesses in large, changing markets run by strong management teams that potentially offer durable growth that can compound over multiple years.

Nonlinear growers

Chosen for their potential for medium-term outsized returns, these are companies with accelerating growth from a new product cycle, a change in the industry cycle, or transition from an investment cycle to a harvest cycle – step-changes in growth often missed or underappreciated by the market.

Special situations

These are companies with an asymmetric risk-reward profile; mispricing opportunities driven by transitory and fixable issues, resulting from short-term pressures such as forced selling, restructuring, weak sentiment, macro concerns or misunderstood business models.

Importantly for investors, the China Evolution Equity Strategy uses ESG integration as part of its investment process. This means incorporating environmental, social, and governance (ESG) factors to enhance investment decisions. Our philosophy is that ESG factors are a component of the investment decision, meaning that they are not considered separately from traditional fundamental analysis.

A differentiated and complementary portfolio

Our focus on uncovering stocks where change and growth are underappreciated or undiscovered leads to a high active share portfolio of around 40-80 stocks which is primarily driven by idiosyncratic factors that have a low correlation to macro influences and mainstream equity markets. Historically, the strategy has consistently exhibited a lower beta (<1) and lower volatility in comparison to the MSCI China All Shares index.

We are unconstrained by index, style or sector with the portfolio largely driven by bottom-up considerations where we believe we have unique insights beyond the consensus names. We think that China market returns (and, therefore, by default many investor portfolios) are too heavily concentrated on the internet sector, whereas we seek to provide a very differentiated source of alpha generation with contributors to performance coming from all types of sectors, ranging from traditional industrials to semiconductors. The result is a portfolio that, in our view, is very different from both the MSCI China Index and our peers, and that can thereby complement most investors’ existing China exposure. A portfolio that, we believe, stands out from the crowd.

Please contact us for more information on our China Evolution Equity Strategy and how we can help.

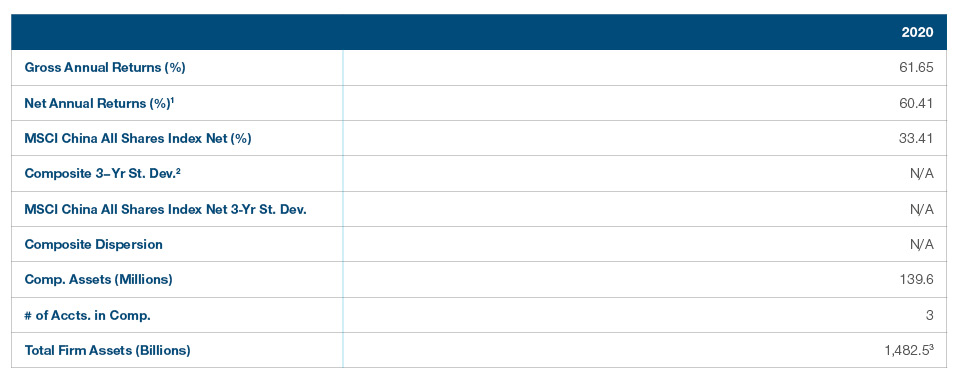

China Evolution Equity Strategy

* Not a formal benchmark; shown only for comparison purposes.

GIPS® Composite Report

China Evolution Equity Composite

Period Ended December 31, 2020

Figures Shown in U.S. dollar

1 Reflects deduction of highest applicable fee schedule without benefit of breakpoints. Investment return and principal value will vary. Past performance is not a reliable indicator of future

performance. Monthly composite performance is available upon request. See below for further information related to net of fee calculations.

2 Three-year annualized ex-post standard deviation is not presented because 36 monthly returns are not available.

3 Preliminary - subject to adjustment.

T. Rowe Price (TRP) claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance

with the GIPS standards. TRP has been independently verified for the 24-year period ended June 30, 2020 by KPMG LLP. The verificaon report is available upon

request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the

GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the

calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm wide

basis. Verification does not ensure the accuracy of any specific composite presentation. TRP is a U.S. investment management firm with various investment advisers registered with the U.S. Securities and Exchange Commission, the U.K. Financial Conduct Authority, and other regulatory bodies in various countries and holds itself out as such to potential clients for GIPS purposes. TRP further defines itself under GIPS as a discretionary investment manager providing services primarily to institutional clients with regard to various mandates, which include U.S., international, and global strategies but excluding the services of the Private Asset Management group. The minimum asset level for equity portfolios to be included in composites is $5 million and prior to January 2002 the minimum was $1 million. The minimum asset level for fixed income and asset allocation portfolios to be included in composites is $10 million; prior to October 2004 the minimum was $5 million; and prior to January 2002 the minimum was $1 million. Valuations are computed and performance reported in U.S. dollars.

Gross performance returns are presented before management and all other fees, where applicable, but after trading expenses. Net of fees performance reflects

the deduction of the highest applicable management fee that would be charged based on the fee schedule contained within this material, without the benefit of

breakpoints. Gross and net performance returns reflect the reinvestment of dividends and are net of non-reclaimable withholding taxes on dividends, interest income, and capital gains. Effective June 30, 2013, portfolio valuation and assets under management are calculated based on the closing price of the security in its respective market. Previously portfolios holding international securities may have been adjusted for after-market events. Policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request.

Dispersion is measured by the standard deviation across asset-weighted portfolio returns represented within a composite for the full year. Dispersion is not calculated for the composites in which there are five or fewer portfolios.

Some portfolios may trade futures, options, and other potentially high-risk derivatives which generally represent less than 10% of a portfolio.

Benchmarks are taken from published sources and may have different calculation methodologies, pricing times, and foreign exchange sources from the composite.

Composite policy requires the temporary removal of any portfolio incurring a client initiated significant cash inflow or outflow greater than or equal to 15% of portfolio assets. The temporary removal of such an account occurs at the beginning of the measurement period in which the significant cash flow occurs and the account reenters the composite on the last day of the current month after the cash flow. Additional information regarding the treatment of significant cash flows is available upon request.

The firm’s list of composite descriptions, a list of limited distribution pooled fund descriptions, and a list of broad distribution pooled funds are available upon request.

GIPS ® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organisation nor does it warrant the accuracy or quality of the

content contained herein.

Risks

The following risks are materially relevant to the portfolio.

- Country risk (China) - All investments in China are subject to risks similar to those for other emerging markets investments. In addition, investments that are purchased or held in connection with a QFII licence or the Stock Connect program may be subject to additional risks.

- Currency risk - Changes in currency exchange rates could reduce investment gains or increase investment losses.

- Emerging markets risk - Emerging markets are less established than developed markets and therefore involve higher risks.

- Small and mid-cap risk - Stocks of small and mid-size companies can be more volatile than stocks of larger companies.

- Stock connect risk - The portfolio may invest in certain Shanghai-listed and Shenzhen-listed securities (“Stock Connect Securities”) through the Shanghai-Hong Kong Stock Connect or the Shenzhen-Hong Kong Stock Connect respectively (“Stock Connect”). This mechanism carries higher risk.

General Portfolio Risks

- Capital risk - The value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

- Equity risk - In general, equities involve higher risks than bonds or money market instruments.

- ESG and Sustainability risk - May result in a material negative impact on the value of an investment and performance of the portfolio.

- Geographic concentration risk - To the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

- Hedging risk - A portfolio’s attempts to reduce or eliminate certain risks through hedging may not work as intended.

- Investment portfolio risk - Investing in portfolios involves certain risks an investor would not face if investing in markets directly.

- Management risk - The investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

- Operational risk - Operational failures could lead to disruptions of portfolio operations or financial losses.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

December 2021 / INVESTMENT INSIGHTS

December 2021 / INVESTMENT INSIGHTS