Fixed Income: The Domino Effect

From currency crises in Argentina and Turkey to extreme volatility in Italian government bonds, it has been an eventful few weeks and months in markets. Yet so far, we have not seen tangible signs of contagion leading to a wider risk aversion cycle. This was a key discussion point during our latest investment policy meetings in which the team analysed the environment to identify where opportunities may arise.

It has been a summer to forget for some—but not all. While some countries and markets came under extreme selling pressure, others emerged relatively unscathed. The moves have been very specific and more reminiscent of dominoes falling than a systematic crisis, when everything is under stress. This has been most evident in emerging markets, where some countries—such as Romania—have been quite stable, while others have deteriorated rapidly, beginning with Argentina then moving to Turkey, Brazil, Indonesia, and, more recently, Russia and South Africa. Those coming under scrutiny have often been countries with either political uncertainty or a current account deficit that markets are worried could become more difficult to finance with U.S. interest rates rising.

“The market has been constantly hunting for the next big selling story, and any emerging market country showing signs of vulnerability has seen its currency in freefall and its domestic government bonds pressured,” said Quentin Fitzsimmons, portfolio manager and member of the fixed income global investment team.

Although its too early to call an end to the volatility—considering the risks associated with tariffs and upcoming political events such as the elections in Brazil and midterm elections in the U.S.—there may already be some attractive entry points as some countries have potentially been punished unfairly with valuations that have adjusted well beyond their associated risks. Mexico stands out in this regard. “Inflation is expected to ease, and it is possible that Mexico’s central bank moves toward a rate-cutting cycle next year,” said Mr. Fitzsimmons. “Attractive valuations are underlined by the historically wide spread of Mbonos [Mexico’s local currency government bonds] to U.S. Treasury bonds.”

Another country whose fundamentals appeal to the investment team is Colombia. “Inflation is stable at a time when the economy is recovering. While the central bank is expected to raise interest rates next year, we believe that the market is pricing in too many hikes, which helps us to build a picture that the local government bond market is moderately attractive,” said Mr. Fitzsimmons.

Turning attention to developed markets, the investment team noted that for the most part there has been much less volatility. However, not all countries have been immune. The Swedish krona, for example, has significantly underperformed other developed market currencies this year as markets became concerned about the state of the housing market and its potential vulnerability to slowing global growth. Repeated delays in interest rate rises by the Swedish central bank probably hasn’t helped in this regard. However, with elections now out of the way, a key risk has been removed from the market, which may provide a good opportunity to go back into a currency whose volatility may have been excessive given its fundamentals.

On the bond front, one of the most extreme examples of volatility in developed markets this year has been Italy, where political concerns triggered significant outflows from international investors. “The correction witnessed in the short end of the Italian curve in May corresponded to a 20-standard deviation event,” said Mr. Fitzsimmons. The investment team noted that while long-term concerns remain, there could be a short-term tactical opportunity to benefit from Italy’s attractive valuations, particularly in short-maturity government bonds.

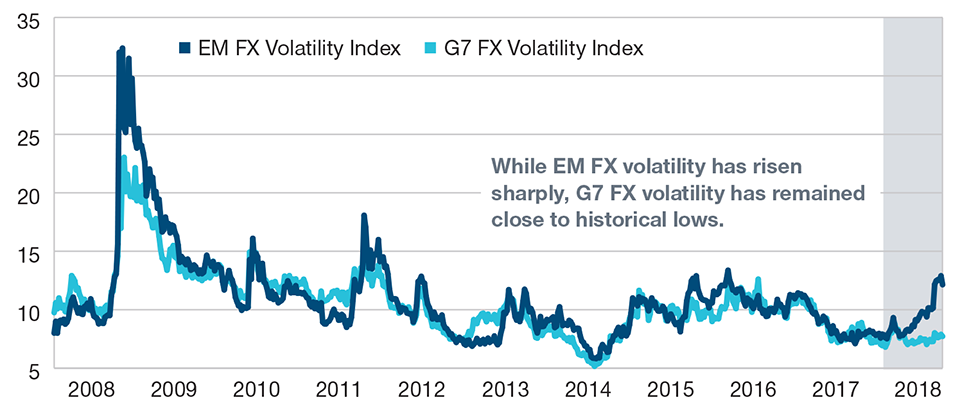

Figure 1: J.P. Morgan Currency Volatility Indicies: Emerging Markets vs. G7

As of September 14, 2018

Source: J.P. Morgan. Analysis by T. Rowe Price.

Within corporate markets, where default rates remain at historic lows, there is also evidence of investors being much more selective and quick to punish companies at signs of any negative news. In some cases, this is suppressing secondary market liquidity. For example, credit spreads on pharmaceutical company Bayer widened significantly on concern that it could face litigation charges. Similarly, credit default swaps on Ford widened substantially after rating agency Moody’s Investors Service, downgraded the U.S. automaker’s credit rating to Baa3, the lowest investment-grade credit rating.

The investment team noted that the European auto sector could be vulnerable should the U.S. impose additional tariffs on European imported goods. This sector could, therefore, be a strong candidate to hold select short credit default swap positions should liquidity suddenly evaporate.

“As monetary conditions continue to tighten in the U.S. at a time when other major central banks dial back their easing programs, a key concern is whether this domino effect mutates into a more systematic environment for lower risk appetite,” concluded Mr. Fitzsimmons.

201809-608172

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.