January 2024 / INVESTMENT INSIGHTS

Putting cash to work in 2024

We explore three possible scenarios as US interest rates peak

Key Insights

- Pandemic‑fueled fiscal and monetary stimulus pumped up the savings of U.S. households and businesses. Much of this cash found its way into money market funds.

- With short‑term U.S. interest rates likely having peaked, we think cash exiting money market funds is likely to move into shorter-term bonds, at least initially.

- However, a consensus that the U.S. economy is headed for a soft landing also could draw investors into equities, particularly sectors that lagged amid rate concerns.

A wall of money is hanging over U.S. financial markets—in the form of a huge stockpile of liquidity parked in money market funds and other short-term liquid accounts. Where those funds move next, and when, could be a decisive factor in the future performance of both stocks and bonds.

Our bottom‑line conclusion is that cash seeking higher returns is likely to move into shorter‑term bonds, given attractive yield levels and a potential for price appreciation as yields move lower. However, if expectations of a soft landing for the U.S. economy becomes the market consensus in 2024, cash also could flow into equities, especially the rate‑sensitive sectors that suffered most during the Federal Reserve’s tightening campaign.

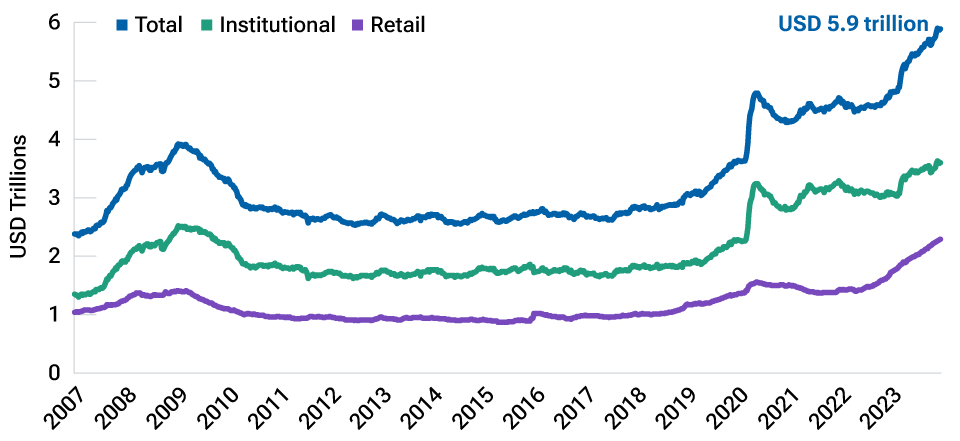

The potential amounts involved are unprecedented in dollar terms, although still below prior peaks as a percentage of U.S. equity market capitalization. As of mid‑December 2023, U.S. money market funds alone held almost USD 6 trillion in assets (Figure 1), up more than 60% since December 2019, on the eve of the pandemic.

U.S. investors are flush with liquidity

(Fig. 1) U.S. money market fund assets.

As of December 27, 2023.

Source: Investment Company Institute.

In large part, the surge in money market assets is a legacy of the pandemic. Near-zero interest rates and massive bond purchases by the U.S. Federal Reserve, coupled with heavy stimulus payments from the U.S. Treasury, pumped a flood of money into the financial system. Households and businesses saved much of that money and amid the uncertainty, stashed it in liquid products.

Although the pandemic is in the rear‑view mirror, investors have had several other incentives to remain liquid for the past several years:

- Surging inflation and rising rates led to one of the worst bond bear markets in history, making longer‑term fixed income assets an unattractive place throughout much of 2022 and into 2023.

- Equities generally sold off along with fixed income assets during that period, reducing the benefits of diversification within traditional stock/bond portfolios.

- The Fed’s rapid rate hikes lifted yields on money market funds and short‑term accounts from near zero to above 5%, improving the rewards for staying liquid.

A look at past economic cycles suggests that this strong liquidity preference will ease at some point, especially if the U.S. economy avoids a deep recession and the Fed moves closer to cutting rates. Investor shifts could send a wave of cash into risk assets.

However, the timing of this move, and the specific asset classes on the receiving end of it, will depend on a number of variables that are hard to forecast, including the direction and pace of future Fed policy moves, lingering inflationary pressures, risks to economic growth, and—not least—investor behavior in the face of uncertainty.

Investor motives also could matter: Assets parked in money market funds to avoid the 2022–2023 stock and bond sell-offs could return to risk assets, while cash shifted from bank savings accounts appears more likely to remain in money market funds as long as they maintain a yield advantage over savings accounts.

Download the full article here:(PDF)

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

January 2024 / INVESTMENT INSIGHTS