Fed Did Not MOVE Enough, Bond Index Suggests

Key insights

- We believe that the Fed’s 25‑basis‑point rate cut on July 31 was insufficient and, therefore, a policy error that increases the risk of a near-term recession.

- The MOVE Index jumped in August, showing that the market believes that the July Fed move was the start of an easing cycle, not an insurance cut.

- Fearing further drag on growth from escalation of the trade war, markets have greatly ratcheted up pressure on the Fed to respond more aggressively.

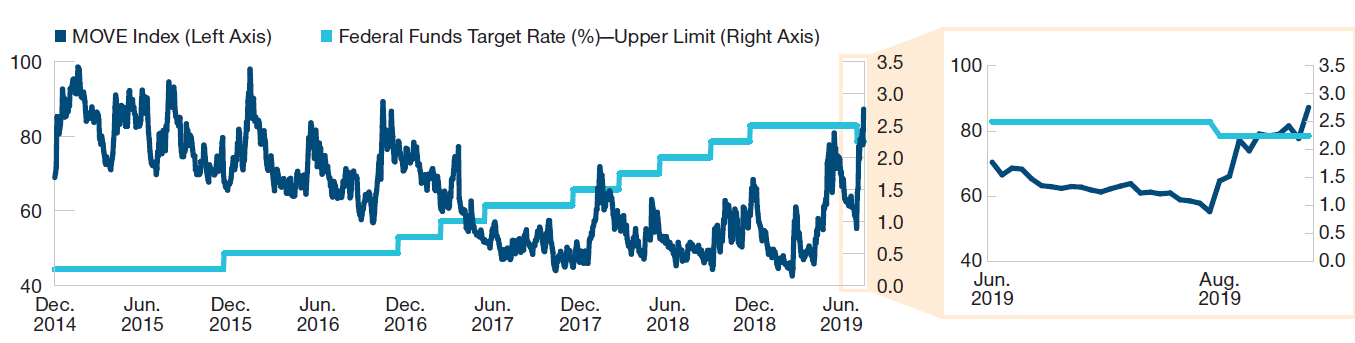

We believe that the Federal Reserve’s decision to lower rates by only 25 basis points1 in July and not more emphatically commit to additional easing was insufficient and, therefore, a policy error that significantly increases the risk of the economy sliding into recession. The Merrill Lynch Option Volatility Estimate (MOVE) Index has jumped since the central bank cut interest rates on July 31, the Fed’s first rate reduction since 2008. As we discussed in a previous Insights publication, we have been closely watching the MOVE Index’s reaction as a key indicator of whether markets saw the Fed’s easing move as a short‑term insurance cut that would extend the economic cycle or the first of a longer series of cuts preceding a recession. Unfortunately, the MOVE has signaled an abrupt shift in sentiment from temporary insurance cuts to fears of a recessionary cutting cycle.

MOVE Surges In Early August

The MOVE appeared to peak in mid‑June as it declined into late July. This would have corresponded to a pattern seen in past insurance cuts of the MOVE peaking approximately at the time of the initial Fed cut. However, the MOVE surged almost 50% in less than two weeks following the Fed’s rate reduction, surpassing its June high. This appears to fit more with the historical pattern of easing cycles, where the index peaks several months after the first cut.

On August 1—the day after the Fed cut—President Donald Trump triggered an immediate escalation in the U.S.‑China trade conflict by tweeting that the U.S. would impose 10% tariffs on another USD 300 billion of Chinese imports on September 1, with the tariff rate possibly rising to 25%. While Trump later said that he would delay most of the fresh tariffs until mid‑December, the unexpected announcement contributed to the early‑August surge in the MOVE, in our view, as the news caused Treasury yields to plummet.

However, it is nearly impossible to separate the disappointing effects of the rate cut from the effects of the sudden increase in trade tensions. Fearing further drag on economic growth from Trump’s escalation of the trade war, markets have greatly ratcheted up pressure on the Fed to respond more aggressively with monetary easing.

MOVE Index Jumps After July 31 Rate Cut

MOVE Index and fed funds rate, December 2014–August 2019

As of August 15, 2019

Sources: Haver Analytics, Bank of America Merrill Lynch, and Federal Reserve Board.

Tighter Financial Conditions

It’s notable that financial conditions tightened immediately after the Federal Open Market Committee (FOMC) announcement on July 31, as conditions commonly loosen following a rate cut. Counterintuitively, the U.S. dollar strengthened and equities declined. Financial conditions continued to tighten after the U.S.‑China trade conflict escalated in August, but the market’s initial reaction to the Fed cut was that it was not aggressive enough to avert an economic downturn. The MOVE’s ascent in August confirms this view.

In another sign that the bond market perceived the July 31 rate reduction as the beginning of an easing cycle, the yield curve flattened meaningfully from late July through mid‑August. On July 30, the difference in yield between the two‑year and 10‑year Treasuries was 21 basis points. That spread closed on August 14 at only one basis point after briefly inverting. The 30‑year Treasury yield hit a record low of 1.98% on August 15, indicating very pessimistic expectations for future growth and inflation. If markets believed that the Fed move was an insurance cut, the yield curve would have steepened as longer‑term yields increased.

In late July, just before the Fed move, federal funds futures prices indicated that investors expected four rate cuts in the next 12 months. Despite the July cut, futures prices in early August still showed expectations for four cuts in the next 12 months, demonstrating that investors believed that the July 31 move was not sufficient to keep the central bank out of an easing cycle and stave off recession.

July Cut Likely the Start of Easing Cycle

A range of indicators, including the MOVE Index, show that the market believes that the July 31 Fed cut was the start of an easing cycle, not an insurance cut that Fed Chairman Powell characterized as a “midcycle adjustment.” We believe that the Fed’s 25‑basis‑point initial cut was a policy error. The central bank would have needed to lower rates by 50 basis points and follow up with dovish comments to convince the market that its first cut in over 10 years truly was a midcycle adjustment.

However, the Fed probably still has a small window of opportunity to act forcefully to change the hawkish narrative, but that would also need to be coupled with major trade war concessions from the Trump administration. Still, with the odds of a near‑term recession now meaningfully higher, we have positioned our core taxable bond portfolios with relatively low risk and maintained a long‑duration2 posture.

What we’re watching next

The market’s reaction to the Fed’s July rate cut means that the statements of Fed officials between policy meetings will be even more important. Notably, two members of the FOMC dissented from the committee’s July 31 decision, preferring to hold rates steady. We will be watching to see if Fed policymakers present more of a united front leading up to the September 17–18 FOMC meeting to convince investors of the central bank’s conviction to sufficiently ease monetary policy.

1 A basis point is 0.01 percentage points.

2 Duration measures a bond’s sensitivity to changes in interest rates.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

201908-933804