November 2023 / INVESTMENT INSIGHTS

High Yield Bond Market Changes Provide Support

Transformations have bolstered high yield for a modest downturn

Key Insights

- The high yield market’s credit quality improvements stemming from recent changes have positioned the asset class well for a moderate economic downturn.

- Credit fundamentals of high yield issuers remain strong as companies have fortified their balance sheets and liquidity profiles to better weather a recession.

- Trends in individual issuance show fewer small, illiquid issues and an increase in secured issues.

In the roughly 15 years since the global financial crisis (GFC), the high yield bond market has improved in several ways. The overall credit quality of the market has improved, the credit profile of individual high yield issuers is stronger, and bonds from larger issuers as well as secured bonds account for an increasing proportion of the market.

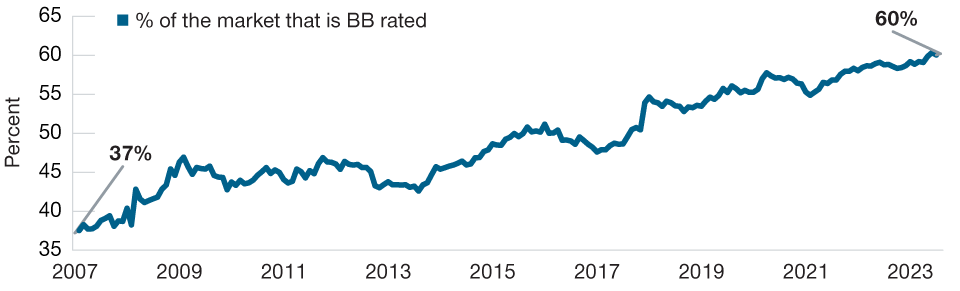

Before the GFC, a minority of the high yield bond market held average credit ratings of BB, near the highest end of the high yield rating spectrum. The percentage of the market that is rated BB has steadily increased, and today the majority of the high yield market is rated BB. Encouragingly, 20% of the high yield market was rated within two ratings upgrades of investment-grade status as of June 30, 2023, with 10% of the market within one credit rating upgrade.1

BB Composition of the High Yield Market

(Fig. 1) High yield credit quality has steadily improved

As of August 31, 2023.

Source: Credit Suisse. High yield market is represented by the Credit Suisse High Yield Index. © 2023 CREDIT SUISSE GROUP AG and/or its affiliates. All rights reserved.

This change in market composition occurred over time, with lower-rated issuers migrating to the bank loan market or borrowing in the direct lending market. Those markets have meaningfully increased in size since the GFC. Concurrently, a significant number of issuers migrated from the investment‑grade market to high yield upon credit rating downgrades. The entrance of these “fallen angels” to the high yield market accelerated in 2020 as pandemic-era restrictions negatively impacted many investment‑grade corporates.

High Yield Issuers Transformed

The profile of the average high yield issuer has strengthened. This trend was accelerated by the uptick in fallen angels. Today, the average high yield issuer has a larger balance sheet and generates higher earnings than prior to the GFC. Considering the higher‑quality bias and general financial flexibility afforded larger companies that generate more cash flow, we feel the asset class is in a solid position should the economic outlook weaken.

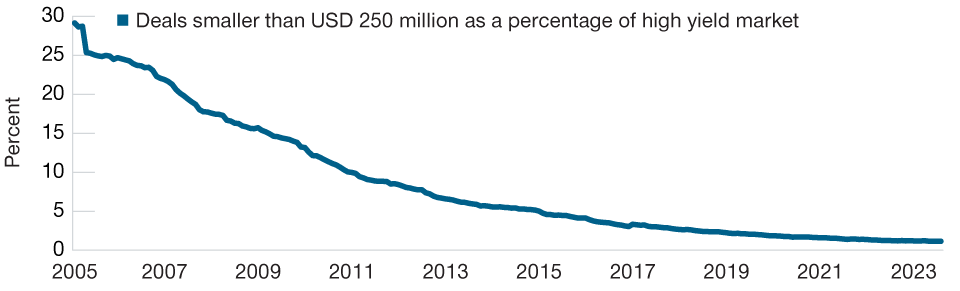

These transformations in high yield issuers have led to changes in new issues. With larger, higher-quality issuers dominating the high yield market, smaller-sized new issues have fallen dramatically. The larger issue sizes could improve liquidity in the high yield market.

Global High Yield Issues Under USD 250 Million

(Fig. 2) Small issue sizes no longer prominent

As of August 31, 2023.

Sources: J.P. Morgan Chase & Co. North America Credit Research. Based on J.P. Morgan North America Credit Research. Not from an index. Analysis by T. Rowe Price.

Credit Fundamentals Are Strong, and Balance Sheets Are Fortified

High yield credit fundamentals appear resilient despite a macro backdrop that could be challenging for risk assets. Since the GFC, refinancings have dominated high yield market new issuance as issuers capitalized on historically low interest rates. Following the initial shock from pandemic‑related shutdowns, high yield issuance dramatically increased at attractive financing rates, strengthening issuers’ balance sheet liquidity. Interest coverage metrics also increased, leaving issuers better able to meet their debt service obligations.

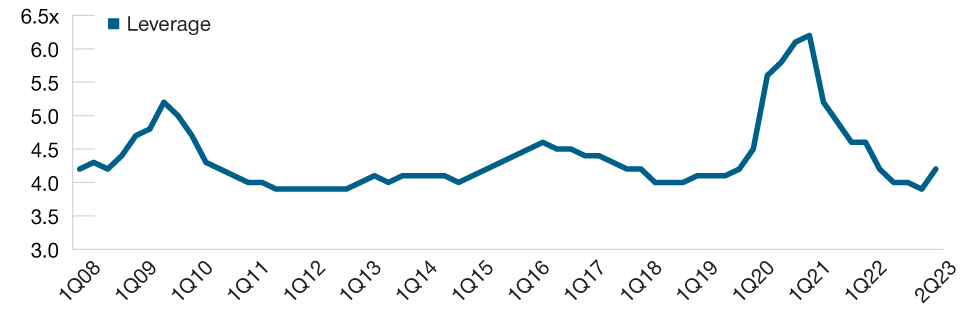

In addition, leverage for U.S. high yield issuers has decreased to its lowest level in over a decade. Despite expectations for a slowing economy, earnings have held up for most high yield issuers, especially in industries that had been severely depressed during the pandemic shutdowns, such as cruise operators.

Fortified balance sheets and resilient earnings place high yield issuers in a solid position heading into any economic downturn.

Average Leverage Ratio of U.S. High Yield Market Issuers

(Fig. 3) High yield issuers have reduced leverage

As of June 30, 2023.

Sources: J.P. Morgan Chase & Co. North America Credit Research. Based on J.P Morgan North America Credit Research. Not from an index.

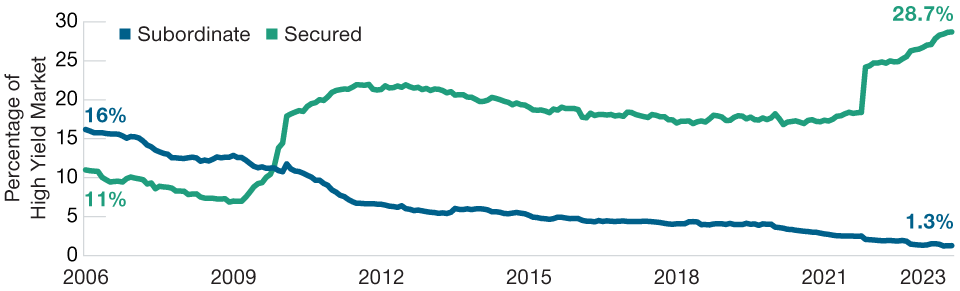

More High Yield Issues Offering Enticing Features

To combat rising inflation, the Federal Reserve has raised rates sharply. As a result, many issuers of bank loans, whose coupon payments are tied to short-term rates, have seen their interest costs increase. In order to balance this floating rate exposure, higher-quality bank loan issuers have opted to partially refinance their loans in the high yield bond market, benefiting from the certainty of fixed coupons while offering secured high yield bonds to replace their senior-secured2 floating rate loans. These secured high yield issues place bonds on par with loans at the top of the capital structure, potentially offering creditors higher recovery rates in the event of any default.

Seniority Structure of Global High Yield Market

(Fig. 4) More high yield bonds appear higher in capital structure

As of August 31, 2023.

Sources: J.P. Morgan Chase & Co. North America Credit Research. Based on J.P Morgan North America Credit Research. Not from an index. Analysis by T. Rowe Price.

Secured high yield bond issuance has recently accelerated, resulting in the highest secured allocation in history. In addition, the amount of junior or subordinate debt in high yield capital structures is at an all-time low, further bolstering recoveries in the event of default.

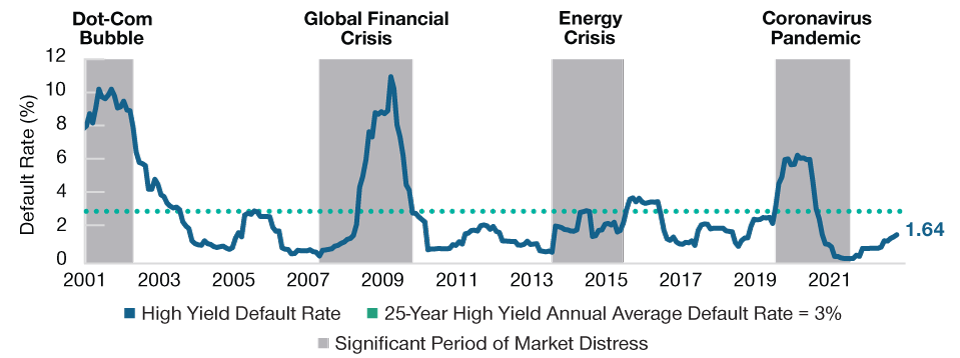

Global High Yield Market Default Rates

(Fig. 5) Defaults are running below the historical average

As of June 30, 2023.

Source: J.P. Morgan Chase & Co. North America Credit Research. Based on J.P Morgan North America Credit Research. Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2023, J.P. Morgan Chase & Co. All rights reserved.

The High Yield Market Appears Resilient

The current default rate, while a backward-looking metric, is a good indication of the strength of the asset class, in our view. The high yield default rate recently picked up but remains well below its long-term average.

Recent defaults have been largely idiosyncratic, including issuers who have defaulted in the past or that recently executed distressed debt exchanges. These defaults appear more company‑specific rather than a result of systemic weakness in the high yield market.

Changes in the composition of the high yield market have improved the average quality of aggregate market. Amid a relatively low default rate, larger, higher‑quality issuers and new supply offering more attractive characteristics have improved the high yield bond market, in our view.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

November 2023 / ASSET ALLOCATION VIEWPOINT