NEWS

T. Rowe Price’s 2017 Parents, Kids & Money Survey, which sampled 1,014 parents of 8 to 14 year olds nationally and their kids, analyzed parent attitudes and behaviors that were associated with kids’ financial habits. The survey found that positive money behaviors and expectations among kids are often associated with parents’ decision to let their kids decide how to save and spend their money on their own, as well as modeling good financial habits. Conversely, troubling financial habits among kids were more frequently seen when parents have a troubling history with money.

“Kids who have the freedom to manage their own money seem to have better money behaviors and are more truthful with their parents about how their money was spent,” says Roger Young, a senior financial planner at T. Rowe Price and father of three. “I know firsthand the temptation of helicopter parenting, but there is evidence of a downside to this approach when it comes to money. More than three-quarters of the kids who manage their own money say that they have money conversations with their parents. Giving them real life money experiences brings finances out of the conceptual and puts it into practice.

“We know that kids’ money habits are formed before they get to high school and that their parents are often their most influential teachers. It’s unsurprising, but still saddening, that parents with troubling money habits seem to be passing them on to their kids. These parents are hit with the double consequences of their own financial mistakes and the prospect that their kids may be set up to relive them.

“To prevent this, parents may want to consider openly discussing their finances with their kids—the good, the bad, and the ugly. Kids who are aware of their parents’ bankruptcy are more than twice as likely to say that they are very or extremely smart about money compared with those who weren’t aware of it (68% vs. 30%). So I don’t think they are destined to follow in their parents’ footsteps,” says Mr. Young.

T. Rowe Price encourages parents to invest in their kids' futures by talking to them about money matters weekly. The survey found that parents who discuss financial topics with their kids at least once a week are significantly more likely to have kids who say they are smart about money (64% vs. 41%). Frequent topics parents have used to initiate money conversations have included:

• Back to school shopping on a budget (47%)

• Figuring out how much was saved by purchasing sale items (45%)

• Going into a physical bank (41%)

• Discussing the cost of college (41%)

• Discussing why they didn’t take a bigger vacation (34%)

To help parents have money conversations, the firm created MoneyConfidentKids.com, which provides free online games for kids; tips for parents that are focused on financial concepts such as goal setting, spending versus saving, inflation, asset allocation, and investment diversification; as well as lessons for educators.

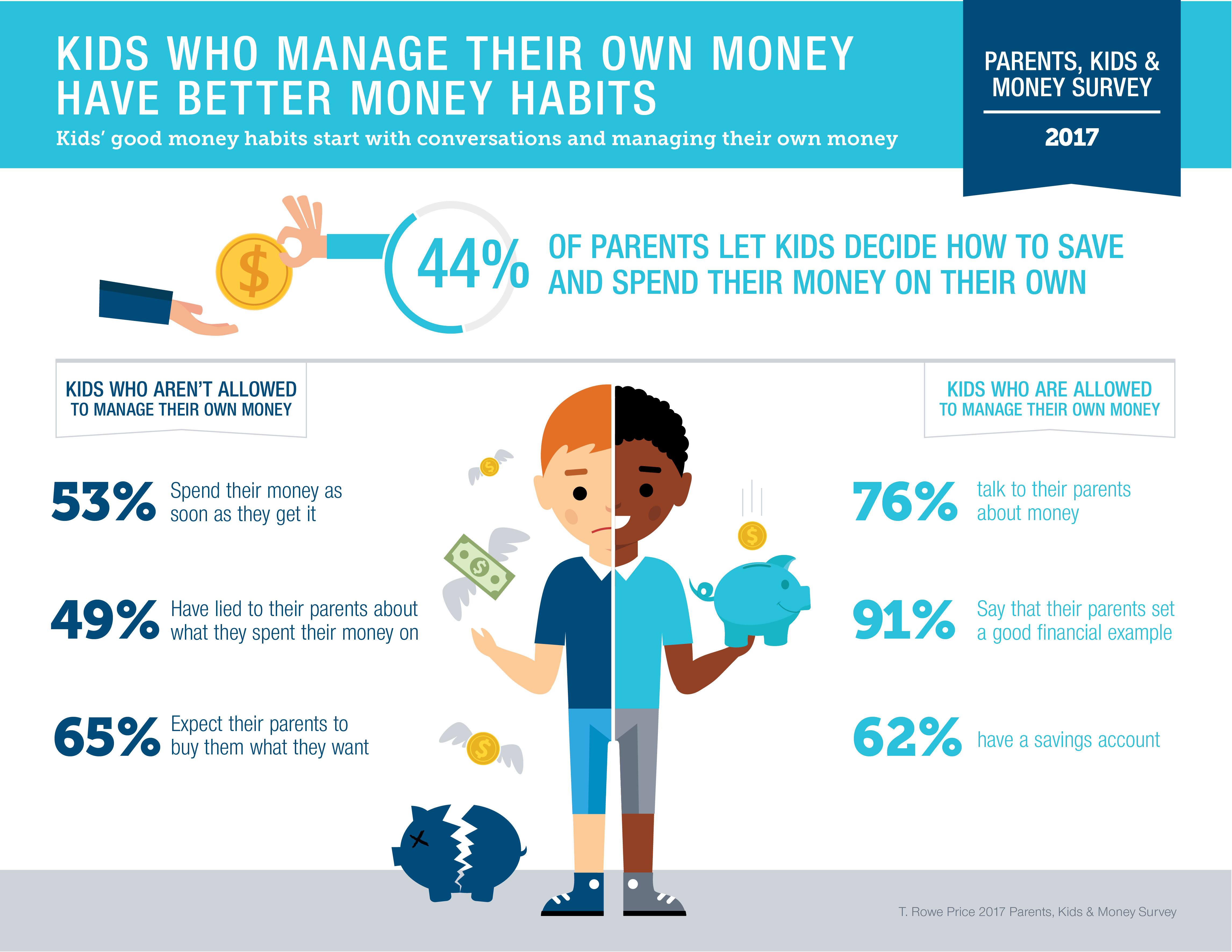

KIDS’ GOOD MONEY HABITS START WITH CONVERSATIONS AND MANAGING THEIR OWN MONEY

- Kids who manage their own money have better money habits: 44% of parents let kids decide how to save and spend their money on their own. Compared with parents who do not give their kids that control, those who do let them manage their money are less likely to have kids who:

- Spend their money as soon as they get it (40% vs. 53%)

- Have lied to their parents about what they spent their money on (29% vs. 49%)

- Expect their parents to buy them what they want (52% vs. 65%)

- Feel ashamed because they have less than other kids (30% vs. 50%)

- Kids who manage their own money discuss money more: They are more likely to say that:

- They talk to their parents about money (76% vs. 70%)

- They have learned about money from their grandparents (55% vs. 44%), teachers (45% vs. 37%), or other family members (32% vs. 22%)

- Many parents still have some reluctance to discuss financial matters: 69% of parents have some reluctance to discuss money matters. And 61% of parents only discuss money with their kids when their kids ask about it.

- When parents model good money habits, kids notice: 39% of parents have at least three types of savings (i.e., retirement savings, emergency fund, college savings, or money saved for another goal). These parents are more likely to have kids who have money saved (98% vs. 86%) and have talked to their parents about money (83% vs. 66%). They are also less likely to:

- Spend their money as soon as they get it (40% vs. 52%)

- Have lied to their parents about what they spent their money on (34% vs. 43%)

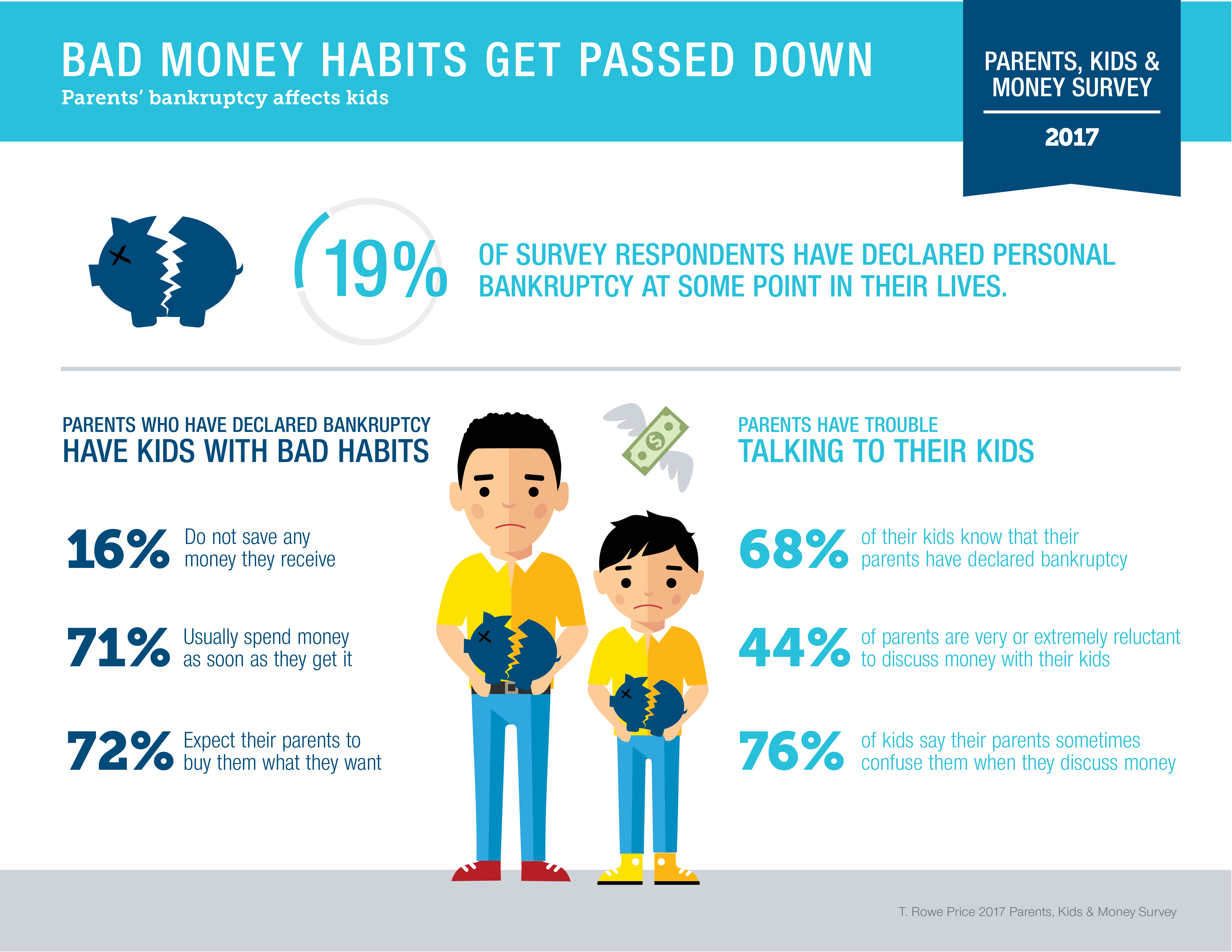

BAD MONEY HABITS GET PASSED DOWN

- Parents’ bankruptcy affects kids: 19% of survey respondents have declared personal bankruptcy at some point in their lives. Compared with parents who have not declared bankruptcy, those who have are more likely to have kids who:

- Do not save any money they receive (16% vs. 6%)

- Usually spend money as soon as they get it (71% vs. 42%)

- Expect their parents to buy them what they want (72% vs. 56%)

- Money is a difficult topic for parents who have declared bankruptcy: 69% of their kids know that their parents have declared bankruptcy. But the parents are more than twice as likely to say that they are very or extremely reluctant to discuss finances with their kids compared with those who have not declared bankruptcy (44% vs. 20%). Additionally, their kids are more likely to say:

- Their parents sometimes confuse them when they talk about money (76% vs. 51%)

- What their parents tell them about money is sometimes different than what they hear at school (70% vs. 53%)

- Significant credit card debt affects kids too: 53% of all respondents have credit card debt, and within that group, 48% have $5,000 or more in credit card debt. While the effects are less pronounced compared with families who have experienced bankruptcy, similar trends are seen. Compared with parents who do not have at least $5,000 in credit card debt, those who do are more likely to have kids who:

- Usually spend money as soon as they get it (58% vs. 44%)

- Expect their parents to buy them what they want (65% vs. 57%)

- Parents with significant credit card debt are also more reluctant to discuss money: Compared with parents who do not have more than $5,000 in credit card debt, parents with $5,000 or more in credit card debt are more likely to say that they are very or extremely reluctant to discuss finances with kids (35% vs. 21%). Additionally, their kids are more likely to say:

- Their parents sometimes confuse them when they talk about money (67% vs. 51%)

- What their parents tell them about money is sometimes different than what they hear at school (65% vs. 53%)

THE COMPOUNDING EFFECT OF BAD MONEY HABITS

- Parents with troubling financial habits are more likely to have pulled money from retirement savings: 44% of all respondents have pulled money from their retirement savings during the past two years. But parents who have declared bankruptcy at some point in their lives are twice as likely to have recently pulled from retirement savings (74% vs. 37%). Similarly, parents with $5,000 or more in credit card debt are significantly more likely to have pulled money from retirement (62% vs. 37%).

- They are also more likely to have pulled money from their kids’ college savings: Parents who have at some point declared bankruptcy are more than twice as likely to have pulled money from their kids’ college savings in the past two years (69% vs. 25%). Likewise, parents who have more than $5,000 in credit card debt are significantly more likely to have pulled money from their kids’ college savings recently (50% vs. 26%).

- Parents with troubling financial habits are more likely to have other kinds of debt: Parents who have declared personal bankruptcy at some point in their life are significantly more likely to currently have over $5,000 in credit card debt (68% vs. 42%). They are also more than twice as likely to have payday loans (22% vs. 10%).

ABOUT THE SURVEY

The ninth annual T. Rowe Price Parents, Kids & Money Survey, conducted by Research Now, aimed to understand the basic financial knowledge, attitudes, and behaviors of both parents of kids ages 8 to 14 and their kids ages 8 to 14. The survey was fielded from January 18, 2017, through January 26, 2017, with a sample size of 1,014 parents and 1,014 kids ages 8 to 14. The margin of error is +/- 3.1 percentage points. All statistical testing done among subgroups (e.g., boys versus girls) is conducted at the 95% confidence level. Reporting includes only findings that are statistically significant at this level.

ABOUT T. ROWE PRICE

Founded in 1937, Baltimore-based T. Rowe Price Group, Inc. (troweprice.com) is a global investment management organization with $810.8 billion in assets under management as of December 31, 2016. The organization provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans, and financial intermediaries. The company also offers a variety of sophisticated investment planning and guidance tools. T. Rowe Price's disciplined, risk-aware investment approach focuses on diversification, style consistency, and fundamental research. For more information, visit troweprice.com or our Twitter, YouTube, LinkedIn, and Facebook sites.