March 2024 / INVESTMENT INSIGHTS

Investment implications of generative artificial intelligence

Reasons why investors should embrace AI as a long-term investment theme

Key Insights

- We believe there are compelling reasons why investors should embrace artificial intelligence (AI) as a long‑term investment theme.

- We retain our positive view on the sector for 2024—not just for AI but also for the broader technology sector in general.

- Many of the global tech stocks that we cover are experiencing accelerating organic earnings growth and operating margin expansion.

There are some compelling reasons, in our view, why investors should embrace artificial intelligence (AI) as a long‑term investment theme, even if some popular AI stocks may appear a little frothy in the short term.

Generative AI constitutes a huge breakthrough

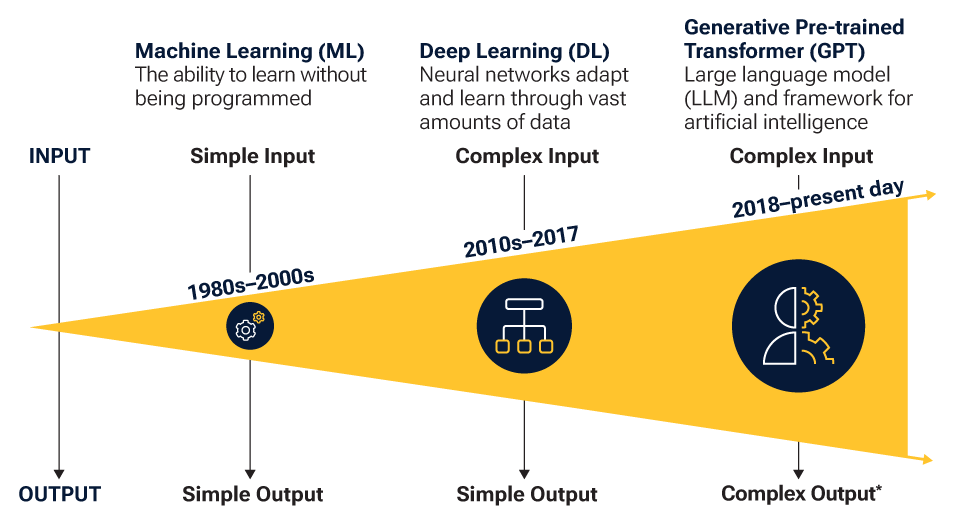

(Fig. 1) Rapid jump from machine learning to deep learning to ChatGPT

As of December 2023.

* Creative, New, Visual, Analytical, Goal‑Seeking.

Source: Analysis by T. Rowe Price. For illustrative purposes only.

2023: An exceptional year for global tech

Looking back, 12 months ago, our global equity managers held an optimistic view of global tech in 2023. We retain our positive view on the sector for 2024—not just for AI but also for the broader technology sector in general. Many of the global tech stocks that our analysts cover are experiencing accelerating organic earnings growth and operating margin expansion, which appears set to continue in 2024. AI has been and may continue to be cyclical, yet we believe that its S‑curve trajectory has likely been underestimated by the market.

AI: Investing in the future, today

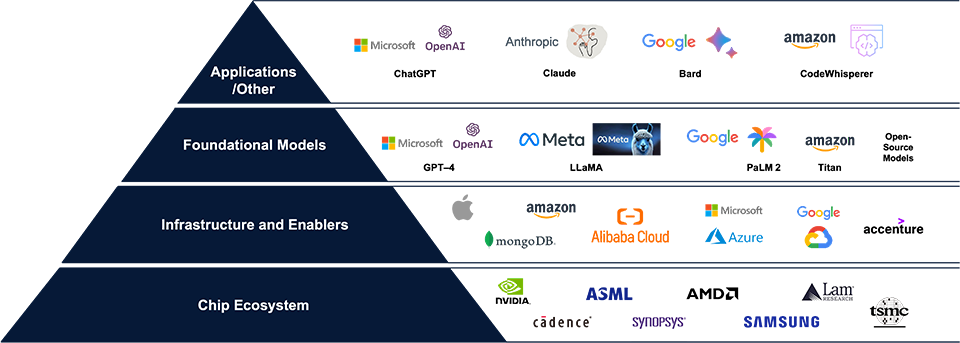

Generative AI is incredibly semiconductor intensive due to its immense parallel processing requirements. One of the best ways to visualize the opportunities is in Figure 2, which represents AI beneficiaries graphically as a pyramid with four different levels. Among the first to benefit, forming the base of the pyramid, are the companies involved in the chip ecosystem for advanced semiconductors and semiconductor capex, such as NVIDIA, TSMC, ASML, Lam Research, etc. One of the best ways to take advantage of generative AI in this mega‑trend has been via the “picks and shovels” and other parts of the infrastructure layer.

Visualizing AI as a pyramid

(Fig. 2) The layers of AI

As of December 2023.

The trademarks shown are the property of their respective owners. Use does not imply endorsement, sponsorship, or affiliation of T. Rowe Price with any of the trademark owners.

The specific securities identified and described are for informational purposes only and do not represent recommendations. This is provided for illustrative purposes only and does not represent the performance of any security.

The second layer of the pyramid is composed of the AI infrastructure providers (Amazon, Apple, Alibaba Cloud, etc.) and AI enablers (IT services companies such as Accenture and Microsoft Azure). At the third pyramid level are the foundational large language models like Open AI’s GPT‑4 or Meta’s LLaMA. Finally, at the top of the pyramid are the customized AI applications, where currently there is less visibility as to who the eventual winners are likely to be.

While the adoption of AI is still in its early stages, it appears to be exceptionally rapid compared with previous IT booms such as PCs and smartphones, thanks in part to generative AI and large language models (LLMs), which have encouraged tech and non‑tech companies in many industries and sectors to experiment with early adoption, driven more by the recognition of potentially large efficiency gains than by FOMO (fear of missing out).

Global tech opportunities in 2024

Globally, the outlook for technology in 2024 appears quite robust, with continued growth in generative AI and a cyclical rebound in the broader‑based semiconductor market, including PCs, smartphones, etc. Of course, this favorable view of tech has to be balanced against broader macro risks and concerns, such as a potential slowing in U.S. consumer demand, the slow Chinese economic recovery, and escalating geopolitical uncertainties in the Middle East, Ukraine, and other regions.

Rapidly growing global AI markets

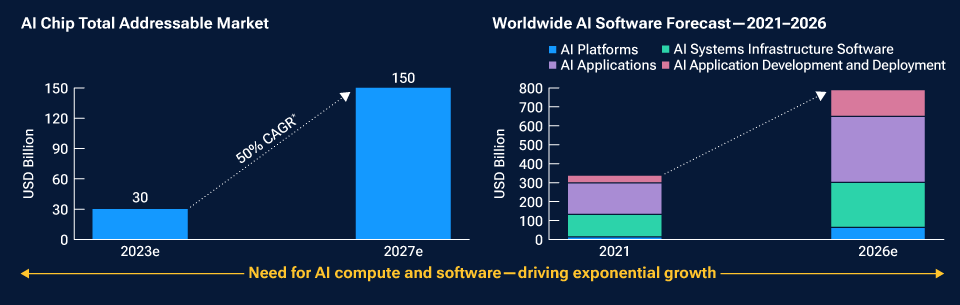

(Fig. 3) Global AI chip and software markets in USD billion

2023 and 2027 estimates for the AI Chip Total Addressable Market are industry forecasts taken from the first study mentioned in the sources below.

There is no guarantee that any forecasts made will come to pass.

* Compound annual growth rate.

Sources: AI Chip Market—AMD Data Center and AI Technology Premier, Software Forecast—William Blair Research based on data from IDC; Worldwide Semiannual Artificial Intelligence Tracker, 2H21.

We think it is likely, however, that the AI boom has enough momentum to continue in 2024, outweighing broader macroeconomic worries, many of which are not new but were also present throughout 2023. We continue to see many interesting areas of opportunity for global technology investors in 2024, including the following:

- Semiconductors overall could continue to be a source of strength. The demand for semiconductors is likely to stay strong, driven by accelerating AI demand, as exemplified by AMD’s latest assessment of the global accelerator chip market being worth USD 400 billion by 2027. The company increased its market growth outlook from a 50% compound annual growth rate (CAGR) to a 70% CAGR from 2023 to 2027. We could also see a bottoming in other areas, such as industrial semiconductors by the second half of 2024.

- Cloud computing and enterprise software are expected to continue to grow due to the increasing demand for flexible and scalable IT solutions. AI development is poised to give a further boost to this, so we think the outlook for data center spending is likely to stay strong. In particular, companies need to get their data “ready” for AI. This means more companies investing in middle‑office and back‑office software such as Workday, SAP, and ServiceNow.

- Areas of Fintech could also be strong, hence our continuing involvement in the sector. E‑commerce has continued to accelerate post the pandemic reflation, and fintech companies are being more disciplined in their operating expenditure.

Balancing risks and opportunities

With such powerful dynamics, we are cognizant of the risks of a potential bubble forming, resulting in excessive valuations for popular AI stocks. As asset managers, we believe it is our job to navigate the rapidly changing AI environment responsibly, by adhering to T. Rowe Price’s long‑established bottom‑up investment framework and not overpaying for “hot” AI stocks.

We have to balance the opportunities against potential risks, which currently we see being linked more to broader macro concerns than to subsector‑specific issues within the technology space.

- On the economic front, while the Fed seems to be managing a decent glide path in the U.S., there remains the risk of a slowdown, which—combined with the current weakness in the Chinese economy—could dampen global demand for technology products and services.

- On geopolitics, while there has been some recent easing in U.S.‑China tensions, we have to be alive to the possibility of it flaring up again, with potential impacts on demand as well as the IT supply chain.

- Finally, regulatory risk also remains a challenge for the industry. As governments try to adapt to the increased adoption of AI—and the broader availability of data—the risk to AI remains of increased government regulations around data privacy, antitrust issues, and national security concerns, as well as potential increases in compliance burdens and costs for technology companies.

Concluding thoughts

We continue to believe the AI story is bigger than many investors realize and could lead to exponentially greater returns and capital expenditures than the market is anticipating. We plan to navigate this mega trend responsibly, while also monitoring the wider technology landscape, and we look to pick up alpha where we can outside of AI. Above all, this will always be done by staying true to our framework: finding companies that sell linchpin (or indispensable) technology, innovating in secular growth markets, with improving fundamentals and reasonable valuations.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

March 2024 / INVESTMENT INSIGHTS