October 2021 / INVESTMENT INSIGHTS

Demand Stimulus and Inflationary Pressures Loom for Post-Election Germany

The new government will likely prioritize social justice and green policies.

Key Insights

- A coalition between the Social Democratic Party (SPD), Green Party, and Free Democratic Party (FDP) is likely to form Germany’s next government.

- The presence of the left-wing Greens in government means that a shift in policy toward social justice and Germany’s green transition is almost inevitable.

- This will stimulate demand and put upward pressure on prices, which the European Central Bank will likely rely on to support higher eurozone inflation.

The German election results are now in and it looks likely that—as predicted by the polls— SPD‑Green‑FDP (traffic light) coalition will form the next government in the Bundestag. If so, the new government will likely seek to raise wages and push forward with Germany’s transition to renewable energy, which will result in additional demand stimulus and eventually raise inflationary pressure in the German economy. However, given the better‑than‑expected performance of the Christian Democratic Union/Christian Social Union (CDU/CSU), a CDU/CSU‑Green‑FDP coalition remains plausible (around a 40% chance in our view).

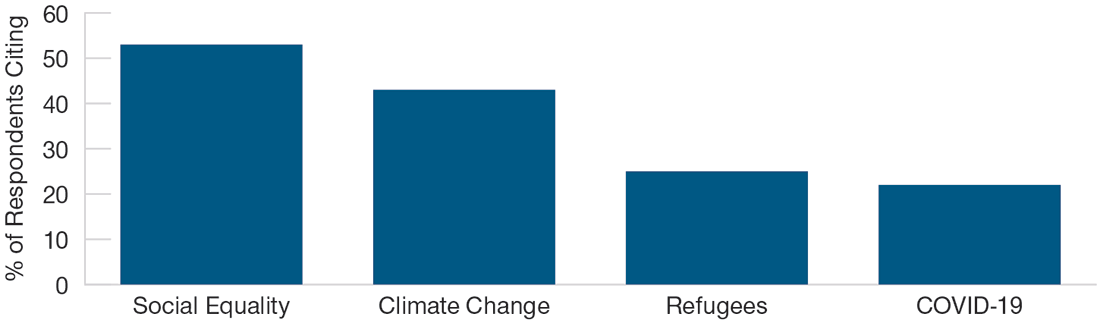

Social Equality and Climate Change Were the Voters’ Main Concerns

The refugee crisis and COVID.19 were regarded as less important

As of September 19, 2021.

Source: Forschungsgruppe Wahlen.

The strong performance of Germany’s center‑left parties is indicative of the issues that voters cared about the most. Polls showed that most Germans regarded social equality and climate change as the key issues in the election, ahead of dealing with refugees and COVID‑19 management (see chart). This clearly favored the SPD and Green parties, which had both highlighted these issues in their manifestos from the very beginning of the campaign.

The election result is historic for several reasons. It is, for example, the first time that the CDU/CSU party’s vote has fallen to below 30% since the Second World War. It also marks the first time that Germany will be led by a three‑party coalition. Finally, the Green Party’s strong result highlights the party’s ongoing transformation into Germany’s third large party. In the past, there were only two: the CDU/CSU and the SPD. But what happens now?

With the election results in, all parties will enter talks to form a coalition government. When it is eventually signed, the coalition agreement will specify which policies will be implemented and clarify where compromises have been made on either side. These negotiations can take six to eight weeks even when there is a strong overlap between party manifestos. However, given that three parties are involved on this occasion (including the FDP, whose manifesto contained very different policy pledges than those of the SPD and the Greens), negotiations will likely take longer and there will be a higher risk of talks breaking down, as happened in 2017.

Based on the election outcome, our view remains that an SPD‑Green led coalition is the most likely coalition negotiation outcome. However, this is not guaranteed, even at this stage. The SPD and Green parties have two potential negotiation partners: the FDP, and the CDU. A coalition with the CDU seems least likely, because more compromises would have to be made relative to a coalition with the smaller FDP.

However, the possibility of a CDU/CSU‑Green‑FDP coalition should not be discounted, especially given the CDU/CSU’s better-than-expected performance in the election. The CDU/CSU could try to make larger concessions to the Green party and FDP than the SPD. The CDU’s leader, Armin Laschet, is a skilled negotiator with many years of experience in coalition building. I believe that the chance of a CDU/CSU‑Green‑FDP coalition is around 40%.

Amid this uncertainty, the important thing to grasp is that any governing coalition, whether led by SPD or CDU, will very likely include the Green Party. In its manifesto, the Green Party pledged EUR 500 billion for Germany’s net zero transition over the next decade. While the amount spent may ultimately fall short of that figure, it is almost certain that a large and ambitious green package will be delivered. The additional economic stimulus from this investment package is estimated to range between 0.75% and 1.25% of gross domestic product, but it could be stronger in the near term if the stimulus is front‑loaded to show voters that their concerns were taken seriously ahead of the next election in 2025.

Market Implications

As outlined above, some risk remains that coalition talks could work out differently to expectations. While negotiations are typically held in secret, some brinksmanship is inevitable. As a result, the priced probability will vary over time, leading to volatility in asset prices.

Given the strong emphasis on social justice and equality in the SPD and Green Party manifestos, as well stronger voter preferences for changes in these areas, it is likely that the eventual coalition party agreement will contain a significant rise in the minimum wage. If the minimum wage rises to EUR 12 per hour, as promised, this will impact around 26% of work contracts, according to 2018 data. Similarly, both parties propose greater public spending to support Germany’s transition to a net zero economy.

These policies will fuel demand in 2022. A rise in the minimum wage will act as an immediate demand stimulus, since workers on the minimum wage tend to spend a high proportion of their income. The investment required for the net zero transition will have an additional demand impact, which we expect will last longer than the one‑off minimum wage change.

However, there may also be a number of inflationary consequences from these policies, particularly given the current inflation environment in Germany. We believe the current wholesale market rise in European gas and electricity will be mostly passed through to German households in January, although the government will likely seek to mitigate the impact in several ways. Nevertheless, higher energy costs will also likely lead German firms to raise their prices to some degree.

The minimum wage rise, in this environment of already strong cost‑push inflation, could prompt unions to ask for higher wages in the autumn wage negotiations, leading to higher medium‑term inflation. The European Central Bank will likely not react to these developments and instead rely on these dynamics to help reset the eurozone’s inflation higher, in line with the new 2% inflation target.

While the economic consequences of an SPD‑Green led coalition could therefore be significant, there will be a large degree of uncertainty about which policies will actually be implemented until the coalition negotiations are over. Since these policies can only be fully priced once they are outlined in the final version of the coalition agreement, there is likely still value in inflation‑linked bunds at current levels.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

October 2021 / INVESTMENT INSIGHTS