personal finance | september 12, 2025

Closing the affordability gap: Maximizing the benefits of 529 college savings plan accounts

How families can bridge the gap between the cost of attending college and what families can afford to pay.

Key Insights

Saving for college can be a big financial challenge for many families.

T. Rowe Price recommends that parents aim to save enough to cover 50% of the published costs.

529 plans are a powerful tool that parents can utilize to bridge the affordability gap and help secure their children’s educational future.

Roger Young, CFP®

Thought Leadership Director

While juggling so many competing priorities, saving for college can be a big financial challenge for many families. Inflation has taken a toll on many household budgets, and finding money to set aside to save for higher education has understandably become increasingly challenging. Parents are looking for ways to bridge the gap without relying too heavily on loans, which can leave graduates with substantial debt upon graduation.

What is the college affordability gap?

The college affordability gap is the difference between the cost of attending college and what families can afford to pay. From 1990 to 2020, the cost of attending college significantly outpaced inflation and wage growth. Since family incomes have not kept pace with rising costs, the affordability gap has widened, leaving parents searching for viable solutions. This discrepancy has forced many families to rely on loans. However, with careful planning, there are other solutions that can help pay for college.

What is the actual cost of college? Sticker vs. actual price

It’s important to understand that the published cost of college is often not what students will actually pay. This is because grants and scholarships can help lower the actual price of college. For example, the average estimated in-state net price for a public, four-year institution was $20,310 in the 2023–2024 academic year, according to College Board data.1 That total is 30% lower than the published price of $28,840.

Grants and scholarships don’t need to be repaid—they essentially provide a discount on tuition. Some of this institutional aid is merit‑based, and some is based on need. Even if you don’t think your income will qualify you for aid, it is potentially worth factoring it into your savings plan as financial assistance may not be based on income alone.

How much should I save?

T. Rowe Price recommends that parents aim to save enough to cover 50% of the published costs—which is around the actual amount that most parents end up paying, according to data from Sallie Mae.2

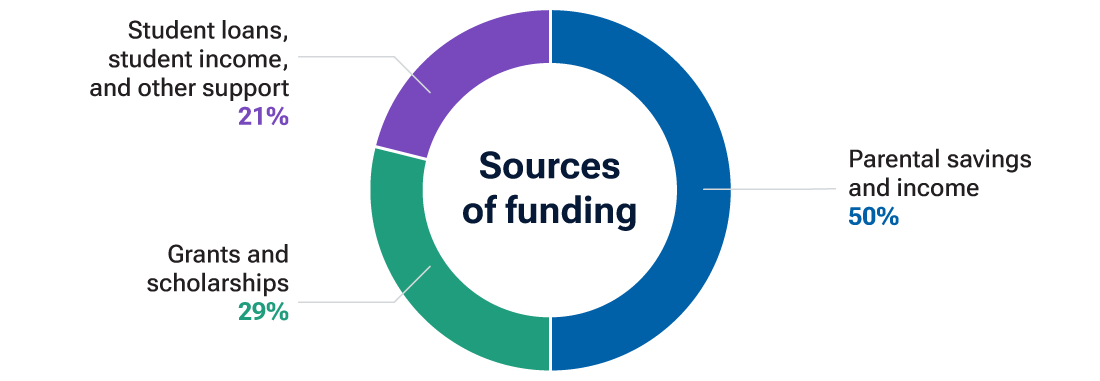

If you save for 50% of the cost, the rest of the college price tag could be covered by alternative funding sources, including (see Fig. 1):

Financial aid: Grants and scholarships make the actual net price of college lower than the published cost.

Loans: Borrowing money is another potential source of funding for college. But debt should only play a limited role, if possible.

Student income: Students can also contribute through their own income and savings from part-time jobs throughout high school and college.

A potential funding plan for college

(Fig. 1) Parents and students may not need to cover 100% of the cost of college. Instead, consider the many sources of potential funding that can help you achieve your goal.

For illustrative purposes only.

How 529 plans can help bridge the affordability gap

One powerful tool parents can utilize to bridge the affordability gap and help secure their children’s educational future is a 529 plan. They offer several benefits, such as:

Higher return potential: 529 plans offer the potential of higher returns over a longer term and tax-advantaged growth compared with lower-yielding bank accounts.3

529 tax benefits: Earnings in a 529 plan grow federally tax-deferred, which means your money has a chance to compound faster because you don’t have to pay taxes on capital gains within the account. Distributions spent on qualified education expenses are federally tax-free. This may also apply to state taxes, depending on your home state. Though contributions are not deductible from federal taxes, some states do offer state tax deductions within limits.

Flexibility: Assets in a 529 account can be used for tuition, room and board, and applicable fees at any eligible higher education institution across the country, including vocational and apprenticeship opportunities. You can use them in more ways than you think! See How 529 Plans Can Unlock a Range of Education Opportunities for more information.

Incentives to help you get started: Some states may offer incentives such as matching contributions to help you start—and continue—saving.

Control: Parents maintain control over the account, including how funds are invested and when withdrawals are made. Also, the beneficiary can be changed to a qualifying family member at any time. This control allows families to tailor their savings strategy to their individual needs and goals.

No income restrictions: 529 plans have no income restrictions, making them accessible to families of all income levels.

One powerful tool parents can utilize to bridge the affordability gap and help secure their children’s educational future is a 529 plan.

One powerful tool parents can utilize to bridge the affordability gap and help secure their children’s educational future is a 529 plan.

Finding the 529 plan that’s right for you

When choosing a 529 plan, it’s important to compare the features and investment options of different plans to find the one that best fits your needs. Be sure to research college savings programs offered by your and your beneficiary’s home state, which may offer other state tax or other state benefits.

Choosing your investment options

When choosing a 529 plan, you will likely want to take the investment options into consideration.

Enrollment-based portfolios

Enrollment-based portfolios are target date investments composed of one or more stock and bond mutual funds. These portfolios’ investments are aligned with a projected enrollment year and automatically shift as your target date approaches. When the target year is further off, the portfolio starts with a greater exposure to stocks to focus on growth potential and then shifts over time to bond funds, with the goal of reducing risk and volatility as the target year nears.

Static portfolios

Static portfolios are fixed investments composed of one or more mutual funds. Unlike enrollment-based portfolios, static portfolios do not change their investment mix over time. Portfolios with greater stock allocations generally carry higher risk and the opportunity for higher returns, while portfolios with more bond and money market funds generally offer less risk and lower returns. You can move your assets to a more conservative or aggressive portfolio up to two times per year per beneficiary.

Developing your college savings strategy

Parents with younger children have time on their side. (See Tips for parents of older children box below.) Start saving for your child’s future education as early as you can. This will allow you to benefit from the potential for compound growth. It’s also important to make regular contributions. Setting up recurring contributions can help you take advantage of the trend that market values tend to increase over time.

Regular monthly contributions

If you set up recurring contributions, this approach can streamline the process and enable you to save money gradually and consistently. In addition, continuing to invest through all types of markets can help you buy more shares when prices are low and fewer shares when prices are high—a process called dollar cost averaging.

Sticking with your plan, even during short‑term market volatility, may enable you to benefit from rebounds in investment prices.

Creating your savings goal

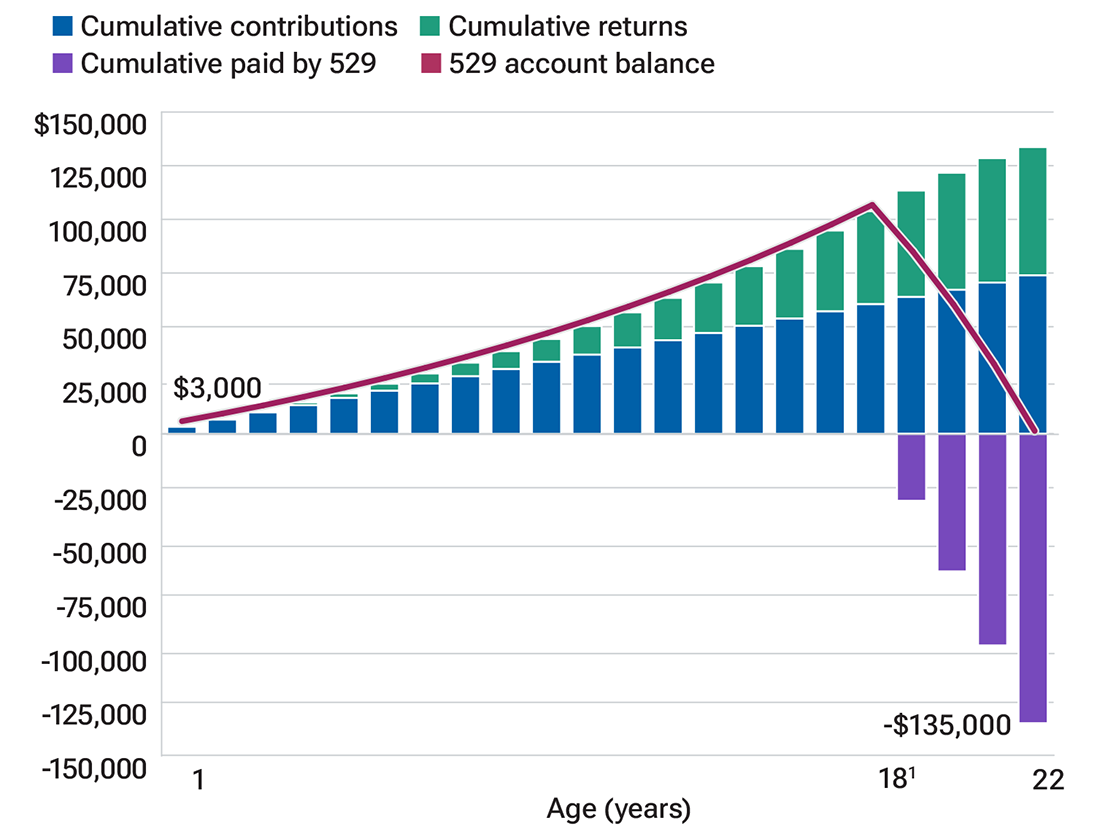

Considering the full cost in today’s dollars is around $24,000 per year, the future amount for four years—after 18 to 21 years of 5% inflation—is projected to be $249,000.

Covering half of that amount would require a balance of $93,000 at age 18, along with continued contributions and investment growth during the four years that the child is in college. That entails contributions of roughly $260 a month from when your child is born through the end of their college career (see Fig. 2). If you’d like to learn about ways you could cut back on spending to save more, check out our article Spend Less to Save More for tips.

If you set up recurring contributions, this approach can streamline the process and enable you to save money gradually and consistently.

If you set up recurring contributions, this approach can streamline the process and enable you to save money gradually and consistently.

Building your college savings to 50% of the cost

(Fig. 2) Setting aside $260 per month for your child’s college education from birth through college graduation may generate enough savings ($124,000) to help cover 50% of the $249,000 future cost of four years of public college.

This hypothetical example assumes $260 contributions starting at birth and continuing through 4 years of college. Assumptions include a $24,000 published cost in today’s dollars of 1 year of public college, 18 years until college with college costs increasing at 5% per year, and a 6% average annual return on investments. This example does not predict or project the performance of any investment. An actual investment may assess fees or other charges that should be considered prior to investing.

Make it a family affair

Anyone can open and contribute to a 529 plan, including a parent, grandparent, other family member, or even a family friend. Consider asking for contributions as a birthday or holiday gift. Additionally, thanks to new legislation, starting in the 2024–2025 school year distributions from a grandparent-owned 529 account will no longer count as income to the student on the Free Application for Federal Student Aid (FAFSA®).

Closing thoughts

The college affordability gap poses a significant challenge for many families, but with careful planning and the right savings strategy, parents can take meaningful steps to bridge the gap. A 529 plan offers a tax-efficient way to save for future education expenses while providing flexibility and control over your savings. Before opening an account, be sure to check the features and investment options of different plans to find the one that’s right for you. By starting early and consistently contributing to a 529 plan, parents can help ensure that their children have access to the education they deserve without facing substantial debt after graduation.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

Tips for parents of older children

If your child is closer to college, here are some additional options that may be available to help cover the cost of college:

State aid/incentives: Many states offer need-based and merit-based financial aid programs to help residents afford college.

Work study programs: Work-study programs provide students with part-time employment opportunities, usually on campus. These jobs can help cover educational expenses and possibly reduce loan debt.

Employer tuition assistance: Many employers will provide financial assistance to help employees cover the costs of continuing education or furthering their academic pursuits. Make sure to be aware of the terms of your program.

In-state tuition: Public colleges and universities offer lower tuition rates to students who are residents of the state where the institution is located. This reduced rate can significantly help with the cost of college.

Starting at a community college: Some of the benefits of starting at a community college include lower tuition costs and reduced living expenses.

Scholarships and grants: Be sure your child applies for all the scholarships and grants that they may be eligible for.

Please note that a 529 plan’s disclosure document includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing. You should compare these plans with any 529 college savings plans offered by your home state or your beneficiary’s home state. Before investing, consider any tax or other state benefits, such as financial aid, scholarship funds, and protection from creditors that are only available for investments in the home state’s plan. Tax benefits may be conditioned on meeting certain requirements, such as residency, purpose for or timing of distributions, or other factors, as applicable.

1Trends in College Pricing and Student Aid 2022. College Board. Data from 2022–2023 academic year. Total cost of attendance includes tuition, fees, room and board, and other expenses.

2How America Pays for College 2023. Sallie Mae. Data from academic year 2022–2023.

3Unlike a traditional bank account that offers Federal Deposit Insurance Corporation (FDIC) protection, investments in 529 plans are generally not guaranteed, and you could lose money, including your principal, by investing in them. There may be other material differences between savings accounts and 529 college savings plan accounts that should be considered prior to investing.

Important Information

This material has been prepared by T. Rowe Price Investment Services, Inc., for general and educational purposes only. This material does not provide fiduciary recommendations concerning investments or investment management. T. Rowe Price Investment Services, Inc., its affiliates, and its associates do not provide legal or tax advice. Any tax-related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material. The views contained herein are those of the authors as of April 2024 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates. All investments involve risk. All charts and tables are shown for illustrative purposes only.

View investment professional background on FINRA's BrokerCheck.

202405-3611912

Next Steps

Learn more about college savings plans.

Contact a Financial Consultant at 1-800-401-1819.