asset allocation | december 13, 2023

Seeking Opportunities Overseas: International Equities Are Positioned for a Comeback

Regime change in markets may signal the end of U.S. dominance.

Key Insights

International equities remain significantly undervalued compared with U.S. stocks and offer a compelling buying opportunity.

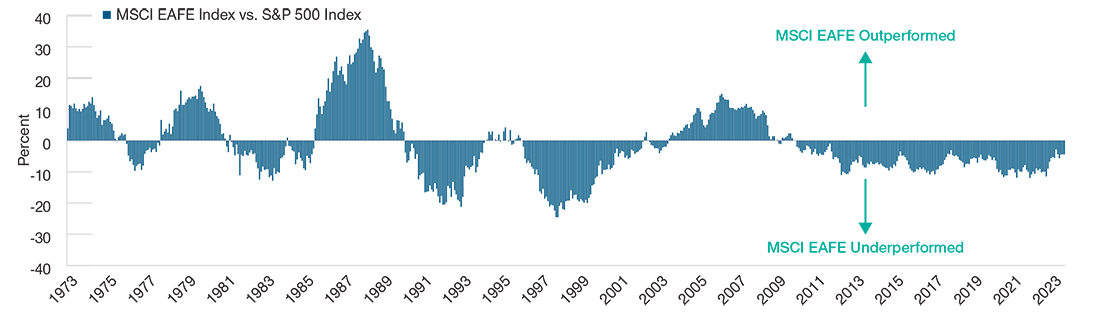

Many of the factors driving the outperformance of U.S. equities since the Global Financial Crisis are, we believe, in the process of unwinding.

Although the U.S. dollar remains strong, it is likely to weaken next year if, as expected, the U.S. Federal Reserve begins to cut rates.

Justin Thomson, CIO

International Equities

Markets are great storytellers, and some of the recent stories that markets have been telling us suggest we may be living through a regime change.

U.S. equities have recovered amid falling growth expectations for overseas markets as some regions, most notably China and Europe, have faced headwinds (though, also notably, MSCI EAFE still outperformed the S&P 500 in the last 12 months ended August 31, 2023, by nearly 2%). Even so, we believe the factors driving the outperformance of international equities in 2022 remain strong—and offer the potential to outperform in the coming years.

How much international equity should you own?

We suggest an equity allocation of 70% U.S. and 30% international.1

Need guidance on how to get there? Our Financial Consultants can help.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

Headwinds to Tailwinds

The starting point for any discussion of the discrepancy between U.S. and international has to be sector composition. Sector weightings have been a positive for the U.S. over the past decade, driven by relatively higher index weightings in the three top-performing sectors of technology, consumer discretionary, and health care. Outside the U.S., sector composition has been negative because of the higher weightings of financials and industrials. The potential unwind of these patterns favors positioning in international equities—especially if inflation proves more resilient and secular themes, such as infrastructure rebuild, automation, defense spending, and renewable energy, continue to emerge.

The U.S. has also benefited from stronger fundamentals. U.S. equities in the postglobal financial crisis (GFC) period were supported by an extraordinary period of sales growth (albeit concentrated in a small number of companies) and the fact that the U.S. is one of two major economic blocs where profit margins rose following the GFC (the other being Japan). Both of these factors are likely to be temporary, however. While continued higher margins are not impossible, they are unlikely. U.S. profit margins are unusually concentrated in a handful of large technology firms, and the weight of incoming capital—combined with greater competition and possibly regulation—could change that.

Likewise, it seems unlikely that sales per share growth will continue to outstrip in nominal gross domestic product (GDP) growth. Although companies headquartered in the U.S. are often successful exporters, history tells us that nominal GDP and the sales of U.S.-listed companies are closely linked. Even if the U.S. continues to be top heavy adding to international equities helps to diversify exposure from the S&P’s remaining 493 stocks that have not produced at nearly the same level.

It is true that the U.S. dollar remains strong, backed by a healthy economy and rising Treasury yields, and is likely to remain so for the rest of this year. However, we believe the dollar will weaken next year if, as expected, the Fed begins to cut rates. A weaker dollar is typically supportive for non-U.S. stocks as it tends to increase the dollar value of dividends earned in foreign currencies.

Valuations also favor international equities, which continue to trade at record discount levels to U.S. stocks. This is partly due to the differences in sector composition described above (the higher index weightings to the strongest-performing sectors have driven U.S. valuations higher) but not entirely so—even when considered on a sector-neutral basis, international markets remain substantially cheaper than in the past. Current price/earnings ratios for the MSCI EAFE Index indicate a 10-year annualized return of 7% to 8% in local currency terms, compared with around 5% for the S&P 500 Index.

U.S. Equities Have Dominated for More Than a Decade

(Fig. 1) They have outperformed international stocks since the Global Financial Crisis.

From January 1, 1973, through September 30, 2023. MSCI EAFE (Europe, Australasia, and Far East) and S&P 500 indices. Past performance is not a reliable indicator of future performance. Source: T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved. Please see Additional Disclosures for information about this MSCI and S&P information.

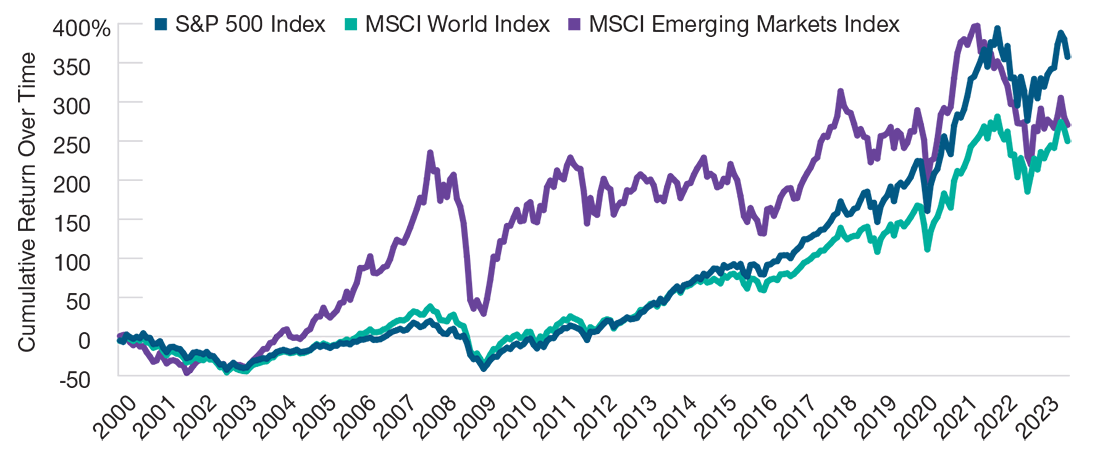

Risk Awareness

Historically, emerging markets have been more volatile than the developed U.S. market. However, international markets may not be uniformly volatile at the same time. In addition, international investments go through cycles of underperformance and outperformance relative to U.S. markets. (See Figure 2.) Rather than trying to anticipate which markets or regions will outperform, allocating a portion of a portfolio to international assets enables investors to potentially benefit from these divergent cycles of performance around the world.

Investors should review their portfolios to determine how much foreign investment they already have. And of course, diversification cannot assure a profit or protect against loss in a declining market.

Although we believe the setup is supportive for international markets, risks are still present. Political instability, currency fluctuations, war, trade disputes, economic setbacks, and other disruptions can have a large impact on countries whose economies are less diverse or developed than the U.S. Such events can hurt both the prospects of a nation and the companies located there.

Higher Return Potential, Greater Volatility

(Fig. 2) While global developed markets tracked the U.S. market, emerging markets

were more volatile.

From December 31, 1999, through September 30, 2023.

Past performance cannot guarantee future results.

Source: T. Rowe Price calculations using data from FactSet Research Systems Inc. All rights reserved.

Tailwinds for Non-U.S. Markets

- Value stocks, particularly banks, are less heavily weighted in the major U.S. indices than in most non-U.S. markets. So high interest rates and value leadership should favor the latter.

- Sectors that historically have proven resilient to inflation, such as energy and materials, are better represented in many non-U.S. equity markets, especially emerging markets.

- For U.S. dollar-based investors, a reversal in dollar strength in the medium term would be a tailwind for local currency returns in non-U.S. markets. Japan could be a less obvious beneficiary of these trends. If higher consumer inflation bleeds through into wage growth, it could shock the economy into a higher level of domestic demand, which would be good for Japanese equities.

1Our research suggests that a 70% U.S./30% non-U.S. mix may boost long-term portfolio performance and may enhance return consistency over time; however, investing consistent with a model allocation does not protect against losses or guarantee future results. The suggested allocation is not tailored to the needs of any specific investor and does not take into account individual circumstances or preferences, and may not align with your accumulation timeframe, withdrawal horizon, or other conditions. It is not intended to suggest that any particular investment action is appropriate for you, nor is it intended to serve as a primary basis for investment decision-making. Other T. Rowe Price educational tools or advice services use different assumptions and methods and may yield different outcomes.

Past performance is not a reliable indicator of future performance.

Additional Disclosures

Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives.

Source: MSCI. MSCI and its affiliates and third-party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast, or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Copyright © 2023, S&P Global Market Intelligence (and its affiliates, as applicable). Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

T. Rowe Price cautions that economic estimates and forward looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual outcomes could differ materially from those anticipated in estimates and forward looking statements, and future results could differ materially from historical performance. The information presented herein is shown for illustrative, informational purposes only. Forecasts are based on subjective estimates about market environments that may never occur. Any historical data used as a basis for this analysis are based on information gathered by T. Rowe Price and from third party sources and have not been independently verified. Forward looking statements speak only as of the date they are made, and T. Rowe Price assumes no duty to and does not undertake to update forward looking statements.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. International investments can be riskier than U.S. investments due to the adverse effects of currency exchange rates, differences in market structure and liquidity, as well as specific country, regional, and economic developments. These risks are generally greater for investments in emerging markets. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor, and T. Rowe Price Associates, Inc., investment adviser.

202312-3271919

Next Steps

Get strategies and tips for today’s market conditions.

Contact a Financial Consultant at 1-800-401-1819.