How much should you have saved for your child’s college education by now?

December 2025, Make Your Plan

- Key Insights

-

- College is expensive, but parents have powerful tools to help them save, including 529 plans.

- Savings benchmarks can help parents gauge whether their college savings strategy remains on track from year to year.

- Parents should aim to save enough to cover 50% of the published cost of college—but that number can be adjusted based on their situation.

For many parents, a child’s college education is one of the biggest long-term savings goals. Achieving that objective is a multistep process, including setting a reasonable goal, developing a college savings strategy, investing the necessary funds, tracking progress, and adjusting the plan as necessary. Understanding how much college may cost in the future and using age-based savings benchmarks can make it easier for parents to gauge their progress and stay on track.

How much does college cost?

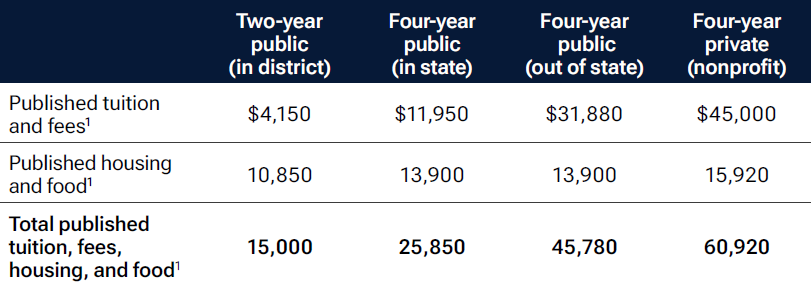

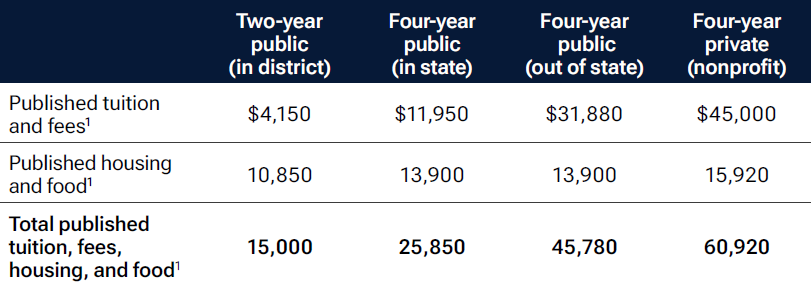

The published cost of college typically includes tuition and fees, but other costs—such as room and board, books, activities, and sometimes insurance and other miscellaneous fees issued by the institution—can add to the total. These costs vary based on many factors, particularly the type of school.

(See “The average one-year cost of college, 2025–2026.”) While college cost inflation has slowed over the past several years, the parents’ long-term savings target should anticipate college becoming more expensive than it is now. Fortunately, T. Rowe Price’s college savings benchmarks factor in the effects of potential inflation.

The average one-year cost of college, 2025–2026

(Fig. 1) Costs vary greatly depending on the type of college

1 Source: College Board Research, Trends in College Pricing, 2024.

close

close

Parents may not need to pay for all of their child’s college costs

Most students do not end up paying the full cost of college. Grants and scholarships can offset a portion of the cost of attendance. What’s more, most families end up paying their share through a combination of savings, current income, and federal student loans. As a starting point, T. Rowe Price recommends aiming to save 50% of the final estimated price. If parents feel they can save more, they should do so.

How age-based milestones can help parents track their progress

Age-based milestones are not a replacement for comprehensive planning, but they provide a quick way to gauge whether a plan is on track. They can also act as a catalyst for parents to take action and start saving more. Having intermediate targets is a useful way to keep the final savings target from feeling too overwhelming.

How much parents need to have saved at key milestones depends on the type of college their child might ultimately attend and whether they’ve been able to save a fixed amount each month starting from the child’s birth through their final year of college. (See “College savings benchmarks by age.”)

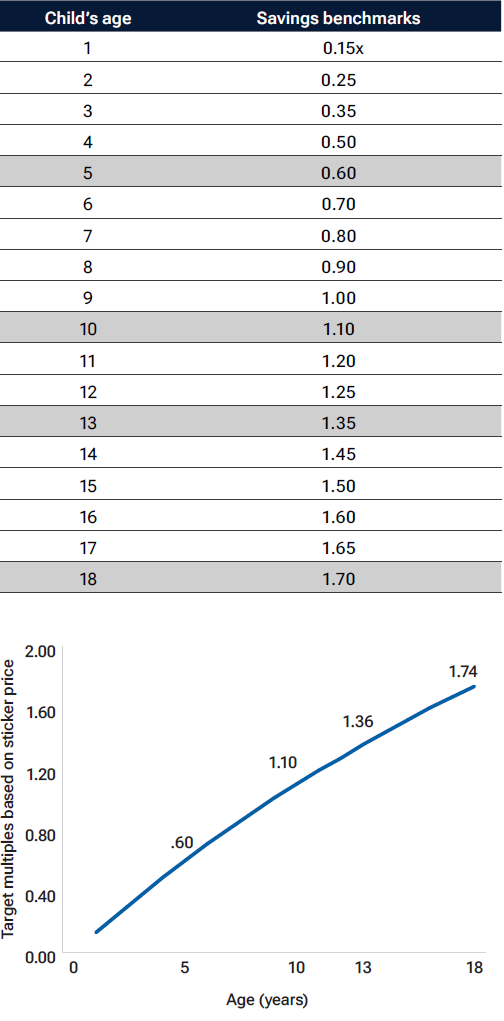

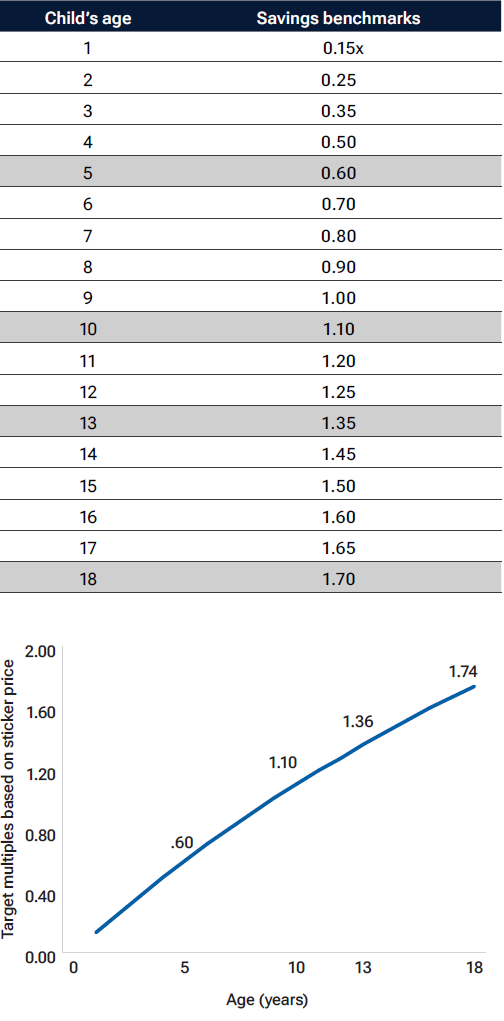

College savings benchmarks by age

(Fig. 2) These benchmarks represent multiples of the current cost of one year of college for your target institution, aiming to cover 50% of the cost of college in the future based on a strategy of saving a flat monthly amount

Increasing college cost (and contributions by the same percentage) does not change these multiples, as we would expect. Similarly, doubling the targeted percentage coverage (to 100%) requires doubling the contributions and therefore doubling the multiple.

Assumes savings will continue during college years.

close

close

To use the age-based benchmarks, parents should estimate the current cost of one year of college at their target type of school (tuition, room and board, and fees for public or private and in state or out of state) and multiply that amount by the benchmark associated with their child’s current age. The resulting dollar amount represents how much they should ideally have saved by now.

Parents can compare their current savings to the target amount to learn whether they are ahead or behind where they need to be. If they are behind, there are steps they can take, depending on the age of their child. (See “Catching up when you have fallen behind.”)

How much money parents should have saved by various ages of their child

What follows are hypothetical examples that illustrate how parents with children of different ages can use these savings benchmarks at key moments of transition in their child’s education. However, these benchmarks can be used at any point in the savings journey—parents just need to look at the specific benchmark (Fig. 2) tied to their child’s age at a given time. In the calculations that follow, the savings targets are rounded to the nearest $100, and they should be considered estimates to help parents better gauge their progress.

How much should you have saved for college when your child is five years old?

At five years old, your child is likely at the end of their childcare years and about to start their first year of elementary school. While a clear idea of their desired career path is unusual at this age, it is a good time to evaluate your college savings progress. Let’s say you believe your child may attend a four-year, in-state public college and you have decided to cover 50% of those costs. The current cost of that type of institution is $25,850 per year.

Parents who are aiming to set aside a steady amount each month should have saved around $15,500 for their child’s college once their child reaches age five. This target balance is calculated by multiplying the current cost of one year of college ($25,850 in this hypothetical example) by the age-five benchmark (0.6x). This calculation is only a rough estimate, but it still provides a useful gauge of progress, as it incorporates the likelihood that college costs will be higher in the future than they are now.

Note: Parents who are unable to save much during the early years may have an opportunity to ramp up their savings starting when their child enters elementary school. See Fig. 4 for a separate set of benchmarks associated with this alternate savings strategy, known as the ramp up strategy.

Catching up when you have fallen behind

For parents who find they are falling behind on their college savings, there are steps to get back on track.

EARLY YEARS: If you are behind on your savings target in the early years, you have plenty of time to close the gap in savings. Look for opportunities to save more, such as redirecting money spent on childcare toward college savings.

HALFWAY POINT: There is still time to save more, and gifted contributions in lieu of presents from family and friends, particularly on holidays and birthdays, can provide a boost. Redirecting new income from promotions, raises, and bonuses to your savings can also help close the gap. If you don’t have changes in your income, consider revisiting your household budget for opportunities to cut back on discretionary spending.

LATER YEARS: Financial aid, such as scholarships and student loans, is likely your best bet to close any savings gap in the final years before college. This is also an important time for parents and college-bound children to have honest discussions about expectations for the college experience. These discussions should cover the adjustments that may be necessary, including the potential need to apply for work-study programs, paid internships, or a part-time job while in college.

How much should you have saved for college when your child is 10 years old?

At age 10, your child is likely about to start middle school. At this point, parents should aim to have saved around 1.1 times the target cost of college, or about $28,400 ($25,850 x 1.1), if you are still targeting an in-state public college.

But what if your career has progressed better than you expected, and your salary has risen accordingly? Perhaps you could cover 75% of college costs. In that case, you can personalize the benchmark by multiplying it by the relative difference between the two target percentages. For example, if you want to aim to cover 75% instead of 50%, divide 75% by 50% to get 1.5, then multiply the age-based benchmark (1.1x) by 1.5 to get a revised benchmark of 1.65x. To cover 75% of college, you therefore want to have set aside around $42,700 ($25,850 x 1.65) now that your child is 10 years old.

Keep in mind that each of these examples starts with the same sticker cost of $25,850, regardless of age. That implies these hypotheticals are for different families with children of different ages, all using the published costs of college as of 2025. As parents apply these benchmarks over the years, they should be sure to update the estimated costs, rather than using the numbers from when their child was younger.

How much should you have saved for college when your child is 13 years old?

Your child is about to graduate from middle school and, believe it or not, college is just a few years away. At this age, they may be starting to have a sense of what they might want to do for a career, which means you might be able to refine your projections based on an updated target, such as the specific cost of a target college.

At this point, parents should aim to have saved about $33,600 to target an in-state public college ($25,850 x 1.35 = $34,900), again with the 50% goal. But perhaps your child has developed an interest in an out-of-state public college. To find out how much you need to have saved for this new target college, simply update the equation with the new college cost ($45,780 for an out-of-state public college in our hypothetical example). Your savings target with a 13-year-old is now $45,780 x 1.35 = $61,800.

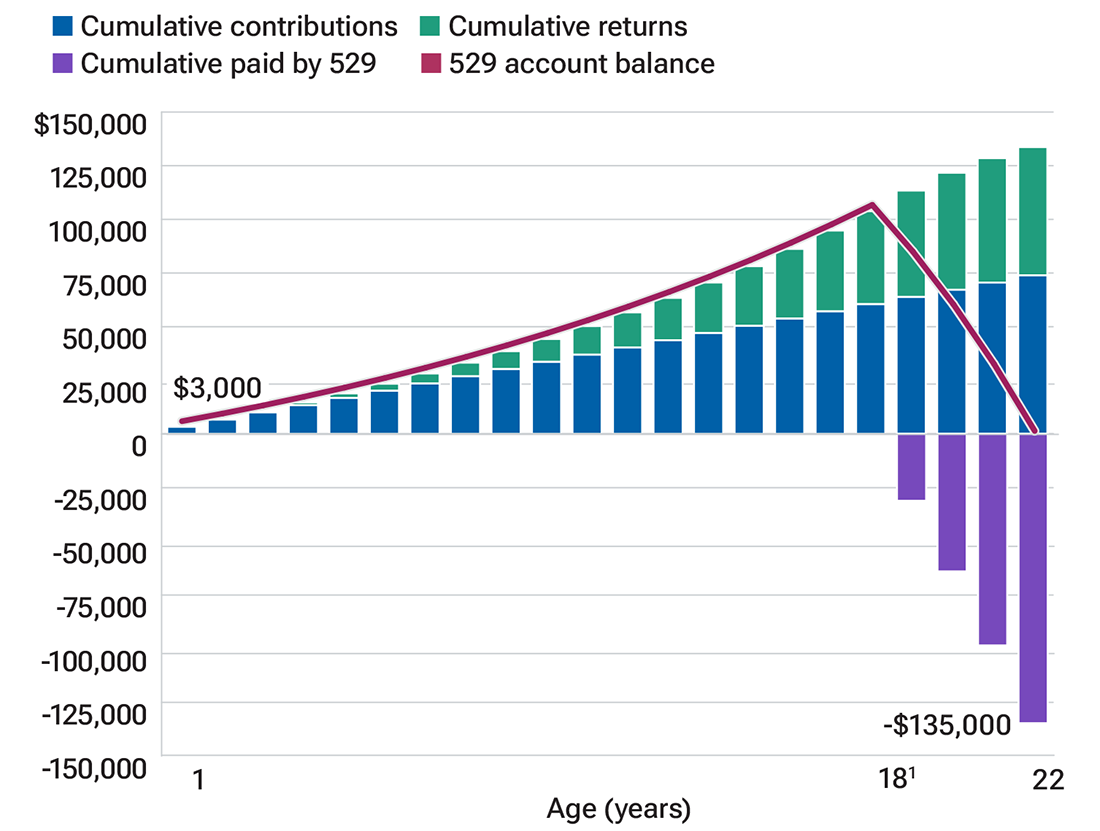

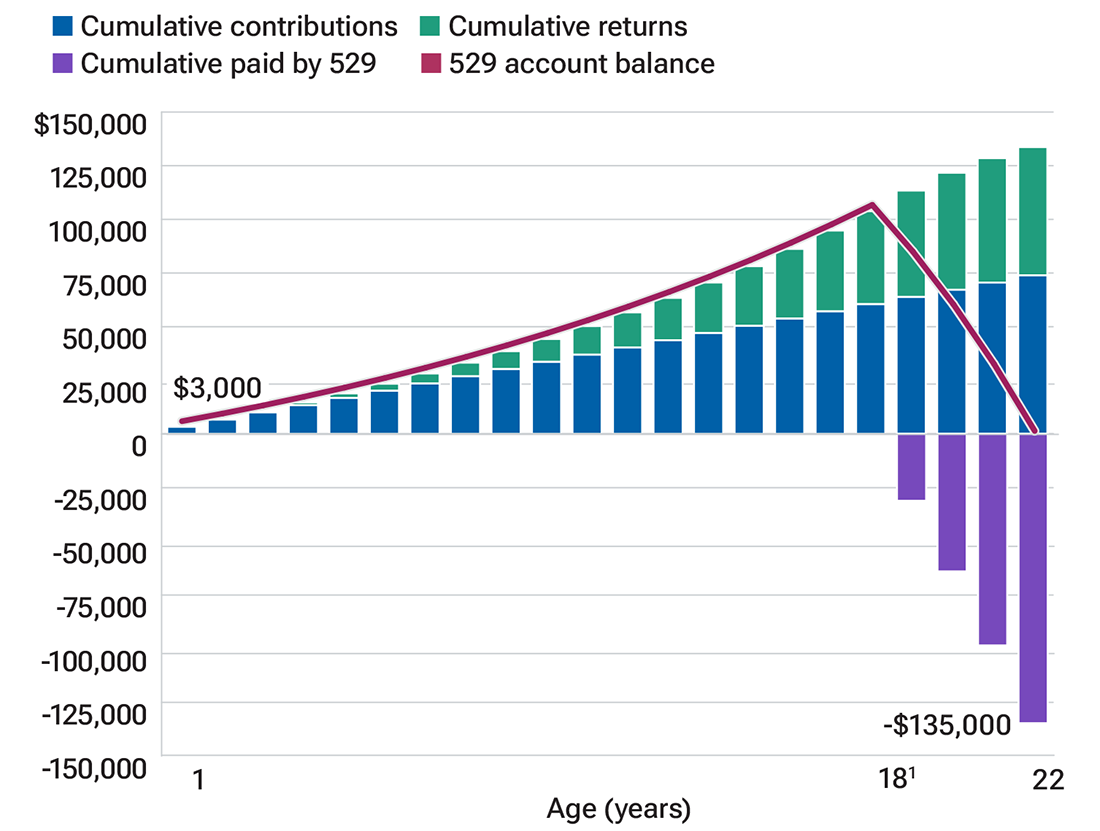

Building your college savings to 50% of the cost

(Fig. 3) Setting aside $280 per month for your child’s college education from birth through college graduation may generate enough savings ($135,000) to help cover 50% of the $270,000 future cost of a four-year college

1 College begins.

This hypothetical example assumes $280 contributions starting at birth and continuing through 4 years of college. Assumptions include a $26,000 published cost in today’s dollars of 1 year of public college, 18 years until college with college costs increasing at 5% per year, and a 6% average annual return on investments. This example does not predict or project the performance of any investment.

close

close

How much should you have saved for college when your child is 18 years old?

With college just around the corner, this is likely the highest total your savings balance will reach. In the final year before college starts for their child, parents would ideally want to have saved about $45,200 to be on track ($25,850 x 1.75). You may notice that this amount is not enough to cover 50% of four years of the estimated college costs (or two times the annual cost). To achieve your goal, you should plan to continue directing the same monthly amount toward college even as your child attends college. Depending on the school’s payment policies, parents can send that amount directly to the college each month or deposit it into their savings account until a payment is due. (See “Building your college savings to 50% of the cost.”) Parents can still make the types of adjustments described in earlier examples, based on different savings targets and/or different types of colleges.

Design a savings plan that is right for you

A college financing planner can help parents determine their college savings target(s) based on their goals and their children’s goals. As their child gets older and develops more clarity on where they want to attend college, parents can adjust the inputs to keep their plan up to date. By tracking their progress against the savings benchmarks, parents can adjust their plan as needed to make up for any shortfalls. Utilizing these benchmarks can help ensure that when a child is ready to go to college, parents have done their best to provide the financial support necessary for their child to achieve their dreams.

T. Rowe Price 529 plans

Decades of helping families save for their education.

T. Rowe Price offers the opportunity to make saving for college easier through three 529 plans: the T. Rowe Price College Savings Plan, the Maryland College Investment Plan, and the Alaska 529 Plan. These plans offer the choice of enrollment-based portfolios, which adjust allocations based on how many years are left until a child will first use the savings, or static portfolios based on a parent’s risk tolerance. Give your child a head start on their future education with a 529 plan. You will get the benefits of potentially tax-free growth that could outpace a traditional savings account.1 State tax benefits can vary from state to state, so be sure to review plans from your home state when making your choice.2

Next steps: Learn more about T. Rowe Price college savings plans.

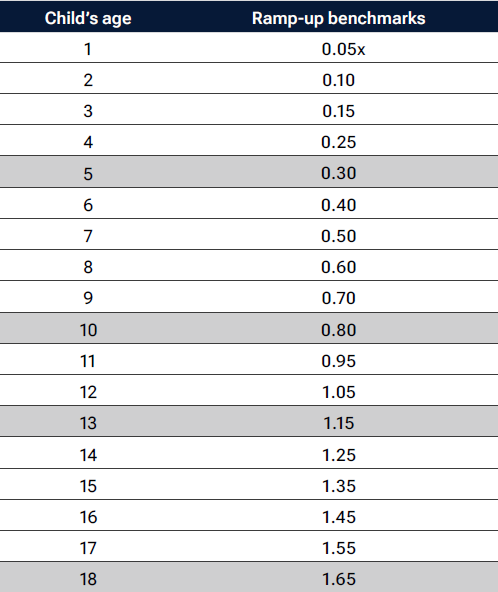

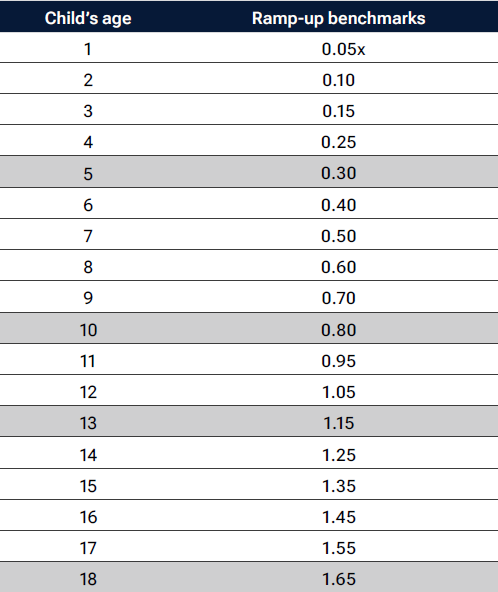

A strategy for parents who cannot save enough in the early years

Not every household can begin saving for college in the first years after their child is born. An alternate strategy can help parents reach their goals by ramping up savings when their child is six years old.

A saving strategy where parents set aside the same amount each month starting with the birth of their child is not a viable strategy for every household. The ramp-up strategy involves parents starting at a lower monthly contribution than the flat strategy illustrates, then doubling the savings rate once the child reaches age six. At this age, children typically enter elementary school, which could free up funds in a household budget previously dedicated to childcare. The ramp-up strategy also increases the savings amount every year to take advantage of potentially rising income (in this example, by 3% per year).

Parents can use these benchmarks (Fig. 4) in the same way as in the hypothetical examples. Simply multiply the current cost of college by the benchmark multiplier associated with your child’s current age to get an estimate for the current savings target. Parents can adjust the benchmark multiplier based on whether they are aiming to cover more or less than the assumed 50% of the cost of college, while adjusting the one-year cost of college based on their target school or institution type.

College savings benchmarks by age: Ramp-up strategy.

(Fig. 4) These benchmarks represent multiples of the current cost of one year of college for your target institution, aiming to cover 50% of the cost of college in the future based on the ramp-up strategy discussed next to this chart

Calculations assume a 6% average annual rate of return and 5% annual inflation in the cost of college and a savings target of 50% of the combined cost of tuition, room and board, and fees. The ramp-up strategy assumes the savings rate doubles at age 6 and increases 3% annually with income. It assumes that contributions continue throughout the college years.

close

close

Roger Young, CFP®

Thought Leadership Director

Roger Young, CFP®

Thought Leadership Director

Want a personalized financial plan delivered by a T. Rowe Price Financial Advisor?

1529 plans offer the potential of higher returns and tax-advantaged growth compared with lower-yielding bank accounts. Unlike a traditional bank account that offers Federal Deposit Insurance Corporation (FDIC) protection, investments in 529 plans are generally not guaranteed, and you could lose money, including your principal, by investing in them. There may be other material differences between savings accounts and 529 college savings plan accounts that should be considered prior to investing.

2The availability of tax benefits may be conditioned on meeting certain requirements, such as residency, purpose for or timing of distributions, or other factors as applicable.

Important Information

Please note that a 529 plan’s disclosure document includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing. You should compare these plans with any 529 college savings plans offered by your home state or your beneficiary’s home state. Before investing, consider any tax or other state benefits, such as financial aid, scholarship funds, and protection from creditors that are only available for investments in the home state’s plan. Tax benefits may be conditioned on meeting certain requirements, such as residency, purpose for or timing of distributions, or other factors, as applicable.

This material is provided for general and educational purposes only and is not intended to provide legal, tax, or investment advice. This material does not provide recommendations concerning investments, investment strategies, or account types; it is not individualized to the needs of any specific investor and is not intended to suggest that any particular investment action is appropriate for you.

Any tax-related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

The views contained herein are those of the authors as of December 2025 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. Actual future outcomes may differ materially from any estimates or forward-looking statements provided.

Past performance is not a guarantee or a reliable indicator of future results. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investment Services, Inc., distributor.

© 2025 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (troweprice.com/en/intellectual-property) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

- 202512-5016700