Developing a college savings strategy that will work best for you

December 2025

- Key Insights

-

- Parents should aim to save enough to cover 50% of their child’s college costs.

- For parents with newborns, setting aside $280 per month may be a good starting point to meet their savings goal.

- Many colleges provide grant and scholarship aid that can help lower the cost of tuition.

- Make a plan to fund college through multiple sources rather than relying heavily on loans.

Higher education can be key to unlocking a variety of careers. However, college can also represent a big financial challenge for many households: It is one of the largest savings goals that families face, next to retirement. It can also be difficult to commit to a savings plan when there is so much uncertainty about how much may be enough.

Saving for a college education can feel overwhelming, and affording the sticker price may seem out of reach. A successful college savings strategy includes setting a reasonable savings target, getting an early start, and choosing the right type of account.

The 50% rule of thumb

The published cost of college includes tuition, fees, room and board, books, supplies, and transportation costs. When it comes to planning for college costs, parents should realize they don’t need to cover the whole sum themselves. In fact, T. Rowe Price suggests that parents aim to save enough to cover 50% of the published costs—which is around what most parents end up paying, according to data from Sallie Mae.1 This target can help parents strike an appropriate balance among their long-term savings goals.

Deciding how much to save for a child’s education and when to start saving are important steps in developing a college savings plan.

The parental contribution to college costs can come from a combination of savings in the years before college and from income during a child’s college years. Money set aside early on will have more time to benefit from the potential for compound growth, so getting an early start on saving can help maximize the impact of that money.

It’s also important to take advantage of specific types of accounts, such as tax-advantaged 529 accounts. These college savings plans are specifically designed to support saving for higher education—whether that’s college or an accredited trade or technical program.

Contrary to popular belief, contributing to a 529 account may have little impact on a student’s financial aid package. These accounts help maximize the impact of your savings through any tax-deferred investment returns while also allowing you to make tax-free withdrawals when paying for qualified education expenses. Qualified expenses include tuition and fees as well as college-related books and supplies, technology needs, and room and board.

Assets in a 529 account can be used for any eligible higher education institution across the country, including colleges and universities, graduate programs, vocational and trade schools, or apprenticeship programs. Though contributions are not deductible from federal taxes, some states do offer state tax deductions with limits. Anyone can open and contribute to a 529 plan account, including a parent, grandparent, other family member, or even a family friend.

Assets in a 529 account can be used for any eligible higher education institution across the country.

How much you’ll pay and how you’ll pay for it

You may be asking yourself, if I save for 50% of the cost, how will the rest of the college price tag be covered? It’s important to understand that the published cost of college is often not what students will actually pay. As a result, your savings strategy should factor in every potential source of funding available.

Financial aid

Grants and scholarships make the actual net price of college lower than the published cost. For example, the average estimated in-state net price for a public, four-year institution was $21,340 in the 2025–2026 academic year, according to College Board data. That total is 31% lower than the published price. (See “Sticker price vs. actual price.”) Grants and scholarships don’t need to be repaid—they essentially provide a discount on tuition. Some of this institutional aid is merit-based, and some is based on need.

Even if you don’t think your income will qualify you for aid, it is potentially worth factoring it in to your savings plan as financial assistance may not be based on income alone.

Sticker price vs. actual price

(Fig. 1) For most students, grants and scholarships can reduce the actual price of college by a significant margin.

| Public, four-year school (in state) | Average annual published cost | Average annual net price* |

|---|---|---|

| Total cost of attendance | $30,990 | $21,340 |

| Tuition and fees only | $11,950 | $2,300 |

| Private, four-year school | ||

| Total cost of attendance | $65,470 | $37,380 |

| Tuition and fees only | $45,000 | $16,910 |

Source: Trends in College Pricing and Student Aid 2025. College Board. Data from 2025–2026 academic year. Total cost of attendance includes tuition, fees, room and board, and other expenses. *Net price = total published college cost minus grants and scholarships.

Loans

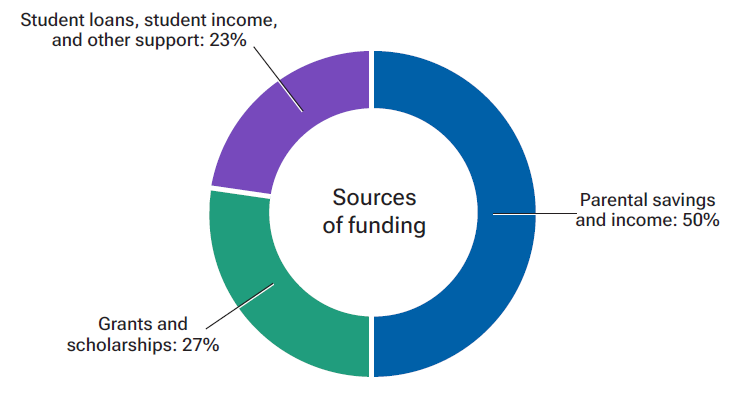

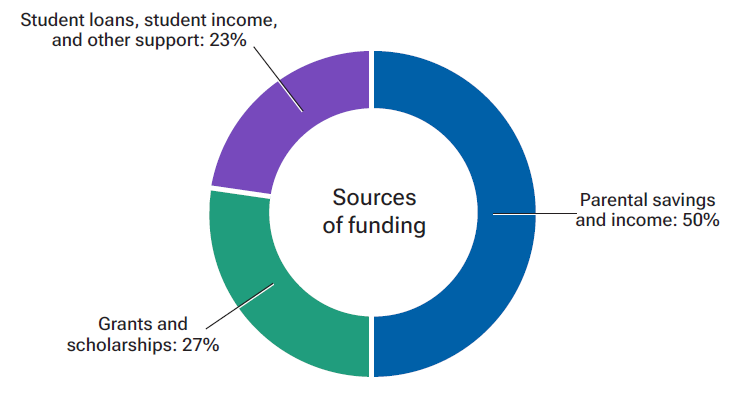

Borrowing money is another potential source of funding for college. But debt should only play a limited role, if possible. For example, during the 2024–2025 academic year, loans accounted for just 23% of the typical family’s college funding sources, with students borrowing 12% and parents borrowing 11%.2

Too much student debt can create a financial burden for students, putting a strain on their finances long after college. College debt also can have a negative effect on parents’ financial situation, potentially leading to delayed retirement or changes to their everyday lifestyle. Parents rarely plan on loans being a big part of their funding, but loans may play a larger role in situations where families have not planned ahead to pay for college or choose a school that stretches their financial resources.

T. Rowe Price recommends limiting student borrowing to federal loans. Dependent undergraduate students can take out $5,500 to $7,500 in federal student loans each year they’re in school, up to a total limit of $31,000.

These limits align with another guideline to consider: Students should try not to borrow an amount that is more than the annual starting salary they expect after graduation, which will vary widely based on degree and career choice. According to study results from the National Association of Colleges and Employers, the average starting salary for students of the 2024 graduating class was about $66,000.

In addition to loans, students can also contribute through their own income and savings. (See “A potential funding plan for college.”) Support from grandparents or other family members or friends can play a role as well. For instance, through gift tax exclusions, family members can gift up to $19,000 per person, per year in 2025 or 2026.

A potential funding plan for college

(Fig. 2) Parents and students may not need to cover 100% of the cost of college. Instead, consider the many sources of potential funding that can help you achieve your goal.

close

close

A savings starting point

Parents with younger children have time on their side. For these families, the goal should be to develop a plan and start saving as early as possible. This means saving well before a child has any sense of the degree they want to pursue or the college they want to attend. Since the cost of college varies greatly from one institution to another and from one degree to another, that will mean developing a strategy despite the uncertainties.

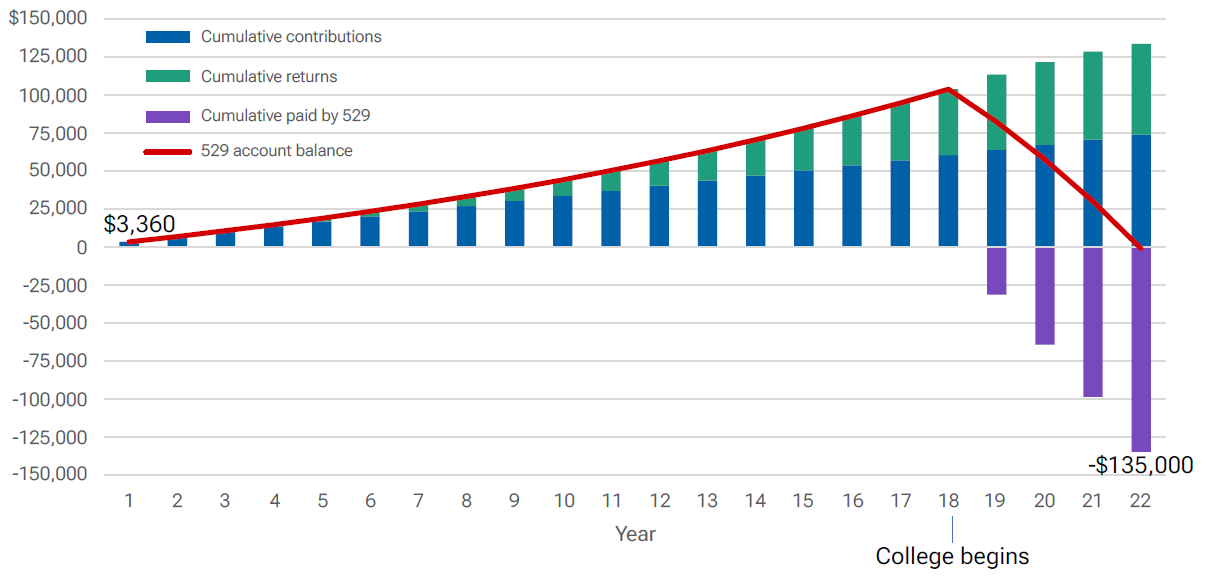

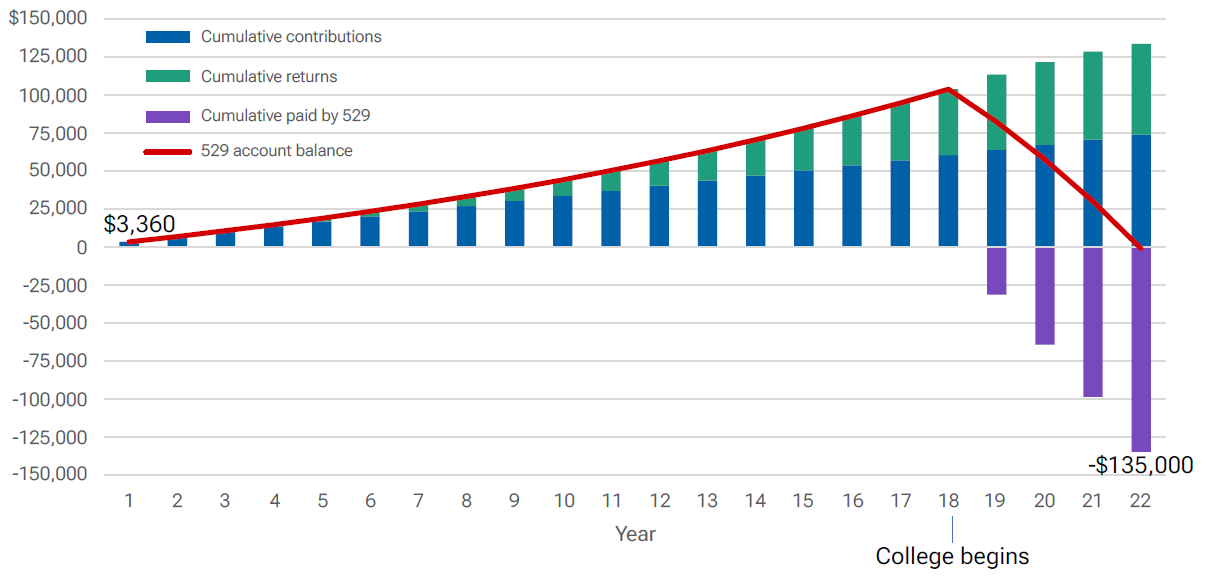

In the absence of an exact savings target, parents should consider saving at a level that gets them on track to cover 50% of the projected future cost of tuition, fees, and room and board for four years of in-state public college. Considering this full cost in today’s dollars is around $26,000 per year, the future amount for four years—after 18 to 21 years of inflation—is projected to be $270,000. Covering half of that amount would require a balance of $104,000 at age 18, along with continued contributions and investment growth during the four years that the child is in college. That entails contributions of roughly $280 a month from when your child is born through the end of their college career. (See “Building your college savings to 50% of the cost.”)

If you aren’t able to save that much right away, save what you can, and reassess the amount you’re able to save regularly, increasing contributions as you are able. Keep in mind, you may need to rely more on student loans, student income, or other support to help make up the difference. Or you may want to revisit expectations of what type of institution your child may be able to afford to attend.

To help achieve your goal, consider setting up recurring contributions to a 529 plan. Steady, recurring contributions over time are an important part of successfully saving for any long-term financial goal.

Building your college savings to 50% of the cost

(Fig. 3) Setting aside $280 per month for your child’s college education from birth through college graduation may generate enough savings ($135,000) to help cover 50% of the $270,000 future cost of four years of public college.

This hypothetical example assumes $280 contributions monthly starting at birth and continuing through four years of college. Assumptions include a $26,000 published cost in today’s dollars of one year of public college, 18 years until college with college costs increasing at 5% per year, and a 6% average annual return on investments. This example does not predict or project the performance of any investment.

close

close

Make adjustments over time

As your child gets older, they may develop a better idea of what career they want to pursue, which may narrow their choice of degree or institution. Resources such as the College Board provide average costs for different types of colleges and universities. Colleges also provide detailed pricing with their own net price calculators, which provide an estimate of the final costs based on a student’s individual financial situation.

Make adjustments and refinements to your savings plan as you gain a better sense of what college might cost for you and your student. For instance, have college costs changed since you established your original plan? Are you able to save more now that you are further along in your career or once an older child has graduated? Does it look like you are earning more than the threshold for need-based aid? These and other assumptions may lead to adjustments in your savings amount as your child approaches college age.

T. Rowe Price recommends that parents revisit their savings plan and check their progress at each school transition, namely the start of elementary school, middle school, and high school.

Overcoming a late start

Parents who aren’t able to start saving right away may face a bigger savings challenge as college approaches.

If you start saving for college once your child has already started school, you may need to set aside more than $280 a month to achieve your target. The typical child starts kindergarten at age 5, and with just 13 years to save before college, parents would need to set aside $340 a month to save enough to cover 50% of the cost of four years of public college—assuming the same $26,000 annual price tag at age 5. Consider repurposing money that was being spent on day care to go into the college fund once the child is in school for a full day.

Parents who begin saving for their child’s college in middle school, typically around age 11, have even less time to save. With just seven years until college, parents would need to set aside $475 a month to achieve their 50% target. This amount is likely out of reach for many household budgets, so the best strategy may be to save as much as you can, then assess your situation in the final years before your child reaches college age.

These hypothetical examples assume a $26,000 published cost (at the time savings begin) of one year of public college, with college costs increasing at 5% per year, and a 6% average annual return on investments.

The final stretch of saving for college

As college approaches, use the most up-to-date cost information and a short list of potential colleges to determine whether you have saved enough. If your savings fall short, look for opportunities to boost your 529 contributions in the final years before college. While you do not want to compromise your retirement savings strategy, you may be able to divert more of your budget toward college savings during these critical years, including any new money such as raises, bonuses, tax refunds, or inheritances.

If saving more isn’t possible, consider revisiting your priorities. Talk to your child about alternative institutions with a lower estimated net price or potentially enrolling in community college as a freshman, then transferring those credits to their target college. While still in high school, your student may also be able to earn college credits through advanced placement or community college classes. Encourage your child to take on part-time work and earmark some of that money for college expenses such as food and books.

Funding a college education is an achievable goal for many families, provided they plan far enough ahead and set reasonable targets. Parents don’t need to cover the entire published costs of college. By considering a mix of funding sources, it’s possible to help your child go to college without compromising your own financial situation.

Roger Young, CFP®

Thought Leadership Director

Roger Young, CFP®

Thought Leadership Director

Confidence runs deeper with a trusted advisor by your side

Get expert advice on investing, retirement, and tax-smart approaches, so you can have greater clarity and confidence in your financial future.

1 How America Pays for College 2025. Sallie Mae. Data from academic year 2024–2025.

2 How America Pays for College 2025. Sallie Mae. Data from academic year 2024–2025.

Important Information

Please note that a 529 plan’s disclosure document includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing. You should compare these plans with any 529 college savings plans offered by your home state or your beneficiary’s home state. Before investing, consider any tax or other state benefits, such as financial aid, scholarship funds, and protection from creditors that are only available for investments in the home state’s plan. Tax benefits may be conditioned on meeting certain requirements, such as residency, purpose for or timing of distributions, or other factors, as applicable.

All investments involve risk, including possible loss of principal.

This material has been prepared for general and educational purposes only. This material does not provide recommendations concerning investments, investment strategies, or account types. It is not individualized to the needs of any specific investor and is not intended to suggest that any particular investment action is appropriate for you, nor is it intended to serve as a primary basis for investment decision-making. T. Rowe Price, its affiliates, and its associates do not provide legal or tax advice. Any tax-related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

T. Rowe Price Investment Services, Inc., Distributor.

© 2025 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, the Bighorn Sheep design, and related indicators (see troweprice.com/ip) are trademarks of T. Rowe Price Group, Inc. All other trademarks are the property of their respective owners.

- 202512-5016279