Asset Allocation | January 18, 2024

A long-term view reveals undervalued opportunities

Identifying pockets of value in a momentum-driven market.

Key Insights

Resurgent optimism has contributed to elevated valuations, but attractive investment opportunities remain.

AI dominated the headlines and markets in 2023, but investors must continue to grapple with the implications of the technological revolution.

We see pockets of value in traditionally defensive areas of the market, such as health care, utilities, and select parts of fixed income.

David Giroux

Co-portfolio Manager, Capital Appreciation and Income Fund; Head of Investment Strategy and Chief Investment Officer, TRPIM

Farris Shuggi

Co-portfolio Manager, Capital Appreciation and Income Fund; Head of Quantitative Equity, TRPIM

Following a downbeat year for markets in 2022, major stock indexes soared in 2023, led by a return to favor for growth stocks and more cyclical segments of the market. Market sentiment has improved as recession fears have subsided and expectations have increased for the Federal Reserve to cut rates in 2024. This optimism has contributed to elevated valuations and intensified the importance of uncovering overlooked and undervalued areas of the market.

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

Artificial Intelligence

2023 was really the year of artificial intelligence (AI), propelled by the proliferation of ChatGPT. This large language model-powered software prompted a change in mindset not just for investors but also for regulators, information technology companies, enterprises, and consumers. We are all trying to grapple with the impact that artificial intelligence can have in a way that markets and market participants simply did not anticipate a year ago.

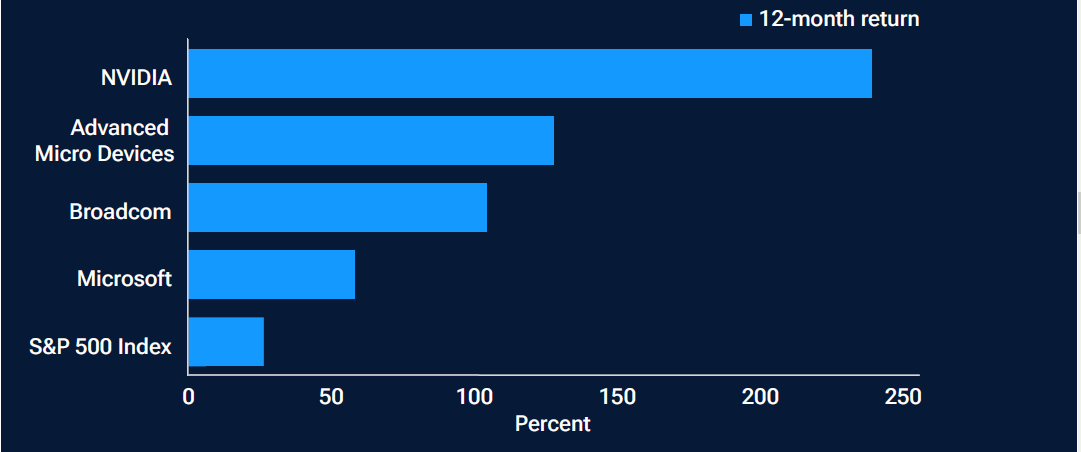

Perhaps no segment of the market felt the impact of this nascent interest more than the semiconductor companies that serve as the arms dealers in the artificial intelligence race. Along with tech giant Microsoft, chipmakers NVIDIA, Advanced Micro Devices, and Broadcom were some of the biggest beneficiaries of the first wave of interest in AI. As part of our process, we are focused on identifying where the next wave will be as the implications of AI on inflation, employment, and society ripple through the global economy.

Technology Names Far Outstripped Market Gains

(Fig. 1) Returns for AI beneficiaries compared with S&P 500 Index

12 months ended December 31, 2023.

Past performance is not a reliable indicator of future performance. The specific securities identified and described are for informational purposes only and do not represent recommendations, nor do they represent performance of an actual investment in the specific security. Does not reflect fees and costs associated with actual trading. There is no assurance that an investment in any security was or will be profitable.

Source: Financial data and analytics provider FactSet. Copyright 2024 FactSet. All Rights Reserved. See Additional Disclosure.

Pockets of Opportunity

While information technology stocks have soared, traditionally defensive areas—health care, utilities, and select parts of fixed income—have been left behind in the market momentum. We see attractive risk/reward opportunities in areas that trailed the market in 2023, particularly over a five year horizon, when momentum matters less and corporate fundamentals matter more.

Secular Tailwinds in Health Care

Health care offers good examples of names that may not be the first beneficiary of the impact of AI—this, in part, explains why the sector trailed others in 2023—but that do stand to benefit from its long-term effects. AI has the potential to power advanced diagnostic tools that could more effectively detect diseases like cancer, to develop new drugs and enhance life sciences applications, and even to potentially take over some aspects of interactions between patients and their doctors and therapists. When we factor these potential effects into our long-term view of companies, it can help us identify compelling investment opportunities that the market may overlook.

Potentially revolutionary new drugs could also have substantial impacts not only on names in health care but on society and the global economy. We are analyzing promising developments in Alzheimer’s treatments, for example, as well as the growing interest in glucagon-like peptide-1 (GLP-1) drugs, which have been used to treat diabetes but also are gaining traction for weight loss.

We also think the backdrop is favorable for names in life sciences, particularly those that undertook significant capital investment in equipment and diagnostic systems in recent years, which we think could be a catalyst for earnings growth in the coming years.

Utilities—A Sector in Transition

The utilities sector is in our view undergoing a seismic change. As the energy mix shifts away from coal and natural gas an toward renewable energy, many companies have invested heavily to focus more on energy transmission and storage. We think one of the reasons the sector has trailed the broader market is the persistent notion that investing in utilities is a play on interest rates, because they are often seen as an alternative to bonds due to their high dividend yield.

This view underappreciates the transition in the sector, where a number of companies have actually been growing their earnings at a healthy rate year over year in addition to their still-strong dividends. We think these companies have sound underlying fundamentals and have less exposure to key international risks, such as exposure to China and foreign currency exchange rates, or idiosyncratic risks, such as the regulatory uncertainties facing pharmaceutical companies with exposure to GLP-1 drugs.

High-quality High Yield

The sea change in interest rates from a couple of years ago, when rates were near zero and value in traditional fixed income was hard to come by, to where we are now is hard to overstate, particularly when we evaluate bonds relative to stocks. BB rated1 bonds are another area of the market where we are finding attractive opportunities to pursue equity-like returns at a fraction of the risk of equity markets.

Insurance companies and other institutions that are big players in the investment-grade market don’t invest as heavily in below investment-grade debt because they would need to increase their capital reserves. With fewer institutional buyers, we think this market segment is more prone to inefficiencies that we can capture because of our fundamental research and analysis, which can help us differentiate between similarly rated credits.

The weight of the securities mentioned in the Capital Appreciation and Income Fund as of December 31, 2023 were as follows: Microsoft: 2.9%, NVIDIA: 0.7%, Advanced Micro Devices 0.0% and Broadcom: 0.0%.

The inception date of the Capital Appreciation and Income Fund was 11/29/2023.

Risks:

Investing in technology stocks entails specific risks, including the potential for wide variations in performance and usually wide price swings, up and down. Technology companies can be affected by, among other things, intense competition, government regulation, earnings disappointments, dependency on patent protection and rapid obsolescence of products and services due to technological innovations or changing consumer preferences.

Health sciences firms are often dependent on government funding and regulation and are vulnerable to product liability lawsuits and competition from low-cost generic product.

Dividends are not guaranteed and are subject to change.

Fixed-income securities are subject to credit risk, liquidity risk, call risk, and interest-rate risk. As interest rates rise, bond prices generally fall. Investments in high-yield bonds involve greater risk of price volatility, illiquidity, and default than higher-rated debt securities.

Call 1-800-225-5132 to request a prospectus or summary prospectus; each includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

1Credit ratings are provided by Moody’s Investors Service, Standard & Poor’s, and Fitch Ratings. A bond is considered non-investment grade (or high yield) if it has a rating of BB+ or lower from Standard & Poor’s and Fitch Ratings or Ba1 or below from Moody’s Investors Service.

Additional Disclosure

The S&P 500 is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”) and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). T. Rowe Price is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500.

Important Information

This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action.

The views contained herein are those of the authors as of January 2024 and are subject to change without notice; these views may differ from those of other T. Rowe Price associates.

This information is not intended to reflect a current or past recommendation concerning investments, investment strategies, or account types, advice of any kind, or a solicitation of an offer to buy or sell any securities or investment services. The opinions and commentary provided do not take into account the investment objectives or financial situation of any particular investor or class of investor. Please consider your own circumstances before making an investment decision.

Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy.

Past performance is not a reliable indicator of future performance. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

T. Rowe Price Investments Services, Inc., distributor of T. Rowe Price mutual funds. T. Rowe Price Investment Management, Inc., investment adviser.

202401-3306325

Next Steps

Get strategies and tips for today’s market conditions.

Contact a Financial Consultant at 1-800-401-1819.