Reverse Yankees Are on the Rise

Executive Summary

- Euro‑denominated bonds issued by U.S. companies, known as reverse Yankees, have surged. The U.S. is now one of the largest sources of outstanding euro corporate debt.

- Ultralow yields and tight corporate spreads in Europe are among the factors driving the rise in reverse Yankee supply and are expected to continue.

- We believe this growing market sector gives investors opportunities to diversify their portfolios and take advantage of attractive valuations.

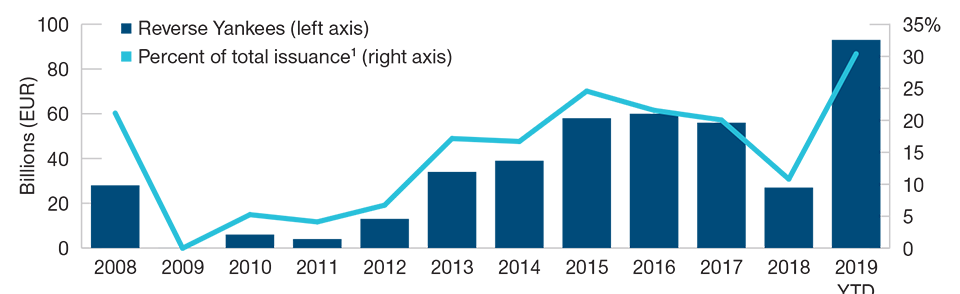

Euro‑denominated issuance by U.S.‑based corporates is surging. American companies pumped approximately EUR 93 billion into the European markets by the middle of December in 2019. Known as “reverse Yankee bonds,” these new issues made up roughly 30% of the total 2019 volume.

Rather than viewing this as a short‑term anomaly, we believe investors can look at the influx of reverse Yankees as a chance to both diversify their portfolios and generate alpha in a growing segment of the euro corporate market.

(Fig. 1) Reverse Yankee Supply Hits New High

Annual euro‑denominated issuance1 by U.S. companies

As of December 13, 2019

Source: J.P. Morgan (see Additional Disclosures).

1 Issuance = Euro‑denominated investment‑grade corporate (nonfinancials)

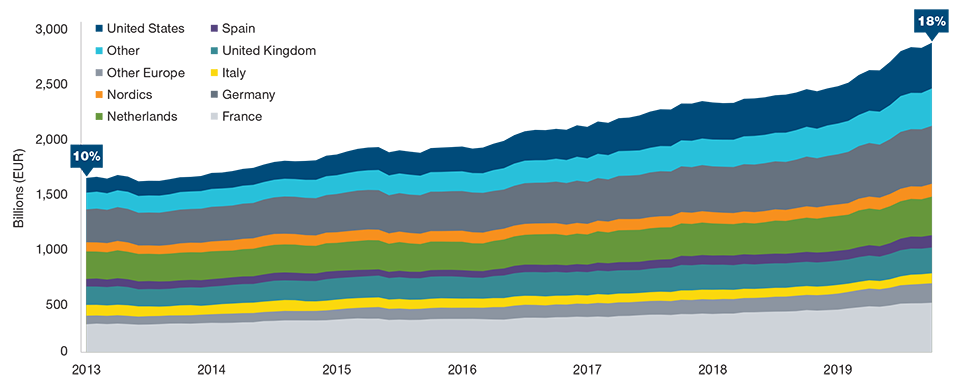

With the exception of a dip in 2018, 2019 appears to be part of a longer‑term trend of growing reverse Yankee supply. Consequently, U.S. corporates form an increasingly large portion of the outstanding euro‑denominated debt. At the end of the third quarter of 2019, 18% of the Bloomberg Barclays Euro Corporate Bond Index was attributed to U.S. companies, with France the only single country with a higher share of the total outstanding debt. However, if U.S. names continue to lead the new issuance tables, they could become the largest source of outstanding euro corporate debt before too long.

...spreads on reverse Yankee bonds are often wide relative to the company’s fundamentals.

...spreads on reverse Yankee bonds are often wide relative to the company’s fundamentals.

Driving Factors Likely to Continue

As the wider European corporate bond market continues to grow and mature, U.S. names are crossing the Atlantic to diversify their funding sources and investor bases. Other reasons for the growing presence of reverse Yankees include:

- Ultralow yields. Corporate yields in the euro‑denominated market remain low due to loose European Central Bank (ECB) policies in response to low inflation and growth concerns in recent years. The low, and in many cases negative, core government yields have pulled down corporate yields, meaning that average corporate funding rates in the euro market remain meaningfully lower than in the U.S. In short, U.S. companies can issue debt with lower coupons than they could by staying at home in the dollar market.

- Tighter spreads. The presence of the ECB’s monthly quantitative easing bond purchases, which restarted in November, increases overall demand in the market relative to supply. This has squeezed corporate spreads, boosting the euro market’s appeal for foreign issuers.Additionally, many U.S. companies are able to issue via their European subsidiaries, meaning their bonds are eligible for inclusion in the ECB’s corporate sector purchase program (CSPP), which restarted again as part of the ECB’s monthly quantitative easing purchases.

- Cheaper cross‑currency basis swaps. Cross‑currency basis swaps are financial instruments that companies can use to convert the proceeds from a bond sale in one currency into another. The rate that companies can swap euros back into dollars cheapened in 2019, which adds to the attractiveness of accessing the low rates in the euro market, particularly for companies not necessarily requiring euro funding.

These trends are likely to continue. The ECB has made it clear that its accommodative monetary policy will remain in place for the long term. By contrast, the U.S. Federal Reserve’s (Fed) policy outlook is more mixed. Despite rate cuts in 2019, the Fed has appeared hesitant to commit to a sustained cutting cycle and, instead, maintains a broadly neutral stance. While eurozone yields could continue to rise off their recent record lows, we see them as remaining below yields in the U.S. for the foreseeable future.

(Fig. 2) U.S. Share of Corporate Market Has Grown

Outstanding euro‑denominated debt by country1

As of October 31, 2019

Source: Bloomberg Index Services (See additional disclosures); data analysis by T. Rowe Price.

1 As measured by Bloomberg Barclays Euro Corporate Bond Index.

Investors Can Find New Opportunities

We believe investors should regard the rise of reverse Yankees as an opportunity. This market sector offers European investors a chance to gain exposure to U.S. names without taking on the currency risk of investing in U.S. dollar debt. This can help diversify an investor’s portfolio as well as add potential sources of alpha.

Another attraction for investors is that spreads on reverse Yankee bonds are often wide relative to the company’s fundamentals. European investors can be less familiar with many U.S. names, resulting in the bonds pricing or trading in the secondary market at a more attractive spread compared with either their fundamentals or with a European name with similar credit quality. This creates alpha opportunities for active, bottom‑up investors.

What we’re watching next

We will focus on identifying relative value opportunities by drawing on our bottom‑up fundamental credit research. The majority of the U.S. companies tapping the euro‑denominated bond market are well known to us, as we often invest in their U.S. dollar-denominated debt and equity. Consequently, we do not need to research them for the first time when they come to the euro market, enabling us to focus more on relative value.

Additional Disclosures

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission.

The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2019, J.P. Morgan Chase & Co. All rights reserved. Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

IMPORTANT INFORMATION

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

201912‑1034007