January 2024 / INVESTMENT INSIGHTS

Three important insights from 2023

A focus on bond yields, the Magnificent 7, and the Fed pivot

Key Insights

- Bond yields have rebounded and are unlikely to return to the anemic levels of the 2010s, despite the Fed’s dovish pivot.

- Given the significant outperformance and high returns on equity by the Magnificent 7 companies, we believe they should be viewed as a separate asset class.

Another year has gone by, and looking back, we learned a lot in 2023. Here are three key insights investors should keep in mind as we enter 2024.

Yield is back.

Bond yields have finally rebounded. During the period 2013–2021, the average yield to worst1 for the Bloomberg Global High Yield Bond Index and the Bloomberg Global Aggregate Index was a modest 6.04% and 1.57%, respectively. As of December 15, 2023, this measure was 8.36% for the global high yield index and 3.60% for the global aggregate index.

Although they may drift lower, given the Fed’s recent dovish signal, bond yields are unlikely to return to the anemic levels of the 2010s as long as inflation remains a threat. Current yield can, therefore, once again be a useful feature in bond portfolios as we move into 2024.

The Magnificent 7 should be viewed as a separate asset class.

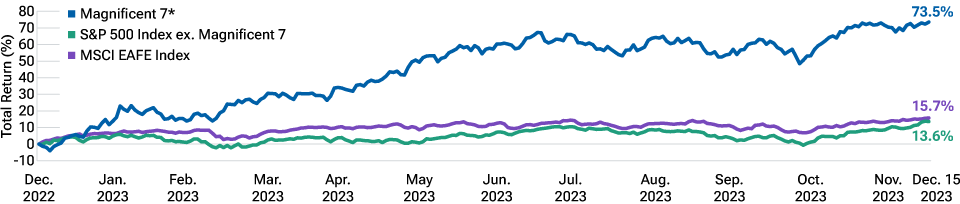

We witnessed the most top-heavy equity markets ever in 2023. The Magnificent 7—a group of stocks that includes Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla—posted massive returns and significantly outpaced their peers in the S&P 500 Index and other global stocks (Figure 1). Given this huge gap in performance, we believe the Magnificent 7 should be viewed as a separate asset class.

Magnificent 7 significantly outperformed other stocks in 2023

(Fig. 1) Comparing year-to-date total returns of mega-cap stocks versus other S&P 500 and global stocks

December 31, 2022, through December 15, 2023.

Past performance is not a reliable indicator of future performance. These statistics are not a projection of future results or company performance. Actual results may vary significantly.

Sources: T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. MSCI and S&P indices. See Additional Disclosures.

* The Magnificent 7 stocks are Apple, Alphabet, Amazon.com, Meta Platforms, Microsoft, NVIDIA, and Tesla. The specific securities identified and described are for informational purposes only and do not represent recommendations. Not representative of an actual investment. There is no assurance that an investment in any security was or will be profitable.

The high valuations of these seven mega‑cap companies collectively, which make up nearly 30% of the S&P 500 Index, has distorted overall U.S. stock valuations. While these high valuations have been accompanied by similarly high returns on equity as of December 18, the real question is whether the Magnificent 7 will be able to sustain the level of profitability and efficiency that they have so far exhibited.

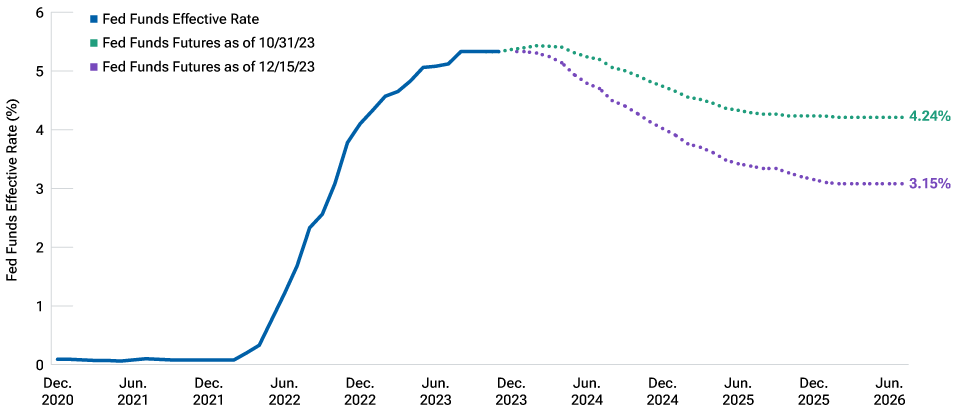

The Fed has pivoted.

The surprisingly dovish signal from the Federal Open Market Committee—a softer rate hike narrative and lower economic projections—at the end of its December meeting was one of the most notable events of the year. Investors spent 2023 fearing that the impacts of tighter monetary policy, amid the Federal Reserve’s (Fed) focus on fighting inflation, would drag the U.S. economy into recession. Fed Chair Jerome Powell’s recent announcement that the Fed would be giving equal attention to its two mandates—fighting inflation and supporting the economy—going forward means that the likelihood of recession in 2024 has fallen considerably.

A dovish Fed signal lowers the likelihood of recession

(Fig. 2) Fed funds effective rate and futures market pricing

December 31, 2020, through December 15, 2023.

Past results are not a reliable indicator of future results. Actual outcomes may differ materially from forward estimates.

Sources: Bloomberg Finance L.P.

We will be closely monitoring all of these themes as we move into 2024 and will update you accordingly as they play out.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

January 2024 / ASSET ALLOCATION VIEWPOINT