July 2023 / INVESTMENT INSIGHTS

A New Fixed Income Regime—Three Active Portfolio Responses

What to expect as monetary policy tightening moves closer to ending

Key Insights

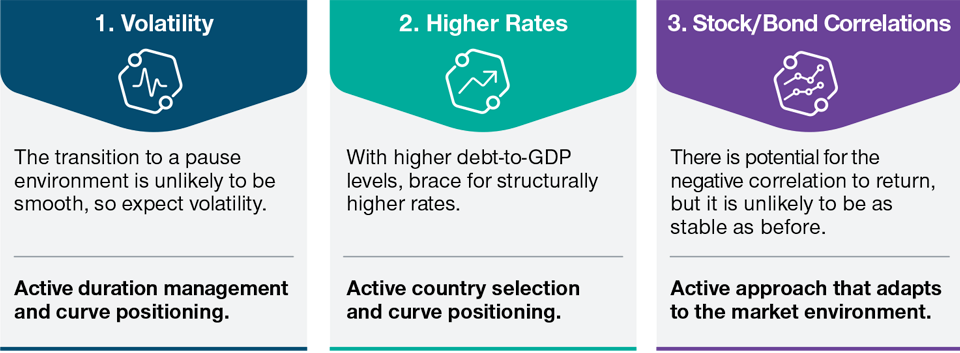

- Volatility is likely to remain high during the transition from a hiking rate environment to a pausing environment, creating potential interest rate and curve management opportunities for active managers.

- With escalating debt-to-gross domestic product levels, investors should expect structurally higher rates going forward in certain countries.

- There is potential for the negative stock/bond correlation to return, but it is unlikely to be as stable as during the post‑financial crisis era because central banks are no longer supporting markets.

The period of aggressive monetary policy tightening is moving closer to the finish line, with a new regime in fixed income markets set to begin. These transitions can often be challenging for investors, so we have identified three key themes to consider and share our ideas for how to navigate this new market paradigm.

What to Expect as Tightening Nears the Peak

Three key themes and active portfolio approaches

As of June 30, 2023.

For illustrative purposes only. This is not to be construed as investment advice or

a recommendation to buy or sell any security. Investments involve risks,

including possible loss of principal.

Source: T. Rowe Price analysis.

1. Smooth Transition to a Pause Environment Unlikely

Defensive interest rate strategies have worked well for more than a year, but the need to continue with such an approach is receding. Central banks are moving closer to the end of their hiking cycles, and most are expected to finish in the second half of this year. At the same time, inflation is easing—albeit slowly—and growth is showing signs of weakening, particularly on the manufacturing side. Against this backdrop, we have become more favorable on duration; however, we believe this stance needs to be kept under constant review.

Transitioning from a hiking environment to a pause environment is never just a simple case of moving from a short duration posture to a long bias and remaining there. A lot happens along the way—and this regime change will be no different. We expect heightened volatility in bond markets before central banks pause rate hikes, especially as the market continues to flip‑flop from worrying about sticky inflation to worrying about a recession. Uncertainty remains high, and it only takes one data print or central bank surprise to change market sentiment around the pricing of rate hikes or when cuts might start.

Portfolio approach—Active duration management and curve positioning

We believe that managing duration actively will be critical to navigating this transition. An active approach facilitates tactical responses to different market climates and regime changes while also providing the flexibility to take advantage of pricing anomalies and dislocations that might occur in a volatile environment.

It may also be beneficial to consider curve positioning. We believe that positioning for a steepening in select curves, such as the U.S. Treasury market, is an attractive opportunity as interest rates reach their peaks in this economic cycle. The normalization could take several quarters to play out, however, so patience is required.

Taking advantage of the broad investment universe is also important. It offers opportunities to capture value resulting from monetary policy dispersion. Central banks are approaching the end of the cycle at varying speeds—emerging markets are the furthest ahead and bond yields are starting to fall there now, particularly in Latin America. In developed markets, there is considerable disparity among countries. New Zealand’s central bank, for example, has signaled the end of hiking, while the Bank of England has indicated that it still needs to deliver more rate rises to combat sticky inflation. The Bank of Japan remains something of an outlier with its accommodative monetary policy stance, but we believe it may alter its yield curve control policy at some point this year.

2. Brace for Structurally Higher Interest Rates and Potential Risk Volatility

Across the globe, government spending has increased materially in recent years due to the pandemic and various schemes to help citizens with the higher cost of living. Debt-to-gross domestic product (GDP) levels have risen, and greater government debt issuance will be needed to help finance the higher deficits. However, this comes at a time when central banks are no longer supporting markets with quantitative easing, which means they will not be mopping up the increased supply as they have done previously. Demand will need to be met entirely by the private sector, which could anchor rates at higher levels than past cycles. It is important to note that this is on a country‑by‑country basis, with some more impacted than others. The UK, for example, is one country that stands out as it needs to sell more than GBP 240 billion worth of gilts in the 2023 fiscal year,1 the second largest on record.

Debt issuance also needs to rise in the U.S. The agreement reached in the U.S. Senate to suspend the debt ceiling until after the presidential election in 2024 means that the Treasury needs to replenish the Treasury General Account. As a result, net Treasury bill issuance of more than USD1.03 trillion is expected in the second and third quarters of this year.2 We believe this will drain liquidity from financial markets and ignite volatility in risk markets such as credit and equity. This backdrop adds to our already cautious view on the outlook for risk markets, where we believe there is potential for corporate fundamentals to deteriorate amid the challenges of slowing growth and higher debt servicing costs.

Portfolio approach—Active country selection and defensive positioning

An active approach to country selection is important in this environment, as is curve positioning, especially as the countries that need to raise more debt may target different maturities. For example, the U.S. is selling shorter‑dated maturities, which is an important factor to consider when looking at this part of the Treasury curve. By contrast, in the UK, the long end is likely to be more impacted by greater gilt issuance.

Given the concerns around the risk environment, a defensive approach may also be warranted as hedging strategies can help to navigate volatility.

3. Potential for Stock/Bond Correlation to Return

A key pressure point for investors last year was the fact that bond yields rose while stock markets were selling off. This went against the traditional tendency for fixed income to be a diversifying asset class that should perform well when equity markets decline. Inflation, and the sheer number of hikes aimed at taming it, were the main drivers of this positive correlation. But with inflation easing, albeit from a high base, and the end in sight for central bank tightening, we believe that the negative stock/bond correlation will make a return. However, it is unlikely to be as stable as the post‑financial crisis era given that central banks are no longer supporting markets with accommodative monetary policies, such as quantitative easing.

Portfolio approach—Active approach that adapts to the market environment

We believe it is important to be able to adapt to the risk environment and not to assume that the stock/bond correlation will always work. For example, if there is an extreme market event that puts major selling pressure on risk assets such as equity and credit, we expect duration to be an effective diversifier. However, this will likely not work if the cause of the sell‑offs is bond yields themselves. Against this backdrop, it is important to be agile and choose hedging tools that are appropriate for the environment. In some instances, this may mean using currency and derivatives markets instead of duration to help to balance and mitigate risk.

In all, the next few months look set to be fraught with volatility in bond markets as we approach these turning points in interest rate cycles around the world. Although this may present challenges, we believe the conditions will create great opportunities for active management within fixed income portfolios.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

July 2023 / INVESTMENT INSIGHTS