NEWS

T. Rowe Price’s 2019 Parents, Kids & Money Survey, which sampled 1,005 parents of 8- to 14-year-olds and their kids, found that more than one-third of parents are uncomfortable discussing saving for college with their kids and few of them are having frequent conversations about saving for college. The lack of communication may help explain why there is a disconnect between kids’ and parents’ expectations about who foots the bill for college.

“Covering college costs can be kids’ first experience with conceptualizing a long-term goal” says Judith Ward, CFP®, a senior financial planner at T. Rowe Price and mother of two college graduates. “The hesitation to discuss saving for college is a missed opportunity that not only lends itself to misunderstandings about who may be footing the bill for college, but also has implications for how kids think about money going forward and balance short-term and long-term needs into adulthood.

“While we think there is an opportunity for parents to have more conversations about college costs with their kids, it’s great to see that 529 college savings accounts are the most popular way to save for college, given their tax advantages and underlying investment options. Additionally, most parents would consider sending their kids to a less expensive school to avoid student debt, representing a much-needed cost consciousness in the college selection process,” says Ms. Ward.

To help parents discuss money with their kids, T. Rowe Price created MoneyConfidentKids.com, which provides free online games for kids; tips for parents that are focused on financial concepts such as goal setting, spending versus saving, inflation, asset allocation, and investment diversification; and classroom lessons for educators.

DISCUSSING COLLEGE COSTS

- Parents are almost as uncomfortable discussing saving for college with their kids as they are discussing drugs, sex, and school safety: Thirty-six percent of parents say they are very or extremely uncomfortable discussing saving for college with their kids, only slightly less than the percentage of parents that say they are very or extremely uncomfortable discussing school safety (38%), sex (38%), and drugs (37%) with their kids.

- Few parents frequently discuss long-term topics such as saving for college: Only 20% of parents frequently discuss “planning for long-term goals such as college.” More parents frequently discuss spending wisely (44%), the importance of saving (44%), and how to earn money (34%).

- Many parents will only be able to cover some college costs: Forty-five percent of parents say they will be able to cover some of their kids’ college costs. While 25% of parents say they will be able to cover most of the cost of college, 19% of parents say they will not be able to cover any, and 12% say they can cover the full bill.

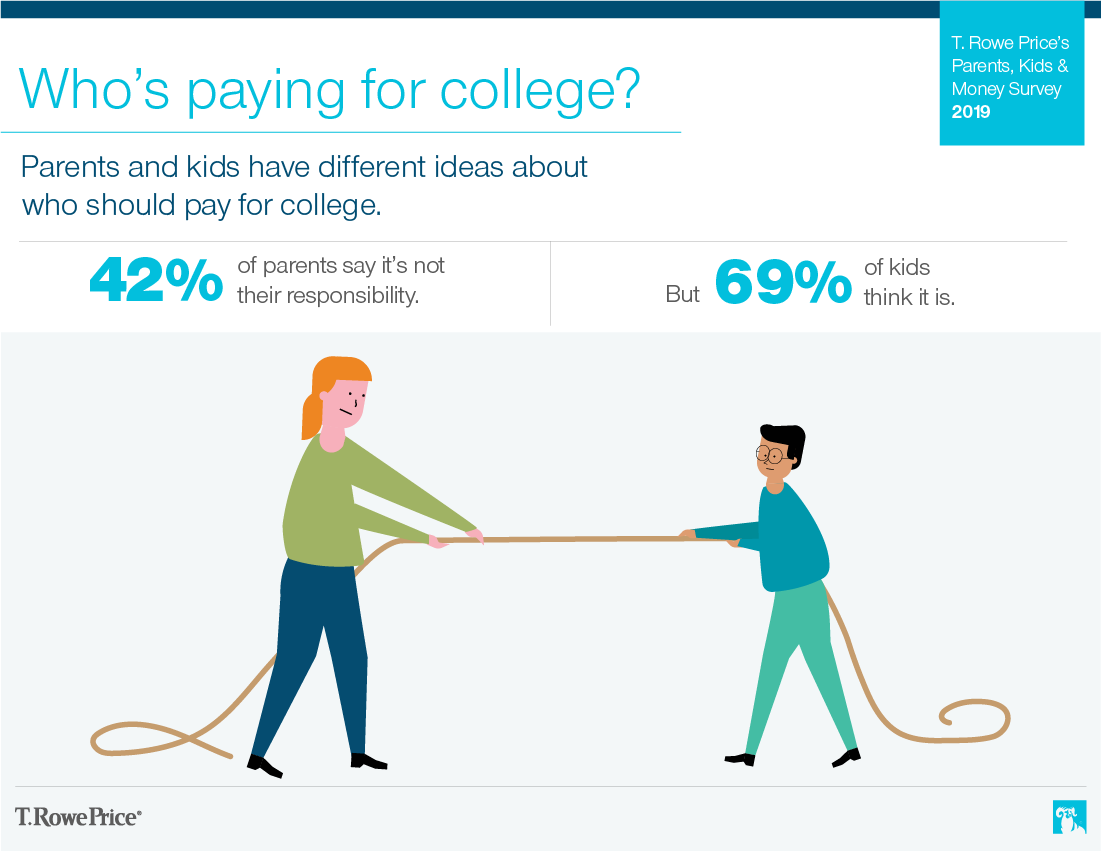

- Many parents expect kids to cover their college costs: Forty-two percent of parents say it’s not their responsibility to pay for college.

- Yet most kids expect their parents to cover college costs: Sixty-nine percent of kids say, “It’s my parents responsibility to pay for my college.”

- The top three approaches parents cite for covering college costs outside of savings depend on the kids: The most commonly cited approaches to paying for college costs after savings are grants and scholarships (42%), kids’ work (37%), and student loans (37%).

- Some kids might be learning about college costs in unexpected ways: Twenty-three percent of kids said they overheard their parents discussing college costs when their parents thought they weren’t listening.

IMPROVEMENTS IN ATTITUDES AND BEHAVIORS

- More parents are using 529 college savings accounts: Forty-four percent of parents in both 2019 and 2018 are saving for college in a 529 account, making it the most popular way to save for college among survey respondents. In 2017 and 2016, regular savings accounts had been the most popular way to save for college, and only 27% were using 529 accounts in 2017 and 37% in 2016.

- Most parents are willing to send their kids to a less expensive school to avoid student debt: Seventy-eight percent of parents say they would be willing to consider sending their kids to a less expensive school to avoid student loans this year, while only 74% would in 2018, 62% in 2017, and 71% in 2016.

IMPACT OF EDUCATION COSTS ON RETIREMENT

- Parents prioritize saving for college over retirement: Fifty-three percent of parents say that saving for their kids’ college is a higher priority than saving for their own retirement.

- Paying for kids’ college is among the most commonly cited reasons for tapping retirement savings: Twenty-six percent of parents have pulled money from their retirement savings in the past two years. When asked why, the top reasons cited are paying off debt (36%), vacation (28%), health care costs (27%), home repair or renovation (26%), and kids’ college education (24%).

- Most parents are willing to delay retirement to cover college costs: Sixty-eight percent of parents agree with the statement “I’d be willing to delay my retirement to pay for my kids’ college education.”

- Supporting kids’ education has an impact on other savings goals: Fifty-eight percent of parents pay more for housing to have access to better schools. While their intentions are well-meaning and this could be considered an investment in their kids’ future, 62% of those parents say that paying more for housing has considerably or extremely affected their ability to save for retirement or college.

Please note that the 529 plan’s disclosure document includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing.

MONEY CONFIDENT KIDS is a registered trademark of T. Rowe Price Group, Inc.

ABOUT THE SURVEY

The 11th annual T. Rowe Price Parents, Kids & Money Survey, conducted by ResearchNow, aimed to understand the basic financial knowledge, attitudes, and behaviors of both parents of kids ages 8 to 14 and their kids ages 8 to 14. The survey was fielded from January 17, 2019, through January 23, 2019, with a sample size of 1,005 parents and 1,005 kids ages 8 to 14. The margin of error is +/- 3.1 percentage points. All statistical testing done among subgroups (e.g., those who are caring for an aging parent) is conducted at the 95% confidence level. Reporting includes only findings that are statistically significant at this level.

ABOUT T. ROWE PRICE

Founded in 1937, Baltimore-based T. Rowe Price Group, Inc. (NASDAQ-GS: TROW) is a global investment management organization with $1.13 trillion in assets under management as of June 30, 2019. The organization provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans, and financial intermediaries. The company also offers a variety of sophisticated investment planning and guidance tools. T. Rowe Price's disciplined, risk-aware investment approach focuses on diversification, style consistency, and fundamental research. For more information, visit troweprice.com or our Twitter, YouTube, LinkedIn, Instagram, and Facebook sites.