FINDINGS ON RETIREMENT VS. COLLEGE

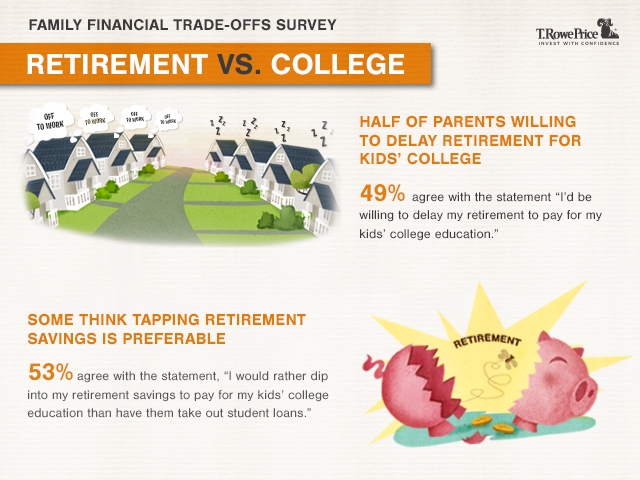

- Half are willing to work more to pay for kids’ college: 49% agree with the statement “I’d be willing to delay my retirement to pay for my kids’ college education.” And 51% agree with the statement “I’d be willing to get a second or part-time job to pay for my kids’ college education.”

- Tapping retirement savings is preferable to letting kids take on student debt: 53% of parents agree with the statement “I would rather dip into my retirement savings to pay for my kids’ college education than have them take on student loans.”

- Student loans have impacted retirement savings: 44% of the parents who used student loans to pay for their own college said that their payments have impacted their ability to save for retirement.

- Most have dipped into retirement savings: 58% of respondents have taken money out of a retirement account to pay for something else. The top item was pay off debt (20%), followed by day-to-day living expenses (13%), kids’ education (12%), and covering expenses while unemployed (12%).

- Some have cashed out retirement account: 27% indicated that they have cashed out a retirement account from a previous job. The most common reason given was that it was needed for day-to-day expenses (37%), followed by “I was young and didn’t know any better” (29%). Twenty-one percent put it toward student loans and college expenses.

- Half think they will never retire: 49% agree with the statement “I don’t think I will ever retire.”

FINDINGS ON COLLEGE PAYMENTS

- Some are willing to take on considerable college debt: 52% of respondents are willing to take on $25,000 or more in debt to pay for their kids’ college education, with 23% willing to take on over $75,000 and 9% saying they would borrow “whatever it takes.”

- It’s likely they will help with kids’ student loans: 47% are willing to let their kids take on monthly student loan payments of $300 or more, with 32% willing to let their kids take on $500 or more. But 77% said they are at least somewhat likely to help their kids pay off their student loans.

- But they still feel guilty that they can’t do more: 63% of parents agree with the statement “I feel guilty that I won’t be able to pay more for their college.”

- And sometimes they feel like a failure: 58% agree with the statement “I sometimes feel like a failure because I’m not providing enough for my family and our future.”

FINDINGS ON COLLEGE PAYMENTS

- Some are willing to take on considerable college debt: 52% of respondents are willing to take on $25,000 or more in debt to pay for their kids’ college education, with 23% willing to take on over $75,000 and 9% saying they would borrow “whatever it takes.”

- It’s likely they will help with kids’ student loans: 47% are willing to let their kids take on monthly student loan payments of $300 or more, with 32% willing to let their kids take on $500 or more. But 77% said they are at least somewhat likely to help their kids pay off their student loans.

- But they still feel guilty that they can’t do more: 63% of parents agree with the statement “I feel guilty that I won’t be able to pay more for their college.”

- And sometimes they feel like a failure: 58% agree with the statement “I sometimes feel like a failure because I’m not providing enough for my family and our future.”

FINDINGS ON COLLEGE PAYMENTS

- Some are willing to take on considerable college debt: 52% of respondents are willing to take on $25,000 or more in debt to pay for their kids’ college education, with 23% willing to take on over $75,000 and 9% saying they would borrow “whatever it takes.”

- It’s likely they will help with kids’ student loans: 47% are willing to let their kids take on monthly student loan payments of $300 or more, with 32% willing to let their kids take on $500 or more. But 77% said they are at least somewhat likely to help their kids pay off their student loans.

- But they still feel guilty that they can’t do more: 63% of parents agree with the statement “I feel guilty that I won’t be able to pay more for their college.”

- And sometimes they feel like a failure: 58% agree with the statement “I sometimes feel like a failure because I’m not providing enough for my family and our future.”

FINDINGS ON COLLEGE PAYMENTS

- Some are willing to take on considerable college debt: 52% of respondents are willing to take on $25,000 or more in debt to pay for their kids’ college education, with 23% willing to take on over $75,000 and 9% saying they would borrow “whatever it takes.”

- It’s likely they will help with kids’ student loans: 47% are willing to let their kids take on monthly student loan payments of $300 or more, with 32% willing to let their kids take on $500 or more. But 77% said they are at least somewhat likely to help their kids pay off their student loans.

- But they still feel guilty that they can’t do more: 63% of parents agree with the statement “I feel guilty that I won’t be able to pay more for their college.”

- And sometimes they feel like a failure: 58% agree with the statement “I sometimes feel like a failure because I’m not providing enough for my family and our future.”

FINDINGS ON ACCOUNT USAGE

- Using the wrong accounts for college: 45% of parents who are saving for their kids’ college indicated that they are using a regular savings account to do so. And while 31% said that they are using a 529 account, nearly as many (30%) said they are using their 401(k)s to save for their kids’ college.

- But mostly using the right accounts for retirement: When asked what accounts they are using for retirement, 69% indicated they are using a 401(k), 25% are using a Traditional IRA, and 24% are using a Roth IRA. However, 33% are using a regular savings account.

- Parents lack awareness of the right types of accounts: When asked why they weren’t using a 529 account to save for college, 28% said they do not know what it is. Similarly, when asked why they were not contributing to a Roth IRA for retirement, 20% indicated that they do not know what it is.

- But there are also misconceptions about the right accounts: Even though contributions to a 529 account can be withdrawn anytime for any reason, 25% cited lack of access as a reason for not saving in a 529 account. Additionally, 15% mistakenly thought that saving in a 529 account meant that they wouldn’t be able to get financial aid, and they cited this as a reason they were not using it. And when asked why they weren’t saving for retirement in a Roth IRA, 15% said it is because they want to be able to withdraw contributions any time, even though Roth IRAs offer this flexibility.

FINDINGS ON MILLENNIALS VS. GEN XERS

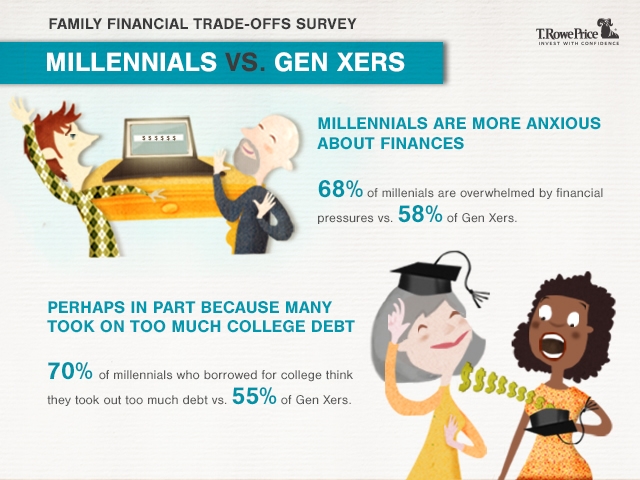

- Millennials are more anxious about finances than Gen Xers: 68% of millennials (respondents between ages 21 and 34) report being overwhelmed by financial pressures compared with 58% Gen Xers (respondents between ages 35 and 50).

- Perhaps in part because many took on too much college debt: Of the millennials who used loans to pay for college, 70% of them think they took out too much debt to pay for college compared with 55% of Gen Xers.

- Parents of millennials were twice as likely to tap retirement savings to cover college: Of the millennials whose parents helped pay for their college, 18% indicated that their parents had taken money from a retirement savings account to cover their college costs. However, only 9% of Gen Xers whose parents helped cover college costs said the same.

- And millennials are more inclined to follow their parents’ example: 62% of millennials would rather dip into retirement savings to pay for college than have their kids take on student loans, compared with 44% of Gen Xers. Additionally, 34% of millennials indicated that they are using a 401(k) plan to save for college, compared with 25% of Gen Xers.

- Millennials are pulling more out from their retirement savings: 65% of millennials have taken money from retirement savings to pay for something else versus 51% of Gen Xers.

- They are less confident in Social Security: 64% of millennials believe that they are more likely to win the lottery than receive any money from Social Security, compared with 49% of Gen Xers.

- And they are more worried about their own retirement: 49% of millennials report losing sleep worrying about how they will pay for retirement, compared with 37% of Gen Xers.

- A small silver lining: More millennials have converted assets from a Traditional IRA or tax-deferred workplace retirement plan to a Roth IRA (24% versus 19% of Gen Xers).

Please note a 529 plan’s disclosure document includes investment objectives, risks, fees, expenses, and other information you should read and consider carefully before investing.

ABOUT THE SURVEYT. Rowe Price’s Family Financial Tradeoffs Survey, conducted by MarketTools, Inc., aimed to understand how parents balance the need to save for retirement and college. An online survey was conducted among parents of kids ages 15 and younger who have a retirement savings account. The survey was fielded from December 18, 2014 through December 29, 2014, with a sample size of 2,000 parents, including a 50/50 quota for gender and age groups (i.e., millennials and Gen Xers). The margin of error for a sample of 2,000 is +/- 2.2% at the 95% confidence interval. All statistical testing done among subgroups is also conducted at the 95% confidence level. Reporting includes only findings that are statistically significant at this level.

ABOUT T. ROWE PRICEFounded in 1937, Baltimore-based T. Rowe Price (NASDAQ-GS: TROW) is a global investment management organization with $746.8 billion in assets under management as of December 31, 2014. The organization provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans, and financial intermediaries. The company also offers a variety of sophisticated investment planning and guidance tools. T. Rowe Price's disciplined, risk-aware investment approach focuses on diversification, style consistency, and fundamental research. For more information, visit troweprice.com, Twitter (twitter.com/troweprice), YouTube (youtube.com/trowepricegroup), LinkedIn (linkedin.com/company/t.-rowe-price), or Facebook (fb.com/troweprice).