NEWS

T. Rowe Price’s 2017 Parents, Kids & Money Survey, which sampled parents of 8 to 14 year olds nationally and their kids, looked at households with kids of only one gender and found that parents who have all boys are going to greater lengths to support their kids’ college education than parents of all girls. To understand the potential role of gender, the survey findings were analyzed to look at families with kids of only one gender, including families with one, two, three, or more kids of a single gender.

“I’m glad to see that parents of all girls seem cost-conscious about college, since price should be an important consideration, but it’s troubling that they aren’t saving as much for their kids’ college,” says Roger Young, a senior financial planner at T. Rowe Price and father of three. “Parents of both boys and girls should prepare for college costs by aiming to save at least enough for a down payment on college.

“A willingness to save more, pay more, and borrow more among parents of all boys suggests there may still be some antiquated expectations based on gender. This is somewhat ironic as more women are attending and graduating from college now than men,” says Mr. Young.

Additional survey findings revealed that parents are still willing to scale back their retirement in order to cover their kids’ college education. Similar findings have been reported in previous T. Rowe Price surveys.

“It’s a difficult balancing act to fully fund retirement and save for kids’ college education. Parents will always go to great lengths to provide for their kids, but they should be cautious about prioritizing college over retirement,” Mr. Young says. “College degrees come with a variety of price tags and there are multiple ways to pay for a degree, but nearly everyone should supplement Social Security with personal savings to ensure a comfortable retirement.”

Mr. Young notes that September is college savings month. T. Rowe Price encourages parents to invest in their kids’ futures by saving for their college and discussing money matters with them at least weekly. The survey found that parents who discuss financial topics with their kids at least once a week are more likely to have kids who say they are smart about money (64% vs. 41%).To help, the firm created MoneyConfidentKids.com, which provides free online games for kids; tips for parents that are focused on financial concepts such as goal setting, spending versus saving, inflation, asset allocation, and investment diversification; as well as lessons for educators.

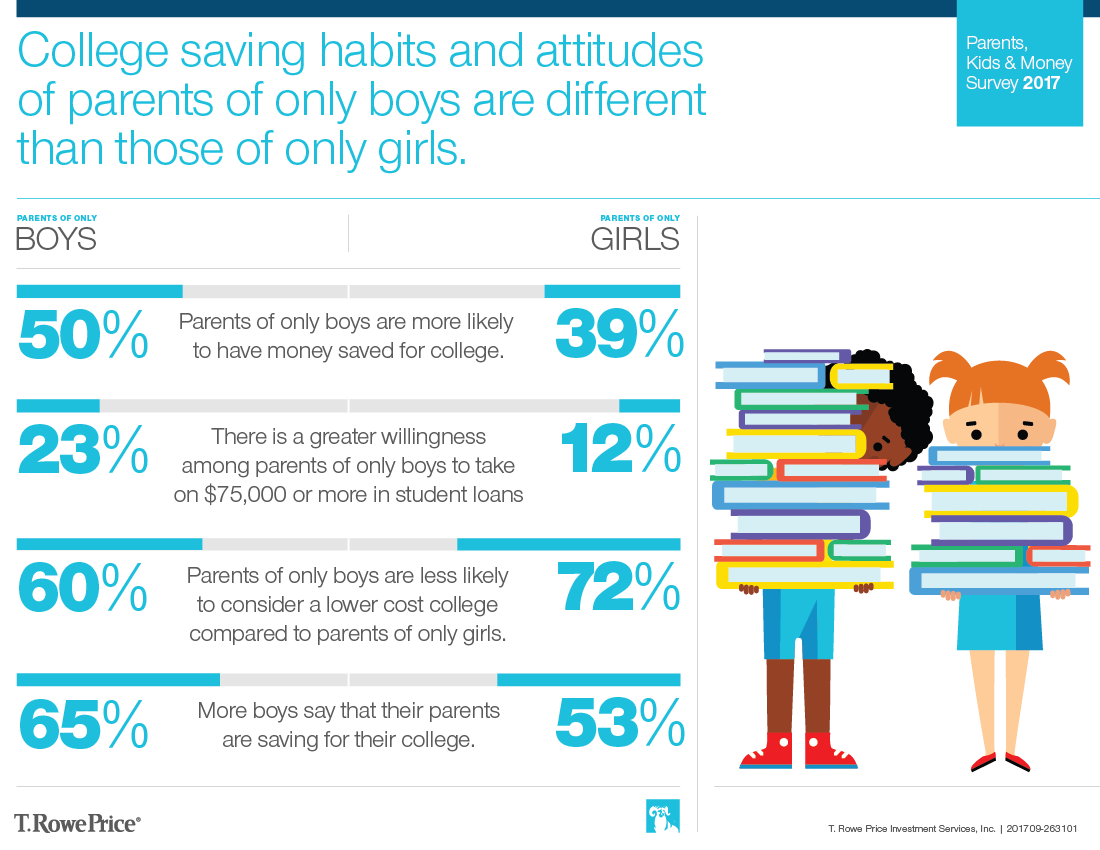

PARENTS SUPPORT BOYS' COLLEGE MORE THAN GIRLS'

Parents of all boys are more likely to have money saved for college: 50% of parents of all boys have money saved for their kids’ college compared with only 39% of parents of all girls. Additionally, among the parents who do save for their kids’ college, parents of all boys contribute to their kids’ college savings more frequently, with 83% contributing at least monthly compared with 70% of parents of all girls.

• Parents of all boys are more likely to say they will cover the entire cost of college: 17% of parents of all boys say they will be able to cover the entire cost of college compared with only 8% of parents of all girls.

• Parents with only boys are less likely to consider a lower cost college: Only 60% of parents of all boys agree with the statement, “I would consider sending my kids to a less expensive college to avoid taking on student loans,” compared with 72% of parents of all girls who agree with that statement.

• There is a greater willingness among parents of all boys to take on significant student debt: 23% of parents of all boys are willing to personally take on $75,000 or more in student loans compared to only 12% of parents of all girls. Parents of all boys are also more willing to let their kids take on significant student debt, with 29% saying they are willing to let their kids take with $50,000 or more in student loans, compared to only 17% of parents of only girls.

• Most parents of all boys prioritize college savings over retirement savings, but only half of parents of all girls do: 68% of parents of all boys say that saving for their kids’ education is a greater priority than saving for retirement, compared to 50% of parents of all girls who said that college savings is a greater priority.

• And more boys agree that their college saving is more important than their parents’ retirement:45% of boys think it’s more important for their parents to save for their college over their parents’ retirement, compared with only 27% of girls.

• More boys say their parents are saving for their college: 65% of boys reported that their parents are saving for their college compared with only 53% of girls.

• Dads of all boys place particularly strong emphasis on college: Dads of all boys are particularly likely to say that saving for their kids’ college is a priority over saving for retirement (73% vs. 28%), even when compared with moms of all boys (63% vs. 37%). Similarly, more dads of all boys are willing to take $75,000 or more in college debt for their kids (33%) compared with moms of all boys (14%).

PARENTS OF BOYS AND GIRLS SHORT-CHANGE RETIREMENT FOR KIDS' COLLEGE

• More parents are saving for their kids’ college than their own retirement: 53% of parents are saving for their kids’ college and 49% are saving for their own retirement.

• Parents are willing to delay their retirement to cover college costs: 73% of parents agree with the statement, “I’d be willing to delay my retirement to pay for my kids’ college education.”

• Parents are more likely to pull money from retirement savings than college savings: 44% of parents have pulled money from their retirement savings over the past two years compared with only 32% of parents who have pulled money from their kids’ college savings during that time span.

• Kids’ education is the second most common reason parents tap retirement savings: 33% of parents who have pulled money from retirement savings in the past two years did so to cover their kids’ college education. This is the second most common reason selected behind only paying off debt (35%).

• Some parents anticipate pulling money from their retirement savings to cover college costs:14% of parents anticipate pulling money from their retirement to cover their kids’ college costs.

ABOUT THE SURVEY

The ninth annual T. Rowe Price Parents, Kids & Money Survey, conducted by Research Now, aimed to understand the basic financial knowledge, attitudes, and behaviors of both parents of kids ages 8 to 14 and their kids ages 8 to 14. The survey was fielded from January 18, 2017, through January 26, 2017, with a sample size of 1,014 parents and 1,014 kids ages 8 to 14. The margin of error is +/- 3.1 percentage points. All statistical testing done among subgroups (e.g., boys versus girls) is conducted at the 90% or 95% confidence level, depending on sample sizes. Reporting includes only findings that are statistically significant at these levels.

ABOUT T. ROWE PRICE

Founded in 1937, Baltimore-based T. Rowe Price Group, Inc. (troweprice.com) is a global investment management organization with $934 billion in assets under management as of August 31, 2017. The organization provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans, and financial intermediaries. The company also offers a variety of sophisticated investment planning and guidance tools. T. Rowe Price's disciplined, risk-aware investment approach focuses on diversification, style consistency, and fundamental research. For more information, visit troweprice.com or our Twitter, YouTube, LinkedIn, and Facebook sites.