News

Additional findings from T. Rowe Price’s 2014 Parents, Kids & Money Survey revealed that boys and girls are not equally prepared when it comes to learning about money matters at home. Additionally, the survey of 8- to 14-year-old kids and their parents found a correlation between talking to kids of either gender about financial concepts and kids developing positive financial behaviors, such as identifying themselves as a saver rather than a spender, feeling more confident about money, and saving for their own college education. T. Rowe Price encourages parents to invest in their kids’ future by talking to them about money matters weekly.

To help parents have money conversations with their sons and daughters, the firm created online resources.MoneyConfidentKids.com provides free online games for kids, lessons for educators, and tips for parents to help families save for college and discuss the key financial concepts of goal-setting, spending versus saving, inflation, asset allocation, and diversification.

Boys vs. Girls Findings:

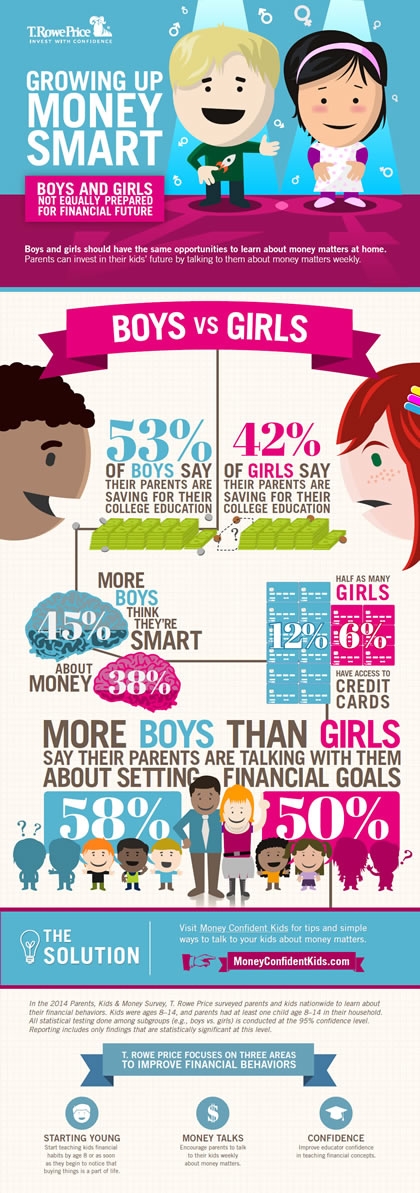

- Boys report having more money conversations: 58% of boys say their parents talk about setting financial goals at least occasionally compared with just 50% of girls.

- So it is no surprise more boys say they are smart about money: 45% of boys say they are very or extremely smart about money, while only 38% of girls say the same.

- And the parents think boys understand more: Of the parents with one child, 80% of parents with a boy think their child understands the value of a dollar compared with only 69% of parents with a girl.

- Boys have more access to credit cards: Twice as many boys have credit cards (12% versus 6% of girls).

- Saving for college: More boys say that their parents are saving for their education (53% versus only 42% of girls).

Findings on the Impact of Having Money Conversations:

- Kids save for college when parents discuss it with them:58% of kids whose parents frequently talk to them about saving for college say they are saving for college on their own, as opposed to 23% of kids whose parents do not frequently discuss college savings.

- And investment-savvy kids are even more likely to save for college: 81% of kids whose parents frequently talk to them about investment vehicles like stocks and bonds say they are saving for college on their own, as opposed to just 25% of kids whose parents do not frequently talk about investment vehicles.

- Kids feel smarter about money: 66% of kids whose parents frequently talk about family finances say they feel smart about money, as opposed to 37% of kids whose parents don’t frequently talk about family finances. Additionally, 60% of kids whose parents frequently talk to them about budgeting feel they are smart about money, as opposed to just 34% of kids whose parents do not frequently talk with them about budgeting.

- Kids identify themselves as "savers": 60% of kids whose parents frequently talk to them about setting financial goals identify themselves as "savers" versus "spenders," as opposed to 46% of kids whose parents do not frequently talk to them about setting financial goals.

Quote

Judith Ward, CFP®, senior financial planner at T. Rowe Price and mother of two

"Boys and girls should have the same opportunities to learn about money matters at home so they can grow into financially savvy adults. If you want to invest in your kids’ futures, start by talking to them about money matters weekly. The correlation between the frequency of conversations about money and kids’ smart financial decision-making is undeniable.

"Data from the U.S. Census Bureau show that more women are enrolled in college than men. However, fewer girls say their parents are saving for their college education. By talking to both girls and boys about planning for education expenses, parents can help kids get involved in college savings and excited about their future."

About T. Rowe Price

Founded in 1937, Baltimore-based T. Rowe Price (troweprice.com) is a global investment management organization with $738.4 billion in assets under management as of June 30, 2014. The organization provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans, and financial intermediaries. The company also offers a variety of sophisticated investment planning and guidance tools. T. Rowe Price's disciplined, risk-aware investment approach focuses on diversification, style consistency, and fundamental research. For more information, visit troweprice.com, Twitter (twitter.com/troweprice), YouTube (youtube.com/trowepricegroup), LinkedIn (linkedin.com/company/t.-rowe-price), or Facebook (fb.com/troweprice).

About the Survey

The sixth annual T. Rowe Price Parents, Kids & Money Survey, conducted by MarketTools, Inc., aimed to understand the basic financial knowledge, attitudes, and behaviors of both parents of kids ages eight to 14 and their kids ages eight to 14. The survey was fielded from January 29, 2014 through January 31, 2014, with a sample size of 1,000 parents and 924 kids ages eight to 14. The margin of error is +/- 3.0 percentage points. Parents of multiple children were asked to consider only one child between the ages eight and 14 when responding to questions about their children. All statistical testing done among subgroups (e.g., boys versus girls) is conducted at the 95% confidence level. Reporting includes only findings that are statistically significant at this level.