retirement planning | june 9, 2023

How Retirees Can Protect Their Savings From High Inflation Rates

4 steps to help preserve the purchasing power of your portfolio.

Key Insights

High inflation can create challenges for retirees.

An effective retirement income strategy should take inflation into account.

Keeping a portion of your portfolio invested in stocks can help offset the effects of inflation.

Roger Young, CFP®

Thought Leadership Director

Heightened inflation can create challenges for retirees, but there are steps you can take to help mitigate its impact. Inflation reduces the purchasing power of your savings by increasing the cost of future expenses. If your living expenses rise higher than the income that your retirement savings can sustainably generate, you risk running out of money.

“Inflation is often unpredictable and can be an important factor to account for when planning your retirement income strategy,” says Roger Young, CFP®, a thought leadership director with T. Rowe Price.

What is inflation?

Inflation is the rate at which prices of common goods and services rise over time. Economists view a certain amount of inflation as a sign of a healthy economy. In fact, the Federal Reserve typically sets monetary policy to target an inflation rate of about 2% per year.

Lately, however, the rate of inflation has been higher: For example, in March 2023, the consumer price index for all urban consumers rose 5.0% over the previous 12 months.1 Temporary spikes in inflation can be unsettling, particularly if they have not occurred in a while.

“While periods of higher inflation may come as a shock, an effective retirement strategy can plan for the possibility of these temporary spikes,” says Young. “We typically recommend assuming a long-term inflation rate of 3%, which is between the Federal Reserve target and the recent inflation rate.”

Subscribe to T. Rowe Price Insights

Receive monthly retirement guidance, financial planning tips, and market updates straight to your inbox.

How does inflation affect retirees?

Rising prices could produce a gap between your planned income and what you actually require to pay your bills. If you need to withdraw a higher amount from your retirement savings over time, that activity could affect the long-term sustainability of your retirement income plan.

Prices generally do not rise evenly across the board, however. The cost of medical care services, which are particularly important in retirement, has risen significantly in recent decades. However, these costs rose at a slower rate than overall inflation over the 12 months through March 2023, at only 1.0%.1 Meanwhile, food and shelter costs rose by more than 8% over the same period.1 (See “Unadjusted 12-Month Rise Ended March 2023: Prices Do Not Rise Evenly” below.)

Unadjusted 12-Month Rise Ended March 2023: Prices Do Not Rise Evenly

Some costs rise at different rates than during other times of inflation.

Source: U.S. Bureau of Labor Statistics, “Consumer Price Index – March 2023”.

Protecting Your Retirement Savings from Sustained Inflation

Most retirement strategies already account for some level of inflation by targeting a level of growth that exceeds inflation over the longer term. It is important to balance the ability to take distributions as needed in the short term with the ability to maintain a level of investment growth for the long term.

Here are four steps that can help you achieve this balance.

1. Review your budget and consider adjusting your spending over the short term.

To avoid having to take larger distributions than planned over the near term, you may find ways to cut costs and control expenses. For example, if you are able to conserve energy usage, you may find that your budget is less affected by a spike in inflation. You may also need to trim some discretionary expenses in your budget, such as downscaling or forgoing a planned vacation or home renovation. If you think some recent price hikes might be temporary, delaying a big expense could make sense. In addition, you may want to consider picking up some part-time work, if needed, to help close the income gap.

2. Ensure a proper allocation to stocks.

Stocks have historically averaged annual returns well in excess of average inflation. This fact makes owning stocks in your retirement portfolio one of the most effective tools available to protect your savings from sustained inflation. However, the relatively higher long-term returns offered by equity investments come with higher near-term risks. For instance, if equity markets fall, you want to remain invested until they have recovered to avoid realizing those losses. Portfolios typically offset some of this short-term market risk by allocating a portion of your savings to bonds, which generate income more consistently. Bond investments may not offset inflation, however, and their value decreases when interest rates rise.

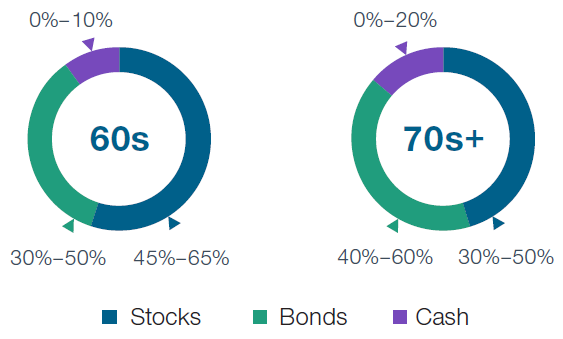

“We typically recommend retirees maintain a portfolio of stocks, bonds, and cash well into retirement,” says Young. (See “Model Asset Allocations for Investors in Retirement” below.)

Model Asset Allocations for Investors in Retirement

Keeping stocks in your retirement portfolio through retirement can help protect against inflation.

3. Maintain an appropriate cash cushion.

Managing long-term growth with near-term income needs makes it very important to regularly revisit your plans. It also underscores the value of having a cash cushion or emergency fund. While inflation will reduce the spending power of cash on hand over time, having cash available can cover unavoidable expenses at times when prices have risen. In addition, that cushion can limit the amounts you need to withdraw from your longer-term investments. Having a healthy cash position to cover one or two years’ worth of expenses early in retirement can be particularly helpful if periods of inflation coincide with declines in the market value of your investments.

4. Regularly consider the impact of inflation as you update your broader financial plan.

An effective retirement strategy relies on an accurate estimate of what a household actually spends. That value is likely to change from year to year in a high-inflation environment, so it requires regular updating.

Similarly, your retirement strategy will require adjustments along the way, whether due to changes in inflation rates, market conditions, or your personal circumstances. If you use planning tools or work with a financial professional, carefully consider the right inflation assumptions to use going forward. And if you have not claimed Social Security benefits yet, remember that those benefits are adjusted for inflation, which could make waiting even more attractive. “Ultimately, maintaining an appropriate allocation to stocks, along with managing spending and staying flexible, are the most important tools retirees can deploy against long-term inflation,” says Young.

Asset Allocation Models:

Within Stocks: 60% U.S. Large-Cap, 25% Developed International, 10% U.S. Small-Cap, 5% Emerging Markets

Within Bonds: 70% U.S. Investment Grade, 10% High Yield, 10% International, 10% Emerging Markets

Within Cash: 100% Money Market Securities, Certificates of Deposit, Bank Accounts, Short-Term Bonds

These allocations are age-based only and do not take risk tolerance into account. Our asset allocation models are designed to meet the needs of a hypothetical investor with an assumed retirement age of 65 and a withdrawal horizon of 30 years. The model asset allocations are based on analysis that seeks to balance long-term return potential with anticipated short-term volatility. The model reflects our view of appropriate levels of trade-off between potential return and short-term volatility for investors of certain ages or time frames. The longer the time frame for investing, the higher the allocation is to stocks (and the higher the volatility) versus bonds or cash. While the asset allocation models have been designed with reasonable assumptions and methods, the tool provides models based on the needs of hypothetical investors only and has certain limitations: The models do not take into account individual circumstances or preferences, and the model displayed for your investment goal and/or age may not align with your accumulation time frame, withdrawal horizon, or view of the appropriate levels of trade-off between potential return and short-term volatility. Investing consistent with a model allocation does not protect against losses or guarantee future results. Please be sure to take other assets, income, and investments into consideration in reviewing results that do not incorporate that information. Other T. Rowe Price educational tools or advice services use different assumptions and methods and may yield different outcomes.

1Bureau of Labor Statistics (accessed 4/25/2023)

Important Information

This material has been prepared by T. Rowe Price for general and educational purposes only. This material does not provide recommendations concerning investments, investment strategies, or account types. It is not individualized to the needs of any specific investor and is not intended to suggest that any particular investment action is appropriate for you, nor is it intended to serve as the primary basis for investment decision-making. T. Rowe Price, its affiliates, and its associates do not provide legal or tax advice. Any tax-related discussion contained in this material, including any attachments/links, is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only. Past performance cannot guarantee future results.

View investment professional background on FINRA's BrokerCheck.

202305-2890899

Next Steps

Gain trusted expertise and the tools that can help you reach your financial objectives.

Contact a Financial Consultant at 1-800-401-1819.