March 2023 / RETIREMENT

Implementing an In-Plan Retirement Income Solution

Insights from plan sponsors and consultants and five key lessons from a case study.

Key Insights

- With increasing retiree assets remaining in plan, defined contribution (DC) plan sponsors are reevaluating plan objectives to incorporate both the spending and saving phases.

- DC plan sponsor and consultant survey data reveal a lack of conviction in any single retirement income product or feature; however, liquid and portable solutions appear more appealing.

- A managed payout solution can be a starting place for DC plan sponsors to begin their retirement income journey, which will most likely span several years and encompass multiple strategies.

Many defined contribution (DC) plan sponsors are in the process of reevaluating their retirement plan objectives to encompass both the spending and savings phases. This evolution in purpose reflects a desire to reposition the plan as not only a savings-oriented vehicle, but also as a decumulation platform that supports retired participants. This shift represents a significant change in mindset—one that we believe will be realized and implemented over an iterative and multiyear journey for most plan sponsors.

Philosophically, we believe that reenvisioning the DC plan as it exists today to also accommodate the needs of retired participants will ultimately require a shift toward a retiree-friendly plan design that offers an array of options, including investment and insured solutions, supported by access to tools and advice.

Where Do You Start?

For plan sponsors that have identified retaining and supporting retired participants as a priority, the most immediate focus is typically on recreating a paycheck-like experience for retirees. At a recent conference for DC plan sponsors, T. Rowe Price was asked to share some insights based on our experience as the first target date provider to offer an in-plan trust with a managed payout feature that can provide a retirement income stream through monthly plan distributions.

Given that the topic of in-plan retirement income solutions can be both amorphous and overwhelming, we structured our observations and “lessons learned” by tackling the following three questions:

(1) What are we trying to solve?

No one needs solutions to problems they don’t have, so a good place to start is to identify and fully understand the “problem” that a retirement income solution is expected to solve. In most cases, we believe a managed payout product, supported by complementary participant tools and education, can be a doable first or second step to facilitate a regular and predictable income stream for retired participants. While a managed payout product isn’t always the single “right” answer, it could represent an achievable entry point for plan sponsors to begin their retirement income journey.

(2) What are plan sponsors looking for?

While we believe that solving for in-plan retirement income will be an iterative process that includes a variety of solutions, we currently observe greater interest in liquid and portable retirement income solutions than solutions that include an explicit guarantee. Spoiler alert—plan sponsor survey data suggest greater focus on recreating a paycheck‑like experience than implementing a guaranteed solution.

(3) What has T. Rowe Price learned from implementing an in-plan retirement income solution in 2019?

A lot! Using our experience as the first target date provider to offer an in-plan trust with a managed payout feature that provides an automatic income stream for retirees as a case study, we will share some lessons from this experience, ranging from the importance of setting expectations to the critical role of the participant experience.

Implications of the original SECURE Act of 2019 (SECURE 1.0) to SECURE 2.0 Act of 2022 (SECURE 2.0)

From a legislative and regulatory point of view, provisions in SECURE 1.0 sought to clarify a fiduciary’s responsibility relative to the selection of an annuity provider and address the growing number of retirees keeping their assets in plan after retirement. While some industry constituents believe SECURE 1.0 did not go far enough to fully assuage plan sponsor concerns about fiduciary liability, it served to accelerate product creation and encourage the launch of innovative solutions to support retired participants who choose to stay in plan. More recently, SECURE 2.0 has become law and includes provisions that further support lifetime income. While implementation of in‑plan retirement income solutions is still likely to be gradual, we are observing more plan sponsors moving from an information‑gathering to a decision-making stage relative to retirement income.

The Elephant in the Retirement Income Room

When discussing retirement income, it can be helpful to begin with addressing the elephant in the retirement income room, which is the fact that the retirement industry has been talking about in-plan retirement income solutions for years now, and we still have not seen significant implementation. This observation begs the question, what makes today different?

One important structural difference that makes the current retirement income conversation different from that of three to five years ago is that increasingly more plan participants are keeping their assets in plan through retirement.

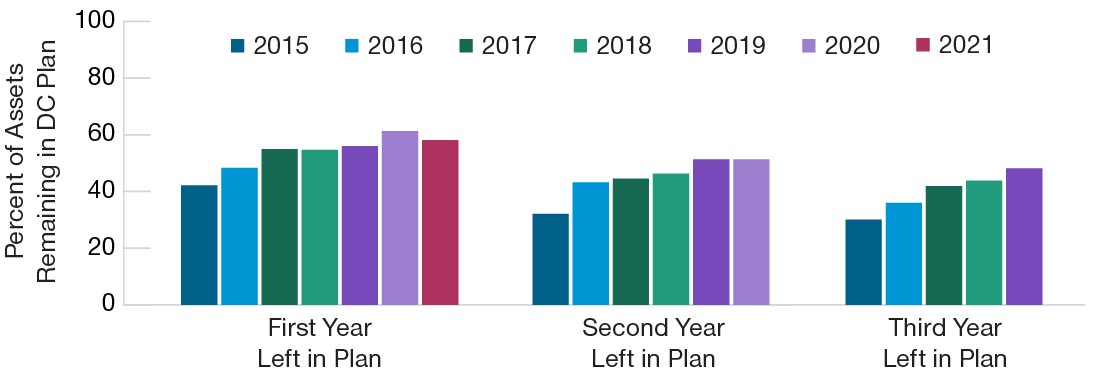

Figure 1 reflects data from the T. Rowe Price recordkeeping platform,1 which services about 2.2 million participants, and shows the average percentage of DC account value that remains in plan for one, two, and, finally, three years after retirement. Focusing on the third cluster of bars, the average percentage of DC account value staying in plan for three years after retirement has been trending upward over the past several years, which, in turn, supports the need for DC plan sponsors to consider how their participants can best withdraw these savings throughout retirement.

More Assets Are Remaining in Plan Postretirement

(Fig. 1) Account value retained in DC plan by participants age 65+ after one, two, orthree years following separation from service

As of December 31, 2021.

Source: T. Rowe Price recordkeeping platform.

So what do plan sponsors think? In a survey of DC plan sponsors that T. Rowe Price conducted in partnership with Pensions &Investments Content Solutions Group, more than half of plan sponsors (59%) cited “recognition of the need to help participants convert DC plan balances to retirement income” as the most influential factor driving their interest in exploring or offering retirement income solutions.

Returning to our first question—“what are we trying to solve?”—this data tells us that we need to solve, first and foremost, for recreating a paycheck-like experience for retirees.

Marketplace Lacks Conviction in Any Single Solution

Now let’s consider our second question—“what are plan sponsors looking for?”—when it comes to in-plan retirement income solutions. Data from the T. Rowe Price DC Plan Sponsor Survey, complemented by results from our most recent DC Consultant and Advisor Survey,3 offer a view into where the DC marketplace currently stands in terms of demand for a variety of retirement income products and features.

When plan sponsors and consultants were asked to identify which retirement income products and features have the greatest appeal, the results yielded a landscape with little differentiation from one solution to the next (Figure 2). In both surveys, respondents were asked to rate the provided retirement income products or features on a scale of one to four (least to most appealing).

Survey Results Yield Little Differentiation Across Potential Solutions

(Fig. 2) Average ratings from plan sponsors and consultants on retirement income products and features

| Retirement Income Products and Features (Ordered by average consultant/advisor score) |

DC Investment Consultants and Advisors* | DC Plan Sponsors† |

|---|---|---|

| 1. Simple systematic withdrawal | 3.4 | 2.9 |

| 2. Managed account (with income planning feature) | 2.9 | 2.6 |

| 3. Target date investment with managed payout feature (non-insured) | 2.6 | 2.7 |

| 4. Investment option with managed payout feature | 2.5 | 2.2 |

| 5. Target date investment with embedded annuity feature | 2.5 | 2.6 |

| 6. Investment that incorporates a partial guarantee‡ | 2.4 | — |

| 7. Investment solution to help maximize Social Security benefits | 2.3 | 2.7 |

| 8. Deferred income annuity (DIA) or qualified longevity annuity contract (QLAC) | 2.0 | 2.1 |

| 9. Immediate annuity | 1.8 | 2.1 |

| 10. Annuity portal (access to out-of-plan annuities)‡ | — | 2.0 |

| 11. Bond ladder-based investment options | 1.6 | 2.0 |

Rating: Least Appealing (1) to Most Appealing (4).

*Source: T. Rowe Price, 2021 Defined Contribution Consultant Study.

† Source: T. Rowe Price, Retirement Income Plan Sponsor Survey, 2020.

‡ DC plan sponsors were not asked to rate, “Investment that incorporates a partial guarantee,” and DC consultants and advisors were not asked to rate, “Annuity portal (access to out-of-plan annuities).”

The average plan sponsor ratings were narrowly dispersed, ranging from a high of 2.9 (simple systematic withdrawal capability) to a low of 2.0 (bond ladder‑based investment options). The average consultant ratings exhibited a relatively wider range with a top‑ranked score of 3.4 (simple systematic withdrawal) and a low score of 1.6 (bond ladder-based investment options). These results suggest the marketplace lacks conviction around any single retirement income product or feature.

On a positive note, both DC plan sponsors and consultants and advisors identified a simple systematic withdrawal capability as the most appealing retirement income product or feature and bond ladder-based investment options as the least appealing. We were encouraged to see that the results from both groups of respondents were generally consistent.

Non-guaranteed Solutions Viewed as More Appealing

With the caveat that the results of both surveys yielded similar ratings from one retirement income product or feature to the next, we observed generally greater support for non-guaranteed solutions. The top three ranked retirement income products or features for both plan sponsors and consultants do not offer a guarantee. Simple systematic withdrawal capabilities ranked as most appealing, with scores of 2.9 and 3.4 from plan sponsors and consultants, respectively.

Managed Accounts as a Retirement Income Solution

A managed account with an income planning feature captured the second‑highest average rating from consultants and advisors (2.9).

In contrast, managed accounts received an average rating of 2.6 from plan sponsors. We believe the relative enthusiasm expressed in the consultant rating may be due, in part, to the fact that some of these firms are creating proprietary managed account solutions.

That said, we see the broader DC industry’s position on the value of personalization evolving, particularly as participants approach retirement and then throughout retirement. For some participants, decumulation will require a more customized investment solution and personalized experience compared with what sufficed in the accumulation phase, where participants’ needs are generally homogenous.

Some Interest in Using Target Date Investments to Address Retirement Income

Consultants and advisors placed a target date investment with an embedded managed payout feature (non-insured) as the third-ranked most appealing retirement income product or feature (2.6). Plan sponsors also rated a target date investment with an embedded managed payout as relatively appealing (2.7). We interpret these survey results as prioritizing:

- the power of the default to serve as many participants as possible,

- a keen interest in positioning the DC plan to distribute a regular stream of income to retired participants, and

- a greater interest for liquid retirement income solutions than an income guarantee.

Plan sponsor interest in using a target date investment to address retirement income is also evidenced in their rating for a target date with an embedded annuity feature (2.6).

Standalone Annuity Products Generally Ranked Lower in Terms of Appeal

Both the plan sponsor and consultant findings indicate that annuities offered on a standalone basis (i.e., not packaged as part of a target date investment) are generally not identified as appealing relative to other available options. Consultants assigned an average rating of 2.0 for a deferred income annuity or qualified longevity annuity contract and an average rating of 1.8 for an immediate annuity, suggesting a lower level of interest in standalone annuities.

Plan sponsor results express a similar lack of conviction for an in-plan annuity (2.1) or an in-plan deferred income annuity or qualified longevity annuity contract (2.1). Notably, the average plan sponsor rating for an annuity portal, defined as access to out-of-plan annuities, was not higher than in-plan annuity products. We hypothesized that out-of-plan annuities could be considered more appealing by plan sponsors, but the data did not confirm that assumption.

Our Managed Payout Solution

Several years ago, one of our clients came to us seeking to partner on a solution that would help their retired participants convert a lifetime’s worth of savings into a stream of income.

The sponsor had a few specific priorities for this solution:

- Had to be 100% liquid and not locked in

- Needed to be portable

- Needed to be easy to communicate to participants

- Needed to be simple to evaluate and monitor

With these objectives in mind, we collaborated and landed on a managed payout solution that retired participants could opt into. In very simple terms, the managed payout is an additional vintage of the plan’s target date suite and is designed to provide a monthly payment based on a 5% annual withdrawal target (adjusted for investment performance over time, see below). According to plan-specific provisions, this feature is only available to fully vested, terminated or retired participants who have attained age 59½ or older (to avoid penalties). In partnership with our client, the in-plan managed payout investment option was implemented in 2019.

Explaining the Managed Payout Feature

The annual payout amount per unit of investment is based on 5% of the average monthly net asset value (NAV) of the target date trust with the managed payout feature over the trailing five years. We did this to increase the predictability of the year-over-year monthly “paycheck” in retirement and reduce the impact of market volatility on distributions, which—considering the volatile market environment that participants experienced in 2022—is increasingly appealing.

Also, the managed payout was designed to be flexible so that participants can withdraw funds from the target date vintage with the managed payout feature at any time. The amount of monthly payments will automatically adjust based on changes in the number of units owned by the participant.

Why 5%?

The short answer is our research has shown that people generally underspend early in retirement, often out of fear that they will run out of money. Also, when we did our modeling, we concluded that retirees could be well served by spending more than 4%—the conventional rule-of-thumb payout rate—early in retirement when they are most likely to enjoy their golden years fully, as opposed to later when they might not physically be able to cross items off their retirement bucket list. It’s important to note that the payout rate which is based on 5% of the average monthly NAV of the investment over the previous five years is nominal, while the conventional 4% rule is typically adjusted upward every year to account for inflation.

The managed payout follows an endowment model, which means that it can’t go to zero. It is always taking 5% of something. This methodology preserves some cushion for unexpected expenses, which we all know are important to plan for—particularly as we emerge from a global pandemic that exposed the financial fragility of many retirement savers. This methodology also allows for a more predictable payout amount with a smoothing mechanism to account for both upside and downside market volatility. This way, we can balance the need to support a meaningful level of income while taking into consideration the market fluctuation and investor aversion to balance depletion.

Five Key Lessons and Observations

Now, for our third, final, and arguably most informative question: What has T. Rowe Price learned from implementing an in-plan retirement income solution?

(1) It’s a feature, not necessarily a new investment.

In conversations with plan sponsors, the managed payout solution is generally seen as a feature they can “turn on,” as opposed to a separate investment outside of the current suite of retirement date investments that would require more extensive monitoring. This has helped more plan sponsors get comfortable with implementation. In many cases, the response we heard from plan sponsors was along the lines of, “Well, why wouldn’t I make this feature available to my participants?” For plan sponsors who want to help participants convert a lump sum of savings into a predictable “paycheck” in retirement, a managed payout can be a noncontentious place to start, particularly when participant investment in the managed payout option is optional and not enabled by default.

(2) The participant experience is paramount.

The quality of the participant experience is correlated with participant adoption. We spend just as much time on the participant experience and communications as we do on investments.

We have observed the power of participant communications and education crafted to support the retirement income experience. For example, we send communications to participants approaching retirement to educate them on the availability and features of this option for creating an income stream in retirement. These campaigns typically see significantly greater participant engagement compared with nonretirement income‑focused communications.

(3) Retirement income isn’t a top priority for all plans. Is it for yours?

Currently, we have over 30 plan sponsors that have added the managed payout investment option, most of whom decided to do so in 2022. Note that the managed payout capability was introduced to the DC marketplace in 2019, soon before the world was overtaken by the coronavirus pandemic. Understandably, plan sponsor priorities shifted in response, but as we hopefully turn the page on the global pandemic, more plan sponsors are reengaging with us on the possibility of adding an investment option with a managed payout feature to their plans.

(4) Adding a retirement income product or feature will be a slow build.

Participant adoption of the managed payout investment option has been modest and generally in line with our expectations. Generally, any plan investment menu option or feature that is not implemented by default will take time to garner participation and adoption. Based on what we’ve seen in terms of adoption, it might be helpful for plan sponsors to take a stab at defining what success looks like for their committee prior to implementation. This can help level set expectations for participant adoption.

Implementing a retirement income solution is a long-term decision and cannot be productively measured over a short time horizon.

(5) Getting the whole picture is key to success.

We observe many participants—particularly those approaching retirement—engaging with the retirement income estimator that supports the managed payout investment experience. We also offer participants access to a broader retirement income tool that uses data aggregation technology to provide participants the opportunity to add in additional accounts to be able to model a more comprehensive and realistic view of their retirement income. We offer plan sponsors educational campaigns that can be shared with participants to help raise participant awareness around the four potential distribution options they have at separation of service, including staying in plan.

Managed Payouts as a Doable First Step

This paper focuses on a managed payout solution because we view it as a great starting place for plan sponsors to begin their retirement income journey, which will most likely span several years and encompass multiple strategies. As the results from our plan sponsor and consultant surveys demonstrated, it would be folly to think that we can solve for retirement income with a single solution. We are encouraging plan sponsors to consider building a retirement income ecosystem that includes a plan design able to facilitate retirement income “paychecks,” a broad array of investments—which may include personalized and/or insured solutions, as well as access to advice.

“Flipping the Switch” for Retirement Income

As of the writing of this paper, there are 37 plans representing $34.4 billion in assets, of which $11.8 billion is invested in the Retirement Trust suite, that have “flipped the switch” and are allowing participants the opportunity to opt into the managed payout solution.

Important Information

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources’ accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date written and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The T. Rowe Price common trust funds (Trusts) are not mutual funds; rather, the Trusts are operated and maintained so as to qualify for exemption from registration as mutual funds pursuant to Section 3(c)(11) of the Investment Company Act of 1940, as amended. The Trusts are established by T. Rowe Price Trust Company under Maryland banking law, and their units are exempt from registration under the Securities Act of 1933. Investments in the Trusts are not deposits or obligations of, or guaranteed by, the U.S. Government or its agencies or T. Rowe Price Trust Company and are subject to investment risks, including possible loss of principal.

The offering circular contains complete information on a Trust’s objective, investment program, and other information, and plan sponsors should read it carefully before deciding to include such Trust as an investment option for plan participants.

The principal value of the target date strategies are not guaranteed at any time, including at or after the target date, which is the approximate year an investor plans to retire (assumed to be age 65) and likely stop making new investments in the trust. If an investor plans to retire significantly earlier or later than age 65, the trusts may not be an appropriate investment even if the investor is retiring on or near the target date. The trustsʼ allocations among a broad range of underlying T. Rowe Price stock and bond investments will change over time. The trusts emphasize potential capital appreciation during the early phases of retirement asset accumulation, balance the need for appreciation with the need for income as retirement approaches, and focus on supporting an income stream over a long‑term post-retirement withdrawal horizon. The trusts are not designed for a lump‑sum redemption at the target date and do not guarantee a particular level of income. The trusts maintain a substantial allocation to equities both prior to and after the target date, which can result in greater volatility over shorter time horizons.

Diversification cannot assure a profit or protect against loss in a declining market.

T. Rowe Price Trust Company. T. Rowe Price Associates, Inc., investment adviser. T. Rowe Price Trust Company and T. Rowe Price Associates, Inc., are affiliated companies.

© 2023 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/ or apart, trademarks of T. Rowe Price Group, Inc.