March 2024 / INVESTMENT INSIGHTS

Dynamic credit investing: A Q&A With Saurabh Sud

Dynamic Credit’s flexible approach has been pivotal over different market conditions

Key Insights

- Different market environments since 2019 highlight the importance of a strategy that is flexible and has access to differentiated sources of returns.

- The strategy employs a flexible, multi-asset credit approach to source opportunities from our research platform rather than focusing on one asset class.

- Using our full investment toolkit, including duration management and fundamental credit shorts, has been important to navigate multiple credit and interest rates cycles.

Saurabh Sud passed his five-year anniversary as portfolio manager of the Dynamic Credit Strategy. We discuss how he has managed the strategy since its inception in January 2019 through an extraordinary period of volatility for credit investors and fixed income markets. He talks about the successes and the lessons learned, and he describes his investment process and its emphasis on seeking attractive performance through finding diversified sources of credit returns across a broad opportunity set.

How would you describe your first five years as portfolio manager?

Looking over the past five years, I am pleased that we delivered on the strategy’s objectives through what was a quite volatile period, not just for equities but for fixed income more specifically. The composite fared well in each calendar year since its inception, which included two quite challenging market environments in 2020 and more recently in 2022. The coronavirus outbreak in 2020 and the ensuing economic shutdowns presented a trying backdrop for credit markets as liquidity was deeply challenged. Trading in many markets froze—even in normally liquid U.S. Treasuries—and credit spreads rose to levels not seen since the global financial crisis of 2008. Still, through our disciplined investment philosophy that emphasizes flexibility, we managed through the volatility and benefited from the ensuing sharp rebound in credit throughout the rest of 2020.

Later in 2022, the unprecedented pace and magnitude of rate hikes from the Federal Reserve (and other global central banks) led to significant losses across all fixed income sectors as bond yields surged and credit spreads widened. Even in this difficult rate environment, the composite was successful in its aim to provide downside support during times of market volatility and held up well relative to global aggregate bond and individual credit indices, which posted double-digit losses in calendar year 2022. While calendar year performance has been more challenged recently as the strategy’s cash-like benchmark has performed well on the back of strong demand, we believe the composite has performed as intended to benefit from the upsides of the fixed income credit markets while avoiding some of the downsides over a full market cycle.

We accomplished this by making full use of our investment toolkit, specifically going short duration in advance of a global interest rate hiking cycle and using our fundamental platform to generate short credit ideas that we believed could support on the downside.

While the past five years have posed the proverbial “trial by fire” for a credit-centric strategy, I think our performance speaks to the importance of our investment process and our team-oriented approach. Often, volatility can create investment opportunities, and I believe the vastly changing market backdrops since 2019 highlight the importance of a strategy that is flexible and aims to leverage the resources of our global fixed income platform to identify and invest in dislocated opportunities across all credit sectors.

The strategy’s repeatable process relies heavily on our global research platform of more than 300 people1—who collaborate across investment strategies, asset classes, and geographies—and flexibility across sectors has been important as markets changed since the inception of the strategy:

- As liquidity improved after the initial COVID-related sell-off, we targeted dislocations in investment-grade corporates. After spreads meaningfully improved, we then moved to sectors that were still dislocated but showed potential for improvement, such as high yield corporates, emerging market corporates, and convertibles.

- More recently, the representative portfolio increased allocations to sectors that typically respond positively to rising rate environments, specifically bank loans and securitized credit.

- At the end of 2023, we leaned in more to credit risk where we saw opportunities, but we remained vigilant with valuations at fair levels.

How would you describe your investment process and style?

The Dynamic Credit Strategy employs a flexible, cross‐sector approach to source opportunities from our global research platform. Rather than narrowly focusing on a specific asset class such as investment‑grade debt or emerging market bonds, this strategy can invest across all credit subsectors and instruments—including traditional bonds and synthetic securities like derivatives—in aiming to take advantage of pricing dislocations, liquidity advantages between derivatives and cash bonds, and compelling yield opportunities wherever they manifest.

The strategy’s alpha-seeking but risk‑aware approach is suitable for a range of market conditions. We believe that our fundamental credit analysis process that generates forward-looking insights from a global research platform with broad sector expertise can help us identify and capitalize on inefficiencies ahead of the market.

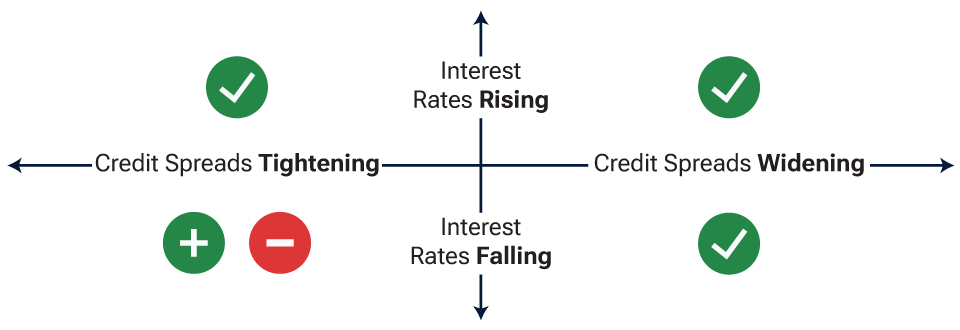

Many beta-centric credit allocations have tended to perform well in benign spread and rate environments while overlooking other market environments. As illustrated in Figure 1, the representative portfolio’s lower credit beta profile should allow it to hold up well in environments where credit spreads are widening, while its active duration management approach should be able to defend in rising interest rate environments. This framework was developed with a forward-looking view when the strategy was developed, and it has lived through all four quadrants since its inception.

Credit exposure through multiple environments

(Fig. 1) Striving for more flexible, alpha-oriented outcomes

Source: T. Rowe Price.

Green icons represent expected outperformance versus credit beta; red icon represents expected underperformance. For illustrative purposes only.

The expected performance for the Dynamic Credit Strategy is relative to alternative credit indices, such as investment-grade corporates, high yield corporates, or emerging market bonds. Market environments and expected performance are based on the general strategy structure but are not based on actual performance nor intended as forward-looking performance projections. As with any investment, performance may vary and is subject to potential loss. Actual performance may differ significantly.

The representative portfolio targets low correlation to equities and the traditional credit asset class. The value of the strategy’s focus on finding investment ideas with low correlations to traditional credit sectors is intended to help limit losses when markets decline. However, this is not just a downside mitigation strategy. We pursue solid upside capture while limiting downside capture over the long-term. As such, we believe the strategy can be utilized as a complement to investors’ current exposure to credit and fixed income to help diversify credit return streams. We believe that our approach to portfolio construction makes the strategy a compelling and consistent credit allocation, and its differentiated historical returns should also enable it to pair well with other credit allocations.

What makes Dynamic Credit different from other fixed income strategies at T. Rowe Price Associates, Inc. (TRPA)?

This question comes up often on how I differentiate the portfolio from other credit-focused investment strategies at TRPA when they draw from the same credit rating and conviction recommendations from our global research platform. The answer is that my approach is different. I apply a different filter and portfolio construction framework on top of our bottom-up analyst recommendations.

When collaborating with our analysts and credit sector experts—through informal and formal meetings on a daily, weekly, and monthly basis—and evaluating individual credits for potential portfolio inclusion as either long or short positions, I ask three key questions:

- Is there a catalyst that could cause the credit to outperform? Depending on the type of credit, this could be a range of factors, such as a potential credit rating upgrade or downgrade for a corporate credit. For consumer‑dependent credit like an asset-backed security (ABS) backed by auto loans, it could be an upturn in consumer payment trends.

- Is the position positively or negatively correlated with the performance of existing portfolio holdings? A meaningful negative correlation could indicate that the new position can provide diversification benefits by gaining when other exposures lose value.

- What is the asymmetry of the return profile? Essentially, will the price benefit more from a positive development than it suffers from a negative outcome—or vice versa? This can affect how a holding would fit into the representative portfolio’s overall positioning in terms of sizing, diversification, and potential alpha generation.

In addition to addressing these three factors, our investment process tries to ensure that we can get a premium for each position’s embedded credit beta, volatility, and liquidity. Our dynamic, flexible, and alpha-oriented approach enabled us to deliver differentiated performance in challenging markets. For example, in 2022, many credit bonds were not offering enough compensation for the interest rate volatility early in the year and helped us avoid drawdowns in those situations.

What have been your biggest investment successes? What have been your mistakes, and what lessons have you learned?

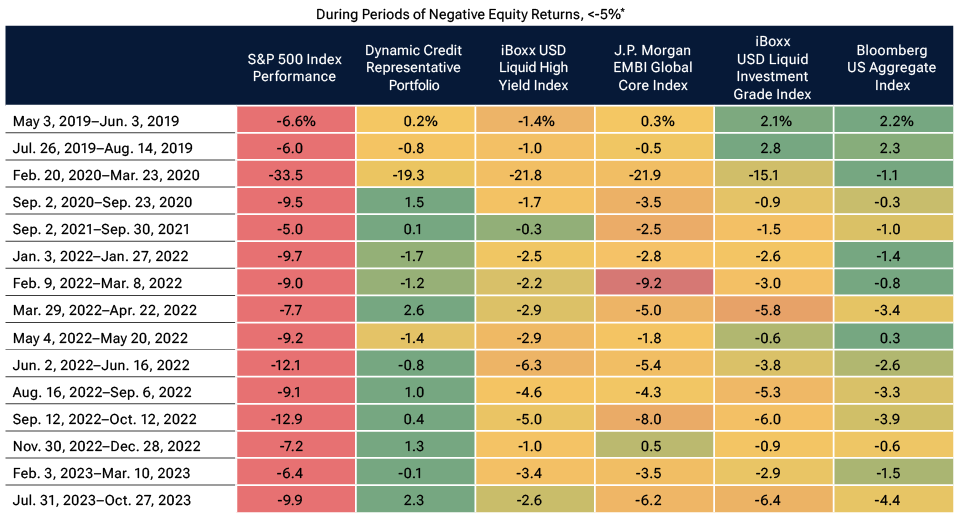

I think one of the most demonstrative successes for the strategy so far has been our performance during periods of significant weakness for riskier asset classes such as equities as shown in Figure 2.

Performance under stressed market periods

(Fig. 2) Dynamic credit held up well during equity drawdowns

Return Analysis—Dynamic Credit Representative Portfolio

NET OF FEES—CUMULATIVE RETURNS

As of December 31, 2023.

Past performance is not a reliable indicator of future performance. Please see the end of the paper for additional information on the Representative Portfolio. Please see the GIPS® Composite Report for additional information on the composite.

Figures are shown in U.S. dollars. Performance figures are shown net of fees. The representative portfolio’s 1-year and since inception annualized returns, net of the highest applicable fee, were 4.22%, and 3.93% as of 31 December 2023.

* Periods selected represent accelerated negative moves greater than 5% in the S&P 500 Index (total return) where equity markets have fallen meaningfully in a short period of time (i.e., below 60 trading days). Shading in table ranks the performance of each category during each drawdown period.

Source: © 2024 Refinitiv. All rights reserved. Indexes shown represent beta credit returns and are benchmarks used by ETFs representing the Strategy’s Multi-Asset Credit – Long Exposure components: High Yield Bond, Emerging Market Bond, US Investment Grade Index and Bloomberg US Aggregate Bond Index, respectively. The ETF benchmarks are shown for illustrative purposes to demonstrate how each of the different sectors performed for the period when looking at passive indexes (peer proxies).

Starting with the representative portfolio inception, we’ve analyzed drawdown periods for equity markets using the S&P 500 as a proxy. We then compared the performance of the representative portfolio relative to major credit and fixed income indices, and Dynamic Credit fared well during most of these periods and points to our emphasis on seeking attractive returns through up and down markets.

Moreover, I believe leveraging the strategy’s full toolkit—including long credit exposures, duration management, and active credit shorting—has been instrumental in its success through turbulent markets. To that point, one of the missteps in my time as portfolio manager happened in the second quarter of 2023, where we increased duration, believing that global central banks were at or near the end of tightening monetary policy. That move turned out to be premature as global rates continued to march higher and central banks maintained restrictive policy to combat stubbornly high inflation. However, the strategy’s flexibility allowed us to quickly move back to a negative duration position on an absolute basis. While the timing was not always right, our willingness and ability to make full use of duration management has helped dampen volatility and capture some upside in rising rate environments that are broadly deflating for fixed income.

Flexibility was important in 2020 as well. We underappreciated the impact that the coronavirus would have on global markets and global monetary policy by prematurely adding risk. As this macro view proved to be incorrect, our disciplined risk process allowed us to pivot away from this stance and be able to benefit from the sharp rebound in markets. While we experienced a sharp drawdown, we still outperformed high yield and emerging markets during the late February to late March 2020 drawdown period as seen in Figure 2 and finished the year with positive returns. As the strategy has matured since then, we have continued to implement and leverage our risk process and collaborate closely with other members of the fixed income platform.

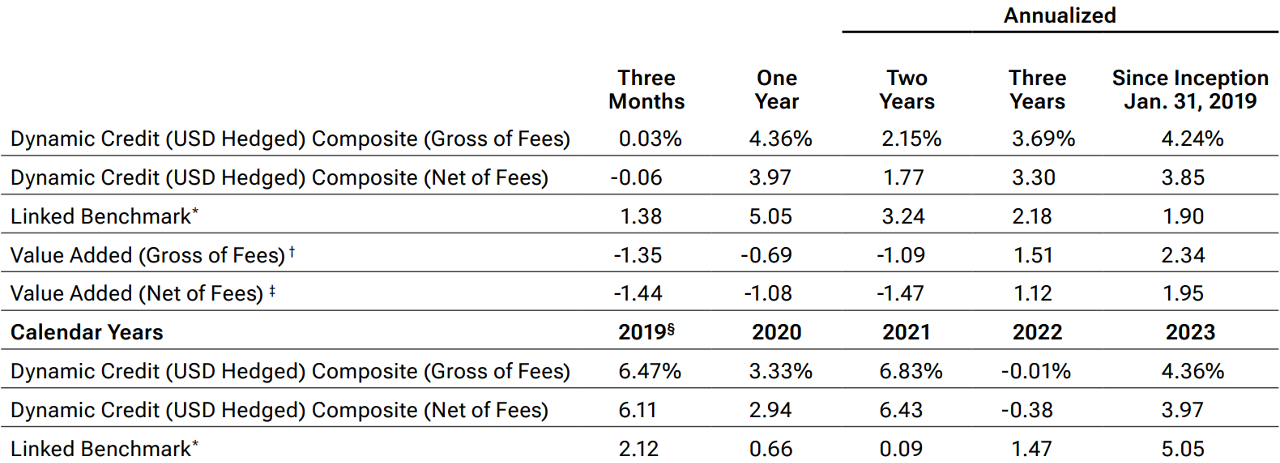

Performance Table

Dynamic Credit (USD Hedged) Composite

Past performance is not a reliable indicator of future performance.

Gross performance returns are presented before management and all other fees, where applicable, but after trading expenses. Net-of-fees performance reflects the deduction of the highest applicable management fee that would be charged based on the fee schedule contained within this material, without the benefit of breakpoints. Gross and net performance returns reflect the reinvestment of dividends and are net of all non-reclaimable withholding taxes on dividends, interest income, and capital gains.

* Effective 1 May 2021, the benchmark for the composite changed to ICE BofA US 3-Month Treasury Bill Index. Prior to May 1, 2021, the benchmark was the 3 Month LIBOR in USD Index. Historical benchmark representations have not been restated.

† The Value Added row is shown as Dynamic Credit (USD Hedged) Composite (Gross of Fees) minus the benchmark in the previous row.

‡ The Value Added row is shown as Dynamic Credit (USD Hedged) Composite (Net of Fees) minus the benchmark in the previous row.

§ Since Inception January 31, 2019 through December 31, 2019.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

April 2024 / INVESTMENT INSIGHTS