April 2023 / INVESTMENT INSIGHTS

China Evolution Equity: Unique Exposure to the China Opportunity Set

The Chinese economy is rich, deep and wide-ranging

China Evolution Equity: Unique exposure to the China opportunity set

China is an economy that has been undergoing unprecedented change, a dynamic that has helped foster an abundant investment landscape.

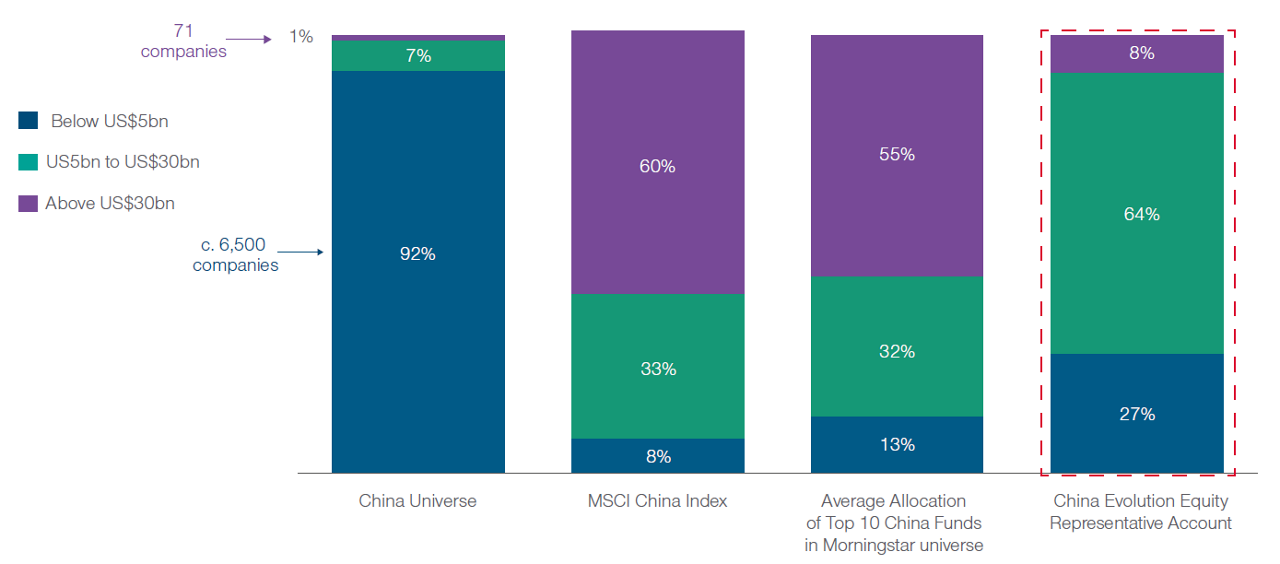

Yet, while China is a large and liquid market, it remains largely under-researched and under-owned, offering exciting opportunities for skilled, active investors. Indeed, the majority of portfolios accessing China stock markets typically limit their exposure to the well-understood and well-owned mega caps (see Why there’s more to China than just Big Tech). Think the likes of Tencent, Alibaba, Baidu, and China Mobile, for example. While many of the mega caps have been extremely successful and can argue a strong investment case for future growth, we believe investors can diversify their portfolio and optimise their investment return by looking beyond this small group of names.

A strategy that looks beyond the index

The T. Rowe Price China Evolution Equity Strategy has been designed to do just that – seeking to exploit inefficiencies across the full spectrum of Chinese markets (both onshore and offshore) to find the best risk-reward opportunities.

We focus on areas of the market that may be overlooked by some investors, going beyond the 100 largest companies by market cap – that dominate the index and are commonly seen in other China portfolios – to identify future winners and mispriced opportunities from across the expanding universe of some 6,500 names or more.

Local expertise in unexplored markets

Fig. 1 China’s opportunity set is much more that the mega caps

Market cap breakdown by stock count (%), as at 31 December 2022.

Sources: MSCI, HKex, FactSet, Wind, Morningstar. Financial data and analytics provider FactSet. Copyright 2023 FactSet. All Rights Reserved.

* The Top 10 China funds refer to the funds in the Morningstar China Equity universe, measured by AUM.The representative portfolio is an account in the composite we believe most closely reflects current portfolio management style for the strategy. Performance isnot a consideration in the selection of the representative portfolio. The characteristics of the representative portfolio shown may differ from those of other accountsin the strategy. Please see the GIPS® Composite Report for additional information on the composite. Please see Additional Disclosures for information about thisMSCI and Morningstar information.

Finding such successful companies across China’s diverse and expanding universe is critically dependent on robust local research and understanding. T. Rowe Price has a long history of investing in China, and we were early investors in A-shares through the QFII and Stock Connect programs. We currently manage assets totalling over US$17 billion in Chinese equities for our clients (as at 31 December 2022).

With a local investment team in Asia since 1987, and having more recently established an office in Shanghai, we have been able to accumulate extensive local knowledge and build long-term relationships with companies, suppliers, competitors and industry experts. All essential to our fundamental, bottom‑up research designed to seek out the best risk-reward opportunities.

Today, we have one of the industry’s strongest in‑house research teams dedicated to the Asia region and specifically to China. Portfolio manager, Wenli Zheng, has been investing in China since 2010. He works closely with a team of over 20 local, on-the-ground analysts in Asia focused solely on opportunities in China. He is further supported by our emerging market debt analysts, ESG specialist teams and over 100 sector and regional specialists who provide a broader perspective on what is happening globally and help evaluate the potential impact for companies in China.

The stability of our research team, strong collaboration and continuous exchange of information between the portfolio manager, our native Chinese analysts and the broader global platform are the key to finding and understanding the companies we believe are best positioned to prosper in an evolving economy like China.

Unique exposure to China’s future growth

The team focuses on identifying outlier companies, beyond the widely owned mega‑cap stocks – that small percentage of exceptional companies which drive the majority of market returns (link to China: Why it pays to look for the overlooked). Currently, this typically means investing in companies with a market capitalisation below US$30 billion at purchase (although we are not compelled to sell should a stock go above this threshold provided the investment thesis remains intact). But these are not necessarily small or mid-sized companies, most are still sizeable, multi-billion dollar companies – established, robust businesses with good liquidity in their shares.

The businesses we seek to find tend to fall into one of three buckets:

Compounders

These are long-term core holdings, typically innovative, scalable businesses in large, changing markets run by strong management teams that potentially offer durable growth that can compound over multiple years.

Nonlinear growers

Chosen for their potential for medium-term outsized returns, these are companies with accelerating growth from a new product cycle, a change in the industry cycle, or transition from an investment cycle to a harvest cycle – step-changes in growth often missed or underappreciated by the market.

Special situations

These are companies with an asymmetric risk-reward profile; mispricing opportunities driven by transitory and fixable issues, resulting from short-term pressures such as forced selling, restructuring, weak sentiment, macro concerns or misunderstood business models.

In addition, the China Evolution Equity Strategy uses ESG integration as part of its investment process. This means incorporating environmental, social, and governance (ESG) factors to enhance investment decisions. Our philosophy is that ESG factors are a component of the investment decision, meaning that they are not considered separately from traditional fundamental analysis.

A differentiated and complementary portfolio

By targeting those stocks which are overlooked and under owned, our China Evolution Equity Strategy is incredibly different from both its benchmark and its peers. With an active share of 90%+, the portfolio of 40-80 stocks is primarily driven by idiosyncratic factors which typically exhibit a low correlation to macro influences.

We are unconstrained by index, style or sector with the portfolio largely driven by bottom-up considerations where we believe we have unique insights beyond the consensus names. We think that China market returns (and, therefore, by default many investor portfolios) are too heavily concentrated on the internet sector, whereas we seek to provide a very differentiated source of alpha generation with contributors to performance coming from all types of sectors, ranging from traditional industrials to innovative enablers of the green transition. The result is a portfolio that, in our view, is very different from both the MSCI China Index and our peers, and that can thereby complement most investors’ existing China exposure. A portfolio that, we believe, stands out from the crowd.

Please contact us for more information on our China Evolution Equity Strategy and how we can help.

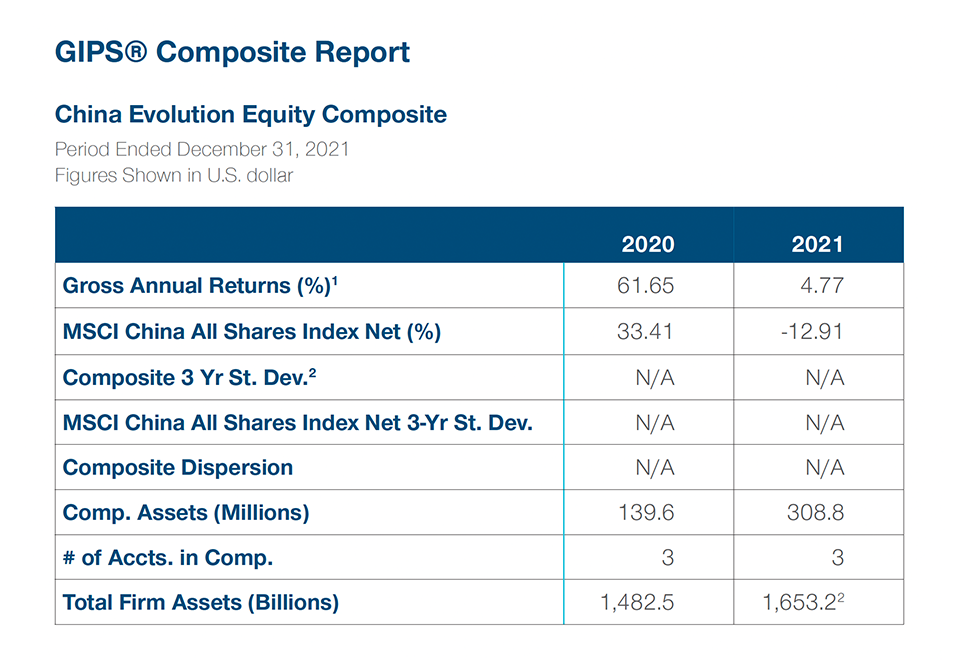

1 Reflects deduction of highest applicable fee schedule without benefit of breakpoints. Investment return and principal value will vary. Past performance is not a reliable indicator of future

performance. Monthly composite performance is available upon request. See below for further information related to net of fee calculations.

2 Three-year annualized ex-post standard deviation is not presented because 36 monthly returns are not available.

3 Preliminary - subject to adjustment.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

April 2023 / INVESTMENT INSIGHTS