May 2023 / INVESTMENT INSIGHTS

Raising the Debt Ceiling Could Pressure Bank Funding

But cash squeeze may force the Fed to halt quantitative tightening

Key Insights

- Treasury will need to issue a wave of debt to refill the U.S. government’s coffers, which could mean that banks must address additional funding pressures.

- We also see the potential for a liquidity crunch that might prompt the Federal Reserve to end efforts to shrink its balance sheet.

- The end of quantitative tightening would remove a headwind for asset prices, but the path to this outcome likely would be fraught with volatility.

What could happen after U.S. political leaders resolve the latest debt limit crisis?

The Treasury will need to issue a significant amount of debt to refill the government’s coffers. There are a lot of moving parts, but this development may force banks to address additional funding pressures this year. We also see the potential for a liquidity crunch that might prompt the Federal Reserve to end efforts to shrink its balance sheet.

Let’s explore these dynamics and what we think they could mean for investors.

Liquidity and How the Fed’s Balance Sheet Has Evolved During Quantitative Tightening

During the coronavirus pandemic, the Fed sought to support the economy and lower long-term interest rates by purchasing financial assets. This quantitative easing swelled the assets on the central bank’s balance sheet to about USD 9 trillion.

The Fed began to shrink its balance sheet in June 2022 by allowing some of the Treasury bonds and mortgage-backed securities that it had accumulated to mature without reinvesting the proceeds. This quantitative tightening (QT) is another mechanism—along with hiking interest rates—that the Fed is using in its efforts to bring inflation to heel.

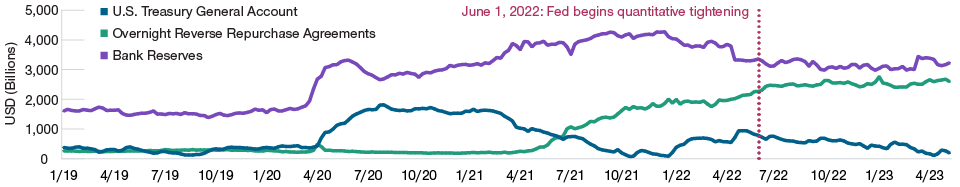

Asset runoffs must be matched by a corresponding decline in the Fed’s liabilities. However, QT so far has affected each of the central bank’s main liability accounts differently (Fig. 1). Here’s a rundown:

- Bank reserves are deposits that commercial banks hold at the Fed and generate interest. To take advantage of higher yields, some bank customers have moved their money from deposit accounts to money market funds. Banks have covered these deposit outflows by drawing down their reserves at the Fed.

- The overnight reverse repurchase program (ON RRP) allows the Fed to borrow cash, secured by Treasuries held in its portfolio. In effect, sellers are parking cash at the Fed, with the higher repurchase price serving as an interest rate on the loan. Money market funds have been especially active in this program, which pulls money from the banking system.

- The Treasury general account (TGA) essentially functions as the U.S. government’s checking account for paying its bills. To avoid breaching the debt ceiling, the Treasury has been withdrawing funds from the TGA instead of issuing new debt. TGA spending typically adds liquidity to the banking system because the balances often end up in the accounts of consumers, businesses, and municipalities.

Bottom Line: QT has pulled reserves from the banking system. However, Treasury spending from the TGA likely moderated some of this drain. Reversing this temporary source of liquidity once the debt ceiling dispute is resolved would expose commercial banks to the weight of quantitative tightening.

Rebuilding the TGA Could Exacerbate the Strain on Bank Reserves

After the debt ceiling has been raised or suspended, the Treasury will need to issue new debt to replenish the TGA and meet budgetary requirements. We believe this flood of new securities has the potential to further drain bank reserves.

How the Liability Side of the Fed’s Balance Sheet Has Evolved

(Fig. 1) The effects of quantitative tightening and the debt limit

As of May 12, 2023.

Source: Federal Reserve via FactSet.

On May 1, the Treasury estimated that it would need to market a total of more than USD 1.4 trillion worth of debt across the second and third quarters of 2023—a level of issuance that would be second only to federal borrowing during the coronavirus pandemic.

To keep the Fed’s assets and liabilities in balance, a meaningful increase in the TGA would have to be offset by reductions in either the ON RRP or bank reserves. The Fed has less control over the liability side of its balance sheet, which could complicate the job of managing the impact of a surge in Treasury debt issuance.

History suggests that as much as 80% of the balance sheet adjustment needed to offset a TGA increase of the size contemplated could come from a reduction in bank reserves.

We believe the share coming from bank reserves is likely to be lower this time, with the exact amount depending on allocation decisions by money market funds. Managers of these funds are unlikely to buy Treasury bills that yield less than the equivalent yields available from the ON RRP unless they have a high degree of confidence that the Fed will cut interest rates soon.

In this scenario, we think marginal buyers, such as diversified bond funds, could step into the breach to purchase Treasuries. Importantly, these investments would be paid for out of institutional bank accounts and, thus, would tend to reduce reserve balances held at the Fed.

Key Implications for the U.S. Banking Industry, Economy, and Markets

The U.S. banking industry has already faced its fair share of challenges this year, with large shifts in deposits taking place:

- from regional banks seen vulnerable to the perceived safety of larger institutions,

- from uninsured deposits to FDIC‑insured accounts, and

- from the banking system to money market funds offering higher yields.

Further funding stress from the coming wave of Treasury issuance may prompt banks to tap increasingly expensive sources of liquidity, such as by offering higher-rate certificates of deposit (CDs). Higher funding costs, in turn, could erode bank earnings, potentially prompting them to tighten credit standards and rein in lending if they don’t see strong opportunities to make loans.

We also see a potential risk that reserve outflows could reach levels that jeopardize the functioning of short-term funding markets, creating the possibility that the Fed might halt efforts to shrink its balance sheet in the back half of 2023. Although the end of QT would remove a headwind for asset prices, the path to this outcome likely would be fraught with volatility.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.