June 2023 / INVESTMENT INSIGHTS

Four Themes Shaping Global High Yield Bonds

Opportunities to generate value amid volatility

Key Insights

- Global high yield bonds offer potentially attractive yields, with better value and opportunities in Europe.

- Default rates are not expected to return to peaks of the past, even if we enter an economic downturn, given strong corporate balance sheets.

- We believe the asset class is well positioned to navigate volatility as credit concerns potentially gain momentum.

Global high yield bonds continue to look attractive given robust corporate fundamentals and yields that are around their highest levels in many years. Corporate balance sheets are relatively healthy as many companies secured low‑cost funding in 2020 and 2021, and this could help keep default rates low this year despite economic growth slowing. The need for new issuance in 2023 is likely to be low, which is also supportive. These factors should sustain the asset class despite the potential for volatility driven by sticky inflation, slowing growth, and banking sector worries.

Here, we delve into four key themes shaping activity and performance in the global high yield credit space.

Four Themes Shaping Global High Yield Markets

Finding opportunities amid volatility

As of April 30, 2023.

Source: T. Rowe Price

1. Attractive Yields

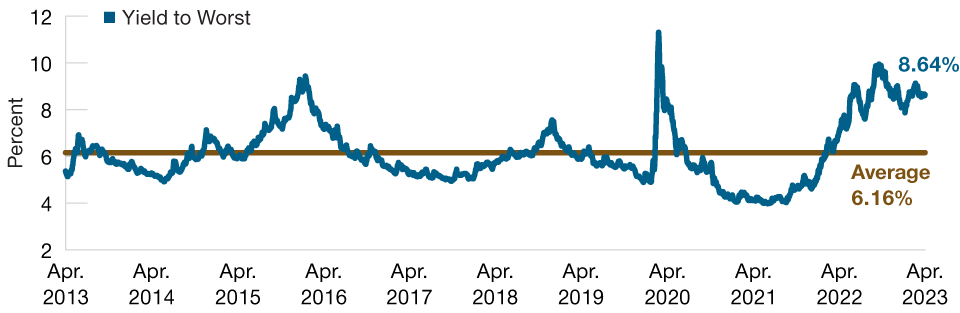

The sharp rise in government bond yields in 2022 propelled yields on global high yield corporate bonds materially higher, reaching almost 10% last October. Although yields are off the highs, we believe they remain compelling, with the yield in the asset class currently above 8%1—a level rarely seen in the past decade, as demonstrated in Figure 1.

Today's Yields Have Rarely Been Observed Over the Last 10 Years

(Fig. 1) Yield to worst of global high yield since April 2013

As of April 30, 2023.

Past performance is not a reliable indicator of future performance.

Global high yield market represented by the ICE BofA Global High Yield Index.

Source: ICE BofA (see Additional Disclosure).

Attractive income opportunities are available for investors with an appropriate investment time horizon. In particular, we see discounted bonds benefiting from a pull to par (their original face value) as they get closer to maturity, providing potential capital appreciation opportunities. Though low, the duration aspect of high yield bonds may also provide some diversification as central banks near the end of their tightening cycles.

By region, we see value in Europe at present despite its challenging growth outlook. European high yield bonds have underperformed U.S. high yield bonds in the last two years and are, therefore, priced cheap considering their higher‑quality composition and lower exposure to cyclical markets such as commodities. Furthermore, Europe’s market is younger and less mature than the U.S. market, meaning it potentially offers more opportunities for price and information discovery.

2. Balance Sheets Look Healthy

Companies are underpinned by robust fundamentals at present. Cash ratios (a measure of liquidity that shows a company’s ability to cover its short‑term obligations) remain strong, while leverage ratios (which show how much of a company’s capital comes from debt) are relatively low. As a result, corporate balance sheets are generally in a relatively healthy state, which should help keep defaults low this year. It’s also important to remember that companies tend to have debt with varying maturities spread over multiple years, so the impact of the rise in interest rates is not immediate—it’s smoothed out over time.

Looking further ahead, we are mindful that slowing growth could impact businesses and weigh on profit margins later this year and into 2024. Therefore, it’s possible that fundamentals may start to deteriorate, but it’s important to remember that the starting point is from a position of strength. Overall, we feel that defensive sectors, including less cyclical health care companies, and sectors like European telecoms will likely fare better in a weaker growth environment.

3. Lack of Supply and Strong Demand Likely to Persist

We expect technical factors to remain supportive. Many high yield companies took advantage of attractive funding conditions in 2020 and 2021 to push out their maturity profiles further in time, with the bulk of maturities coming after 2025. Therefore, most companies do not need to issue new bonds or refinance this year, creating a lack of supply on the primary market. With high cash levels on balance sheets and limited new issuance, we expect the select few that come to market to be met with strong demand, particularly amid elevated cash flow.

4. Volatility Remains a Challenge

It’s important to be mindful that the asset class is likely to experience volatility. Markets and investors are currently grappling with several challenges, including stubbornly high inflation, slowing economic growth, and banking sector concerns. We expect that the balance of risks will start to shift, however, from macro concerns to credit volatility as slowing growth is likely to put pressure on company profit margins. Against this backdrop, security selection is imperative.

Overall, volatility is to be expected in the months ahead, but the asset class is well positioned to navigate it, in our view. We believe there remain ample opportunities to generate value and capitalize on the attractive all‑in yields, but security selection is crucial.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.