November 2022 / ASSET ALLOCATION VIEWPOINT

Markets May Need More Than a Fed Pivot to Cure Woes

For sustained gains, markets need a Fed pivot and positive outlook

Key Insights

- Each stock market rally this year has fizzled to new market lows, but many investors hope that a Fed pivot could lead to sustained gains.

- We believe that a shift to a constructive economic outlook, in addition to a Fed pivot, would likely be more supportive for financial markets.

Investors have been disappointed this year as financial markets have reversed course after each rally and resumed a painful march downward to new lows (Figure 1). Overall, market sell‑offs have primarily coincided with the U.S. Federal Reserve’s decisions to raise interest rates, and many believe that a sustainable rally could ensue once the Fed stops hiking and starts cutting rates, typically known as a Fed pivot.

So Far, Markets Have Fizzled After Each Rally

(Fig. 1) Periods of positive returns have been short‑lived, with pullbacks to newmarket lows

Past performance is not a reliable indicator of future performance.

Year‑to‑date as of October 25, 2022.

Sources: S&P indices. See Additional Disclosures.

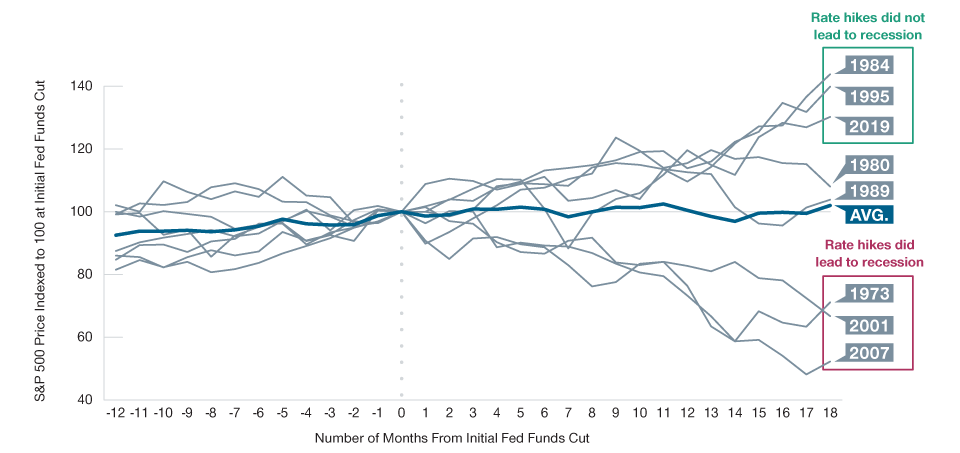

Since 1970, there have been eight instances when the Fed shifted from a hawkish to a more dovish policy stance, and stock market performance after these policy shifts has been mixed (Figure 2). Fed pivots in the mid‑1980s and mid‑1990s were accompanied by market gains as the economy remained strong enough, despite some signs of weakness, to avoid a recession.

Historical Fed Pivots* Have Yielded Mixed Results

(Fig. 2) When Fed hikes caused a recession, a sustained stock market rally was unlikely

Past performance is not a reliable indicator of future performance. Results for other time periods may differ.

January 1970 to September 2022.

Sources: T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. S&P indices and Bloomberg Finance, L.P. See AdditionalDisclosures.

*The Fed pivot is determined to have occurred in the month where the Fed funds target rate decreases from the highest rate recorded in a 2‑year period, with atleast 100 basis points of rate increases.

Meanwhile, shifts in monetary policy did not help financial markets prior to the global financial crisis in the late 2000s or in the early 1970s, when inflation measured by the widely used consumer price index surged to 12%. In these instances, the stock market did not rally until the economy was poised for a rebound from recession.

Notably, our analysis showed that when Fed hikes caused a sharp slowdown in economic activity that led to a recession, financial markets performed poorly, even after a Fed pivot. However, when the rate hikes did not cause a recession—often referred to as a “soft landing”—stock markets rallied after the pivot.

In our view, a Fed pivot may not be the cure for the current market woes. Ultimately, we believe a shift to a more constructive global economic outlook, in addition to a change in monetary policy, would likely be more supportive for financial markets. As a result, our Asset Allocation Committee remains cautious and is maintaining an underweight allocation to stocks relative to bonds.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

November 2022 / MARKETS & ECONOMY

November 2022 / INVESTMENT INSIGHTS