April 2022 / SEARCH FOR YIELD

Balancing Yield With Portfolio Stability

Understanding an asset’s growth and defensive qualities is key

Key Insights

- When making asset allocation decisions, we look beyond asset class labels and classify assets as either a growth component or a defensive component.

- Some corporate bonds have been highly correlated with equities in recent years and, therefore, function more as “growth” rather than “defensive” assets.

- In the current environment, we would suggest considering inflation-linked bonds, as well as active strategies with a wide toolkit.

Investors typically have several objectives when constructing multi‑asset portfolios, which may include delivering a targeted income, generating capital gains, and avoiding large drawdowns. The problem is, some of these objectives may conflict. For example, allocations to equities and higher‑yielding assets often play a key role in delivering growth and yield outcomes—however, allocating solely to such assets is unlikely to deliver a stable portfolio in volatile markets.

In this, the second in a series of articles on the search for yield, we focus on how understanding the difference between growth and defensive assets within fixed income can ensure that your bond portfolio is delivering on other objectives, such as diversification, as well as providing yield.

Not All Bonds Provide Diversification

(Fig. 1) Some corporate debt moves in tandem with equities

As of February 28, 2022.

Past performance is not a reliable indicator of future performance.

Source: Bloomberg Finance L.P. Analysis by T. Rowe Price.

Global Aggregate: Bloomberg Global Aggregate hedged to EUR, Global Investment Grade (IG): Bloomberg Global Aggregate Corporate hedged to EUR, Global High Yield (HY): Bloomberg Global High Yield hedged to EUR, Emerging Market Debt (EMD) Hard Currency (HC): Bloomberg EM Hard Currency Aggregate hedged to EUR.

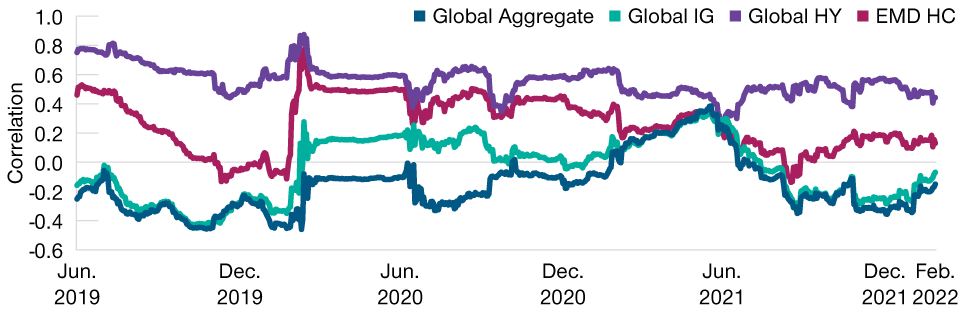

High Yield Debt Has Been Highly Correlated With Equities

(Fig. 2) This is particularly apparent during periods of turbulence

As of February 28, 2022.

Past performance is not a reliable indicator of future performance.

Source: Bloomberg Finance L.P. Analysis by T. Rowe Price.

Global Equities: MSCI ACWI in EUR, Global Aggregate: Bloomberg Global Aggregate hedged to EUR, Global IG: Bloomberg Global Aggregate Corporate hedged to EUR, Global HY: Bloomberg Global High Yield hedged to EUR, EMD HC: Bloomberg EM Hard Currency Aggregate hedged to EUR.

When making asset allocation decisions, we believe it is useful to look beyond asset class labels such as “equities” or “fixed income.” For this reason, we use a component‑based approach to building multi‑asset portfolios that examines the outcomes and characteristics of assets. This approach classifies assets as either a growth component with growth characteristics or a defensive component with proven ability to provide stability in periods of market volatility. We believe that this makes it less likely that diversification disappears in periods when it is most required—in turbulent spells of market stress.

Although the yield on fixed income assets has generally increased from the lows seen during the COVID‑19 pandemic, they remain low relative to much of history, particularly for high‑quality government bonds. For investors looking to generate a regular income, this makes investing elsewhere in the fixed income universe more attractive. The only issue with such a strategy is that holdings such as corporate bonds, high yield, and emerging market debt are more heavily exposed to the economic and market cycle and, hence, are better classified as growth‑oriented assets. Through this lens, we observe a greater bias toward growth assets for the typical multi‑asset portfolio than may be immediately obvious at first glance.

For example, global aggregate bonds, which we view as a safe haven asset, tended to have low positive or negative correlation with global equities over the past few years. Other forms of fixed income, however, were more likely to move in the same direction as equity markets—particularly during the pandemic crisis period of early 2020 (Figure 1). Even the correlations of investment‑grade corporate credit with equities spiked as investors sought out only the safest havens and the values of risky assets plummeted. However, as sentiment improved from the second quarter of 2020 onward, assets such as high yield and emerging market debt rebounded sharply.

High yield debt offers perhaps the clearest example of how the search for yield can impact portfolio stability (Figure 2). Although it is classified as fixed income, the asset is highly exposed to economic conditions and sentiment and has tended to move in a similar way to equity markets. Expecting diversification from high yield in times of equity market turbulence is likely to lead only to disappointment. Put simply, you cannot diversify equity risk by holding high yield bonds.

In the current environment, where fears over persistent inflation and central bank responses to it are at the forefront of investors’ thinking, it may be that high‑quality fixed income is less attractive as a diversifying asset. We would suggest considering inflation‑linked government bonds, as well as active strategies with a wide toolkit and a proven ability to add value in turbulent markets, against this background. Active returns—or alpha—have imperfect correlations with market returns and may, therefore, add to the diversification of portfolios.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.