April 2022 / INVESTMENT INSIGHTS

Asset Allocation in the Era of High Inflation

Responding to changing growth and inflation dynamics

Key Insights

- Inflation is one of the biggest risks facing investors in 2022, made worse by the surge in energy and commodity prices that followed Russia’s war on Ukraine.

- In this study we looked at which asset classes can be used to hedge against inflation, based on monthly historical data from September 1976 to December 2021.

- We provide some guidelines as to how investors could tactically adjust their portfolio asset allocation in response to changing growth and inflation dynamics.

Inflation is one of the biggest risks facing investors in 2022. The risk has increased after the surge in energy and commodity prices that followed Russia’s invasion of Ukraine and the subsequent sanctions against Russia. In the U.S., consumer price inflation rose in February to 7.9%—its highest rate in 40 years—with increases in food, rent, airfares, apparel, and many other items. Inflation is also headline news in other developed countries, posing severe challenges to the ultra-accommodative monetary policies of central banks. Whether high inflation is transitory or permanent has been a hotly debated topic. What is certain is that the short-term outlook has been made worse by the spike in commodities, and inflation is likely to remain elevated relative to pre-pandemic levels for an extended period.

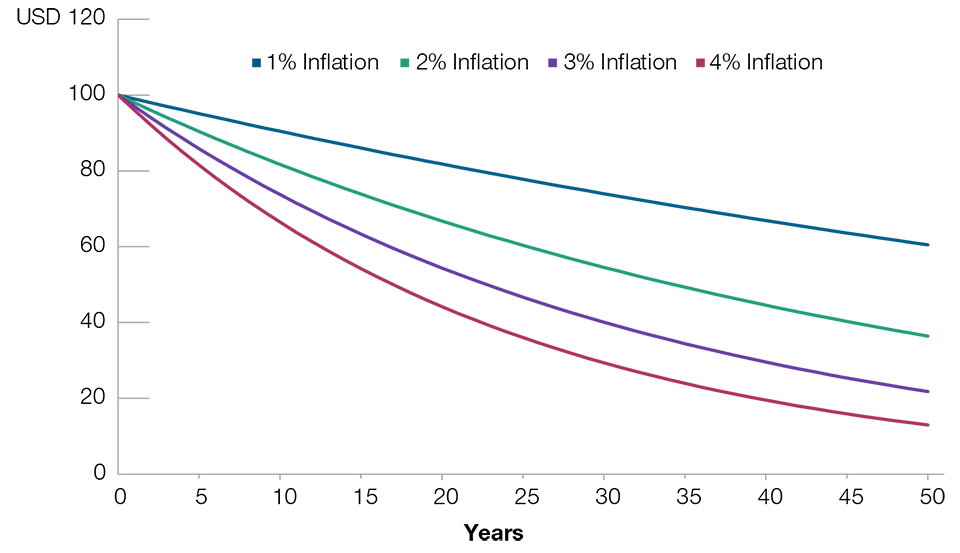

Regardless of its path, inflation affects everyone, particularly those with longer investment horizons. This is because inflation likely reduces our purchasing power, and over time, it can potentially result in a substantial erosion of our net worth in real terms (Fig.1). For retirees, it may also increase the risk of outliving their nest eggs. With elevated inflation in the post-pandemic recovery persisting longer than many had anticipated, it is of paramount importance to manage our portfolios well against inflation risk. It is “real growth,” or the ability to grow purchasing power over time, that matters most to investors.

Impact of Inflation on Long-Term Purchasing Power

(Fig. 1) Real value of USD 100 at end of period

Source: T. Rowe Price. Information presented herein is hypothetical in nature. The diagram above shows the decrease of the face value of USD 100 in different trajectories due to different levels of inflation over time. The analysis is shown for illustrative, informational purposes only and does not constitute any investment advice or recommendations. It is not intended to forecast or predict future events and does not guarantee future results. Actual future outcomes may differ materially.

Is Gold the Best Inflation Hedge?

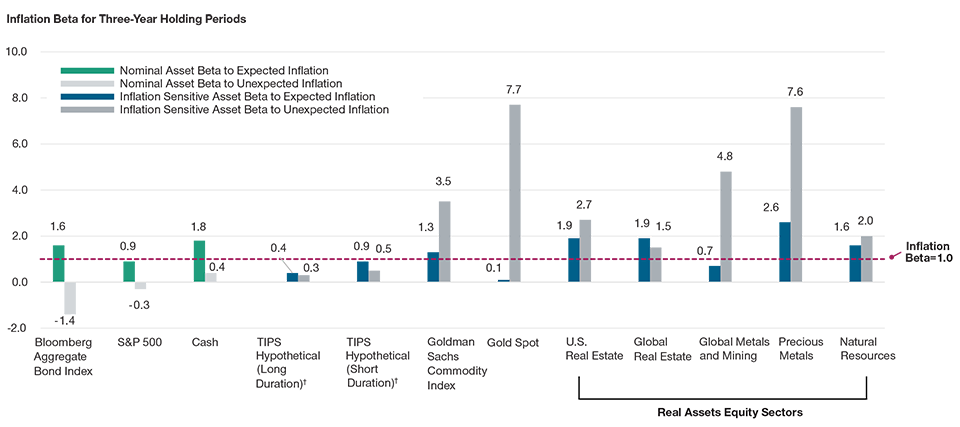

The next question, naturally, is which asset classes can be used to hedge against inflation? The answer seems obvious: Many believe that inflation-sensitive assets such as gold and inflation-linked government bonds (e.g., U.S. TIPS1) are the best inflation hedges. But is this really the case?

Our research shows that the same asset can display very different inflation sensitivities in different inflationary environments. More specifically, we studied if, and how, major asset classes have behaved differently toward expected and unexpected inflation. The results are shown in Fig. 2. For expected inflation, we found that short-term TIPS were a good hedge, while both long-term TIPS and gold were very poor hedges. For unexpected inflation, gold exhibited a strong beta to inflation, but both long and short duration TIPS fell short.

Inflation Beta* for Expected vs. Unexpected Inflation

(Fig. 2) September 1, 1976, through December 31, 2021

Past performance is not a reliable indicator of future performance.

Inflation measured by Consumer Price Index (CPI) for All Urban Consumers, non-seasonally adjusted. Expected inflation was obtained as that part of current CPI inflation that can be explained by trends in past inflation (using a regression framework), and unexpected inflation then emerges as the residual that can’t be explained by recent inflation trends.

*The inflation beta of an asset measures how much an asset’s price moves (on average) in response to an increase or decrease in inflation. In Fig. 2, inflation beta

provides a useful measure of each asset’s ability to provide a hedge against expected and unexpected inflation.

† Data based on the TIPS return model. See Appendix for assumptions and limitations of the U.S. TIPS return model.

The above analysis is based on historical monthly index return data, September 1976 to December 2021 (sourced from Morningstar EnCorr, St. Louis Federal Reserve Economic Database, and T. Rowe Price internal sources and combined by T. Rowe Price calculations). Historical index returns are used to illustrate the hypothetical performance and characteristics of a portfolio of real assets stocks and do not represent the performance or characteristics of any T. Rowe Price product. See Appendix for a description of each sector analyzed.

Sources for index data: Bloomberg Index Services Limited, ICE BofA, London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”), Morningstar, MSCI, Standard & Poor’s, and Wilshire. Please see Additional Disclosures in the Appendix for information about this sourcing information.

Many nominal asset classes, including traditional stocks and bonds, tend to directionally compensate for expected inflation—sometimes better than inflation-sensitive assets. But these nominal assets typically suffer from drawdowns during periods when inflation surprises to the upside. Thus, investors in a typical stock/bond portfolio face a conundrum: When times are good and inflation rises predictably, their current asset mix should rise strongly but leaves them exposed to sudden drawdowns when inflation rises unpredictably.

Real Assets Equities Tend to Perform Better in an Inflationary Environment

This research has found that real assets equities responded more favorably to periods of high or rising inflation than the broad equity market, where returns are relatively weak, at the cost of less favorable returns during periods of low or falling inflation, where broad equity returns are relatively strong. On the contrary, TIPS provide a real rate of return guaranteed by the government, thus eliminating inflation risk, but responded much less strongly to inflation surprises and really only preserve capital that is dedicated to TIPS. Thus, real assets equities can achieve a similar inflation hedge with a much smaller capital allocation than inflation-linked bonds.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.