March 2022 / POLICY INSIGHTS

U.S. Fiscal Stimulus: Takeaways for Investors

Timing, scale, and targets of new spending are key considerations.

The amount of fiscal stimulus passed into law by the U.S. Congress last year included roughly USD 2.45 trillion in new spending, equivalent to more than 10% of U.S. gross domestic product (GDP) in 2019, as measured by the Bureau of Economic Analysis. This came on the heels of about USD 2.6 trillion dollars of pandemic‑related relief spending in 2020.

There may be more to come if Democrats manage to push through some version of President Joe Biden’s Build Back Better plan in 2022. But parsing out the potential economic and investment implications for the near term and the long term requires that we go beyond the headline numbers and delve into the details.

The roll‑off of spending that provided a bridge for households and businesses during the pandemic should be most important to the economic outlook over the next 12 to 24 months, given consumers’ contributions to U.S. GDP. Meanwhile, longer‑dated investments in infrastructure could provide additional fuel for key secular growth trends related to the clean energy transition and help to reshape the U.S. economy over the long term.

Near‑Term Relief

President Biden signed the USD 1.9 trillion American Rescue Plan Act into law in March 2021 to help shore up the economy amid the pandemic. Key components of this package included direct relief to households via one‑time stimulus checks, extended and expanded unemployment insurance, and advance payments on the bumped‑up child‑care tax credit.

Besides bolstering consumer spending, these disbursements appeared to contribute to improvements in consumers’ balance sheets. The roll‑off of this extraordinary fiscal stimulus could act as a drag on the U.S. economy and some corporate earnings this year and into 2023, in our view. At the same time, the end of direct payments could encourage some workers to return to the labor market, although progress on containing the spread of the coronavirus would also factor into these decisions.

Building for the Long Term

The Infrastructure Investment and Jobs Act was signed into law in November 2021 and authorizes about USD 550 billion worth of new expenditures. About half of that spending is earmarked for projects related to traditional transportation infrastructure: roads and bridges, passenger and freight rail, airports, and ports and waterways.

This influx of federal money should pull forward the start date for much‑needed infrastructure upgrades while increasing municipalities’ capacity to fund these endeavors. We view these investments as a longer‑term tailwind for the economy. This federal money will be deployed over the next five years, but many of these projects will take longer to complete. Investors looking for companies that might benefit from a wave of infrastructure spending should bear this in mind.

On the campaign trail, President Biden set the ambitious target for the U.S. electric power industry to achieve net‑zero carbon emissions by 2035. True, the bipartisan infrastructure package did not explicitly include funding for renewable energy. But the USD 73 billion designated for upgrades to the nation’s power grid, in our view, could be critical to greater adoption of renewable energy and electric vehicles.

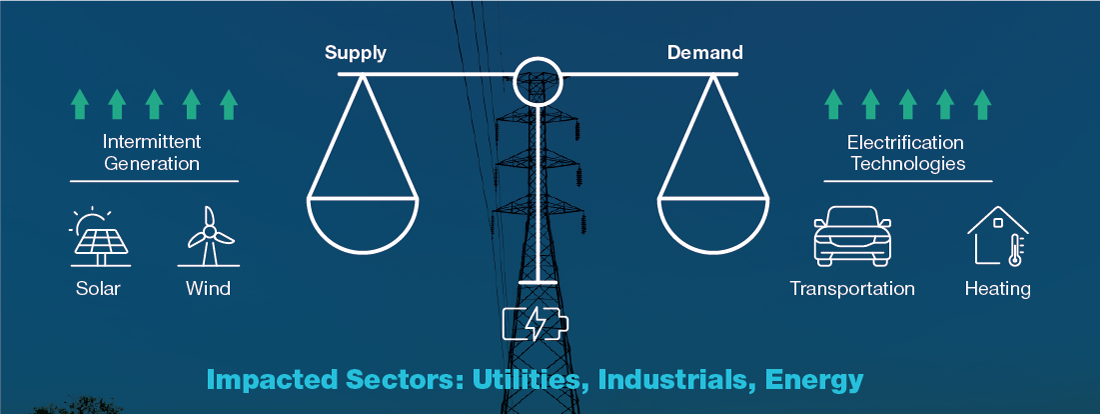

The intermittent nature of wind and solar power can make it difficult for systems to match electricity supply and demand at a given time. Solar energy poses a particular challenge because peak daytime production does not correspond with peak consumption, which typically occurs during the evening. In our view, investments in power transmission, battery‑based storage, and smart technologies will prove necessary to balance load and availability more dynamically to limit the risk of service disruptions.

These federal outlays could have important long‑term implications for utilities, automakers and other industrials, and the energy sector.

What About Build Back Better?

It remains to be seen whether Democrats can muster enough support to pass a slimmed‑down version of the stalled Build Back Better plan using the reconciliation process, which requires only a simple majority in the Senate.

Investments in the Power Grid Are Critical to the Clean Energy Transition

Upgrades needed to balance dynamically between electricity supply and demand

Source: T. Rowe Price.

Several factors suggest the possibility of compromise. Democrats appear to mostly agree on the revenue‑raising measures, including higher tax rates for corporations. The approach of midterm elections could also imbue lawmakers with a sense of urgency. Depending on the outcome of these contests, this may be the Biden administration’s last chance to achieve its agenda via legislation.

Still, the bill’s fate and final shape remain uncertain at this stage. We would expect clarity to emerge as negotiations pick up over the coming months. We are also watching incoming inflation data, as elevated levels could influence lawmakers’ appetite for further federal spending.

The potential end of monthly payments related to the expanded child‑care tax credit could be a modest headwind to consumer spending in 2022. An earlier draft of the Build Back Better package had proposed extending this program for another year. Whether this measure, or something similar, would make it into the final bill remains uncertain.

Other proposed line items would extend and expand tax credits for clean energy projects and electric vehicles and create new ones for emerging technologies that could advance the transition from fossil fuels. Earmarks for expanding access to health insurance via Affordable Care Act subsidies could also be an incremental benefit for managed care companies.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

March 2022 / STRATEGY SPOTLIGHT