November 2021 / INVESTMENT INSIGHTS

A Disciplined Investment Approach in Pursuit of Compounding

Avoid complacency when seeking to buy and hold durable growers

Key Insights

- We seek companies that we believe can compound in value over time by sustaining robust earnings and free cash flow growth.

- While patience is a virtue, we continually test and reassess the assumptions underpinning our investment ideas.

- We are finding opportunities in companies that we expect to benefit from potentially durable tailwinds, such as the growing adoption of e‑commerce.

The strategy’s largest holdings and sector allocations bear little resemblance to where they stood two decades ago, a reminder of the massive changes that have taken place in the global economy and the dynamism of individual industries during an era characterized by technology‑driven innovation and disruption. Amid this change, the principles that underpin our investment approach have stayed consistent and remain important touchstones.

We believe that stocks tend to follow their earnings and free cash flow over the long term. Accordingly, we seek to identify the rare companies that we believe have the potential to sustain strong growth in a variety of macroeconomic and regulatory environments.

Although we remain committed to our approach, this emphasis on consistency should not be mistaken for complacency. Rigorous due diligence is critical to our process. We continually test our assumptions and reassess our existing and prospective investments to ascertain whether we think a company’s underlying business fundamentals could support an extended run of strong growth.

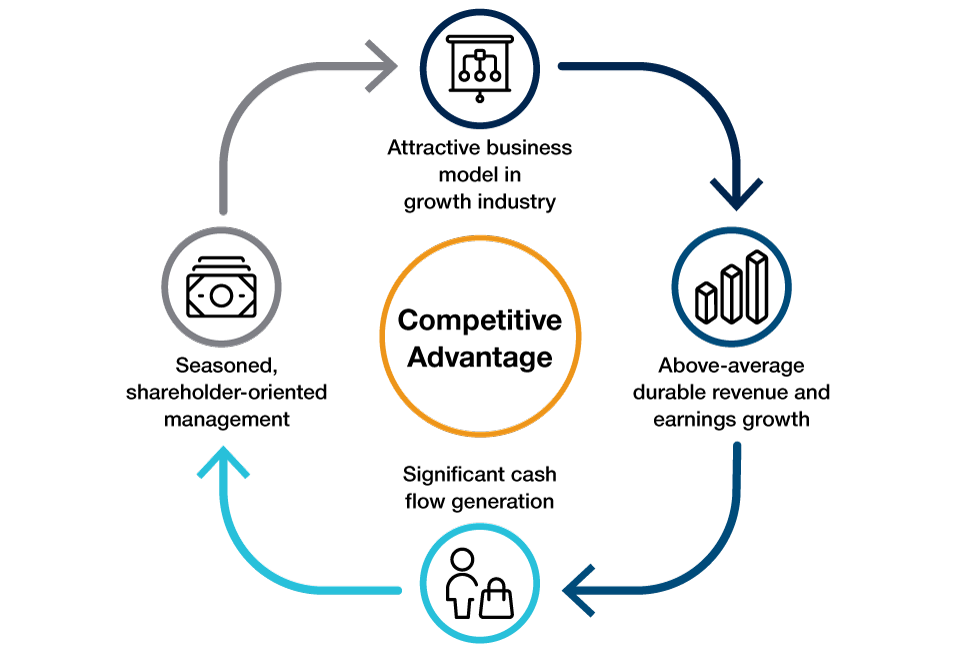

The Qualities of Potential Compounders

The blue chips that we favor are, in our view, entrenched industry leaders or companies that have the potential to become industry leaders. Accordingly, we seek to invest in names that we believe are well positioned within their industry and offer exposure to potentially strong secular tailwinds—such as the digitalization of the enterprise and the broader economy—as well as large addressable markets that could create a long growth runway. High proportions of recurring or service revenue also appeal to us, as do names with sales that are well diversified by geography or product line.

Seeking Companies With the Potential for All.Seasons Growth

The qualities favored by our investment process

Source: T. Rowe Price.

For illustrative purposes only.

But a high‑quality business model and favorable industry dynamics aren’t necessarily enough. We gravitate toward capable management teams that have a history of execution and are allocating capital in ways that we believe can build long-term value for shareholders. Companies that check these boxes often exhibit a commitment to pursuing innovation, with an eye toward staying ahead of the competition and unlocking new opportunities. Here, we favor companies with multiple potentially high‑return areas where they can deploy capital.

We appreciate a compelling growth story that has the potential to stretch across multiple chapters, but we also remain valuation‑conscious when selecting stocks and determining position sizing. In our framework, a company’s valuation represents the difference between the rate at which we think the underlying business could create value—for example, through growth in earnings or free cash flow—and the corresponding return potential embedded in the stock. Our process seeks to limit exposure to names where a lofty valuation already appears to reflect too many years’ worth of strong growth.

This approach yields a portfolio of holdings that generally fall into two buckets:

- Established companies that tend to grow at a steadier pace and appear to trade at less demanding valuations; and

- Rapidly growing disruptors, including incumbents and possible future leaders in the e‑commerce space and digital payments, where we regard the long‑term risk/reward proposition as favorable because we think the market does not fully appreciate the levers that these companies can pull over time to potentially improve profitability and expand their addressable markets.

Patience Is a Virtue

In a market fixated on the latest quarterly results and macroeconomic data, our willingness to take a long view of a company’s growth prospects can sometimes create temporary dislocations for us to try to exploit.

At the same time, we remain cognizant of the adage that boredom kills compounding, or the idea that investors who react to short‑term changes in a stock’s price risk missing out on the rewards that may come from sticking with a potentially long‑lasting growth story.

We believe that consistently adding value by trading in and out of names is exceedingly difficult and can saddle investors with additional costs. Our patient strategy instead aims to rely on compounding to do the hard work. We strive to buy and hold high‑quality companies that we believe have the potential to create long‑term value by sustaining a strong rate of earnings and free cash flow growth.

This emphasis on identifying and sticking with possible durable growers—backed by our deep understanding of their underlying businesses and the industries in which they operate—can help to give us the conviction to ride out near‑term volatility stemming from macro concerns and short‑term earnings hiccups or setbacks that appear temporary.

No Place for Complacency

With our focus on buying and holding high‑quality growth stocks, we are sometimes asked about our sell discipline and how we avoid being too patient and falling in love with a particular name. Here, continual due diligence and collaboration between analysts and portfolio managers are critical to our process.

Consider the case of Amazon.com, a prominent holding in the strategy for more than a decade and a name where our investment thesis has evolved with the company itself. We do not own the stock because of its massive market capitalization or sizable weighting in the popular large‑cap indexes but because the firm’s underlying growth prospects still strike us as compelling, thanks to the size of the addressable markets in which it competes—e‑commerce, online advertising, and cloud services that are critical to the digitalization of the economy. Amazon.com’s financial wherewithal and culture of innovation also factor into our long‑term investment case.

However, like any other company in our portfolio, Amazon.com must earn its keep by continuing to execute, innovate, and grow. Although we strive to identify companies that we believe can compound in value over time, we are also wary of concentration risk and aim to ensure that individual position sizes reflect our level of conviction and our assessment of their risk/reward profiles. Our in‑depth understanding of online commerce and the digital payments ecosystem, supported by collaboration with our global team of research analysts, has helped us to test the assumptions underlying our investment in Amazon.com.

We have strong conviction in the potential opportunities created by the accelerating convergence of social media, online marketing, and digital commerce. Popular social media platforms, especially graphic‑ and video‑intensive ones, increasingly help consumers to discover products and services, while the emergence of a separate stack of modular e‑commerce solutions has made it easier for merchants to reach and sell to customers online. Innovative companies have also started to disrupt complex, fragmented markets, such as the one for used cars, by leveraging the technologies of today to make a painful process more palatable to consumers.

By identifying high‑quality companies that we believe can consistently grow their earnings and cash flow over time, we hope to buy and hold these names and allow them to compound in value. Albeit simple in theory, this patient approach to investing requires rigorous due diligence and a deep knowledge of individual companies and industries to target the small universe of companies that could have the potential to live up to our high expectations.

What we’re watching next

The market and financial media appear to be watching how hotly debated macro‑level developments play out, from the upsurge in infections stemming from the delta variant of the coronavirus and its implications for economic activity to when central banks might adjust their accommodative policies and how long recent inflationary pressures could persist. As investors with a longer‑term orientation who rely on bottom‑up fundamental research, we are aware of these higher‑level concerns but strive not to overreact to them. Rather, we have focused our energy on identifying the companies whose post‑pandemic business prospects appear to have strengthened significantly, and not temporarily, during the downcycle. With the market still caught up in trading the most visible near‑term winners and losers from the pandemic, we believe that taking the long view can help us to uncover dislocations that could create opportunities with compelling risk/reward profiles.

MAIN RISK

The following risks are materially relevant to the portfolio:

Style risk—different investment styles typically go in and out of favour depending on market conditions and investor sentiment.

GENERAL PORTFOLIO RISKS

Capital risk—the value of your investment will vary and is not guaranteed. It will be affected by changes in the exchange rate between the base currency of the portfolio and the currency in which you subscribed, if different.

ESG and Sustainability risk—May result in a material negative impact on the value of an investment and performance of the portfolio.

Equity risk—in general, equities involve higher risks than bonds or money market instruments.

Geographic concentration risk—to the extent that a portfolio invests a large portion of its assets in a particular geographic area, its performance will be more strongly affected by events within that area.

Hedging risk—a portfolio’s attempts to reduce or eliminate certain risks through hedging may not work as intended.

Investment portfolio risk—investing in portfolios involves certain risks an investor would not face if investing in markets directly.

Management risk—the investment manager or its designees may at times find their obligations to a portfolio to be in conflict with their obligations to other investment portfolios they manage (although in such cases, all portfolios will be dealt with equitably).

Operational risk—operational failures could lead to disruptions of portfolio operations or financial losses.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.