June 2021 / INVESTMENT INSIGHTS

Finding Value in Equity Markets Amid Elevated Valuations

When the upside potential may be limited, selectivity is required

Key Insights

- With extended equity valuations, hope for further upside mainly rests in earnings growth. However, US equity markets in particular seem to have already priced in much of this expected earnings growth.

- We believe revisions in earnings estimates will benefit value, small‑cap and emerging markets equities and countries such as the UK and Japan.

- When equity valuations are elevated, it is vital to be actively selective to make the most of diminishing expected returns.

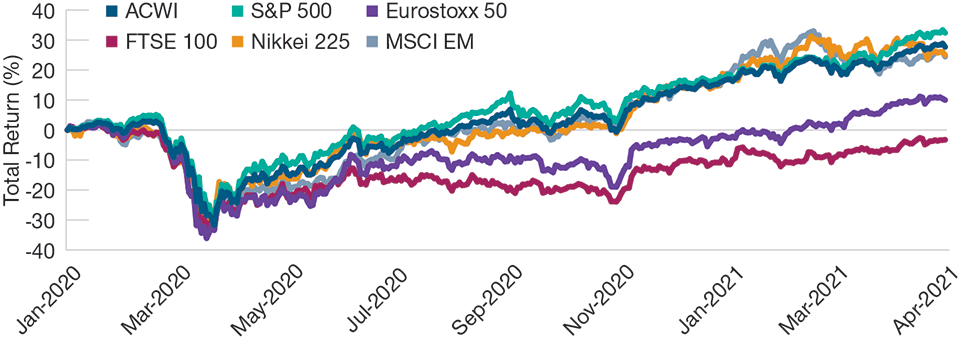

Most equity markets have rebounded strongly since the severe coronavirus‑induced sell‑off in February and March of last year (Figure 1). Many markets have powered past pre‑crisis levels and some, such as the S&P 500, continue to set record highs. As a result, the valuations of many stock markets have become elevated. The question now is whether the rally has much upside left in it, or whether these rich valuations will begin to drag down markets.

Equities Have Rebounded Strongly Since Last Year’s Sell‑Off

(Fig. 1) Total returns of equity markets since January 2020

As of 30 April 2021.

Past performance is not a reliable indicator of future performance.

MSCI All Country World (ACWI), Standard & Poor’s (S&P 500), Eurostoxx 50, FTSE 100, Nikkei 225, MSCI Emerging Markets (MSCI EM).

Sources: T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. MSCI and S&P (see Additional Disclosures).

Valuations are a key force driving equity market returns, but they are not the only one—over the short term, other forces, such as policy and sentiment, are more likely to dominate performance. The current market rally has been fuelled by several factors: massive fiscal support from governments, particularly in the US; central banks’ ultra‑accommodative monetary policy, which has flooded markets with liquidity; and growing optimism over adapting to life with the virus and the continued economic recovery, helped by vaccine rollouts.

However, the tidal wave of fiscal stimulus will come to its end, rising inflation may force central banks to taper support and sentiment will eventually peak. Investors will, at some point, begin to worry about whether such elevated valuations can be justified by company fundamentals. In other words, the supportive context for high valuations could be fading.

Furthermore, valuations matter mostly during extreme periods: When valuations are very low, long‑term future returns tend to be high; when valuations are very high, long‑term future returns tend to be low. Over the short term, however, high prices can go higher, and low prices can go lower. It is notoriously difficult to predict the inflection points in markets—in other words, when rich is too rich and cheap is too cheap. This is especially true under today’s unprecedented circumstances.

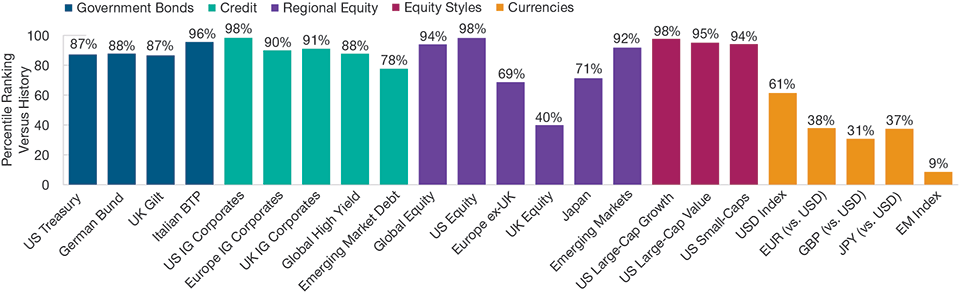

Not all asset class valuations are equally elevated. Figure 2 compares the current valuations of various asset classes with their values over the past 15 years and gives them a percentile ranking. For example, 10‑year US government bonds are currently more expensive than they have been 87% of the time over the last 15 years. As Figure 2 shows, some equity markets are very expensive relative to history, while others are relatively attractively priced.

Figure 2 also shows that equity markets are not alone in seeing elevated valuations: The valuations of assets such as government and corporate bonds are also stretched. Investors seeking to generate returns may find no better alternatives than equity markets—and with rising inflation expectations, there is greater incentive to invest and make money work hard.

Not All Valuations Are Equally Elevated

(Fig. 2) Current valuation percentile rankings versus past 15 years

As of 30 April 2021.

Past performance is not a reliable indicator of future performance.

Indices: US 10‑year Treasury, German 10‑year bund, UK 10‑year gilt, Italian 10‑year BTP, Bloomberg Barclays (BB) US Corporate Aggregate, BB EuroAgg Corporate, BB Global Aggregate Corporate—United Kingdom, BB Global High Yield, BB EM USD Aggregate, MSCI AC World, S&P 500, MSCI Europe ex UK, MSCI UK, MSCI Japan, MSCI EM, Russell 1000 Growth, Russell 1000 Value, Russell 2000, USD index, EUR spot, GBP spot, JPY spot, JPM EM Currency Index.

Sources: T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved. Source for Bloomberg Barclays index data: Bloomberg Index Services Limited. MSCI and S&P (see Additional Disclosures).

With extended valuations, hope for further upside mainly rests in earnings growth. Massive pent‑up demand, robust fiscal stimulus and the prospect of fully reopened economies are good reasons to expect strong earnings growth in 2021 and 2022. Earnings over the first quarter of this year have generally surpassed analysts’ estimates by a wide margin: So far, profits for the S&P 500 have grown by about 50% relative to 2020, albeit from a very low, pandemic disrupted, base.

However, US equity markets in particular seem to have already priced in much of this expected earnings growth. Meanwhile, equity markets outside the US—especially in emerging markets—appear to have more upside potential when the global economy picks up speed. While some emerging markets—such as India and Brazil—face challenges with slow vaccine rollouts, others—such as China, South Korea and Taiwan—appear to be in control of the pandemic. Also, an economic recovery in developed markets should positively impact the economies of emerging markets, supporting their corporate earnings.

Earnings estimates are continually revised, and a review of estimate trends during the first two years of recovery following the last two recessions shows that estimates generally increased as it took time for forecasts to adapt to the strengthening economic environment. In our view, the scale of the economic recovery in 2021 and 2022 may see a similar trend of upward revisions. Notably, the pattern for three‑ to seven‑year periods after recessions, however, shows a decline in earnings estimates over time as the pace of growth begins to moderate.

Given recent strong upward moves, most of the good news appears to be already priced into equity markets, and the upside potential going forward may be somewhat limited. Therefore, T. Rowe Price UK and European Investment Committees, along with our other multi‑asset teams, recently modestly decreased overall equity exposure within multi‑asset portfolios. However, we maintain a tilt towards segments most sensitive to economic conditions—such as value, small‑cap and emerging markets equities—that we see as most likely to benefit from further upward revisions in earnings estimates.

Exposure to the expected global economic recovery, coupled with factors such as valuations, could help to separate regional equity markets. Export‑oriented economies such as the UK and Japan, for example, may do better than the US and Europe when global markets reopen. The UK may also be supported by the successful rollout of vaccines, its tilt to more cyclical areas and attractive valuations, while Japan may receive additional support from reforms focused on shareholder value and corporate governance, alongside the expected reopening of Asian markets.

Although valuations do matter and are an important driver of equity market performance, investors should consider myriad factors impacting equity markets. We are in uncharted territory, and the difficulty of forecasting the behaviour of equity markets over the rest of the year means it is prudent to be cautious and remain diversified. However, there are still cyclical areas across global equity markets that are likely to fare better than others—and it is towards these areas that investors should consider tilting their portfolios. When valuations are elevated, it is important to be actively selective to make the most out of diminishing expected returns. It is equally important to manage overall equity exposure and retain the flexibility of going back to the market should valuations become more inviting.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution retail investors in any jurisdiction.

June 2021 / MARKET OUTLOOK