Health Care Costs in Retirement

It's Time for a New Perspective

A recent survey from T. Rowe Price found that retirees list health care costs as their top spending concern. That's not surprising: Some studies predict that a 65-year-old couple may need up to $400,0001 to cover those costs in retirement.

We believe, however, that there's a more effective—and less intimidating—way to calculate and plan for future retiree health care expenses. Consider these three factors:

1. Health care isn't a one-time, bulk expense.

It's more practical to look at health care as an annual expense incurred over 20-30 years than as a lump sum. For example, a couple might spend a total of $86,000 for cable TV in retirement.2 But when budgeting, they'd consider it a monthly expense of about $150, not a single large payment. The same holds true for health care.

Source: T. Rowe Price estimate based on projected 2020 Medicare premiums and data from the Health and Retirement Study (HRS).

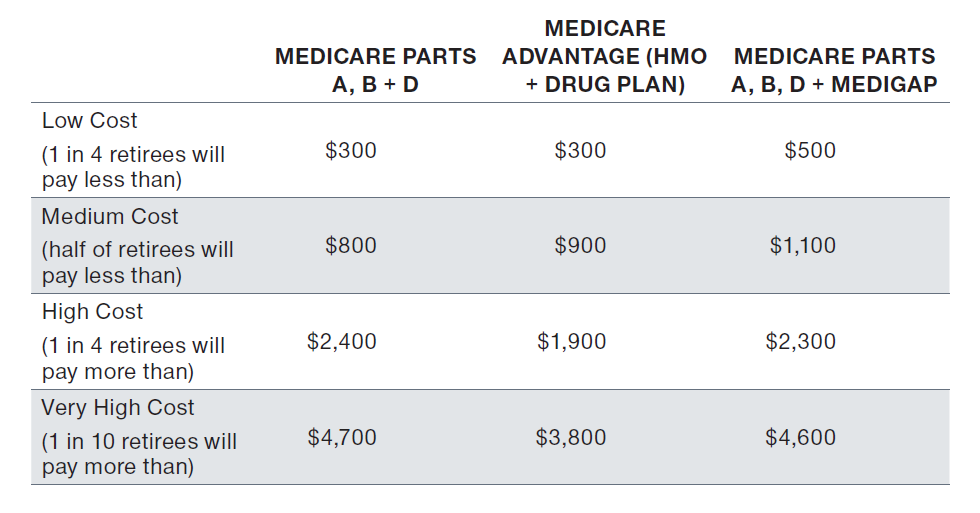

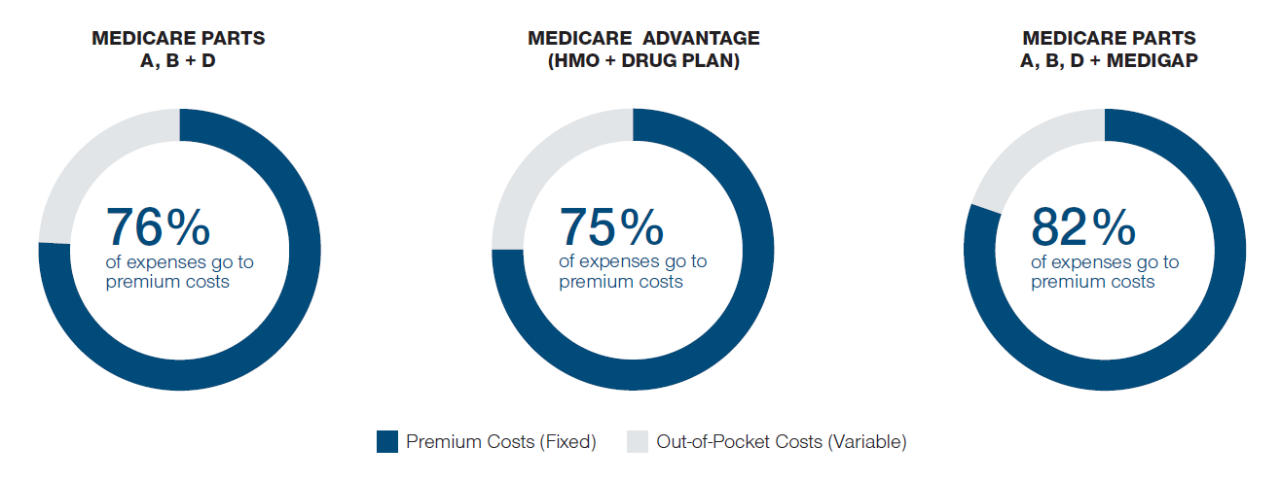

2. Separate premiums from out-of-pocket expenses.

Premiums are relatively stable. As shown below, Medicare premiums with prescription drug coverage account for between 75% and 82% of annual health care costs for the majority of retirees, no matter what type of coverage they have.

We suggest maintaining a liquid fund, like a savings account, with enough money to meet out-of-pocket expenses. Replenished annually, this fund can help retirees cope with out-of-pocket uncertainties.

Source: T. Rowe Price estimates based on projected 2020 Medicare premiums and data from the HRS. All costs are rounded up to the nearest hundred.

3. Don't get caught up in one large number.

Most estimates assume a single type of coverage, which may actually be different for each retiree. The astronomical numbers we often see are usually skewed by an unfortunate few who pay very high expenses over a long period. That won't be the case for most retirees.

As the chart above shows, half of retirees who have traditional Medicare (Parts A and B), a prescription drug plan (Part D) and Medigap will spend less than $1,110 a year on out-of-pocket expenses. Only one in 10 will likely spend more than $4,600, and, and it's unlikely they'll keep paying that much over the rest of their lifetime.

Article Resources

Medicare premiums with prescription drug coverage account for between 75% and 82% of annual healthcare costs for the majority of retirees, reguardless of the type of coverage.

So What Guidance Can Employers and Advisors Offer?

The first step is to replace panic with prudent planning.

For employers, this is an excellent teaching moment - a chance to alert employees to the need for Medicare preparation, while resetting their expectations and allaying their fears. Use our Key Insights document and our research paper A New Way to Calculate Health Care Costs as guides.

For advisors, start by presenting health care expenses rationally, as a combination of predictable monthly expenses (insurance premiums) that can be budgeted for, and less predictable expenses (out-of-pocket) that can be managed from savings.

Next, emphasize careful consideration of Medicare options, comparing premiums, coverage and out-of-pocket expenses.

Finally, suggest keeping a liquid cash reserve to help cover unpredictable expenses, replenishing it each year based on the previous year's expenditures.

Use our Key Insights document to inform your clients, and our full research paper, A New Way to Calculate Health Care Costs, to learn more about our research and cost calculations.

In short, health care expenses can seem daunting - but to a large extent, they can be planned for and managed.

About This Study

We analyzed nationally representative data on retiree health care expenses and projected 2020 Medicare premiums to estimate annual health care expenses for different types of Medicare coverage and to break down the costs between insurance premiums and out-of-pocket expenses.3 We also provided guidelines on how retirees can plan to meet their annual health insurance premiums and out-of-pocket expenses.

1. Fronstin, Paul and Jack VanDerhei. "Savings Medicare Beneficiaries Need for Health Expenses: Some Couples Could Need as Much as $400,000, Up From $370,000 in 2017." EBRI Issue Brief, no. 460 (Employee Benefit Research Institute, October 8, 2018).

2. Assuming a $150 monthly cable expense with 3% annual inflation over 30 years.

3. Health and Retirement Study public use dataset. Produced and distributed by the University of Michigan with funding from the National Institute on Aging (grant number NIA U01AG009740). Ann Arbor, MI.

Contact your T. Rowe Price representative to find out how we can take your plan to the next level.